Bitcoin's 10x Multiplier: Could It Shake Wall Street?

Table of Contents

H2: Bitcoin's Historical Growth and Potential for a 10x Multiplier

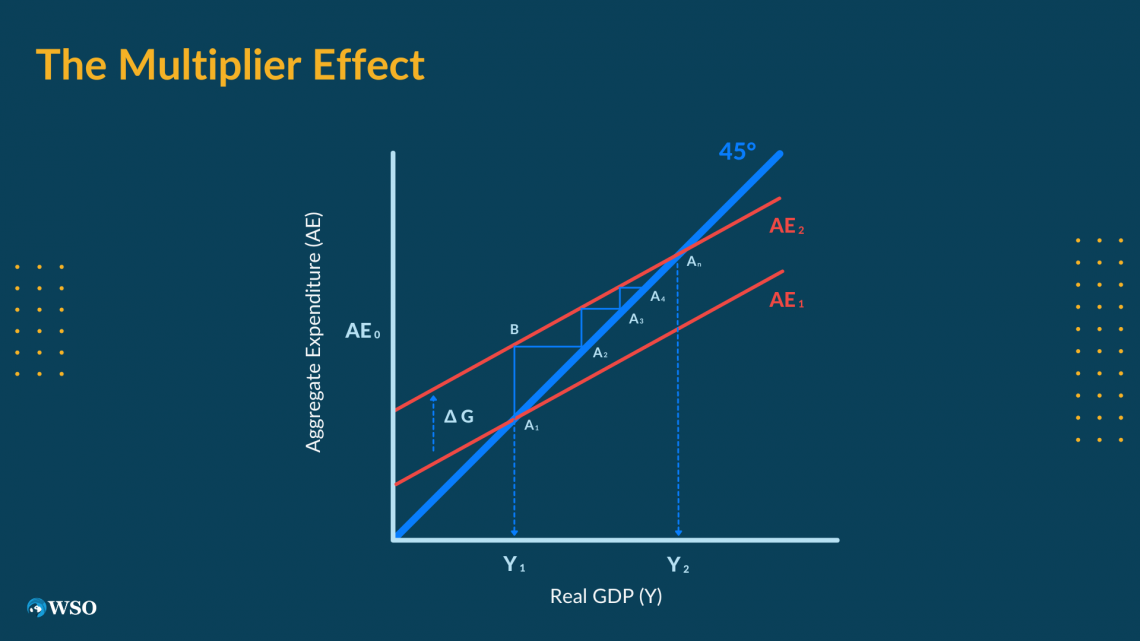

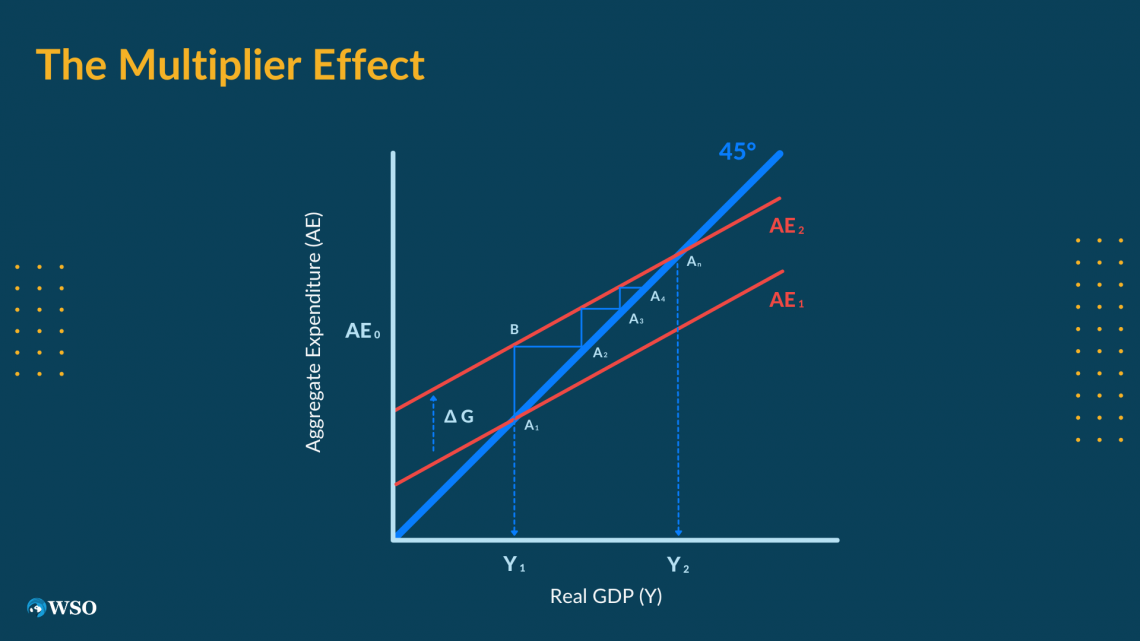

Bitcoin's history is punctuated by periods of explosive growth. From its humble beginnings to its current status as a significant asset class, Bitcoin has demonstrated a remarkable capacity for price appreciation. Past price surges have been fueled by several factors: increased institutional adoption, positive regulatory developments (or at least reduced regulatory hostility), and significant technological advancements within the Bitcoin ecosystem.

To understand the potential for a 10x multiplier, we need to analyze these factors in the context of current market conditions. A 10x increase would require a substantial increase in market capitalization and widespread adoption. However, considering Bitcoin's limited supply (21 million coins), such a scenario isn't entirely implausible.

- Historical price charts showing significant growth periods: Analyzing Bitcoin's price history reveals several instances of substantial growth, demonstrating its potential for rapid price appreciation.

- Examples of previous bull markets and their drivers: The 2017 bull market, for example, was largely driven by increasing mainstream awareness and speculation. Future bull runs might be driven by factors such as institutional investment, further technological advancements (Layer-2 scaling solutions), and regulatory clarity.

- Analysis of current market conditions and their impact on future price: Macroeconomic factors, such as inflation and geopolitical uncertainty, can significantly influence Bitcoin's price. Increased institutional adoption and the maturation of the cryptocurrency ecosystem are also key factors to consider.

H2: The Impact of a 10x Bitcoin Multiplier on Traditional Finance

