BofA Reassures Investors: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Rationale: Understanding Their Positive Market Outlook

BofA's positive market outlook rests on a comprehensive analysis of key economic indicators and growth prospects. Their forecast suggests continued, albeit moderated, economic expansion. This optimistic stance is fueled by several factors:

- Moderate Inflation: BofA's analysis indicates that inflation, while still elevated, is gradually cooling, reducing pressure on the Federal Reserve to aggressively raise interest rates. This less aggressive monetary policy stance supports continued economic growth.

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains relatively robust, suggesting continued demand in the economy. This bodes well for corporate earnings and overall market performance.

- Positive GDP Growth Projections: BofA projects continued, albeit slower, GDP growth for the coming quarters, suggesting sustained economic expansion. They highlight the strength of certain sectors as contributing factors to this growth.

- Strategic Sector Highlights: BofA's research points to specific sectors, such as technology and healthcare, as exhibiting strong growth potential. They cite innovations and demographic trends as driving forces behind their positive outlook in these areas.

- Supporting Evidence: These conclusions are substantiated by BofA's recent reports and statements from their chief economists and market strategists. (Note: For precise quotes and report references, consult BofA's official publications.)

Addressing Investor Concerns: Debunking Common Valuation Worries

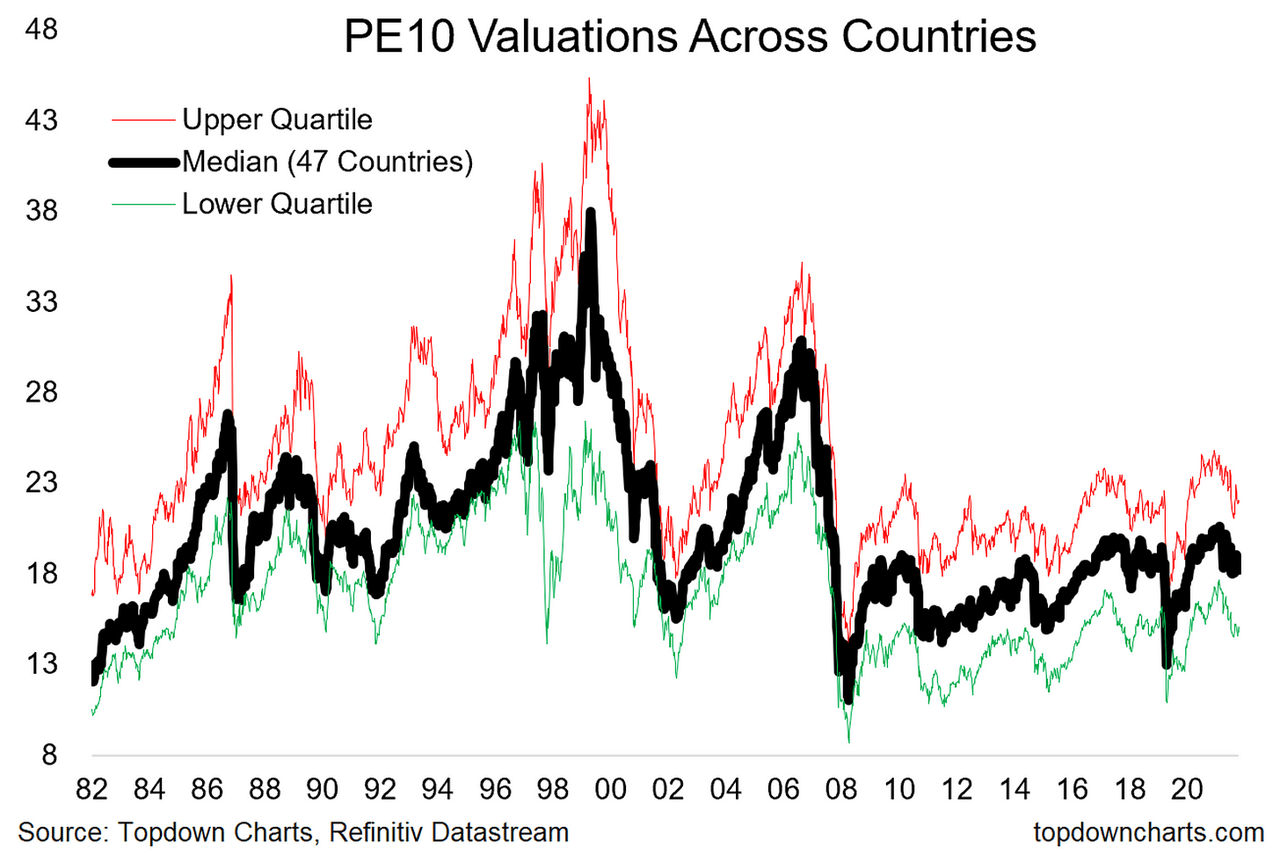

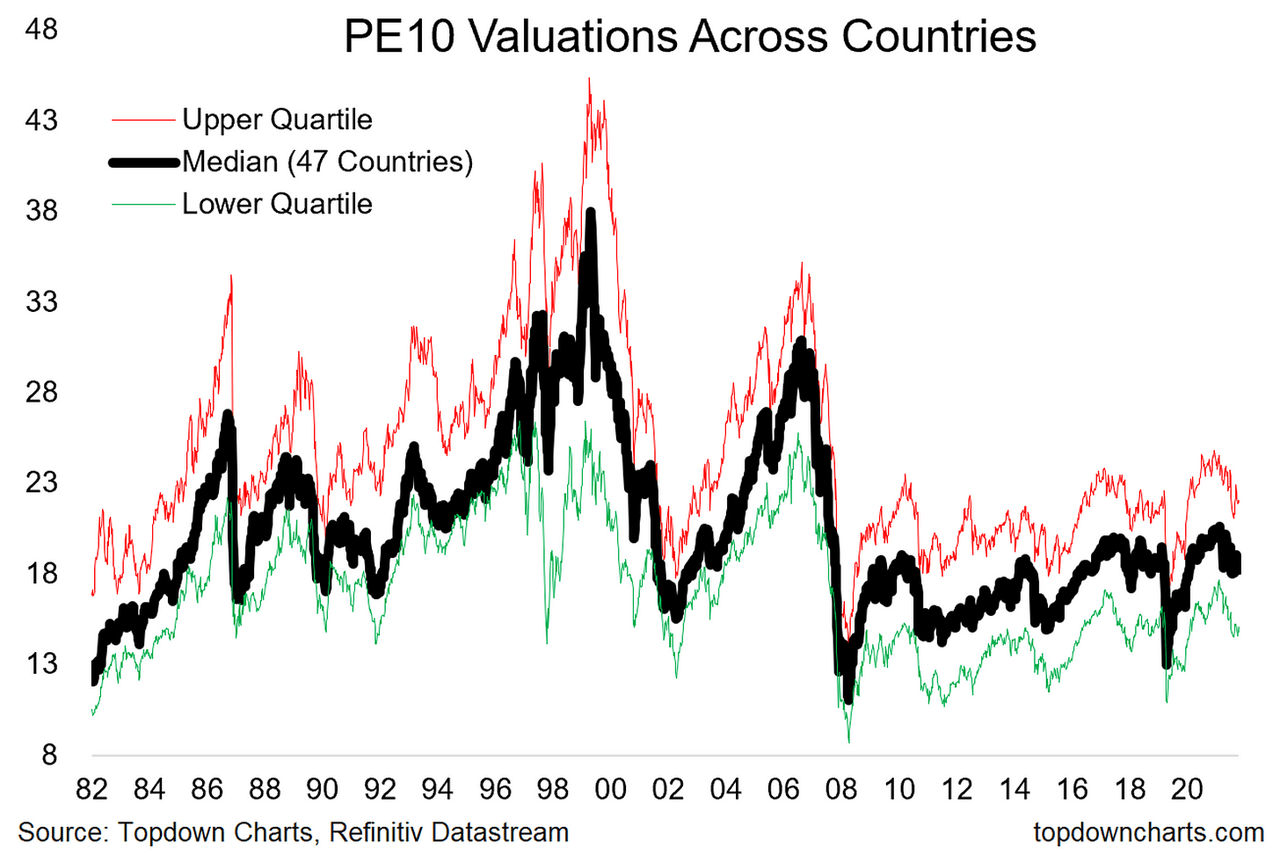

Many investors are understandably concerned about potentially overvalued stocks. The fear of a market correction or even a bear market is palpable. However, BofA counters these anxieties with several arguments:

- Long-Term Growth Potential: BofA emphasizes that current valuations should be assessed within the context of long-term growth prospects. They argue that focusing solely on short-term fluctuations can be misleading.

