Billionaires' Favorite ETF: Projected 110% Growth In 2025?

Table of Contents

Identifying "Billionaires' Favorite ETF"

Pinpointing a single "favorite" ETF among billionaires is challenging. Their portfolios are vast, highly diversified, and shrouded in secrecy. However, by analyzing publicly available information and common investment trends, we can identify ETFs frequently held by high-net-worth individuals and institutions, many of which exhibit significant growth potential. These often fall within sectors poised for expansion.

Billionaires typically favor long-term growth strategies, focusing on sustainable investments and diversification across various asset classes. They're less likely to chase short-term gains and more interested in building wealth over decades. Their investment strategies often include:

- Long-term vision: Investing with a horizon of 5, 10, or even 20+ years.

- Diversification: Spreading investments across multiple sectors and asset classes to mitigate risk.

- Index funds and ETFs: Favorable for their low cost and broad market exposure.

Here are a few examples of ETFs that often feature in high-net-worth portfolios and exhibit high growth potential:

- Example 1: VOO (Vanguard S&P 500 ETF) – Focus on the S&P 500, known for its broad market exposure and long-term growth potential.

- Example 2: QQQ (Invesco QQQ Trust) – Focus on the Nasdaq-100, known for its concentration in technology giants and high growth potential.

- Example 3: TAN (Invesco Solar ETF) – Focus on the solar energy sector, known for its potential for significant growth due to increasing demand for renewable energy.

Analyzing the Projected 110% Growth in 2025

It's crucial to understand that the 110% growth projection for any specific ETF in 2025 is purely an estimate. This projection is highly speculative and depends on numerous unpredictable factors. While optimistic, it's vital to acknowledge the inherent risks. Such projections are based on various factors, including:

- Market Trend 1: Technological Advancements: Rapid innovations in AI, renewable energy, and biotechnology could fuel significant growth in related sectors.

- Market Trend 2: Economic Growth: A strong global economy can significantly boost investment returns across many sectors.

However, significant risks accompany high-growth projections:

- Risk Factor 1: Market Volatility: Unexpected market corrections or downturns can significantly impact investment values. Mitigation strategies include diversification and a long-term investment horizon.

- Risk Factor 2: Geopolitical Instability: Unforeseen geopolitical events can create uncertainty and volatility in the market. Staying informed about global events and diversifying investments can help mitigate this risk.

Investment Strategies for Accessing the Billionaire's ETF Strategy

While mirroring the exact portfolio of a billionaire is impossible, investors can adopt similar strategies to potentially benefit from high-growth opportunities. Key elements include:

- Diversification strategy: Don't put all your eggs in one basket. Diversify across different sectors, asset classes (stocks, bonds, real estate, etc.), and geographies to reduce risk.

- Long-term investment horizon: High-growth investments often involve volatility. Patience and a long-term perspective are essential for weathering market fluctuations.

- Seeking professional advice: Consider consulting a qualified financial advisor to create a personalized investment strategy tailored to your risk tolerance and financial goals. They can help you select suitable ETFs and navigate the complexities of the market.

Alternative Investment Options: Consider individual stocks within sectors represented by high-growth ETFs. Thorough due diligence is crucial when selecting individual stocks.

Conclusion

Identifying a single "Billionaires' Favorite ETF" is unrealistic. However, studying the investment approaches of the ultra-wealthy reveals a focus on long-term growth, diversification, and exposure to high-potential sectors. The projected 110% growth for certain ETFs in 2025 is a bold prediction, subject to significant market fluctuations. Thorough research and professional financial advice are paramount before investing in high-growth ETFs. Learn more about identifying high-potential ETFs and building a diversified portfolio to potentially benefit from similar growth opportunities as billionaires. Start your research on "Billionaires' Favorite ETF" strategies today!

Featured Posts

-

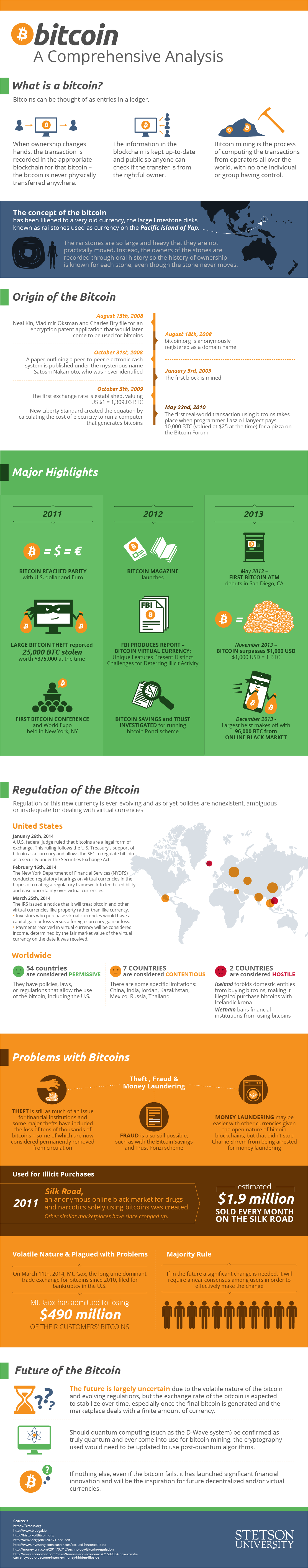

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025 -

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025 -

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025 -

Eliminatorias Sudamericanas Neymar Y Messi Se Enfrentan En Buenos Aires

May 08, 2025

Eliminatorias Sudamericanas Neymar Y Messi Se Enfrentan En Buenos Aires

May 08, 2025 -

Dwp Home Visit Numbers Double Implications For Benefit Claimants

May 08, 2025

Dwp Home Visit Numbers Double Implications For Benefit Claimants

May 08, 2025