BofA's View: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: A Deeper Dive into the Current Valuation Landscape

BofA's analysts argue that the current high stock market valuations are justified by several key factors. Their analysis suggests that a closer look reveals a healthy market, not an overinflated one poised for a crash. This assessment considers several crucial elements, offering a more nuanced understanding of the current valuation landscape than a simple P/E ratio might suggest.

The Impact of Low Interest Rates

Historically low interest rates significantly influence present value calculations used in stock valuations. Lower interest rates reduce the discount rate applied to future earnings, leading to higher present values and thus, higher stock prices. This also impacts bond yields, making stocks a relatively more attractive investment compared to bonds.

- Lower interest rates justify higher Price-to-Earnings (P/E) ratios. When borrowing costs are low, companies can invest more readily, boosting future earnings potential, which supports higher valuations.

- Current interest rates are significantly below historical averages. This disparity makes current valuations, while seemingly high, less alarming in a historical context. A comparison to the high-interest rate environment of the 1980s, for example, illustrates this point effectively.

- BofA's analysis projects sustained low interest rates for the foreseeable future. This projection further supports their argument that current stock market valuations are not unsustainable.

Strong Corporate Earnings Growth

Robust corporate earnings are a key pillar supporting current stock market valuations. Many companies are exceeding expectations, driven by various factors, including technological advancements and increased efficiency.

- Data shows consistent earnings growth across numerous sectors. This widespread growth isn't limited to a few tech giants; it's a more broad-based phenomenon.

- Technological advancements and innovation continue to fuel growth. Companies leveraging new technologies are often experiencing disproportionately high growth rates.

- Several specific companies and sectors have significantly exceeded earnings expectations. This strong performance provides concrete evidence to back up BofA's optimistic outlook.

Sustained Economic Growth Projections

BofA's economic forecasts predict continued expansion, contributing to the justification of current valuations. This positive economic outlook forms a crucial part of their overall assessment.

- Several underlying factors contribute to this projected growth. These include government policies aimed at stimulating economic activity and positive global economic trends.

- Government policies and global economic trends are largely supportive of sustained growth. While risks exist, BofA's analysis suggests that the prevailing trends point towards continued expansion.

- BofA's reports cite positive economic indicators, such as GDP growth and employment figures, to support their projections. These specific figures add credibility to their forecasts and overall argument.

Addressing Common Concerns About High Stock Market Valuations

While BofA presents a positive outlook, it’s important to address potential counterarguments. Many investors remain wary of the seemingly high valuations.

The "Overvalued" Argument

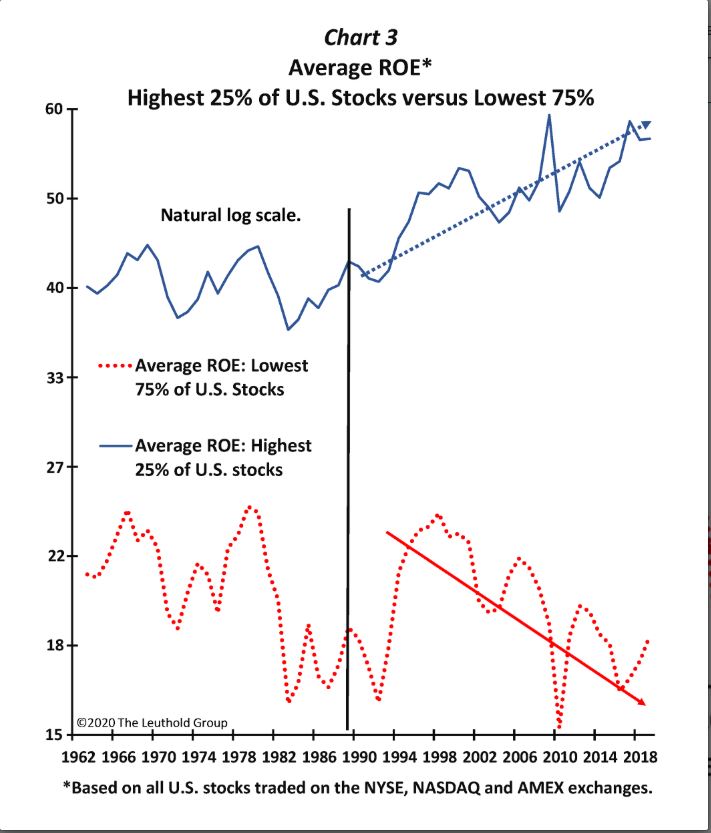

Some argue that current valuations represent a significant overvaluation. However, BofA counters this by emphasizing the need for context and adjusted metrics.

- Comparisons to historical valuations adjusted for inflation and interest rates paint a different picture. Looking only at nominal P/E ratios without considering inflation and interest rates can be misleading.

- Several companies with high valuations also exhibit strong growth prospects. High valuations aren't always indicative of overvaluation; they can reflect anticipated future growth.

- Alternative valuation metrics, beyond P/E ratios, support BofA's conclusions. Considering other metrics provides a more comprehensive view and reduces reliance on a single indicator.

