Chart Of The Week: Bitcoin's 10x Multiplier And Its Market Impact

Table of Contents

Historical Analysis of Bitcoin's 10x Multiplier Events

Bitcoin's journey has been punctuated by periods of explosive growth. Analyzing these historical 10x multiplier events provides valuable context for understanding its potential future trajectory.

Identifying Past 10x Multiplier Periods

Several instances throughout Bitcoin's history saw its price increase tenfold. Pinpointing these periods is crucial for identifying potential patterns and indicators.

- 2010-2011: Bitcoin's price rose from under $0.10 to over $1. This early surge reflected increasing awareness and adoption among early adopters and tech enthusiasts.

- 2011-2013: A subsequent 10x jump took Bitcoin from around $1 to over $100, fuelled by increasing media attention and growing belief in its potential as a decentralized currency.

- 2015-2017: Arguably the most significant 10x surge, Bitcoin saw its price skyrocket from under $100 to over $1,000, propelled by factors like the first Bitcoin halving event and growing institutional interest.

- 2019-2021: Another substantial 10x multiplier occurred between 2019 and 2021, leading up to Bitcoin's all-time high (ATH) above $60,000. This period involved increased mainstream adoption and significant institutional investments.

Analyzing these periods reveals a common thread: each 10x multiplier was preceded by periods of significant growth, followed by a period of consolidation before the next significant move.

Market Sentiment and Volatility During 10x Multipliers

The market sentiment surrounding Bitcoin's 10x multiplier events has been highly volatile, characterized by waves of fear, greed, and exuberant excitement.

- Early Stages: Initial periods often involved a mix of skepticism and cautious optimism among early adopters.

- Mid-Stage: As the price climbs, narratives of "fear of missing out" (FOMO) drive increased buying pressure, pushing the price even higher.

- Peak: At the peak of each multiplier, euphoric sentiment abounds, with many new investors entering the market.

- Correction: Following these periods, significant price corrections often occur, leading to fear and uncertainty among investors.

News articles and social media trends played a considerable role in shaping market sentiment, with positive media coverage usually fueling bullish momentum.

Macroeconomic Factors Influencing 10x Growth

External macroeconomic factors played a crucial role in the price surges.

- Global Economic Uncertainty: Periods of economic instability often drove investors towards Bitcoin as a safe haven asset and store of value.

- Inflationary Pressures: High inflation rates in various economies contributed to increased Bitcoin adoption as an inflation hedge.

- Regulatory Developments: While regulatory uncertainty could lead to price drops, the legalization or positive regulatory frameworks in some countries bolstered investor confidence.

- Technological Advancements: Significant advancements in Bitcoin's underlying technology and scalability (e.g., Lightning Network) enhanced its functionality and appeal.

Potential Indicators for Future 10x Multiplier Events

Predicting Bitcoin's price is notoriously difficult; however, various indicators can provide clues.

On-Chain Metrics and Their Predictive Power

On-chain data provides valuable insights into Bitcoin's network activity.

- Transaction Volume: Increased transaction volume often indicates growing user adoption and potential price appreciation.

- Hash Rate: A rising hash rate shows increased network security and computational power behind Bitcoin.

- Active Addresses: A growing number of active addresses signifies broader participation in the network.

These metrics, when analyzed in conjunction with price action, can provide valuable leading indicators.

Macroeconomic and Geopolitical Factors

Global events can significantly impact Bitcoin's price.

- Global Economic Crisis: A major economic crisis could drive increased demand for Bitcoin as a hedge against traditional financial systems.

- Geopolitical Instability: Political tensions and instability can lead to capital flight into Bitcoin, fueling price increases.

- Inflationary Pressures: Persistent high inflation could drive investors towards Bitcoin as a store of value.

Adoption Rate and Institutional Investment

Wider adoption plays a crucial role.

- Institutional Investors: Increasing participation from institutional investors (hedge funds, corporations) typically results in significant price increases.

- Merchant Adoption: The growing number of merchants accepting Bitcoin as payment enhances its utility and practicality.

- Public Awareness: Increased public understanding and acceptance of Bitcoin as a legitimate asset class contribute to price growth.

Assessing the Impact of a Future 10x Multiplier on the Market

A future 10x multiplier would have far-reaching consequences.

Ripple Effects on Other Cryptocurrencies (Altcoins)

The impact on altcoins is uncertain.

- Altcoin Season: A Bitcoin bull market often triggers an "altcoin season," where altcoins experience significant price increases relative to Bitcoin.

- Bitcoin Dominance: Alternatively, Bitcoin's dominance might increase, drawing investment away from other cryptocurrencies.

Implications for Traditional Financial Markets

A Bitcoin bull run could cause a significant shift in capital flows.

- Capital Flight: Investors might move capital from traditional assets (stocks, bonds) into Bitcoin.

- Regulatory Responses: Increased volatility could prompt regulatory bodies to increase scrutiny and potentially implement new regulations.

Risks and Challenges Associated with a 10x Multiplier

Significant risks are associated with such rapid price appreciation.

- Market Corrections: Sharp price corrections are common following periods of explosive growth.

- Regulatory Crackdown: Governments might respond to increased volatility by implementing stricter regulations.

- Speculative Bubbles: Rapid price increases can create speculative bubbles, leading to significant losses for investors.

