Tax Code Changes From HMRC: How Your Savings Are Affected

Table of Contents

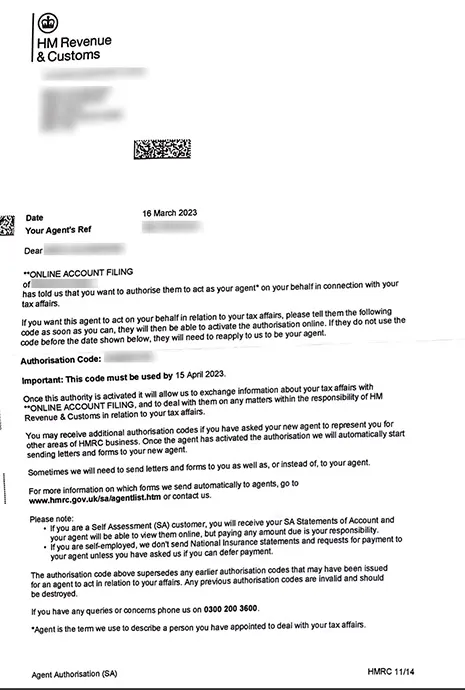

Understanding the Latest HMRC Tax Code Changes

Staying on top of HMRC tax code changes is vital for protecting your hard-earned savings. Let's examine the key alterations and their impact.

Key Changes Affecting Savings Accounts

Several adjustments to tax rates and allowances directly affect savings accounts. These changes can impact your net returns significantly.

- Personal Savings Allowance (PSA): The PSA, which allows a certain amount of savings interest tax-free, may have been adjusted. Understanding the new limit is critical. For example, a reduction in the PSA could mean a higher tax bill on your savings interest.

- Changes to Tax Bands: The tax bands themselves might have shifted, meaning that interest on even modest savings could now fall into a higher tax bracket for some individuals.

- Impact on Different Income Levels: High-income earners will likely be more affected by changes to the PSA or tax bands than lower-income earners. Someone earning close to the higher-rate threshold could see a substantial increase in their tax bill on savings interest.

Example: If your savings interest previously fell within the PSA, but the allowance has been lowered, you might now find yourself paying tax on a portion of your interest that was previously tax-free.

For the most up-to-date information, consult the official HMRC website [insert relevant HMRC link here].

Changes to ISAs (Individual Savings Accounts)

ISAs remain a popular tax-efficient savings option, but recent HMRC tax code changes may have altered the landscape.

- ISA Allowance Limits: The annual allowance for contributions to ISAs might have been adjusted upwards or downwards. Knowing the current limit is essential for maximizing your tax-efficient savings.

- Impact on Existing ISA Holders: Existing ISA holders need to understand how the changes might affect their current investments.

- Different ISA Types: The changes might affect different ISA types differently. For example, the allowance for Cash ISAs might differ from that for Stocks and Shares ISAs.

[Insert link to relevant government website for ISA information here]

Impact on Dividend Income

Changes to dividend taxation can significantly impact your investment returns.

- Dividend Tax Rates: The tax rates applied to dividend income may have been revised. This means that the amount of tax you pay on dividends from your shares could have increased or decreased.

- Dividend Allowance: The dividend allowance, which allows a certain amount of dividend income to be received tax-free, might have been modified.

- Impact on Different Dividend Levels: The impact of these changes will vary based on the level of dividend income you receive. Higher dividend income will be more significantly affected.

[Insert link to relevant HMRC publications on dividend taxation here]

Planning for the Future with the New Tax Codes

Proactive planning is key to mitigating the impact of the new tax codes on your savings.

Strategies to Minimize Your Tax Liability

Several strategies can help you minimize your tax liability related to your savings.

- Tax-Efficient Savings Options: Exploring options like ISAs and pensions remains crucial for minimizing your overall tax burden.

- Income Management: Carefully managing your income can help you stay within lower tax brackets. This might involve strategic withdrawals or deferring income.

- Professional Financial Advice: Seeking guidance from a qualified financial advisor is highly recommended, especially if you have complex financial circumstances.

Utilizing Tax-Advantaged Savings Accounts

Tax-advantaged savings accounts, such as ISAs and pensions, offer significant benefits for protecting your savings from higher tax rates.

- ISA Advantages: ISAs provide tax-free growth and withdrawals, making them a valuable tool for long-term savings.

- Pension Advantages: Pension contributions benefit from tax relief, reducing your overall tax burden.

- Eligibility and Limitations: Understanding the eligibility criteria and limitations of each account type is crucial before investing.

