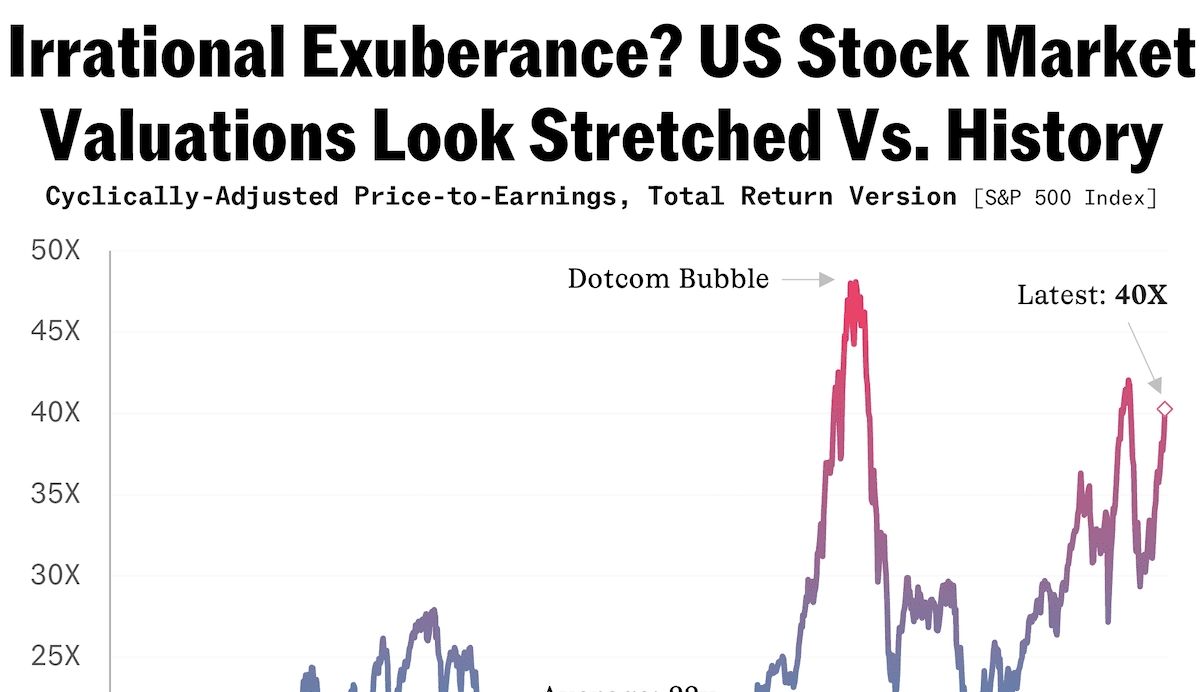

BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale: Why Stretched Valuations Aren't Necessarily a Cause for Alarm

Bank of America's optimistic outlook on the current market, despite acknowledging high stock market valuations, is based on several key factors. They argue that while valuations are elevated compared to historical averages, several positive economic indicators and strong corporate performance counterbalance the risk.

- Strong Corporate Earnings Growth Projections: BofA's analysts forecast robust corporate earnings growth for the coming quarters, driven by increased consumer spending and continued business investment. This positive earnings outlook supports the current, relatively high stock valuations.

- Resilient Consumer Spending Despite Inflation: Despite persistent inflation, consumer spending remains surprisingly strong. This resilience suggests a robust underlying economy capable of supporting current stock prices, even with elevated valuations.