A 10x Bitcoin multiplier would be a watershed moment for the global financial system. The potential consequences for Wall Street and traditional finance are profound. A massive influx of capital into Bitcoin could trigger a significant outflow from traditional assets like stocks and bonds, potentially destabilizing existing markets.

- Potential outflow of investment from stocks and bonds into Bitcoin: Investors seeking higher returns and diversification might shift a substantial portion of their portfolios into Bitcoin, reducing demand for traditional assets.

- Impact on the dominance of the US dollar: A surge in Bitcoin's value could challenge the dominance of the US dollar as the world's reserve currency, potentially impacting global trade and finance.

- Increased competition for institutional investors: Traditional financial institutions would face increased competition from cryptocurrency investment firms and platforms.

- Potential regulatory responses: Governments worldwide might respond with stricter regulations or initiatives to control the cryptocurrency market.

H2: Factors That Could Contribute to (or Inhibit) a 10x Bitcoin Multiplier

Several factors could influence whether Bitcoin reaches a 10x multiplier. These include technological advancements, regulatory developments, macroeconomic conditions, and institutional adoption.

- Technological upgrades (e.g., Lightning Network improvements): Improvements in scalability and transaction speed could increase Bitcoin's usability and adoption.

- Regulatory clarity or uncertainty in different jurisdictions: Clear and consistent regulations could boost investor confidence, while uncertainty could hinder growth.

- The impact of global economic events on Bitcoin’s price: Global economic downturns or periods of high inflation can impact the price of Bitcoin, both positively and negatively.

- The role of large-scale institutional investment: Continued and increased investment by institutional investors, like hedge funds and corporations, could drive substantial price increases.