Staying Informed About Future HMRC Updates

The tax landscape is constantly evolving. Staying updated is crucial to maintaining an efficient savings strategy.

- Regularly Check HMRC: Make it a habit to check the official HMRC website regularly for updates on tax legislation.

- Subscribe to Updates: Sign up for newsletters or alerts from reputable financial sources to stay informed about changes.

Conclusion

The recent HMRC tax code changes have a considerable impact on personal savings. Understanding the adjustments to the PSA, ISA allowances, and dividend tax rates is crucial for protecting your financial future. Proactive planning, utilizing tax-efficient savings strategies like ISAs and pensions, and seeking professional financial advice when needed are key to minimizing your tax liability and optimizing your savings. Review your current savings plans in light of these HMRC tax code changes and take steps to ensure your savings are protected. Don't hesitate to seek professional guidance to optimize your savings strategies and achieve your financial goals.

Featured Posts

-

Brexits Negative Effect On Uk Luxury Goods Exports To The European Union

May 20, 2025

Brexits Negative Effect On Uk Luxury Goods Exports To The European Union

May 20, 2025 -

Le Mass Marche Africain Des Solutions Spatiales Ouvre Ses Portes A Abidjan

May 20, 2025

Le Mass Marche Africain Des Solutions Spatiales Ouvre Ses Portes A Abidjan

May 20, 2025 -

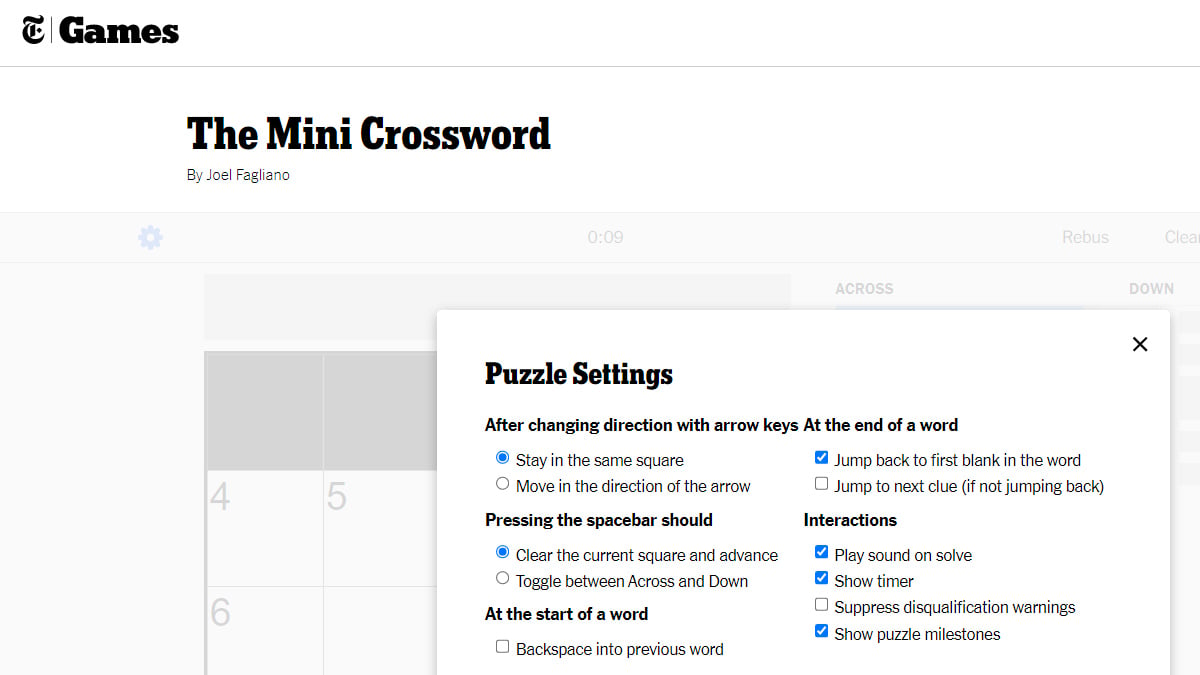

Nyt Mini Crossword Answers For May 9th

May 20, 2025

Nyt Mini Crossword Answers For May 9th

May 20, 2025 -

Asheville Rising Good Morning Americas Ginger Zees Wlos Visit

May 20, 2025

Asheville Rising Good Morning Americas Ginger Zees Wlos Visit

May 20, 2025 -

Evaluating The Impact Of Trumps Aerospace Initiatives

May 20, 2025

Evaluating The Impact Of Trumps Aerospace Initiatives

May 20, 2025