BOE Should Consider Smaller QE In Future Economic Shocks: Greene's Proposal

Table of Contents

Greene's Critique of Large-Scale QE

Greene's proposal directly challenges the BOE's past reliance on large-scale QE programs. The argument centers on the significant side effects of injecting vast sums of money into the economy without sufficient targeting. The potential negative consequences, according to Greene, include:

- Increased Inflationary Pressures: Massive QE programs can lead to a surge in money supply, exceeding the economy's capacity to absorb it, thus driving up inflation and eroding purchasing power.

- Creation of Asset Bubbles: The influx of liquidity can inflate asset prices (stocks, bonds, real estate) disproportionately, creating unsustainable bubbles that eventually burst, causing significant economic disruption.

- Inefficient Allocation of Capital: Large-scale QE often leads to a misallocation of capital, favoring certain sectors over others, potentially hindering overall economic growth and productivity.

- Exacerbation of Existing Inequalities: The benefits of QE often disproportionately accrue to wealthier individuals and institutions, widening the gap between the rich and poor.

Bullet Points:

- Analysis of the 2008-09 financial crisis and subsequent QE programs reveals a clear correlation between large-scale QE and subsequent asset price inflation.

- Studies indicate a significant increase in house prices and equity valuations following periods of expansive QE policies.

- Research suggests a link between large-scale QE and increased wealth inequality, with the wealthiest benefiting the most from asset price appreciation.

The Case for Smaller, Targeted QE

Greene's central argument is that smaller, targeted QE programs offer a more effective and less risky alternative. This approach involves carefully directing asset purchases towards specific sectors or regions of the economy most in need of stimulus. The advantages of this precision monetary policy are:

- More Precise Control over Monetary Policy: Smaller interventions allow for finer adjustments, minimizing the risk of overstimulation and subsequent inflation.

- Better Targeting of Specific Sectors: QE can be directed at sectors experiencing acute distress, providing more effective support where it is most needed. This could involve focused purchases of corporate bonds in struggling industries or municipal bonds in economically depressed regions.

- Reduced Risk of Asset Bubbles and Inflation: By limiting the overall amount of liquidity injected, the risk of creating asset bubbles and fueling runaway inflation is significantly reduced.

- Improved Efficiency in Resource Allocation: Targeted QE ensures that resources are directed towards productive investments, rather than being spread thinly across the economy, potentially leading to lower overall economic growth.

Bullet Points:

- Examples of sectors that might benefit from targeted QE include small and medium-sized enterprises (SMEs), renewable energy firms, or infrastructure projects.

- Targeted QE could be implemented through the selective purchase of bonds issued by specific sectors or geographic locations.

- Empirical evidence from other countries suggests that targeted QE can stimulate economic activity in specific sectors without triggering widespread inflation.

Addressing Potential Counterarguments

Critics might argue that smaller QE programs are insufficient to stimulate economic activity during a severe downturn. Furthermore, they might argue that large-scale QE is essential for providing sufficient liquidity to financial markets. Greene addresses these concerns:

- Effectiveness of Smaller QE: The argument hinges on targeting. While smaller overall injections may seem less potent, they are considerably more effective when strategically focused on sectors with high multiplier effects. This ensures a better return on investment.

- Liquidity Provision: While large-scale QE may increase overall liquidity, smaller, targeted interventions can effectively address specific liquidity shortfalls in stressed sectors, minimizing the risks associated with widespread liquidity injections.

- Alternative Monetary Policy Tools: Smaller, targeted QE doesn't exclude other monetary policy tools, but works in tandem with them. It offers a targeted supplement rather than a sole solution.

Bullet Points:

- Simulations and models can be developed to demonstrate the potential effectiveness of targeted QE compared to large-scale interventions.

- The role of other monetary policy tools, such as interest rate adjustments and forward guidance, should be considered in conjunction with smaller QE initiatives.

- Case studies of targeted QE programs implemented in other countries can provide valuable insights into its effectiveness and potential risks.

Conclusion: Reforming BOE's QE Strategy

Greene's proposal for smaller, more targeted QE programs offers a compelling path towards a more efficient and less risky monetary policy for the BOE. By focusing on precision and addressing specific economic vulnerabilities, this approach can effectively mitigate the risks associated with large-scale QE while still achieving the desired economic stimulus. The BOE needs to consider a more nuanced and adaptive approach to future economic shocks. We urge policymakers to seriously consider the implications of Greene's recommendations and explore the potential for reforming QE strategies. Further research and open discussion are crucial for navigating the complexities of monetary policy in the face of future economic uncertainty. Share your thoughts – how can the BOE best utilize QE for future economic stability? Let's discuss the future of BOE's monetary policy and its use of QE.

Featured Posts

-

Ice Blocks Father From Meeting Newborn Son Mahmoud Khalils Case

Apr 23, 2025

Ice Blocks Father From Meeting Newborn Son Mahmoud Khalils Case

Apr 23, 2025 -

Canadian Households Face Economic Headwinds Amidst Trumps Tariffs

Apr 23, 2025

Canadian Households Face Economic Headwinds Amidst Trumps Tariffs

Apr 23, 2025 -

Provuss Heartfelt Tribute To Baseball Legend Bob Uecker

Apr 23, 2025

Provuss Heartfelt Tribute To Baseball Legend Bob Uecker

Apr 23, 2025 -

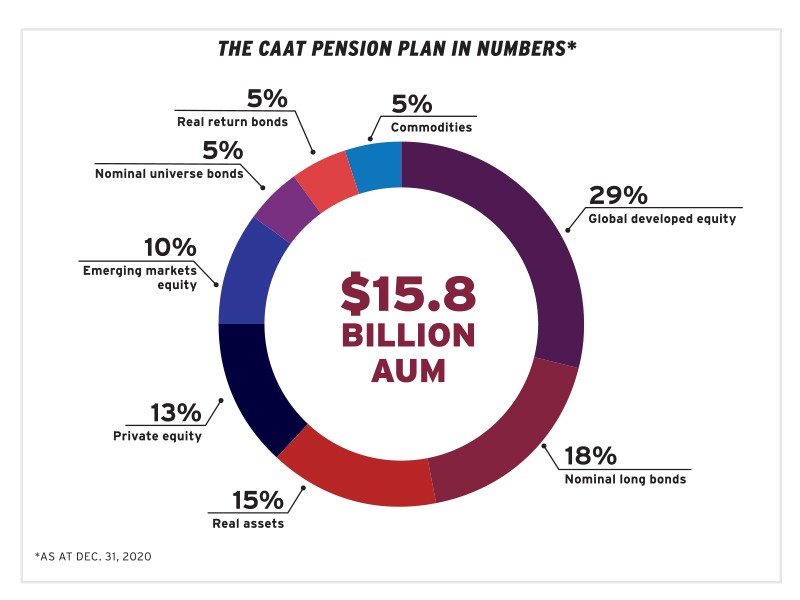

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025 -

Switzerland Expands Eu Sanctions On Russian Media Outlets

Apr 23, 2025

Switzerland Expands Eu Sanctions On Russian Media Outlets

Apr 23, 2025