H3: Assessing the Risks and Rewards of Investing in Bitcoin

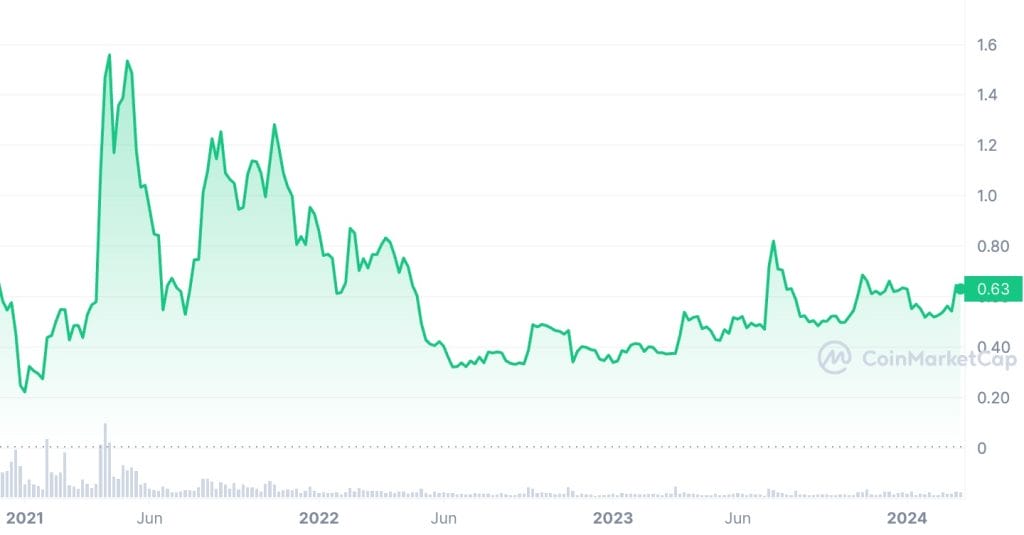

Investing in Bitcoin carries significant risk. Its price is highly volatile, subject to substantial swings. Past market crashes demonstrate the potential for significant losses. However, the potential for high rewards also exists.

- Examples of past market crashes and their impact on Bitcoin's price: The 2018 and 2022 bear markets highlight Bitcoin's price volatility.

- Strategies for mitigating risk (e.g., dollar-cost averaging, diversification): Investors can mitigate risk through strategies like dollar-cost averaging and diversification across different asset classes.

- Considerations for long-term vs. short-term investment strategies: Long-term investment strategies are often preferred for Bitcoin due to its historical volatility.

3. Conclusion

The possibility of a Bitcoin 10x multiplier presents a compelling yet complex scenario. While historical growth and certain catalysts suggest it's not beyond the realm of possibility, significant risks and hurdles remain. A 10x increase would undoubtedly reshape the financial landscape, potentially challenging the dominance of Wall Street and traditional finance. Understanding the interplay between technological advancements, regulatory changes, and macroeconomic factors is crucial to assessing this potential. Understanding the potential of Bitcoin's 10x multiplier is crucial for navigating the future of finance; stay informed and consider how this revolutionary cryptocurrency could reshape the financial world.

Featured Posts

-

Greenlands Strategic Importance Weighing Trumps China Fears

May 08, 2025

Greenlands Strategic Importance Weighing Trumps China Fears

May 08, 2025 -

Is Xrps 400 Rise Sustainable Future Price Analysis

May 08, 2025

Is Xrps 400 Rise Sustainable Future Price Analysis

May 08, 2025 -

Saglik Bakanligi Personel Alimi Son Dakika 37 Bin Kisilik Bueyuek Alim

May 08, 2025

Saglik Bakanligi Personel Alimi Son Dakika 37 Bin Kisilik Bueyuek Alim

May 08, 2025 -

Did Saturday Night Live Make Counting Crows Famous A Retrospective

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous A Retrospective

May 08, 2025 -

Xrp Up 400 In 3 Months Investment Analysis And Future Outlook

May 08, 2025

Xrp Up 400 In 3 Months Investment Analysis And Future Outlook

May 08, 2025