Bitcoin's Potential 1,500% Surge: A Growth Investor's Forecast

Table of Contents

Factors Contributing to Bitcoin's Potential Surge

Several converging factors could propel Bitcoin to unprecedented heights, potentially leading to the significant Bitcoin price surge predicted by some analysts. Let's examine the key elements fueling this optimistic Bitcoin forecast.

Increasing Institutional Adoption

The growing interest from major financial institutions is a significant catalyst for a potential Bitcoin price surge. This isn't just about a few early adopters; we're seeing a genuine shift in the landscape of cryptocurrency investment.

- Growing interest from major financial institutions, hedge funds, and corporations: More and more established financial players are allocating a portion of their portfolios to Bitcoin, recognizing its potential as a long-term investment asset.

- Increased allocation of assets by institutional investors towards Bitcoin as a hedge against inflation: With concerns about inflation rising globally, Bitcoin's scarcity and decentralized nature are increasingly attractive to institutional investors seeking to preserve capital.

- Grayscale Bitcoin Trust (GBTC) and other investment vehicles driving demand: The availability of regulated investment vehicles makes Bitcoin more accessible to institutional investors, increasing demand and influencing the Bitcoin price.

- Examples of large companies adding Bitcoin to their balance sheets: Companies like MicroStrategy and Tesla have publicly embraced Bitcoin, signaling a shift in corporate investment strategy and bolstering confidence in the cryptocurrency. This has a direct influence on the Bitcoin forecast.

Global Macroeconomic Uncertainty and Inflation

The current macroeconomic climate, characterized by uncertainty and inflation, is a powerful tailwind for Bitcoin's price. Its potential as an inflation hedge is attracting significant attention from investors seeking to protect their wealth.

- Bitcoin's role as a potential inflation hedge in times of economic uncertainty: Many investors see Bitcoin as a store of value, potentially safeguarding against the erosive effects of inflation. This perception is crucial to the positive Bitcoin forecast.

- Comparison of Bitcoin's performance against traditional assets during inflationary periods: Historical data suggests that Bitcoin has performed relatively well during periods of high inflation, outpacing some traditional assets.

- Analysis of investor sentiment during periods of high inflation: Investor sentiment toward Bitcoin tends to become more bullish during times of economic uncertainty and high inflation, fueling demand and driving up the price.

- Discussion of how Bitcoin's scarcity contributes to its value proposition during inflation: With a fixed supply of 21 million coins, Bitcoin's scarcity is a key differentiator from fiat currencies, making it an attractive investment during inflationary periods and contributing to a higher Bitcoin forecast.

Technological Advancements and Network Effects

Ongoing technological advancements are enhancing Bitcoin's functionality and scalability, paving the way for wider adoption and a potential Bitcoin price surge.

- The Lightning Network improving transaction speeds and scalability: The Lightning Network addresses Bitcoin's scalability challenges, allowing for faster and cheaper transactions.

- Taproot upgrade enhancing privacy and efficiency: Taproot enhances Bitcoin's privacy and efficiency, making it a more attractive option for users and businesses.

- Growing adoption of Bitcoin as a payment method: As more merchants accept Bitcoin, its utility increases, making it a more viable alternative to traditional payment methods. This positively impacts the Bitcoin growth forecast.

- Increasing network hash rate and decentralization bolstering security and resilience: The increasing hash rate and decentralization strengthen Bitcoin's security and resilience, building trust and confidence in the network.

Risks and Considerations for Bitcoin Investors

Despite the optimistic Bitcoin price surge forecast, it's crucial to acknowledge the inherent risks associated with Bitcoin investment. A realistic Bitcoin forecast must account for these potential downsides.

Volatility and Market Corrections

Bitcoin is known for its significant price volatility. Understanding this volatility is crucial for any Bitcoin investment strategy.

- Explanation of Bitcoin's historical price volatility: Bitcoin's price has experienced dramatic swings in the past, highlighting the inherent risk.

- Discussion of the potential for significant price drops: Investors should be prepared for substantial price corrections, which are a normal part of Bitcoin's price cycle.

- Importance of risk management strategies for Bitcoin investors, such as diversification: Diversification is key to mitigating risk. Don't invest more than you can afford to lose.