Potential Market Corrections

Market corrections are normal, healthy parts of the market cycle. While BofA acknowledges their possibility, they don't necessarily signal a catastrophic event.

- Corrections can present excellent opportunities for long-term investors. They allow investors to buy high-quality assets at lower prices.

- BofA provides a risk assessment and suggests strategies for navigating potential corrections. Their analysis assists investors in making informed decisions during periods of volatility.

- Historical examples of market corrections show subsequent strong recoveries. This pattern demonstrates the cyclical nature of the market and its ability to rebound from downturns.

Conclusion

BofA's analysis suggests that current stock market valuations, while high, are not necessarily cause for alarm. Their optimistic outlook rests on the impact of low interest rates, strong corporate earnings growth, and projections of sustained economic expansion. While market corrections are possible, they are a normal part of the cycle. Don't let concerns about current stock market valuations deter you. Review BofA's detailed analysis and make informed investment decisions based on a comprehensive understanding of the current market landscape. [Link to relevant BofA resources here]

Featured Posts

-

Fears Grow For Missing Midland Athlete In Las Vegas

Apr 29, 2025

Fears Grow For Missing Midland Athlete In Las Vegas

Apr 29, 2025 -

Fn Abwzby Tjrbt Fnyt Astthnayyt Tbda 19 Nwfmbr

Apr 29, 2025

Fn Abwzby Tjrbt Fnyt Astthnayyt Tbda 19 Nwfmbr

Apr 29, 2025 -

How Film Tax Credits Shape Minnesotas Entertainment Industry

Apr 29, 2025

How Film Tax Credits Shape Minnesotas Entertainment Industry

Apr 29, 2025 -

Goldblum Family Enjoys Italian Football Como 1907 Match

Apr 29, 2025

Goldblum Family Enjoys Italian Football Como 1907 Match

Apr 29, 2025 -

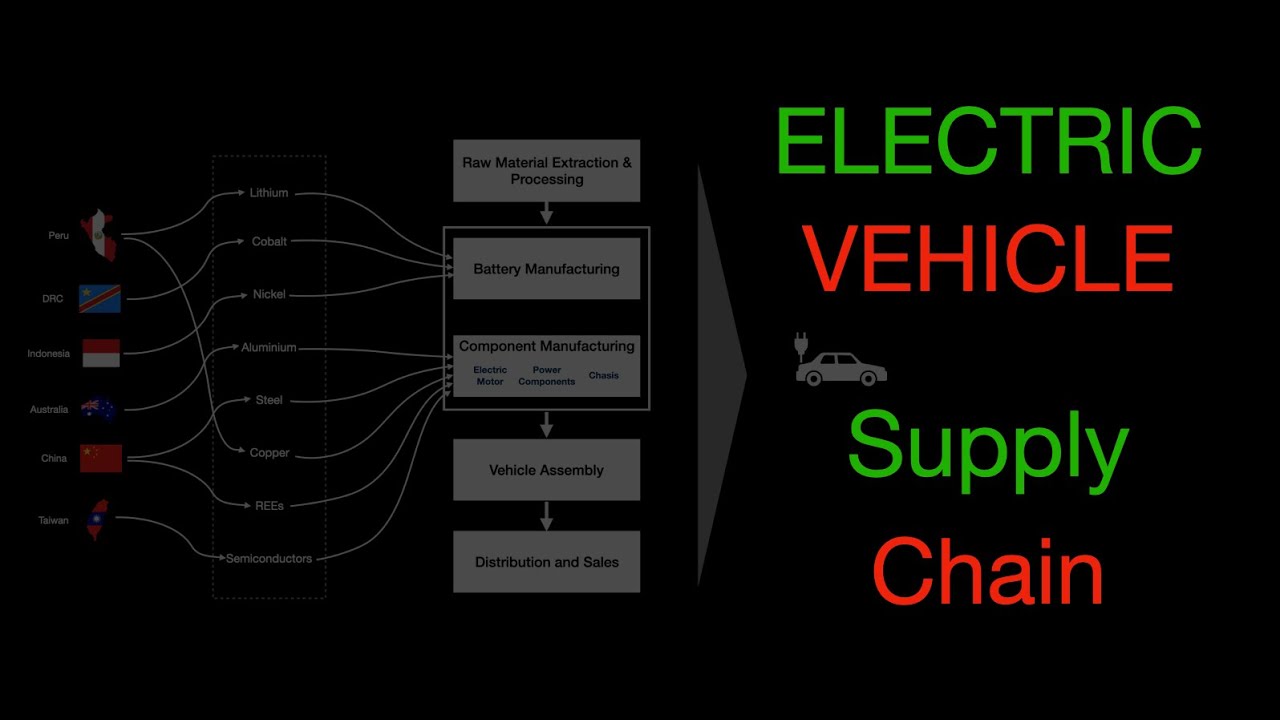

Dysprosiums Growing Importance In Electric Vehicles A Supply Chain Crisis

Apr 29, 2025

Dysprosiums Growing Importance In Electric Vehicles A Supply Chain Crisis

Apr 29, 2025