- Discounted Cash Flow Analysis: BofA likely employs discounted cash flow analysis and other valuation metrics to demonstrate that current prices are justified by future earnings potential. This rigorous approach provides a more nuanced view of market valuations.

- Mitigation of Downturn Risks: BofA likely highlights factors mitigating the risk of a severe market downturn, such as robust corporate balance sheets and improved regulatory frameworks.

- Portfolio Diversification: BofA stresses the importance of a diversified investment portfolio as a cornerstone of effective risk management. Spreading investments across different asset classes and sectors helps reduce overall portfolio volatility.

Strategic Investment Strategies in the Current Market

Based on BofA's analysis, several investment strategies might be considered:

- Long-Term Investing: BofA strongly advocates for a long-term investment horizon, encouraging investors to avoid making impulsive decisions based on short-term market fluctuations.

- Strategic Sector Allocation: Given BofA's positive outlook on specific sectors, investors may want to allocate more resources to technology, healthcare, and other promising areas. However, thorough individual research is crucial before investing in any specific sector.

- Value Investing Approach: Identifying undervalued stocks with strong fundamentals could be a fruitful strategy in the current environment. Thorough fundamental analysis is essential to make informed decisions.

- Risk Management Techniques: Employing techniques like hedging or carefully managing leverage can further mitigate investment risk. This requires a deeper understanding of investment tools and strategies.

- Actionable Tip: Review your investment portfolio regularly, ensuring it's aligned with your risk tolerance and financial goals. Consult with a financial advisor if needed.

The Role of Corporate Earnings in Shaping Valuations

Strong corporate earnings are crucial in justifying current stock market valuations. Several factors contribute to this:

- Improved Supply Chains: Easing supply chain disruptions boost corporate profit margins and revenue growth. This positive impact translates directly into higher earnings per share (EPS).

- Increased Consumer Spending: Continued consumer spending drives sales, leading to increased revenues and profits for companies across various sectors. This contributes significantly to higher stock valuations.

- Earnings Growth and Stock Prices: A strong correlation typically exists between earnings growth and stock prices. Companies demonstrating consistent earnings growth tend to command higher valuations.

Conclusion

BofA's analysis suggests that current stock market valuations, while seemingly high, shouldn't be a cause for excessive alarm. Their positive outlook is supported by factors such as moderate inflation, resilient consumer spending, and strong corporate earnings. The emphasis on long-term investment strategies, careful risk management, and a diversified portfolio remains crucial. Don't let unfounded fears about stock market valuations derail your investment plans. Learn more about BofA's market outlook and develop a robust investment strategy today!

Featured Posts

-

Chelsea Handler On Elon Musk Would She Date Him To Save America Her Viral Response

Apr 26, 2025

Chelsea Handler On Elon Musk Would She Date Him To Save America Her Viral Response

