Falling Iron Ore Prices: Analysis Of China's Steel Production Reduction

Table of Contents

China's Steel Production Slowdown: The Underlying Causes

The slowdown in China's steel production is a complex issue stemming from a confluence of factors. The Chinese government's commitment to environmental sustainability and economic restructuring plays a significant role, alongside weakening domestic demand and rising production costs.

Government Regulations and Environmental Concerns

China's commitment to environmental protection is driving significant changes in its steel industry. The government has implemented increasingly stringent environmental regulations to curb pollution from steel mills.

- Stricter emission standards: New regulations limit emissions of pollutants like sulfur dioxide and particulate matter, forcing steel mills to invest heavily in cleaner technologies or face penalties.

- Carbon emission reduction targets: As part of its broader commitment to climate change mitigation, China is pushing for substantial reductions in carbon emissions from its industrial sector, significantly impacting steel production.

- Sustainable development policies: Government policies promoting resource efficiency and sustainable development are encouraging steel mills to adopt more environmentally friendly production methods, impacting short-term output.

- Increased enforcement: The Chinese government is actively enforcing environmental regulations, leading to increased scrutiny and penalties for non-compliance, further limiting production.

Weakening Domestic Demand

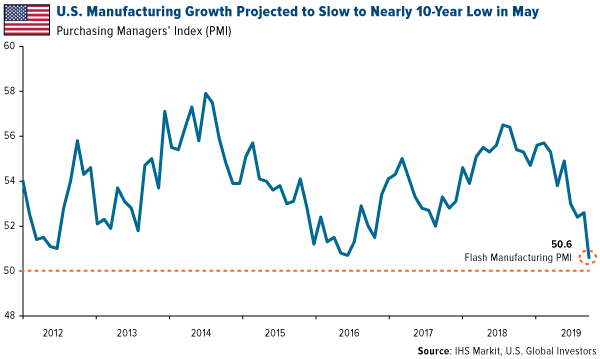

A slowdown in several key sectors of the Chinese economy is contributing to the reduced demand for steel.

- Construction sector slowdown: The construction sector, a major consumer of steel, has experienced a significant slowdown, impacting demand. This is partly due to government efforts to curb excessive real estate development and focus on higher quality infrastructure.

- Reduced infrastructure investment: While infrastructure investment remains a priority, the scale of investment has been reduced compared to previous years. This directly impacts the demand for steel used in construction projects.

- Real estate market correction: A cooling real estate market, following government measures to control property prices, has significantly reduced the demand for steel used in construction and development.

- Overall economic slowdown: The broader slowdown in the Chinese economy is impacting overall steel consumption across various sectors.

Increased Production Costs

Rising input costs are squeezing the profitability of Chinese steel mills, contributing to the production slowdown.

- Rising energy prices: Increased energy costs, particularly for coal and electricity, are significantly increasing the cost of steel production.

- Higher transportation costs: Rising fuel prices and logistical challenges have increased transportation costs for both raw materials and finished steel products.

- Coking coal price fluctuations: Coking coal, a crucial ingredient in steelmaking, has experienced price volatility, adding to the uncertainty and increasing costs for steel producers.

- Inflationary pressures: General inflationary pressures are impacting operating expenses for steel mills, further reducing their profit margins.