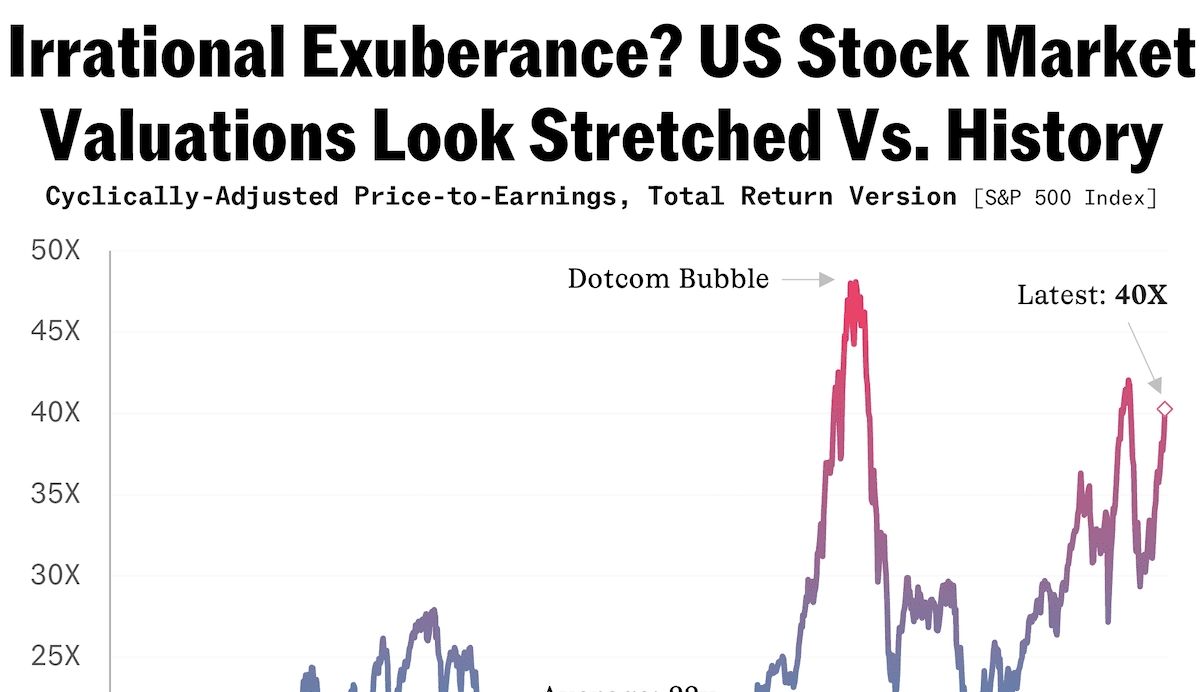

- Positive Economic Indicators: Several key economic indicators point towards continued, albeit moderate, growth. Low unemployment rates, coupled with increasing manufacturing output and strong retail sales, paint a picture of continued economic strength.

- Low Interest Rates (Relative to Historical Averages): While interest rates are rising, they remain relatively low compared to historical averages. This low-rate environment continues to support borrowing and investment, mitigating some of the risk associated with high stock market valuations.

- Potential for Further Monetary Policy Support: While the Federal Reserve is focused on controlling inflation, the possibility of further monetary policy support, should economic conditions deteriorate, provides a cushion against significant market downturns.

Factors Mitigating Risk in the Current Market Environment

Several other factors contribute to BofA's belief that the risks associated with high stock market valuations are not as severe as some might fear. These mitigating factors help offset the impact of elevated valuations:

- Technological Advancements Driving Future Growth: Technological innovation continues to drive productivity growth and create new opportunities for investment, justifying, at least partially, the high valuations in certain sectors of the market. These advancements represent a powerful engine of future economic expansion.

- Government Spending and Infrastructure Investments: Government investment in infrastructure and other key sectors provides a significant stimulus to economic growth, further boosting corporate profits and mitigating some downside risks.

- Strong Global Demand (in Specific Sectors): Strong global demand, particularly in technology and healthcare, is supporting high valuations in those sectors. This robust global demand helps to offset weaker performance in other areas of the market.

- Strategic Asset Allocation Strategies to Manage Risk: Employing effective portfolio diversification and strategic asset allocation can significantly reduce the impact of high valuations. Diversifying across different asset classes and sectors is key to managing investment risk.