Apr 26, 2025 -

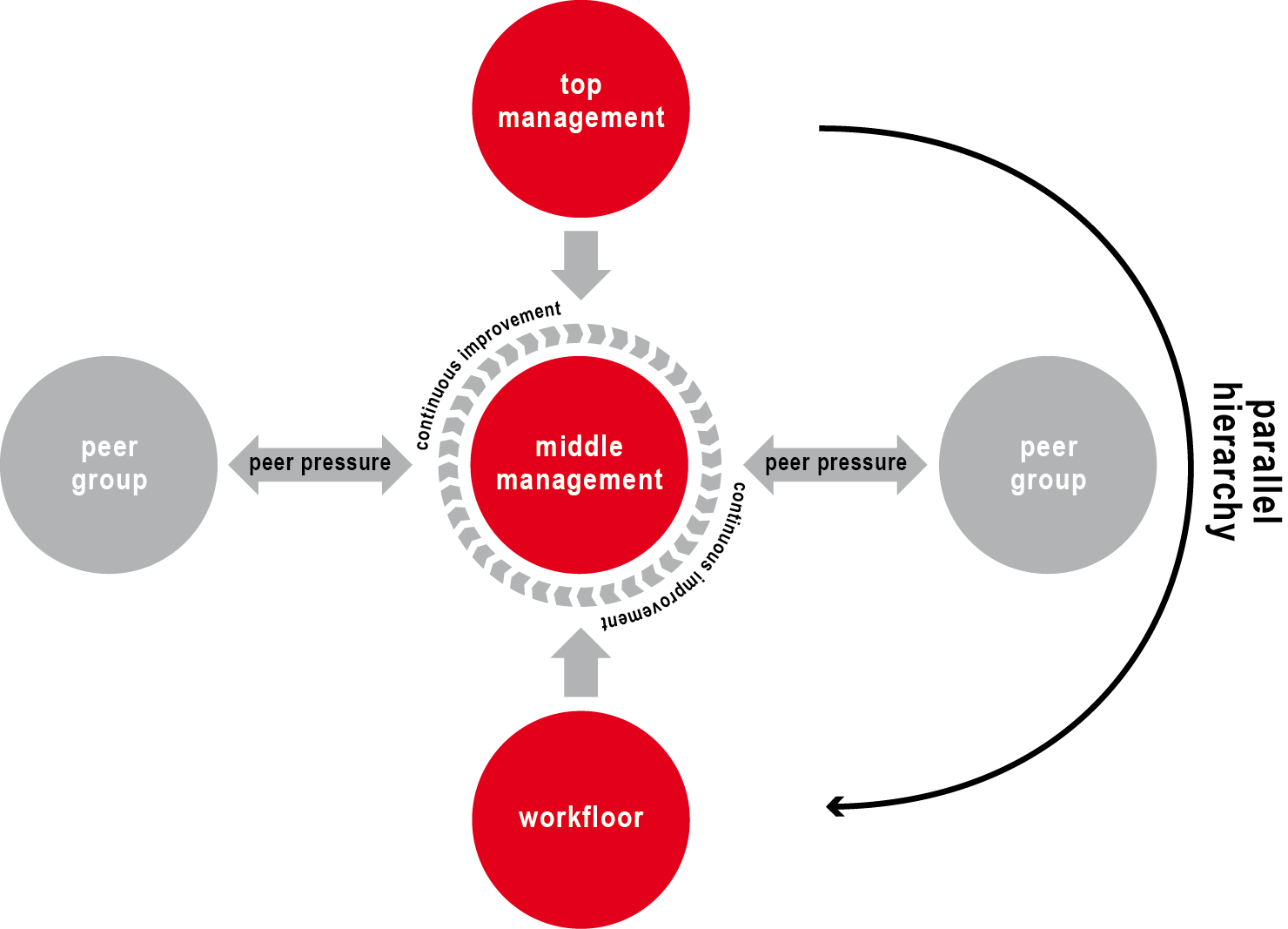

Why Invest In Middle Management A Strategic Approach To Business Growth

Apr 26, 2025

Why Invest In Middle Management A Strategic Approach To Business Growth

Apr 26, 2025 -

Gavin Newsoms Record Fact Checking Recent Controversies

Apr 26, 2025

Gavin Newsoms Record Fact Checking Recent Controversies

Apr 26, 2025 -

Chelsea Handlers New Book I Ll Have What Shes Having Buy Online Now

Apr 26, 2025

Chelsea Handlers New Book I Ll Have What Shes Having Buy Online Now

Apr 26, 2025 -

Deion Sanders On Son Shedeurs Speed A Different Kind Of Success

Apr 26, 2025

Deion Sanders On Son Shedeurs Speed A Different Kind Of Success

Apr 26, 2025

Latest Posts

-

Whats App Spyware Litigation Metas 168 Million Verdict And Whats Next

May 09, 2025

