Bitcoin Price Prediction: Could Trump's 100-Day Speech Send BTC Past $100,000?

Table of Contents

Trump's Potential Impact on Bitcoin

Political Uncertainty and Safe-Haven Assets

Bitcoin has increasingly been viewed as a safe-haven asset during times of political and economic instability. When traditional markets experience turbulence, investors often seek alternative stores of value, and Bitcoin, with its decentralized nature and limited supply, has emerged as a compelling option.

- Increased demand for Bitcoin as a hedge against inflation and economic downturn: Political uncertainty often leads to inflation, eroding the purchasing power of fiat currencies. Bitcoin, with a fixed supply of 21 million coins, is seen by some as a hedge against this inflation.

- Potential flight to safety from traditional markets into cryptocurrencies: Investors may move their assets out of volatile stock markets and into what they perceive as safer havens, such as Bitcoin.

- Examples of past political events and their effect on Bitcoin's price: Historical data shows correlations between significant political events and Bitcoin price fluctuations. For example, periods of heightened geopolitical tension often see an increase in Bitcoin's value as investors seek refuge from uncertainty.

Regulatory Changes and Their Influence

A hypothetical Trump speech (or similar significant political event) could also influence Bitcoin's price through regulatory announcements. The cryptocurrency market is highly sensitive to regulatory clarity.

- Positive regulatory announcements leading to increased institutional investment: Clear, favorable regulations could attract large institutional investors, driving up demand and price.

- Negative regulatory announcements causing a price dip: Conversely, negative or ambiguous regulatory signals could trigger a sell-off, leading to a price decline.

- The importance of clarity and predictability in cryptocurrency regulation: Consistent and transparent regulations are crucial for fostering growth and stability in the Bitcoin market.

Market Sentiment and Bitcoin's Price

Analyzing Current Market Conditions

Understanding the current state of the Bitcoin market is crucial for any price prediction. Several factors contribute to overall market sentiment.

- Analysis of current Bitcoin price and trading volume: Analyzing current trading data provides insights into market dynamics and investor behavior.

- Discussion of key indicators like market capitalization and circulating supply: These metrics help determine Bitcoin's overall market dominance and potential for growth.

- Mention of prominent Bitcoin analysts' predictions: While not definitive, the opinions of respected analysts can offer valuable perspectives on potential price movements.

Predicting the Price Surge to $100,000

Reaching a $100,000 Bitcoin price requires a confluence of favorable factors. While ambitious, it's not entirely improbable.

- Mass adoption by institutions and retail investors: Widespread adoption is a key driver of price appreciation. Increased institutional investment and broader retail acceptance are essential.

- Technological advancements increasing Bitcoin's efficiency and scalability: Improvements in scalability and transaction speed will make Bitcoin more user-friendly and attractive to a wider audience.

- Geopolitical events influencing investor decisions: Significant global events, such as political instability or economic crises, could propel investors towards Bitcoin as a safe haven, further driving up the price.

Risks and Challenges to Reaching $100,000

Potential Headwinds for Bitcoin's Price

Several obstacles could prevent Bitcoin from reaching the $100,000 mark.

- Increased regulatory scrutiny and potential bans: Stringent regulations or outright bans in major economies could significantly impact Bitcoin's price.

- Competition from other cryptocurrencies: The emergence of competing cryptocurrencies with superior technology or features could divert investment away from Bitcoin.

- Market manipulation and volatility: The cryptocurrency market is susceptible to manipulation, and sudden price swings can be detrimental to investor confidence.

Considering Alternative Scenarios

A balanced perspective requires considering scenarios where Bitcoin might not reach $100,000.

- Prolonged bear market conditions: Extended periods of low prices and declining investor interest could hinder price appreciation.

- Negative news events impacting investor confidence: Major security breaches or negative regulatory developments could trigger significant price drops.

- Technological limitations hindering Bitcoin's adoption: If scalability issues persist, adoption might be slower than anticipated, limiting price growth.

Conclusion

The potential impact of a significant political event, like a hypothetical Trump speech, on Bitcoin's price is complex and depends on various interacting factors. While a surge past $100,000 is possible given widespread adoption, technological advancements, and favorable regulatory environments, significant risks and challenges remain. Increased regulatory scrutiny, competition, and market volatility could hinder price growth. Therefore, a thorough understanding of market dynamics, technological advancements, and political developments is crucial for informed decision-making.

To stay ahead of the curve and make informed decisions about your Bitcoin investments, continue researching Bitcoin and stay informed about market trends and political developments that may affect its price. Keep an eye on Bitcoin price prediction analyses, understand Bitcoin's future price potential, and follow Bitcoin's price outlook closely. The future of Bitcoin remains uncertain, but its potential to continue disrupting the financial world is undeniable.

