BofA's Rationale: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Underlying Economic Assumptions

BofA's positive stance on current stock market valuations rests on several key economic assumptions. Their analysis suggests a robust economic landscape capable of supporting current price levels.

Robust Corporate Earnings Growth

BofA projects continued strong corporate earnings growth, a crucial factor underpinning their view on valuations. This growth is expected to offset concerns about high price-to-earnings ratios.

- Sectors Driving Growth: Technology, healthcare, and consumer discretionary sectors are anticipated to be key drivers of earnings growth.

- Expected EPS Growth: BofA forecasts double-digit earnings-per-share (EPS) growth for several key sectors in the coming years.

- Factors Contributing to Strength: Strong consumer spending, ongoing technological advancements, and increasing global demand are contributing factors. This robust earnings growth justifies, in BofA's view, current valuation multiples.

Moderate Inflation Expectations

BofA's assessment of inflation plays a significant role in their valuation analysis. They anticipate moderate inflation, impacting interest rates and subsequently, stock valuations.

- Inflation Forecast: BofA projects inflation to gradually decline over the next few years, settling within a manageable range.

- Interest Rate Trajectory: They expect a measured approach to interest rate hikes, avoiding a drastic increase that could negatively impact market valuations.

- Valuation Impact: While higher interest rates generally put downward pressure on valuations, BofA believes the projected moderate increase is manageable and won't significantly derail market growth. Their monetary policy expectations are crucial to this assessment of valuation impact.

Strong Consumer Spending

BofA's analysis highlights the strength of consumer spending as a critical indicator of economic health and market performance. This strong consumer confidence directly supports corporate revenue and profitability.

- Key Indicators: Retail sales figures, consumer confidence indices, and employment data all point towards sustained consumer spending.

- Spending Growth Projections: BofA anticipates continued, albeit potentially moderating, growth in consumer spending, fueling corporate revenue and profits.

- Impact on Corporate Revenue: This sustained consumer spending directly translates into higher corporate revenues, supporting the projections for robust earnings growth and justifying, to some extent, current market valuations.

BofA's Valuation Metrics and Analysis

BofA's valuation analysis goes beyond simply looking at historical data. Their approach incorporates forward-looking metrics and a sector-specific analysis to provide a more nuanced perspective.

Focus on Forward-Looking Metrics

Instead of relying solely on past performance, BofA emphasizes the use of forward-looking valuation metrics. This approach allows them to incorporate future growth expectations into their assessment.

- Metrics Used: BofA utilizes forward P/E ratios, PEG ratios, and other forward-looking metrics to gauge the attractiveness of current stock market valuations.

- Rationale: Using forward-looking data allows for a more accurate reflection of a company's future earnings potential and growth trajectory, providing a more comprehensive view of value.

- Advantages: This approach mitigates the risk of basing valuations on potentially outdated historical information.

Sector-Specific Valuation Analysis

BofA's analysis doesn't treat all sectors equally. They recognize the diverse growth potential and risk profiles across different sectors, resulting in variations in valuations.

- High Valuation Sectors: Sectors with strong growth prospects, such as technology and healthcare, are likely to command higher valuations.

- Low Valuation Sectors: Sectors facing headwinds or slower growth might have comparatively lower valuations.

- BofA's Outlook: BofA analyzes each sector individually, considering its specific growth potential, risks, and competitive dynamics to assess relative valuation.

Addressing Potential Market Risks and Counterarguments

While BofA maintains an optimistic outlook, they acknowledge potential market risks and address common concerns surrounding high valuations.

Acknowledging Geopolitical Uncertainty

Geopolitical uncertainty and supply chain disruptions present potential headwinds. BofA incorporates these risks into their analysis.

- Geopolitical Risks: The ongoing geopolitical situation, including potential conflicts and trade disputes, are considered in their projections.

- Impact Assessment: BofA assesses the potential impact of these risks on corporate earnings and adjusts their valuations accordingly.

- Mitigation Strategies: BofA's analysis incorporates a range of scenarios and considers potential mitigation strategies employed by companies.

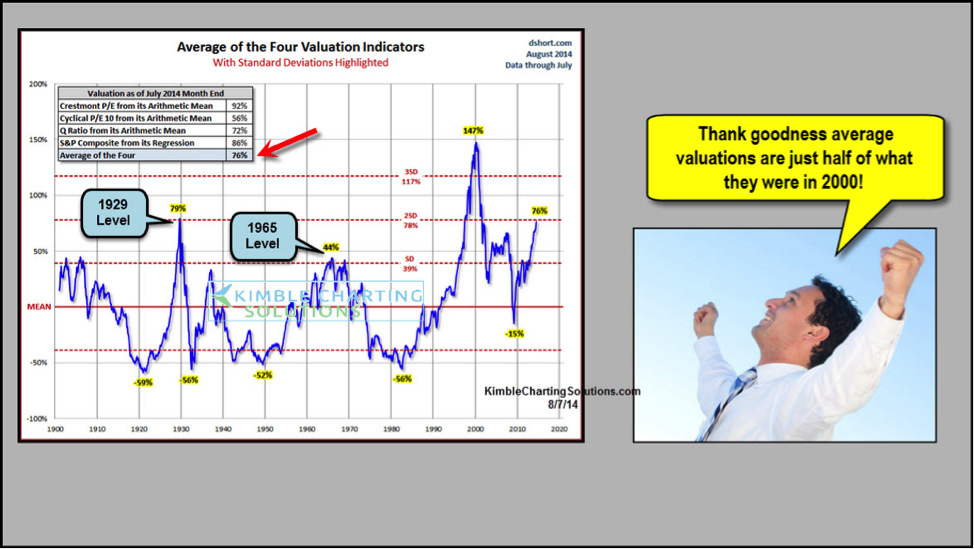

Responding to Concerns about High Valuations

The argument that current stock market valuations are high is valid. However, BofA offers counterarguments.