Whats App Spyware Litigation Metas 168 Million Verdict And Whats Next

May 09, 2025 -

The Whats App Spyware Case Metas Financial Hit And Strategic Response

May 09, 2025

The Whats App Spyware Case Metas Financial Hit And Strategic Response

May 09, 2025 -

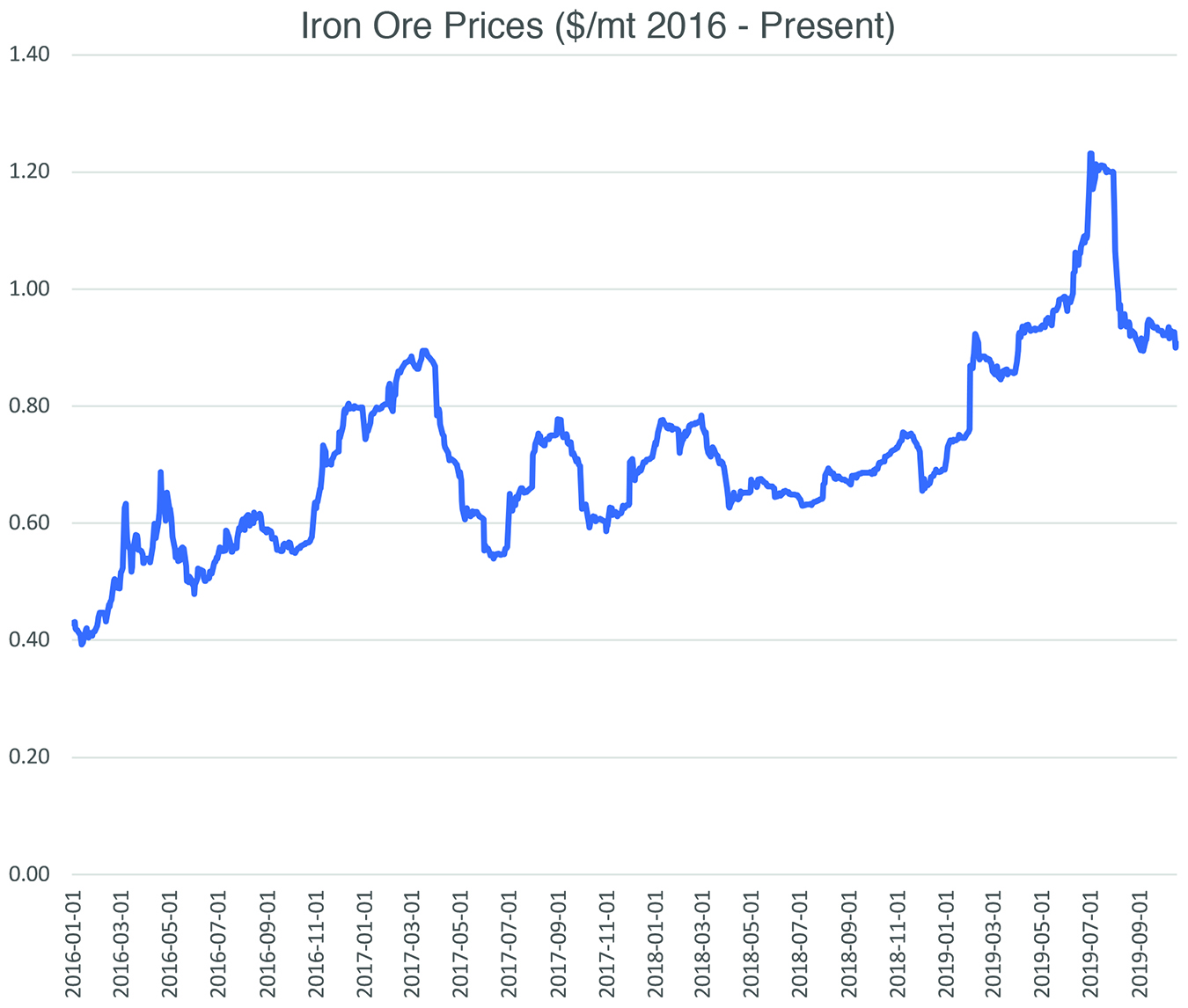

Falling Iron Ore Prices Analysis Of Chinas Steel Production Reduction

May 09, 2025

Falling Iron Ore Prices Analysis Of Chinas Steel Production Reduction

May 09, 2025 -

Analysis Of Lais Ve Day Speech The Evolving Totalitarian Threat To Taiwan

May 09, 2025

Analysis Of Lais Ve Day Speech The Evolving Totalitarian Threat To Taiwan

May 09, 2025 -

Whats App Spyware Lawsuit Metas 168 Million Loss And Future Implications

May 09, 2025

Whats App Spyware Lawsuit Metas 168 Million Loss And Future Implications

May 09, 2025