Bitcoin's Critical Juncture: Price Levels And Market Analysis

Table of Contents

Current Bitcoin Price and Volatility

Bitcoin's price currently sits at [insert current Bitcoin price] (USD). This represents a [percentage change] shift from its price [duration] ago. The cryptocurrency market is inherently volatile, and Bitcoin is no exception. Historical data reveals periods of significant price swings, ranging from dramatic bull runs to sharp corrections. The following chart illustrates Bitcoin's price fluctuations over the past [time period, e.g., year]: [Insert chart/graph here].

- Key Support and Resistance Levels: Currently, key support levels seem to be around [price] and resistance levels around [price]. These levels are dynamic and subject to change based on market conditions.

- Factors Influencing Price Volatility: Several factors contribute to Bitcoin's volatile nature:

- Regulatory Changes: Government regulations and pronouncements concerning cryptocurrency adoption significantly influence market sentiment.

- Market Sentiment: News cycles, social media trends, and overall investor confidence heavily impact Bitcoin's price.

- Adoption Rates: Increased adoption by businesses and institutional investors can lead to price increases, while decreased adoption can result in price drops.

- Comparison with Past Volatility: Compared to previous years, the current volatility is [higher/lower/similar], potentially indicating [reason for the assessment].

Key Factors Influencing Bitcoin's Price

Understanding Bitcoin's price movements requires analyzing various interconnected factors.

-

Macroeconomic Factors: Global economic uncertainty, inflation rates, and interest rate adjustments by central banks can influence investor appetite for risk assets like Bitcoin. High inflation often fuels demand for Bitcoin as a hedge against inflation.

-

Regulatory Developments: Regulatory clarity (or lack thereof) in different jurisdictions significantly affects Bitcoin's price. Positive regulatory developments tend to increase investor confidence, while negative news often causes price drops.

-

Institutional Adoption: Large-scale investments from institutional players like hedge funds and corporations have a profound impact on Bitcoin's price. Increased institutional involvement signals growing acceptance and legitimization.

-

Social Media Sentiment and News Cycles: Social media platforms and news outlets play a crucial role in shaping public perception and, consequently, Bitcoin's price. Positive news and supportive narratives often drive prices up, while negative news or FUD (Fear, Uncertainty, and Doubt) can cause significant declines.

-

Bullet Points:

- Correlation with Traditional Markets: Bitcoin's correlation with traditional markets is [explain the correlation, or lack thereof, and provide supporting data].

- Impact of Specific Regulations: [Give examples of specific regulations and their effect on Bitcoin's price.]

- Major Institutional Investors: [List some major institutional investors and their known involvement in the Bitcoin market.]

- Effect of Positive/Negative News: [Provide examples of how positive and negative news stories affected Bitcoin's price].