- Analysis of past market corrections and their impact on Bitcoin's price: Studying past market corrections can help investors understand the potential impact of future volatility.

Regulatory Uncertainty and Government Intervention

The regulatory landscape surrounding Bitcoin remains fluid, presenting a significant risk factor.

- Discussion of the varying regulatory landscapes for Bitcoin across different countries: Different countries have different regulations regarding Bitcoin, creating uncertainty for investors.

- Analysis of potential government regulations impacting Bitcoin's price and adoption: Government regulations can significantly impact Bitcoin's price and adoption.

- Examples of past regulatory actions and their effects on cryptocurrency markets: Studying past regulatory actions can offer insights into potential future impacts.

- Importance of staying informed about regulatory developments in the Bitcoin space: Keeping abreast of regulatory developments is crucial for navigating the risks effectively.

Security Risks and Scams

The cryptocurrency space is unfortunately susceptible to scams and security breaches. Protecting your investment is paramount.

- Importance of using secure wallets and exchanges: Choosing reputable and secure platforms is crucial for protecting your Bitcoin.

- Awareness of phishing scams and other security threats: Be vigilant against phishing scams and other security threats.

- Emphasis on the need for due diligence when investing in Bitcoin: Thorough research and due diligence are essential before investing.

- Recommendations for protecting Bitcoin investments from theft or loss: Implement strong security measures to protect your Bitcoin from theft or loss.

Conclusion

Bitcoin's potential for a 1,500% surge is driven by several factors, including increased institutional adoption, macroeconomic uncertainty, and technological advancements. However, investors should carefully consider the significant risks associated with Bitcoin's volatility and regulatory uncertainty. While this forecast presents a compelling case for growth investors, it's crucial to conduct thorough research, diversify your portfolio, and implement robust risk management strategies. Before investing in Bitcoin or any cryptocurrency, seek professional financial advice. Don't miss the opportunity to understand the potential of this exciting asset – research the potential of a Bitcoin price surge today and learn how to navigate the exciting world of cryptocurrency investment. Understand the potential for a Bitcoin price surge and make informed investment decisions.

Featured Posts

-

Andor Season 1 Episodes 1 3 Where To Stream Online Hulu And You Tube

May 08, 2025

Andor Season 1 Episodes 1 3 Where To Stream Online Hulu And You Tube

May 08, 2025 -

Chart Of The Week Bitcoins 10x Multiplier And Its Market Impact

May 08, 2025

Chart Of The Week Bitcoins 10x Multiplier And Its Market Impact

May 08, 2025 -

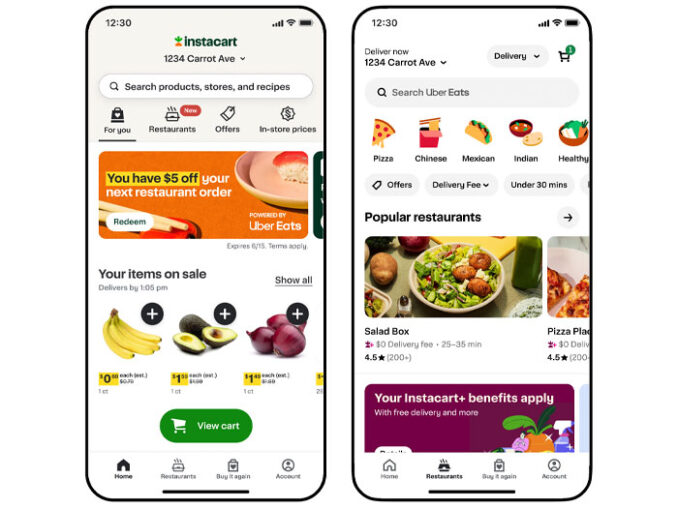

Door Dash Faces Lawsuit From Uber Allegations Of Anti Competitive Practices

May 08, 2025

Door Dash Faces Lawsuit From Uber Allegations Of Anti Competitive Practices

May 08, 2025 -

Rogues Legacy Gambits Powerful New Weapon

May 08, 2025

Rogues Legacy Gambits Powerful New Weapon

May 08, 2025 -

Revisiting Rare Double Performances In Okc Thunder History

May 08, 2025

Revisiting Rare Double Performances In Okc Thunder History

May 08, 2025