Alternative Investment Strategies to Consider Amidst High Valuations

While equities remain a core component of many portfolios, investors concerned about stretched stock market valuations might consider diversifying their holdings. This doesn't necessarily mean abandoning stocks, but rather complementing them with alternative investments:

- Diversification into Bonds or Other Fixed-Income Securities: Bonds offer a potentially lower-risk alternative to equities, providing a degree of stability within a portfolio. This is particularly relevant in an environment of rising interest rates.

- Exploration of Alternative Asset Classes like Real Estate or Commodities: Real estate and commodities can offer diversification benefits, acting as a hedge against equity market volatility and inflation. These asset classes often have a low correlation with traditional stocks.

- Strategic Use of Derivatives for Hedging Purposes: Derivatives, when used strategically, can provide a means to hedge against potential market declines. However, derivatives are complex instruments, requiring significant understanding and caution.

Long-Term Perspective: Maintaining a Balanced Investment Strategy

Maintaining a long-term investment horizon is crucial in navigating periods of high stock market valuations. Short-term market fluctuations are normal and should not dictate long-term investment decisions.

- Avoid Knee-jerk Reactions to Short-Term Market Fluctuations: Emotional decision-making based on daily price movements is often detrimental to long-term investment success. Instead, focus on long-term growth and your overall financial goals.

- Focus on Fundamental Analysis and Company Performance Rather Than Daily Price Movements: Solid fundamental analysis provides a more robust basis for investment decisions than short-term price movements. Focus on a company's financial health, growth prospects, and competitive advantage.

- Regular Portfolio Review and Rebalancing: Regularly review your portfolio's performance and rebalance it to maintain your desired asset allocation. This helps manage risk and ensures your portfolio remains aligned with your long-term goals.

Navigating Stretched Stock Market Valuations with Confidence

BofA's analysis suggests that while stretched stock market valuations are a valid concern, the situation is not necessarily cause for alarm. Strong corporate earnings, resilient consumer spending, and various mitigating economic factors help to offset the risks associated with high valuations. By employing a long-term perspective, focusing on fundamental analysis, and strategically diversifying your portfolio, you can navigate this market environment with greater confidence.

Don't let concerns about stretched stock market valuations paralyze you. Contact a financial advisor today to discuss a tailored strategy that addresses these challenges and helps you achieve your financial goals. Remember that a well-diversified investment strategy, considering your risk tolerance, is crucial for successfully navigating the complexities of high stock market valuations and market volatility.

Featured Posts

-

Selling Sunset Star Highlights Post Fire Landlord Price Gouging In La

Apr 24, 2025

Selling Sunset Star Highlights Post Fire Landlord Price Gouging In La

Apr 24, 2025 -

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 24, 2025

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 24, 2025 -

White House Announces Drop In Illegal Border Crossings At U S Canada Border

Apr 24, 2025

White House Announces Drop In Illegal Border Crossings At U S Canada Border

Apr 24, 2025 -

Ella Bleu Travoltas New Look A Fashion Cover Story At 24

Apr 24, 2025

Ella Bleu Travoltas New Look A Fashion Cover Story At 24

Apr 24, 2025 -

Elite Colleges Increase Fundraising Amidst Political Scrutiny

Apr 24, 2025

Elite Colleges Increase Fundraising Amidst Political Scrutiny

Apr 24, 2025

Latest Posts

-

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025 -

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025 -

How Donald Trumps First 100 Days Impacted Elon Musks Net Worth

May 10, 2025

How Donald Trumps First 100 Days Impacted Elon Musks Net Worth

May 10, 2025 -

Recent Tesla Stock Drop How It Affected The Price Of Dogecoin And Elon Musks Influence

May 10, 2025

Recent Tesla Stock Drop How It Affected The Price Of Dogecoin And Elon Musks Influence

May 10, 2025 -

Trump Trade War Billionaire Losses Reach 174 Billion

May 10, 2025

Trump Trade War Billionaire Losses Reach 174 Billion

May 10, 2025