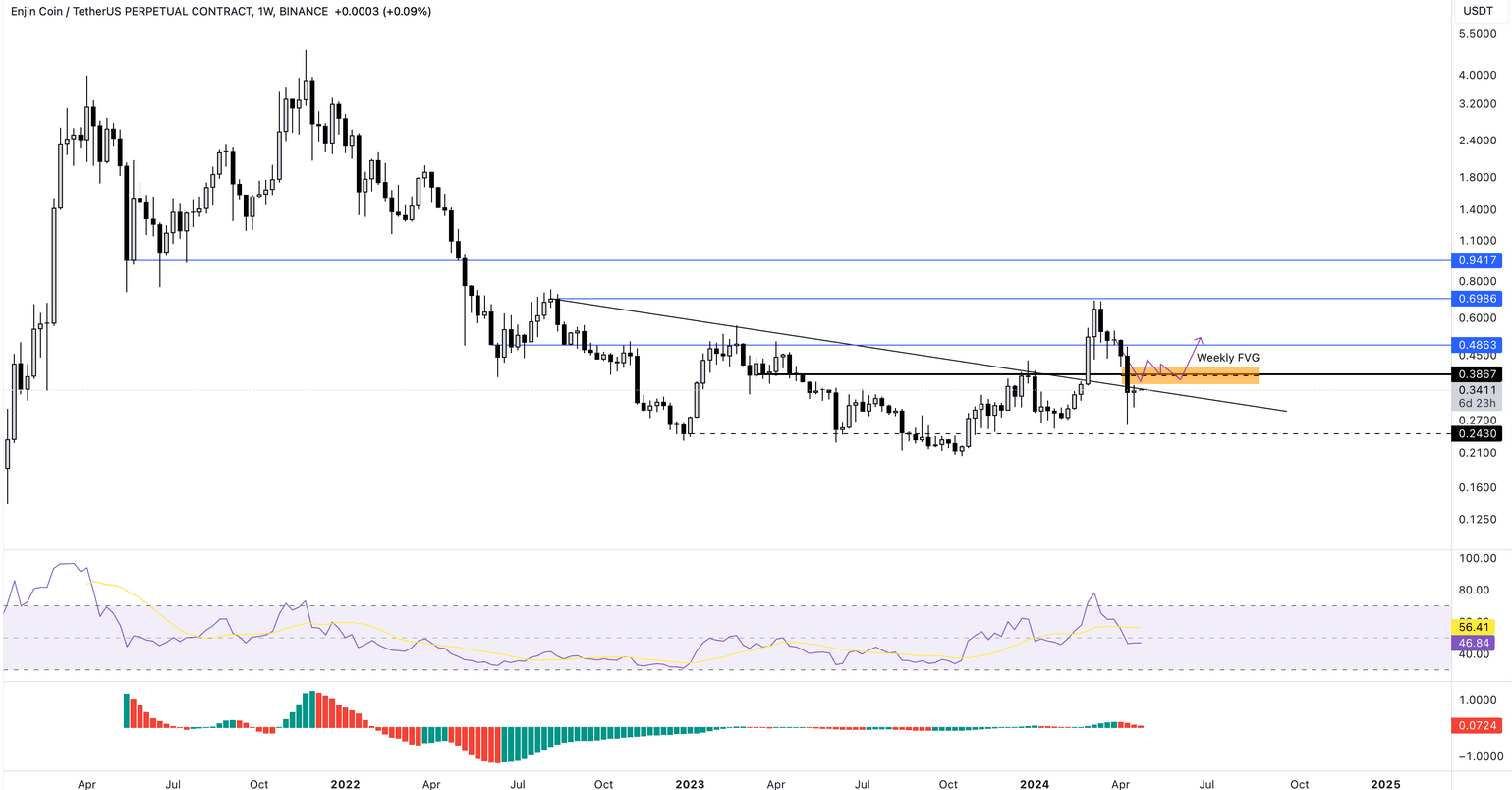

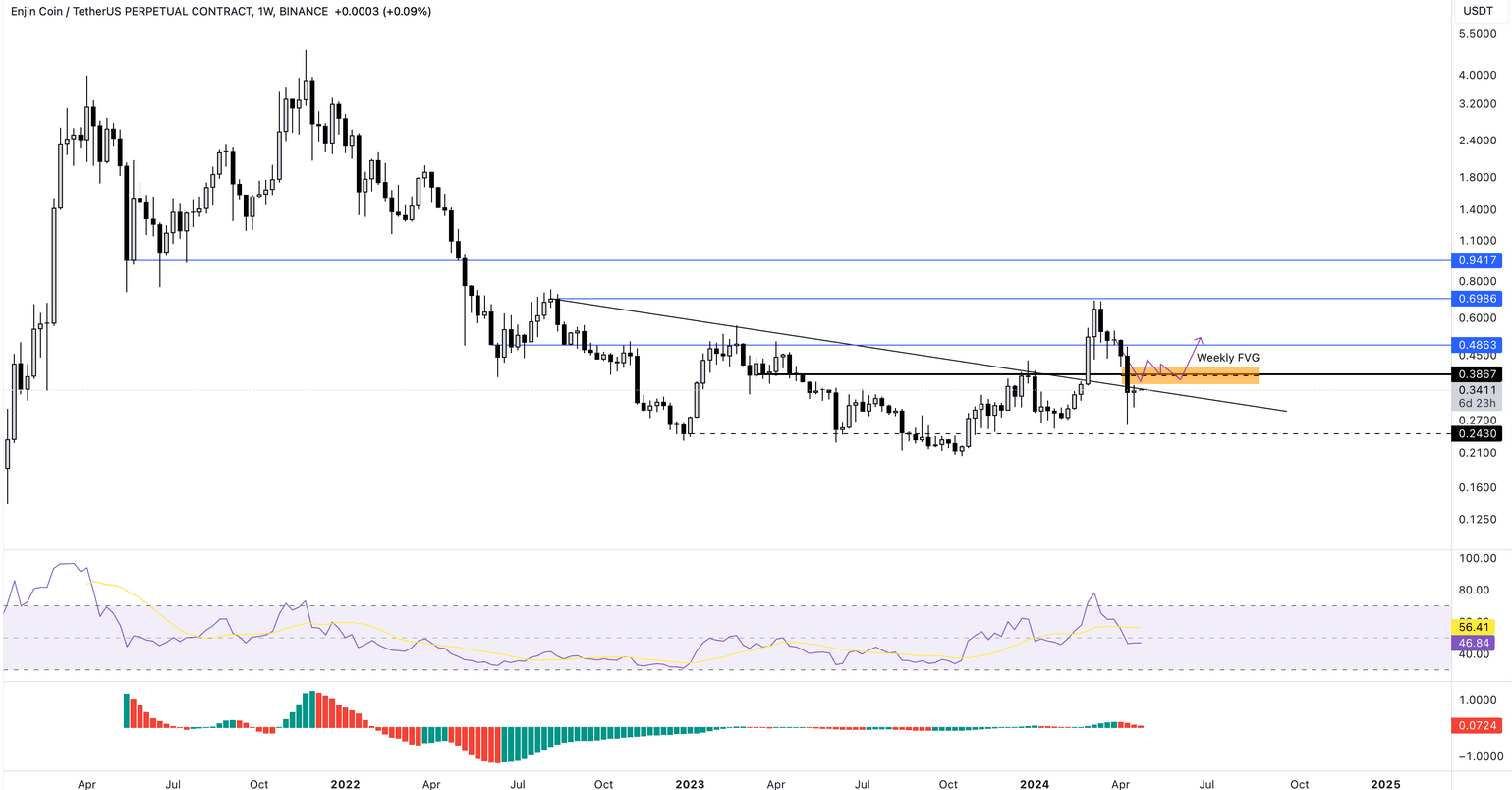

Technical Analysis of Bitcoin's Chart

Technical analysis provides valuable insights into potential price movements based on chart patterns and indicators.

-

Technical Indicators: We can utilize indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and others to gauge momentum and potential trend reversals. [Include a chart with these indicators applied to a Bitcoin price chart].

-

Chart Patterns: Identifying chart patterns like head and shoulders, double tops/bottoms, and triangles can offer clues about future price action. [Include examples of these chart patterns if applicable].

-

Support and Resistance Levels (Technical): Technical analysis helps identify potential support and resistance levels based on historical price action and indicator signals. These levels can offer insights into potential price reversals.

-

Potential Future Price Movements: Based on the technical analysis, potential future price movements could include [mention potential scenarios, accompanied by disclaimers: e.g., "a continuation of the uptrend to [price], or a pullback to [price]".]

-

Bullet Points:

- RSI Interpretation: [Explain the current RSI reading and its implications].

- MACD Interpretation: [Explain the current MACD reading and its implications].

- Chart Pattern Interpretation: [Explain the identified chart patterns and their likely implications].

- Price Predictions (with disclaimers): [Provide cautiously optimistic or pessimistic projections based on technical analysis, emphasizing that these are not financial advice.]

Future Predictions and Market Sentiment

Predicting Bitcoin's future price is inherently uncertain. However, analyzing market sentiment and considering potential events can offer possible scenarios.

-

Market Sentiment Analysis: Gauging market sentiment through social media analysis, news sentiment, and investor surveys can help understand the overall prevailing mood. [Cite sources of market sentiment data].

-

Potential Impact of Upcoming Events: Upcoming events, such as [mention significant upcoming events, e.g., regulatory changes, conferences, halving events], could significantly impact Bitcoin's price.