- Low Interest Rates: Historically low interest rates justify higher valuations, as the cost of borrowing is lower, leading to increased investment and higher corporate profits.

- Strong Earnings Growth: BofA's projections of strong earnings growth offset concerns about high price-to-earnings ratios.

Conclusion: BofA's Rationale: Reassessing Stock Market Valuations

In summary, BofA's positive outlook on current stock market valuations is based on their assessment of robust corporate earnings growth, moderate inflation expectations, strong consumer spending, and the strategic use of forward-looking valuation metrics. They acknowledge potential risks, but their analysis suggests that these are manageable and do not necessarily invalidate current market levels. BofA believes current stock market valuations are not necessarily a market threat. Understand BofA's rationale for a more nuanced view of current stock market valuations and adjust your investment strategy accordingly. Explore BofA's research for a comprehensive understanding of their valuation analysis and its implications for your investment portfolio.

Featured Posts

-

Market Downturns Opportunities For Individual Investors

Apr 28, 2025

Market Downturns Opportunities For Individual Investors

Apr 28, 2025 -

Denny Hamlin Gets Michael Jordans Backing The Booing Makes Him Better Effect

Apr 28, 2025

Denny Hamlin Gets Michael Jordans Backing The Booing Makes Him Better Effect

Apr 28, 2025 -

10 Gb Data Sim And Abu Dhabi Pass 15 Discount On Top Attractions

Apr 28, 2025

10 Gb Data Sim And Abu Dhabi Pass 15 Discount On Top Attractions

Apr 28, 2025 -

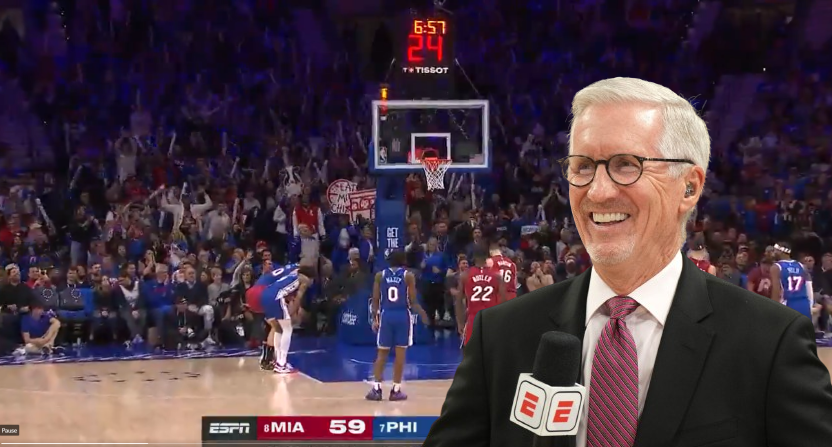

Marv Albert Mike Breens Pick For Greatest Basketball Announcer Of All Time

Apr 28, 2025

Marv Albert Mike Breens Pick For Greatest Basketball Announcer Of All Time

Apr 28, 2025 -

Boston Red Sox Injury Update Crawford Bello Abreu And Rafaela

Apr 28, 2025

Boston Red Sox Injury Update Crawford Bello Abreu And Rafaela

Apr 28, 2025

Latest Posts

-

Tsena Voprosa Skolko Stoit Foto S Borisom Dzhonsonom

May 12, 2025

Tsena Voprosa Skolko Stoit Foto S Borisom Dzhonsonom

May 12, 2025 -

El Ex Primer Ministro Britanico Boris Johnson Victima De Ataque De Avestruz En Texas

May 12, 2025

El Ex Primer Ministro Britanico Boris Johnson Victima De Ataque De Avestruz En Texas

May 12, 2025 -

Boris Dzhonson Prodaet Fotografii S Soboy Pravda Ili Vymysel

May 12, 2025

Boris Dzhonson Prodaet Fotografii S Soboy Pravda Ili Vymysel

May 12, 2025 -

Avestruz Ataca A Boris Johnson Durante Paseo Familiar En Texas

May 12, 2025

Avestruz Ataca A Boris Johnson Durante Paseo Familiar En Texas

May 12, 2025 -

Chto Obsuzhdali Putin I Dzhonson Fokus Na Atomnykh Podlodkakh Rossii

May 12, 2025

Chto Obsuzhdali Putin I Dzhonson Fokus Na Atomnykh Podlodkakh Rossii

May 12, 2025