Bitcoin Price Prediction 2024: Will Trump's Policies Affect BTC's Value?

Table of Contents

Trump's Economic Policies and their Potential Impact on Bitcoin

Trump's economic policies, if implemented again, could significantly shape the Bitcoin landscape in 2024. Let's analyze key areas:

Fiscal Policy and Inflation

A Trump administration might favor increased government spending, potentially leading to higher inflation. Inflation erodes the purchasing power of fiat currencies, making assets like Bitcoin, often viewed as a hedge against inflation, more attractive.

- Increased money supply: Increased government spending often leads to an expansion of the money supply, diluting the value of existing currency.

- Impact on purchasing power: As inflation rises, each dollar buys less, potentially increasing the demand for Bitcoin as a store of value.

- Bitcoin as a safe haven asset: In times of high inflation, investors often seek alternative assets; Bitcoin's limited supply could make it a desirable safe haven.

Regulatory Approach to Cryptocurrencies

Trump's past stance on cryptocurrency regulation has been characterized by a lack of clear direction. This ambiguity could continue, or we might see either stricter regulations or a more laissez-faire approach.

- Stricter regulations: Increased regulatory scrutiny could stifle institutional investment and reduce trading volume, potentially depressing Bitcoin's price.

- Deregulation: A more hands-off approach could foster innovation and attract institutional investors, potentially boosting Bitcoin's price.

- Continued ambiguity: Uncertainty surrounding regulation can create volatility, leading to price swings in both directions. This would make Bitcoin price prediction 2024 even more challenging.

US Dollar Strength and Bitcoin's Correlation

Bitcoin's price often exhibits an inverse correlation with the US dollar's strength. Trump's economic policies could impact the dollar's value, indirectly influencing Bitcoin.

- Strong dollar vs. weak dollar scenarios for Bitcoin: A strong dollar might suppress Bitcoin's price, while a weak dollar could boost it, as investors seek alternatives.

- International implications: The dollar's value affects global trade and investment flows, indirectly impacting Bitcoin's appeal as a global currency.

- Impact on investor sentiment: A strong or weak dollar can significantly influence investor sentiment, affecting Bitcoin demand.

Geopolitical Factors and Bitcoin's Price in 2024

Geopolitical instability can significantly impact Bitcoin's price. Trump's foreign policy, if re-implemented, could influence global economic uncertainty and subsequently, Bitcoin's value.

Global Economic Uncertainty

Global uncertainty often drives investors towards safe haven assets, including Bitcoin. Trump's potential trade policies and international relations could contribute to this uncertainty.

- Trade wars and their impact: Trade disputes can create economic instability, potentially increasing demand for Bitcoin as a hedge against risk.

- International relations and Bitcoin adoption: Trump's foreign policy could influence the adoption of Bitcoin in various countries, either positively or negatively.

- Flight to safety and Bitcoin demand: In times of global uncertainty, investors often seek safety in assets like Bitcoin, pushing up its price.

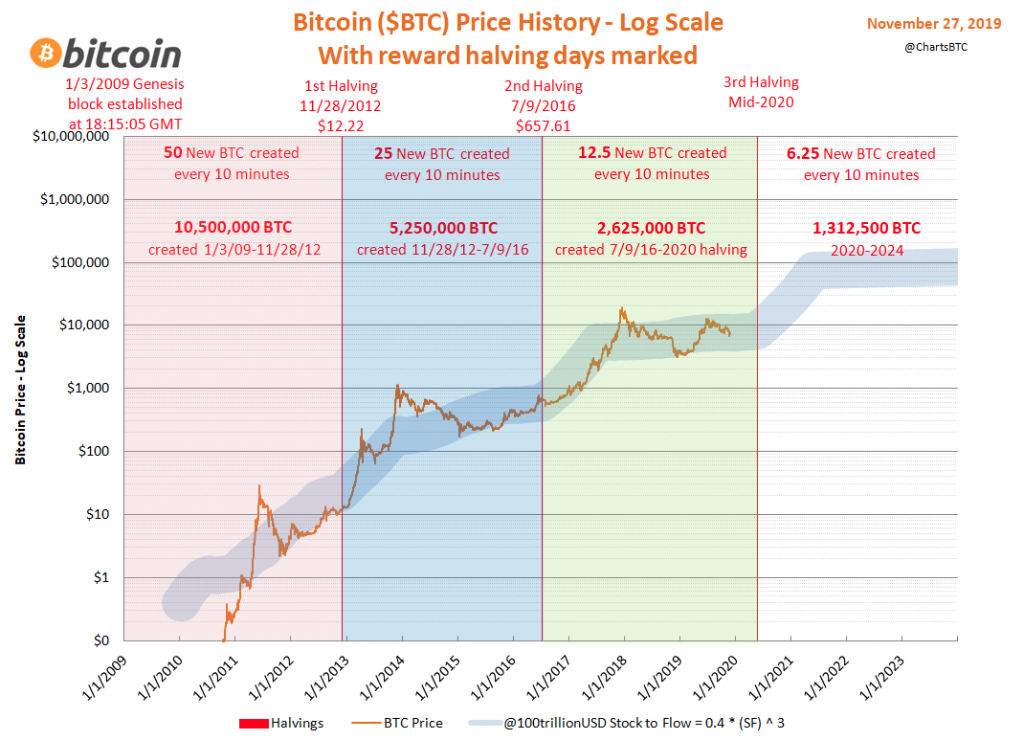

The 2024 Bitcoin Halving and its Influence

The 2024 Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation, is a major factor in any Bitcoin price prediction 2024. Historically, halvings have been followed by price increases due to decreased supply and increased scarcity.