Conclusion: Navigating the Future with Bitcoin's 10x Multiplier Potential

Bitcoin's history is marked by periods of remarkable price growth, represented by its 10x multiplier events. While predicting the future is impossible, analyzing past events, on-chain metrics, macroeconomic factors, and adoption rates provides valuable insights. Understanding the potential for future 10x multipliers, as well as the associated risks and challenges, is crucial for informed Bitcoin investment. Stay informed about Bitcoin's price action and potential 10x multiplier events by following our regular market analysis and insights. Understand the risks and rewards associated with Bitcoin investment before making any decisions.

Featured Posts

-

Cyndi Lauper And Counting Crows Jones Beach Concert Announced

May 08, 2025

Cyndi Lauper And Counting Crows Jones Beach Concert Announced

May 08, 2025 -

Analyzing Bitcoins Rebound Opportunities And Risks For Investors

May 08, 2025

Analyzing Bitcoins Rebound Opportunities And Risks For Investors

May 08, 2025 -

Denver Nuggets Player Weighs In On Westbrook Trade Speculation

May 08, 2025

Denver Nuggets Player Weighs In On Westbrook Trade Speculation

May 08, 2025 -

Seri Ata Na Vesprem Prodolzhuva Pobeda Nad Ps Zh

May 08, 2025

Seri Ata Na Vesprem Prodolzhuva Pobeda Nad Ps Zh

May 08, 2025 -

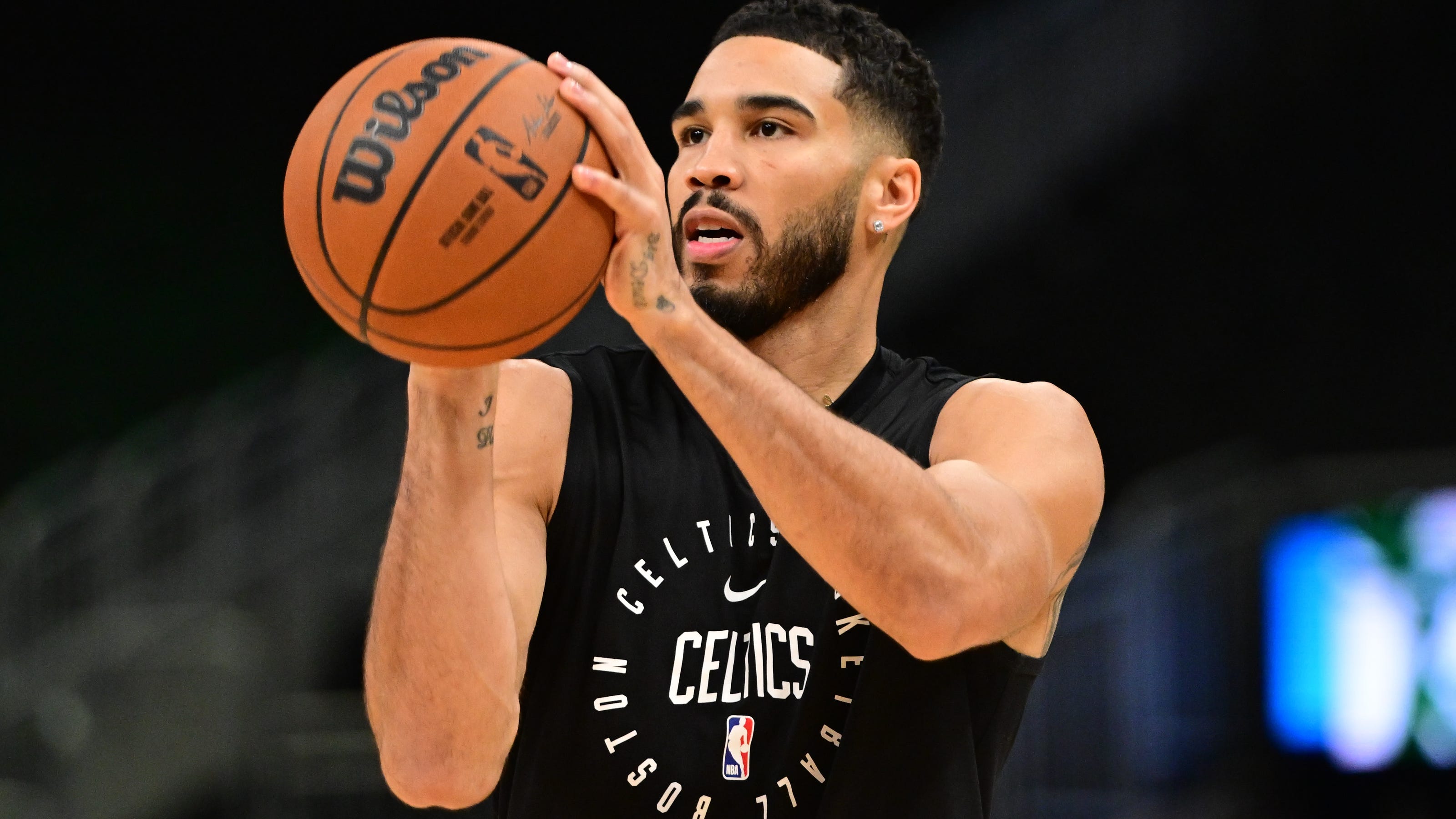

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025