-

Bullish and Bearish Scenarios:

- Bullish Scenario: [Describe a possible scenario that leads to price increases, including catalysts].

- Bearish Scenario: [Describe a possible scenario that leads to price decreases, including catalysts].

-

Bullet Points:

- Potential Catalysts for Price Increases: [List potential positive factors driving price increases].

- Potential Catalysts for Price Decreases: [List potential negative factors driving price decreases].

- Importance of Diversification: It's crucial to diversify investments and not allocate all capital to a single asset like Bitcoin.

Conclusion: Navigating Bitcoin's Critical Juncture

Bitcoin's current price is a reflection of complex interplay between macroeconomic factors, regulatory developments, institutional adoption, and market sentiment. While technical analysis offers valuable insights, predicting future price movements remains highly speculative. Remember that investing in Bitcoin carries significant risks. Thorough research and a deep understanding of the market are essential for informed investment decisions. Stay tuned for further updates on Bitcoin's price and market analysis as we continue to navigate this critical juncture. Continue learning about Bitcoin's critical juncture to make well-informed investment decisions.

Featured Posts

-

Ethereums Bullish Trend Analysis Of Recent Accumulation And Price Movement

May 08, 2025

Ethereums Bullish Trend Analysis Of Recent Accumulation And Price Movement

May 08, 2025 -

Star Wars Yavin 4 Delay A George Lucas Proteges Perspective

May 08, 2025

Star Wars Yavin 4 Delay A George Lucas Proteges Perspective

May 08, 2025 -

Gcci Presidents Made In Gujranwala Exhibition Sufians Commendation

May 08, 2025

Gcci Presidents Made In Gujranwala Exhibition Sufians Commendation

May 08, 2025 -

Neymar En Prelista De Brasil Regreso Ante Argentina

May 08, 2025

Neymar En Prelista De Brasil Regreso Ante Argentina

May 08, 2025 -

Where To Invest A Map Of The Countrys Top Emerging Business Areas

May 08, 2025

Where To Invest A Map Of The Countrys Top Emerging Business Areas

May 08, 2025