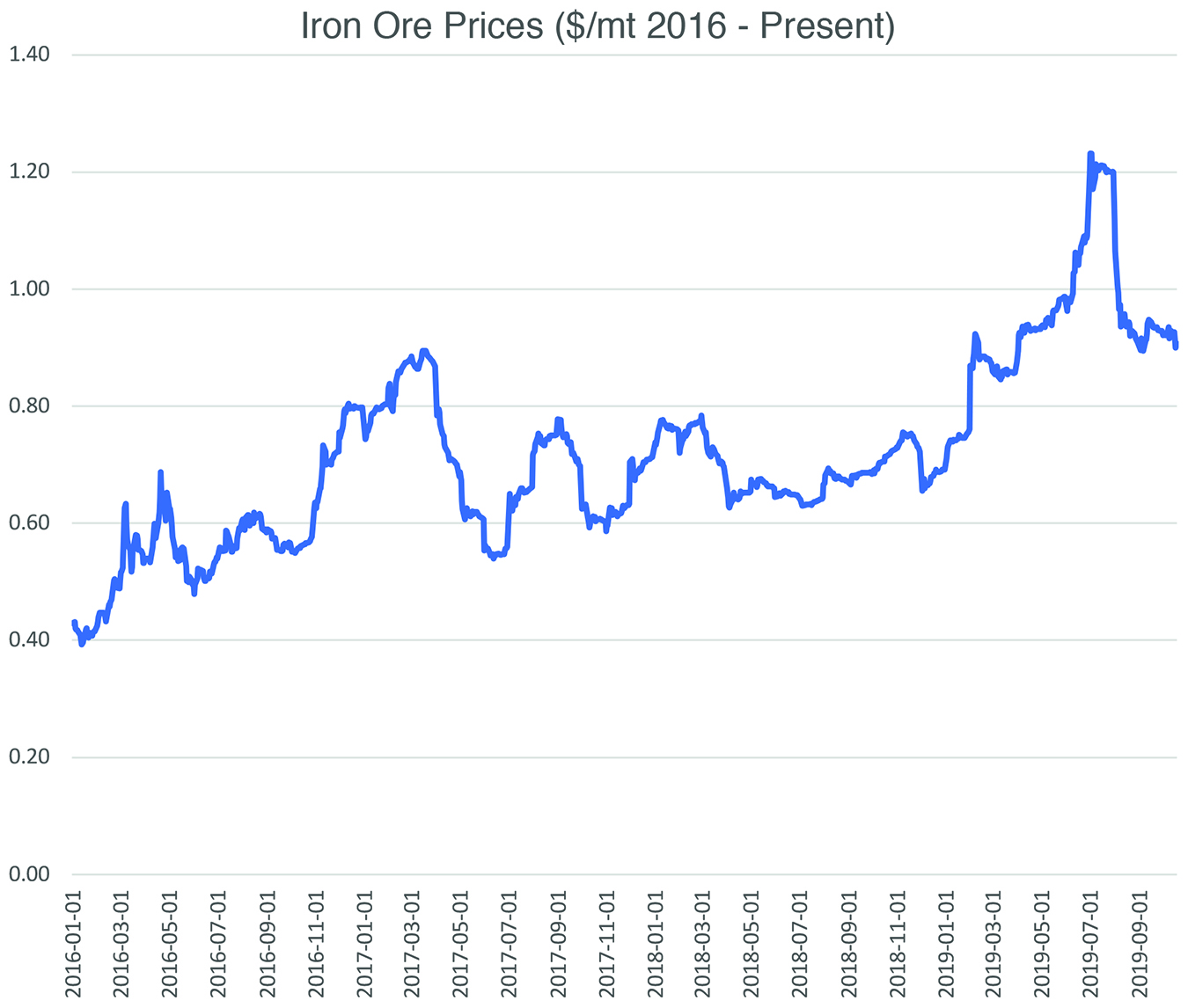

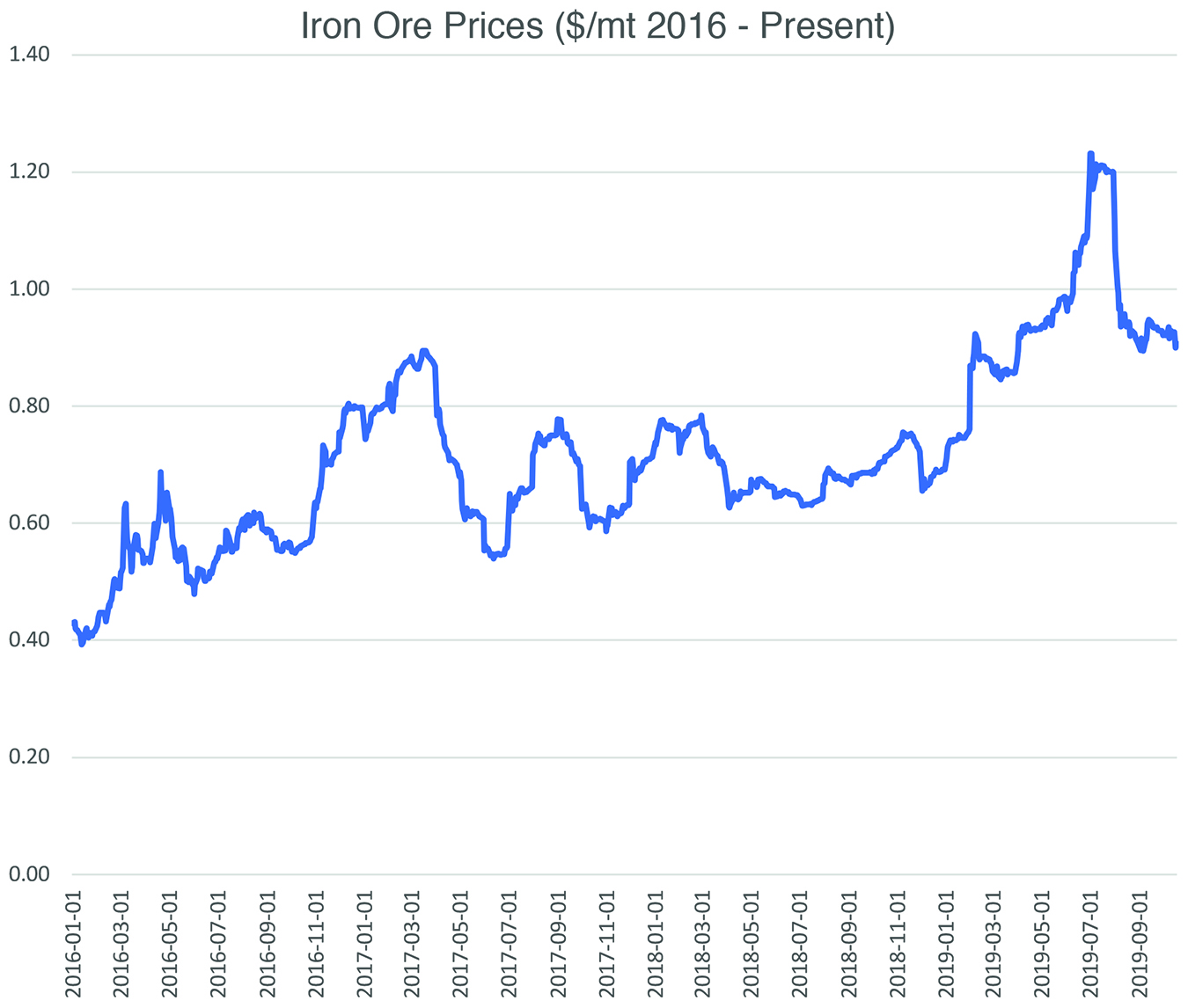

The Ripple Effect: Impact on the Iron Ore Market

The reduction in China's steel production has had a significant and immediate impact on the global iron ore market.

Reduced Demand for Iron Ore

The direct correlation between steel production and iron ore demand is clearly evident.

- Lower iron ore demand: As China produces less steel, its demand for iron ore, the primary raw material, has decreased substantially.

- Impact on mining companies: Iron ore mining companies, particularly those heavily reliant on the Chinese market, are facing reduced profitability and revenue.

- Price wars among suppliers: Decreased demand has led to increased competition and price wars among iron ore suppliers, pushing prices down.

- Potential for further price drops: The outlook for iron ore prices remains uncertain, with the potential for further price declines depending on the future trajectory of Chinese steel production.

Implications for Global Iron Ore Suppliers

The decline in Chinese demand significantly impacts major iron ore exporters.

- Impact on Australia and Brazil: Australia and Brazil, the world's largest iron ore exporters, are experiencing a direct hit to their economies due to the reduced demand from China.

- Shifting trade dynamics: Iron ore suppliers are seeking alternative markets to offset the decline in Chinese demand, potentially leading to shifts in global trade patterns.

- Increased competition: The increased competition among iron ore producers is likely to continue, putting pressure on prices and profit margins.

- Long-term outlook uncertainty: The long-term outlook for iron ore prices and market stability remains uncertain, depending heavily on the recovery of the Chinese steel industry and global economic conditions.

Future Predictions and Market Outlook for Falling Iron Ore Prices

Predicting the future of iron ore prices requires a careful analysis of several interconnected factors.

Analysis of Future Steel Demand in China

Several key factors will determine the future trajectory of steel demand in China.

- Infrastructure project pipeline: The scale and pace of future infrastructure projects will significantly influence steel demand.

- Real estate sector recovery: The recovery of the Chinese real estate sector will play a crucial role in determining steel demand.

- Government policy changes: Changes in government policies regarding environmental regulations and economic stimulus packages will significantly impact steel production.

