BofA's View: Understanding And Addressing Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA, a leading global financial institution, consistently monitors and analyzes market conditions. Their current stance often reflects a cautious optimism, acknowledging that stock market valuations are currently elevated compared to historical averages. While specific reports change, the general sentiment often points towards a market that may be vulnerable to corrections. This assessment is based on a comprehensive analysis utilizing various key metrics.

-

Key Metrics Used by BofA to Assess Valuations: BofA employs a range of metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and dividend yields, to gauge market valuations. They analyze these metrics across different sectors and geographies.

-

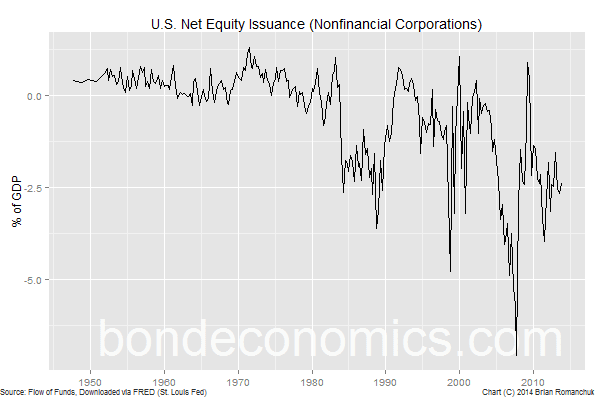

Comparison to Historical Valuations: BofA's analyses often compare current valuations to historical averages, revealing whether current levels are significantly above or below long-term norms. This historical context provides a crucial benchmark for assessing potential risks.

-

Factors Contributing to Elevated Valuations: Several factors have contributed to the elevated stock market valuations. These include persistently low interest rates, strong corporate earnings (particularly in technology sectors), and the continued influx of investment into high-growth areas, fueled by technological advancements.

-

Geographic Analysis of Valuation: BofA's research includes a detailed geographic analysis of valuations, comparing valuations in the US market against global markets. This comparative analysis identifies regions with higher or lower valuations, highlighting potential opportunities and risks.

Risks Associated with Elevated Stock Market Valuations

Investing in a market with high valuations presents several inherent risks. While potential for growth remains, the downside potential is also significant.

-

Increased Market Vulnerability to Corrections or Crashes: Highly valued markets are inherently more susceptible to sharp corrections or even crashes. A relatively small negative catalyst could trigger a significant sell-off.

-

Reduced Potential for Future Returns: When valuations are high, the potential for future returns is naturally lower than when valuations are more modest. Investors may see smaller gains, or even losses, if the market corrects.

-

Impact of Rising Interest Rates on Valuations: Rising interest rates typically negatively impact stock valuations, as they increase the cost of borrowing for companies and make bonds a more attractive alternative for investors. BofA's analysis frequently models the impact of different interest rate scenarios.

-

Specific Sectors or Asset Classes Showing Higher-Than-Average Risk: BofA often identifies specific sectors or asset classes that exhibit higher-than-average risk due to their elevated valuations. This granular analysis allows investors to make informed decisions about portfolio allocation.

BofA's Recommended Strategies for Addressing Elevated Valuations

BofA suggests several strategies to help investors navigate the challenges of elevated stock market valuations and mitigate potential risks.

-

Diversification Strategies: Diversification across asset classes (stocks, bonds, real estate, etc.), geographies, and sectors is crucial to reduce overall portfolio risk.

-

Defensive Investment Approaches: BofA may recommend defensive investment approaches like value investing (focusing on undervalued companies) and dividend investing (seeking income-generating stocks) to provide a buffer against market volatility.

-

Importance of Risk Management and Portfolio Rebalancing: Regular portfolio rebalancing is crucial to maintain the desired asset allocation and control risk. BofA emphasizes the importance of a well-defined risk management strategy.

-

Potential Opportunities within Specific Undervalued Sectors: Even in a generally overvalued market, some sectors might be undervalued. BofA's analysis often highlights such opportunities.

-

Considering Alternative Investments: BofA may suggest exploring alternative investments, such as commodities or private equity, to diversify beyond traditional stocks and bonds.

Long-Term Outlook and Potential Market Scenarios

BofA's long-term outlook and market scenarios are dynamic and change based on various economic factors. However, their analyses frequently incorporate:

-

Likely Market Trajectory Based on Their Analysis: Based on their assessment of macroeconomic indicators and other factors, BofA attempts to project the likely trajectory of the market.

-

Potential Catalysts for Market Shifts: BofA’s analysis identifies potential catalysts for significant market shifts, such as key economic data releases, geopolitical events, or changes in monetary policy.

-

Scenarios for Different Levels of Interest Rate Increases: BofA models various interest rate increase scenarios to illustrate their potential impact on market valuations and investor returns.

-

BofA's View on Inflation's Long-Term Impact on Valuations: Inflation’s impact on valuations is a central theme in BofA's analysis. They assess inflation’s potential to erode returns and alter investment strategies.

Conclusion

Understanding BofA's view on elevated stock market valuations is crucial for informed investment decisions. BofA’s analysis consistently highlights the risks associated with currently elevated valuations, emphasizing the need for diversification, defensive investment strategies, and robust risk management. While opportunities exist, a cautious and strategic approach is recommended. Visit BofA's website to access their latest research and gain valuable insights into managing your portfolio effectively in this market environment, particularly concerning elevated stock market valuations and related market risks. By understanding BofA's market analysis and recommended strategies, investors can better navigate this complex investment landscape.

Featured Posts

-

Eni Cuts Costs To Maintain Share Buyback Despite Lower Cash Flow

Apr 25, 2025

Eni Cuts Costs To Maintain Share Buyback Despite Lower Cash Flow

Apr 25, 2025 -

Cowboys Insider Reveals Unexpected Nfl Draft Prospects

Apr 25, 2025

Cowboys Insider Reveals Unexpected Nfl Draft Prospects

Apr 25, 2025 -

Pumas Influence On Hyrox A Look At Their Cutting Edge Footwear

Apr 25, 2025

Pumas Influence On Hyrox A Look At Their Cutting Edge Footwear

Apr 25, 2025 -

Cindy Crawford 58 Relives Pepsi Icon Status In Daisy Dukes

Apr 25, 2025

Cindy Crawford 58 Relives Pepsi Icon Status In Daisy Dukes

Apr 25, 2025 -

2025 Nfl Draft The New York Jets Draft Strategy Needs And Potential Picks

Apr 25, 2025

2025 Nfl Draft The New York Jets Draft Strategy Needs And Potential Picks

Apr 25, 2025