Featured Posts

-

Middle Managers The Unsung Heroes Of Business Success And Employee Development

May 08, 2025

Middle Managers The Unsung Heroes Of Business Success And Employee Development

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadlwn Ky Tfsylat

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadlwn Ky Tfsylat

May 08, 2025 -

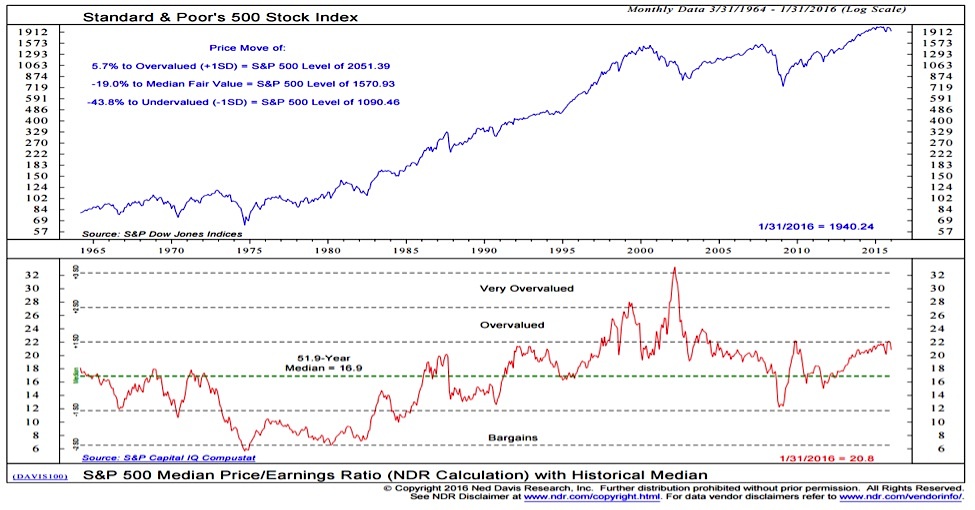

Bof A Reassures Investors Why Current Stock Market Valuations Are Not A Threat

May 08, 2025

Bof A Reassures Investors Why Current Stock Market Valuations Are Not A Threat

May 08, 2025 -

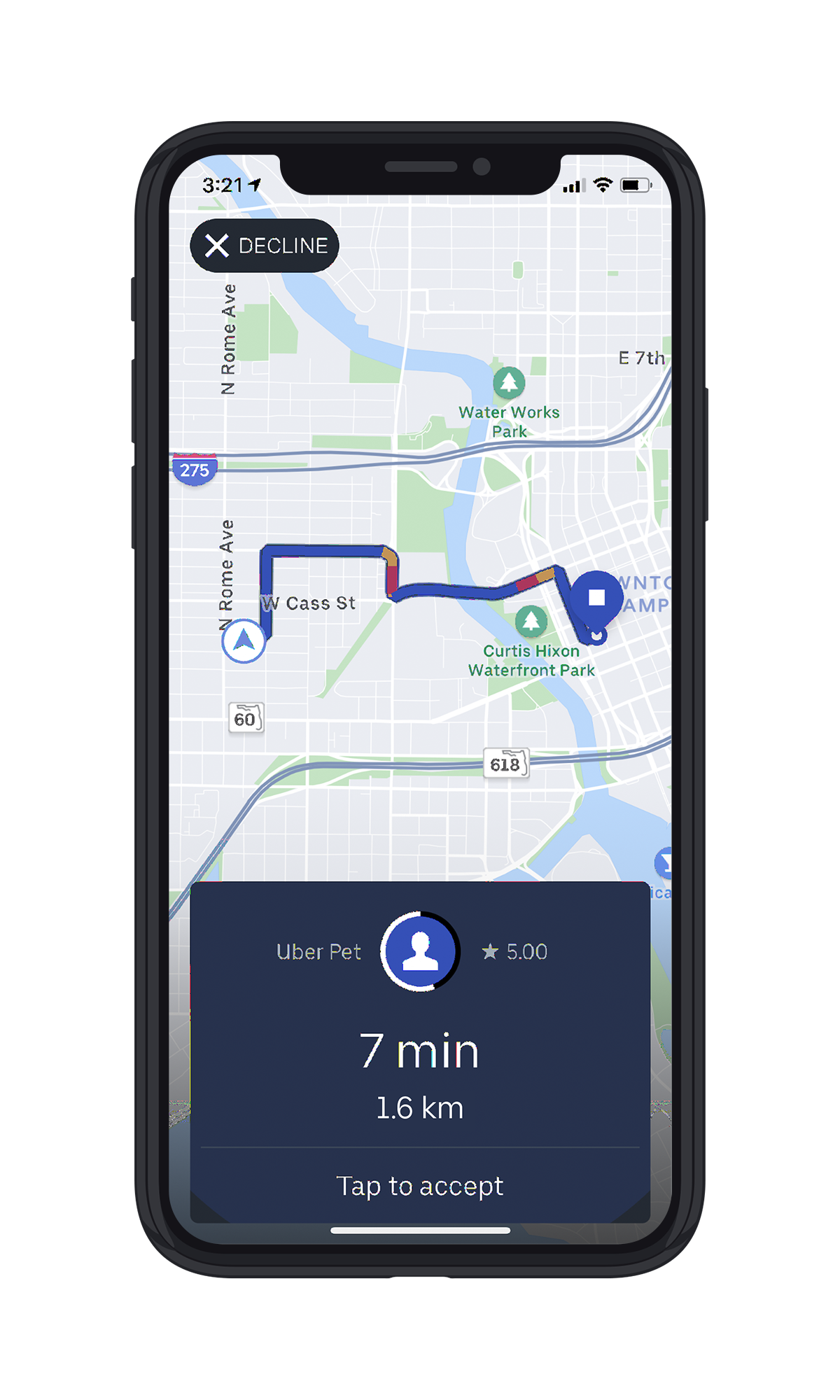

Uber Pet New Cities Added Delhi And Mumbai

May 08, 2025

Uber Pet New Cities Added Delhi And Mumbai

May 08, 2025 -

El Flamengo Presenta A Sergio Hernandez Como Su Nuevo Dt

May 08, 2025

El Flamengo Presenta A Sergio Hernandez Como Su Nuevo Dt

May 08, 2025