BlackRock ETF: Is This Billionaire-Favored Investment Right For You?

Table of Contents

Understanding BlackRock and its ETF Offerings

BlackRock, a name synonymous with financial stability and expertise, has a long and storied history in asset management. Its iShares ETF platform offers a vast and diverse range of ETFs, covering virtually every asset class imaginable. From broad market index funds tracking the S&P 500 to sector-specific ETFs focused on technology or healthcare, and even bond ETFs and international ETFs, BlackRock provides extensive options for diversified investing.

-

Examples of Popular BlackRock ETFs:

- IVV (iShares Core S&P 500): Tracks the S&P 500 index, offering broad market exposure.

- IWM (iShares Russell 2000): Focuses on small-cap U.S. companies.

- IEF (iShares 7-10 Year Treasury Bond ETF): Provides exposure to U.S. Treasury bonds.

-

Expense Ratios: A crucial factor to consider is the expense ratio – the annual fee charged to manage the ETF. Lower expense ratios translate to higher returns over time. BlackRock generally offers competitive expense ratios, but comparing them to other ETF providers is always advisable.

-

Active vs. Passive Management: BlackRock offers both actively and passively managed ETFs. Passive ETFs (like most iShares Core ETFs) track a specific index, while actively managed ETFs aim to outperform their benchmark. Understanding this distinction is vital for aligning your investment strategy.

Benefits of Investing in BlackRock ETFs

BlackRock ETFs offer several compelling advantages for investors.

Diversification and Low Costs

BlackRock ETFs allow for significant diversification across various asset classes and sectors, mitigating risk. Investing in a diverse portfolio of BlackRock ETFs can significantly reduce the impact of any single investment performing poorly.

- Advantages of Diversification: Reduces overall portfolio volatility and minimizes losses during market downturns.

- Expense Ratio Comparison: BlackRock often boasts lower expense ratios than actively managed mutual funds or some competitors, preserving more of your returns.

- Impact of Lower Expense Ratios: Even small differences in expense ratios can significantly impact long-term returns, compounding over time.

Liquidity and Accessibility

BlackRock ETFs are traded on major exchanges, providing excellent liquidity. This means you can buy and sell them easily throughout the trading day, at prices reflecting current market conditions.

- Trading Flexibility: Buy or sell shares quickly, unlike mutual funds which only trade at the end of the day.

- Transparency of Holdings: BlackRock provides clear information on the assets held within each ETF, enabling informed decision-making.

- Accessibility: BlackRock ETFs are readily available through most brokerage accounts.

Tracking Performance

Passively managed BlackRock ETFs aim to closely mirror the performance of their underlying indices.

- Tracking Error: While perfect tracking is impossible, BlackRock strives to minimize the difference (tracking error) between the ETF's performance and the index's performance.

- Performance Comparison: Researching the tracking performance of specific BlackRock ETFs against competitors allows investors to make informed choices.

Potential Drawbacks and Risks

While BlackRock ETFs offer numerous advantages, it's crucial to acknowledge potential drawbacks and risks.

Market Risk

Investing in ETFs, regardless of the provider, carries inherent market risk. The value of your investment can fluctuate based on market conditions.

- Market Volatility: Stock prices can experience significant ups and downs, potentially leading to losses.

- Risk Tolerance: Align your investments with your risk tolerance; consider a more conservative approach if you're risk-averse.

Expense Ratios and Hidden Fees

While BlackRock’s expense ratios are generally competitive, always meticulously compare them across different ETFs. Hidden fees can also exist, so read the prospectuses carefully.

- Long-Term Impact of Expense Ratios: Even small differences in expense ratios can significantly erode long-term returns.

- Potential Fees: Brokerage commissions can also impact overall returns.

Not Suitable for All Investors

BlackRock ETFs aren't a one-size-fits-all solution. They may not be appropriate for all investors.

- Investment Goals and Time Horizon: Consider your investment goals (e.g., retirement, education) and your time horizon before investing.

- Professional Advice: Consulting a financial advisor is recommended to determine if BlackRock ETFs align with your personal financial plan.

Conclusion

BlackRock ETFs can be a valuable addition to a diversified portfolio, offering diversification, low costs, and liquidity. However, potential drawbacks, such as market risk and the need for careful expense ratio comparison, must be considered. Before investing in any BlackRock ETF, thoroughly research different options and consult a financial advisor to determine if a BlackRock ETF strategy aligns with your personal financial plan. Remember to consider the overall expense ratios and your investment risk tolerance before investing in any BlackRock ETF.

Featured Posts

-

Is Palantir Stock A Good Buy Before May 5th Risk And Reward Assessment

May 09, 2025

Is Palantir Stock A Good Buy Before May 5th Risk And Reward Assessment

May 09, 2025 -

Playoff Hope For Oilers Hinges On Draisaitls Recovery From Lower Body Injury

May 09, 2025

Playoff Hope For Oilers Hinges On Draisaitls Recovery From Lower Body Injury

May 09, 2025 -

Is Young Thugs Back Outside Album Imminent A Look At The Rollout

May 09, 2025

Is Young Thugs Back Outside Album Imminent A Look At The Rollout

May 09, 2025 -

Madhyamik Pariksha Result 2025 Check Merit List Online

May 09, 2025

Madhyamik Pariksha Result 2025 Check Merit List Online

May 09, 2025 -

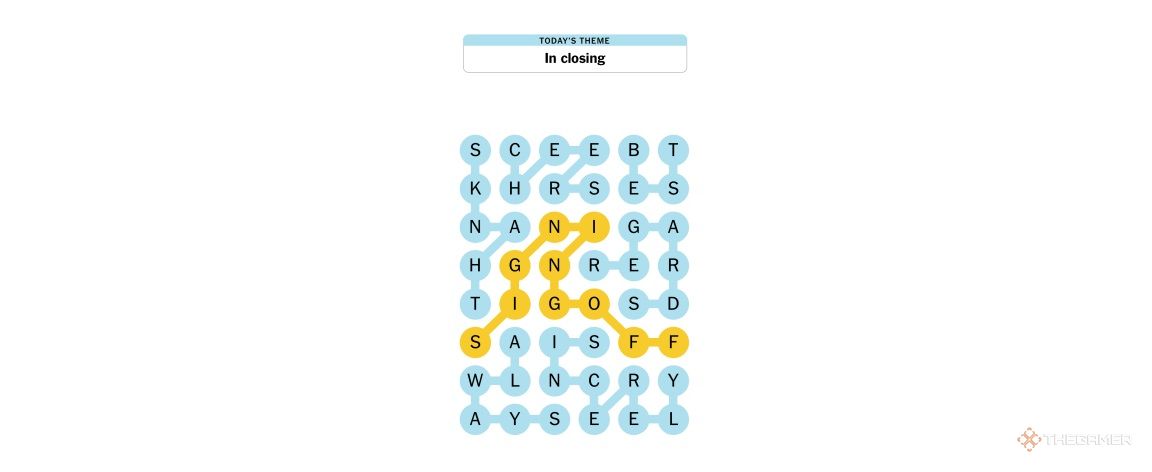

Solve The Nyt Strands Crossword April 6 2025 Guide

May 09, 2025

Solve The Nyt Strands Crossword April 6 2025 Guide

May 09, 2025