- Long-term industry sustainability: The long-term sustainability of China's steel industry, given its environmental challenges and economic transitions, is key to predicting future demand.

Potential for Price Stabilization or Further Decline

Several factors could influence the future direction of iron ore prices.

- Factors contributing to a price rebound: A significant increase in infrastructure investment or a faster-than-expected recovery in the real estate market could lead to a price rebound.

- Factors leading to continued decline: Continued environmental regulations, a prolonged slowdown in the Chinese economy, or increased competition among suppliers could lead to further price declines.

- Market volatility analysis: Understanding the volatility of the iron ore market is crucial for investors and businesses operating within the sector.

- Risk mitigation strategies: Developing strategies to mitigate risk within the volatile iron ore market is crucial for all stakeholders.

Conclusion

The decline in iron ore prices is intrinsically linked to the reduction in China's steel production, driven by a complex interplay of government regulations, weakening domestic demand, and increased production costs. Understanding these interconnected factors is crucial for navigating the complexities of this dynamic market. Staying informed about the latest developments, analyzing future predictions, and closely monitoring trends in falling iron ore prices is essential for making informed decisions about investments and business strategies. Don't wait for the market to dictate your next move; proactively monitor the changes in iron ore market dynamics and adapt your approach accordingly.

Featured Posts

-

The Trade Wars Impact On Crypto One Cryptocurrency That Could Thrive

May 09, 2025

The Trade Wars Impact On Crypto One Cryptocurrency That Could Thrive

May 09, 2025 -

Snowfall Warning Issued For Parts Of Western Manitoba

May 09, 2025

Snowfall Warning Issued For Parts Of Western Manitoba

May 09, 2025 -

High Potential Season 1s Underrated Character A Prime Target For Season 2

May 09, 2025

High Potential Season 1s Underrated Character A Prime Target For Season 2

May 09, 2025 -

New Funding Fuels Madeleine Mc Cann Search

May 09, 2025

New Funding Fuels Madeleine Mc Cann Search

May 09, 2025 -

One Cryptocurrency Surviving The Trade War Investment Analysis

May 09, 2025

One Cryptocurrency Surviving The Trade War Investment Analysis

May 09, 2025