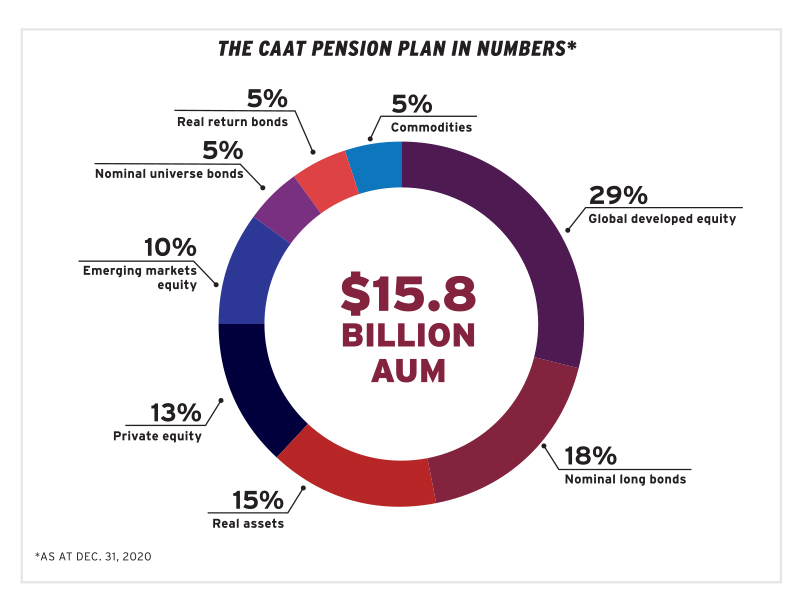

CAAT Pension Plan Seeks Increased Canadian Private Investment

Table of Contents

Why CAAT is Focusing on Canadian Private Investment

CAAT's strategic shift towards increased Canadian private investment is driven by several key factors. Diversification is paramount; by reducing reliance on traditionally volatile public markets, the pension plan aims to mitigate risk and secure long-term returns for its beneficiaries. The Canadian private market presents compelling opportunities for higher returns compared to publicly traded assets. Investing in private equity, infrastructure, and real estate often yields stronger, longer-term growth.

Furthermore, this strategy aligns perfectly with a commitment to responsible investing and supports domestic economic growth. Investing in Canadian businesses directly contributes to job creation and infrastructure development, boosting the Canadian economy. This focus on domestic opportunities promotes sustainable and impactful growth.

- Reduced reliance on public markets: Minimizing exposure to market fluctuations improves the overall stability of the pension fund.

- Potential for higher returns: Private investments often offer superior returns compared to traditional public market investments.

- Support for Canadian businesses and job growth: Investing domestically creates jobs and strengthens the Canadian economy.

- Alignment with responsible investing principles (ESG considerations): CAAT can prioritize investments that align with environmental, social, and governance (ESG) criteria.

- Enhanced risk diversification: Spreading investments across various sectors and asset classes reduces overall portfolio risk.

Target Investment Areas for CAAT's Canadian Private Investment Strategy

CAAT's Canadian private investment strategy is targeting several key sectors with high growth potential. These include:

-

Private Equity: Investments in promising Canadian companies across diverse sectors, from technology to healthcare, offer opportunities for significant capital appreciation. This allows CAAT to participate in the growth story of successful Canadian businesses.

-

Infrastructure: Large-scale infrastructure projects, such as renewable energy initiatives (wind, solar, hydro), transportation networks, and utility upgrades, offer stable, long-term returns and contribute to essential national infrastructure development. This focus on sustainable infrastructure is also in line with global ESG principles.

-

Real Estate: Acquisitions of commercial and residential properties across Canada offer diversified exposure to a resilient asset class. Strategic real estate investments can provide both income generation and capital appreciation.

-

Venture Capital: Funding innovative Canadian startups with high-growth potential provides exposure to disruptive technologies and emerging markets, offering the chance for substantial returns while supporting Canadian innovation.

These strategic investment areas offer a balanced approach, combining high-growth potential with relatively stable, long-term income streams, perfectly suited to the needs of a large pension fund.

Impact on the Canadian Economy and Financial Markets

The increased Canadian private investment by CAAT will have a substantial ripple effect on the Canadian economy and financial markets. The injection of capital into Canadian businesses will stimulate economic activity, directly leading to job creation across various sectors. Increased investment in infrastructure projects will further enhance economic productivity and improve the quality of life for Canadians.

-

Increased capital flow into Canadian businesses: This will provide much-needed funding for growth and expansion, particularly for SMEs.

-

Stimulation of economic activity and job creation: New projects and expansion initiatives will generate employment opportunities across the country.

-

Potential for enhanced market liquidity and improved valuations of Canadian assets: Increased investment will improve the liquidity of the Canadian private markets, attracting further investment.

-

Strengthening of the Canadian financial ecosystem: This will attract more international investors and bolster Canada's position as a stable and attractive investment destination.

This infusion of domestic capital can significantly improve the Canadian economic outlook, leading to a more robust and resilient financial ecosystem.

Conclusion

CAAT's strategic shift towards increased Canadian private investment presents a win-win scenario. The pension plan benefits from diversification and the potential for enhanced returns, while the Canadian economy receives a significant boost through job creation, economic stimulus, and strengthened infrastructure. This proactive strategy highlights a broader trend among Canadian pension funds to support domestic growth and reinforces Canada's position as a compelling investment destination.

Call to Action: Learn more about CAAT's investment strategy and discover how Canadian private investment opportunities can benefit your business. Explore the possibilities of partnering with CAAT Pension Plan for future growth and development. Invest in Canada's future through Canadian private investment opportunities.