- Reduced supply: The halving event reduces the influx of new Bitcoins into the market, creating scarcity.

- Increased scarcity: Scarcity, in the context of a limited supply, can drive up demand and prices.

- Potential price increase: Historically, halving events have been followed by significant price increases in Bitcoin.

- Interaction with market sentiment driven by Trump’s policies: The impact of the halving could be amplified or dampened depending on the market sentiment influenced by Trump's political and economic actions.

Conclusion

Predicting the precise Bitcoin price in 2024 is impossible. However, considering a potential Trump presidency and its potential influence on fiscal policy, regulation, the US dollar, and global geopolitical stability alongside the 2024 Bitcoin halving presents a complex picture. While a Trump administration might introduce volatility through its economic and foreign policies, the halving event itself suggests an inherent upward pressure on Bitcoin’s price. The interplay of these factors—economic, political, and technological—will ultimately shape the Bitcoin price in 2024. It's crucial to continue researching Bitcoin price prediction 2024 and stay informed about relevant political and economic developments to make informed decisions. Further reading on cryptocurrency investment strategies and the mechanics of the 2024 Bitcoin halving is highly recommended.

Featured Posts

-

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025 -

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025 -

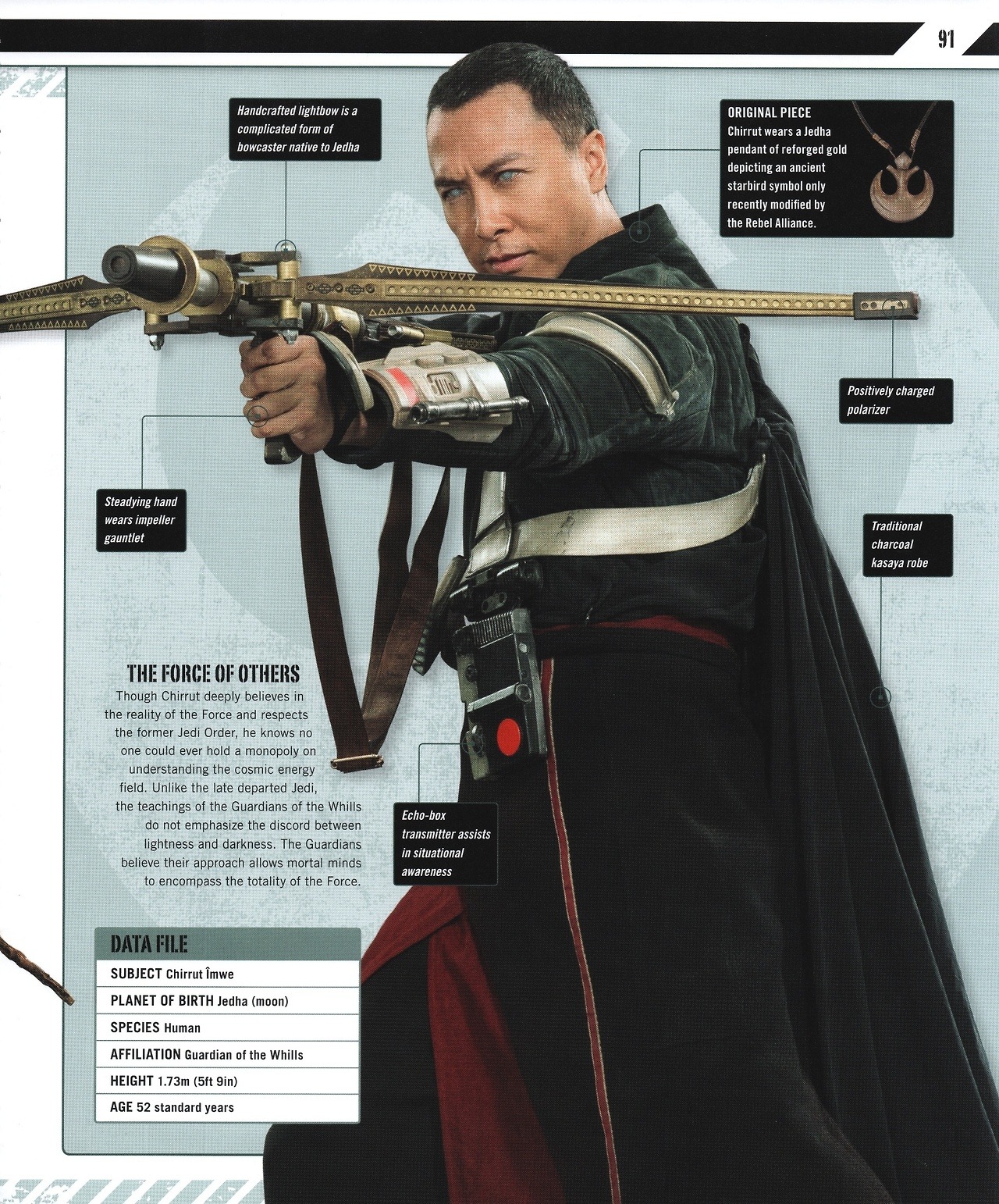

Rogue One Star Weighs In On Beloved Character

May 08, 2025

Rogue One Star Weighs In On Beloved Character

May 08, 2025 -

Bitcoins Potential 1 500 Surge A Growth Investors Forecast

May 08, 2025

Bitcoins Potential 1 500 Surge A Growth Investors Forecast

May 08, 2025 -

Stephen Kings The Long Walk Movie Release Date Announced At Cinema Con

May 08, 2025

Stephen Kings The Long Walk Movie Release Date Announced At Cinema Con

May 08, 2025