Featured Posts

-

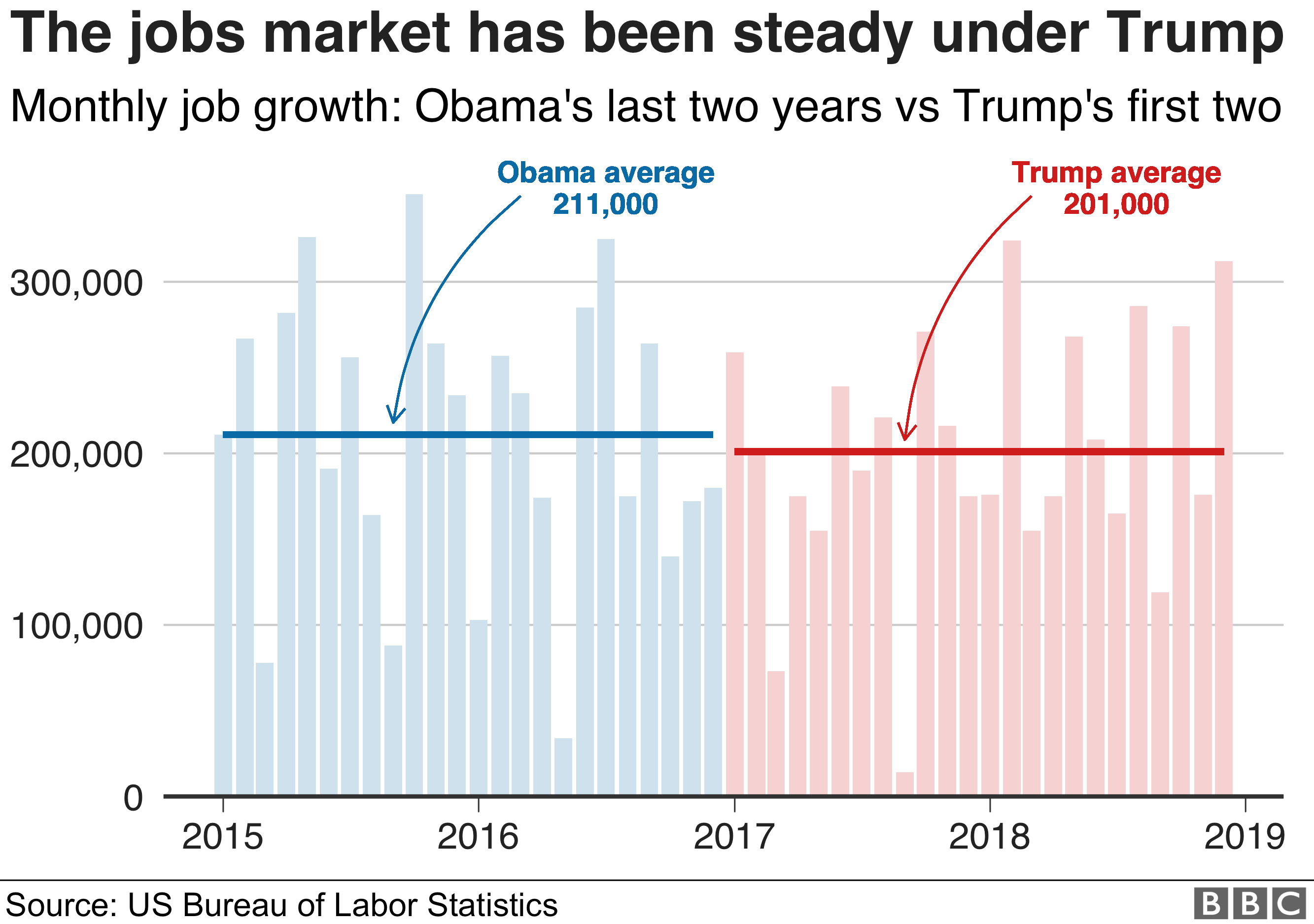

The Trump Presidency And The Us Economy A Statistical Perspective

Apr 23, 2025

The Trump Presidency And The Us Economy A Statistical Perspective

Apr 23, 2025 -

P E I Easter Weekend Business Hours And Holiday Closures

Apr 23, 2025

P E I Easter Weekend Business Hours And Holiday Closures

Apr 23, 2025 -

How To Remove Your Online Presence A Step By Step Guide

Apr 23, 2025

How To Remove Your Online Presence A Step By Step Guide

Apr 23, 2025 -

350 Kata Kata Motivasi Hari Senin Semangat Kerja Sepanjang Pekan

Apr 23, 2025

350 Kata Kata Motivasi Hari Senin Semangat Kerja Sepanjang Pekan

Apr 23, 2025 -

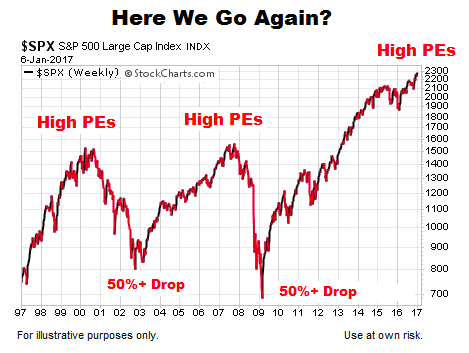

Bof As Take Are High Stock Market Valuations Cause For Concern

Apr 23, 2025

Bof As Take Are High Stock Market Valuations Cause For Concern

Apr 23, 2025