Bond Market Crisis: Are Investors Missing The Warning Signs?

Table of Contents

Rising Interest Rates and Their Impact

The Federal Reserve's monetary policy plays a pivotal role in shaping the bond market. The aggressive interest rate hikes implemented by the Fed to combat inflation have had a significant impact on bond prices.

The Federal Reserve's Role

The Federal Reserve's actions, including quantitative tightening (QT), directly influence interest rates. QT involves reducing the Fed's balance sheet by allowing Treasury securities and mortgage-backed securities to mature without reinvestment.

- Inverse Relationship: There's an inverse relationship between interest rates and bond prices. As interest rates rise, the value of existing bonds with lower coupon rates falls, as newer bonds offer higher yields.

- Impact on Portfolios: Rising rates significantly impact existing bond portfolios. Investors holding long-term bonds with fixed interest rates face potential capital losses as their value diminishes.

- Further Rate Hikes: The potential for further interest rate hikes adds to the uncertainty and risk. Predicting the Fed's future moves remains challenging, adding to the volatility in the bond market.

- Inflation's Influence: High inflation directly affects bond yields. Investors demand higher yields to compensate for the erosion of purchasing power caused by inflation, leading to increased bond yields.

Keywords: Interest rate risk, bond yield, Federal Reserve, quantitative tightening, inflation, bond portfolio.

Inflationary Pressures and Their Effect on Bond Markets

Persistent inflationary pressures pose a significant threat to the bond market. High inflation erodes the purchasing power of fixed-income investments, making bonds less attractive.

Persistent Inflationary Trends

Current inflationary trends are forcing central banks worldwide to adopt tighter monetary policies, putting further pressure on bond prices.

- Real Yields: High inflation reduces real yields (nominal yield minus inflation rate), making bonds less appealing compared to other asset classes.

- Purchasing Power Erosion: Inflation diminishes the future value of fixed income payments, eroding the purchasing power of bondholders. Unexpected spikes in inflation can trigger a rapid sell-off in the bond market.

- Inflationary Surprises: Unexpected surges in inflation can dramatically impact bond valuations. Investors react by demanding higher yields to offset the increased risk, causing bond prices to fall.

- Inflation Risk Management: Investors can employ strategies like inflation-linked bonds or Treasury Inflation-Protected Securities (TIPS) to hedge against inflation risk.

Keywords: Inflation, real yield, purchasing power, inflation risk, bond valuation.

Sovereign Debt Concerns and Global Economic Uncertainty

Geopolitical risks and global economic uncertainty significantly influence investor sentiment and the stability of bond markets.

Geopolitical Risks and Their Influence

Global events, such as wars, political instability, and trade disputes, introduce uncertainty into the market, impacting investor confidence and bond prices.

- Investor Confidence: Geopolitical instability can cause investors to flee riskier assets, including bonds from emerging markets, driving up yields and decreasing prices.

- Sovereign Debt Risks: Investing in sovereign debt from countries with high debt levels or political instability carries significant risk. Defaults or restructuring can lead to substantial losses.

- Global Slowdowns: Global economic slowdowns often lead to decreased demand for bonds as investors seek safer havens. This can trigger a downward spiral in bond prices.

- Diversification Strategies: Diversifying bond holdings across different countries and currencies can help mitigate risk associated with geopolitical events and economic uncertainty.

Keywords: Sovereign debt, geopolitical risk, economic uncertainty, global recession, bond diversification.

Identifying Warning Signs and Risk Management Strategies

Recognizing early warning signs is crucial for proactive risk management in the bond market.

Recognizing Early Indicators

Investors should closely monitor several key indicators:

- Increased Volatility: Sudden and significant price swings in the bond market indicate increased uncertainty and potential risk.

- Widening Credit Spreads: A widening gap between the yields of corporate bonds and government bonds suggests increased credit risk and investor apprehension.

- Decreasing Demand: A decline in demand for bonds often precedes price drops, indicating a shift in investor sentiment.

- Rating Downgrades: Credit rating downgrades of corporate or sovereign bonds signal increased risk of default, potentially causing price declines.

- Changes in Investor Sentiment: A shift in investor sentiment, such as increased risk aversion, can trigger significant sell-offs in the bond market.

Strategies for Mitigating Risk

Several strategies can help mitigate risk in a volatile bond market:

- Diversification: Diversifying bond holdings across different maturities, sectors, and issuers reduces exposure to specific risks.

- Hedging Strategies: Employing hedging strategies, such as options or futures contracts, can protect against potential losses.

- Shortening Duration: Shortening the duration of a bond portfolio reduces sensitivity to interest rate changes.

- Alternative Investments: Considering alternative investments, such as real estate or commodities, can diversify your portfolio and reduce overall risk.

Keywords: Risk management, bond volatility, credit spread, bond duration, alternative investments.

Conclusion

A bond market crisis can be triggered by a combination of factors, including rising interest rates, persistent inflation, sovereign debt concerns, and global economic uncertainty. Monitoring key indicators like increased volatility, widening credit spreads, and decreasing demand is crucial. Proactive risk management strategies, such as diversification, hedging, and shortening bond duration, are essential to protect your portfolio from the potential challenges of a bond market crisis. Understanding these bond market risks and acting decisively is critical for navigating this complex environment. Stay informed, diversify your investments, and consider seeking professional financial advice to safeguard your portfolio against potential bond market volatility.

Featured Posts

-

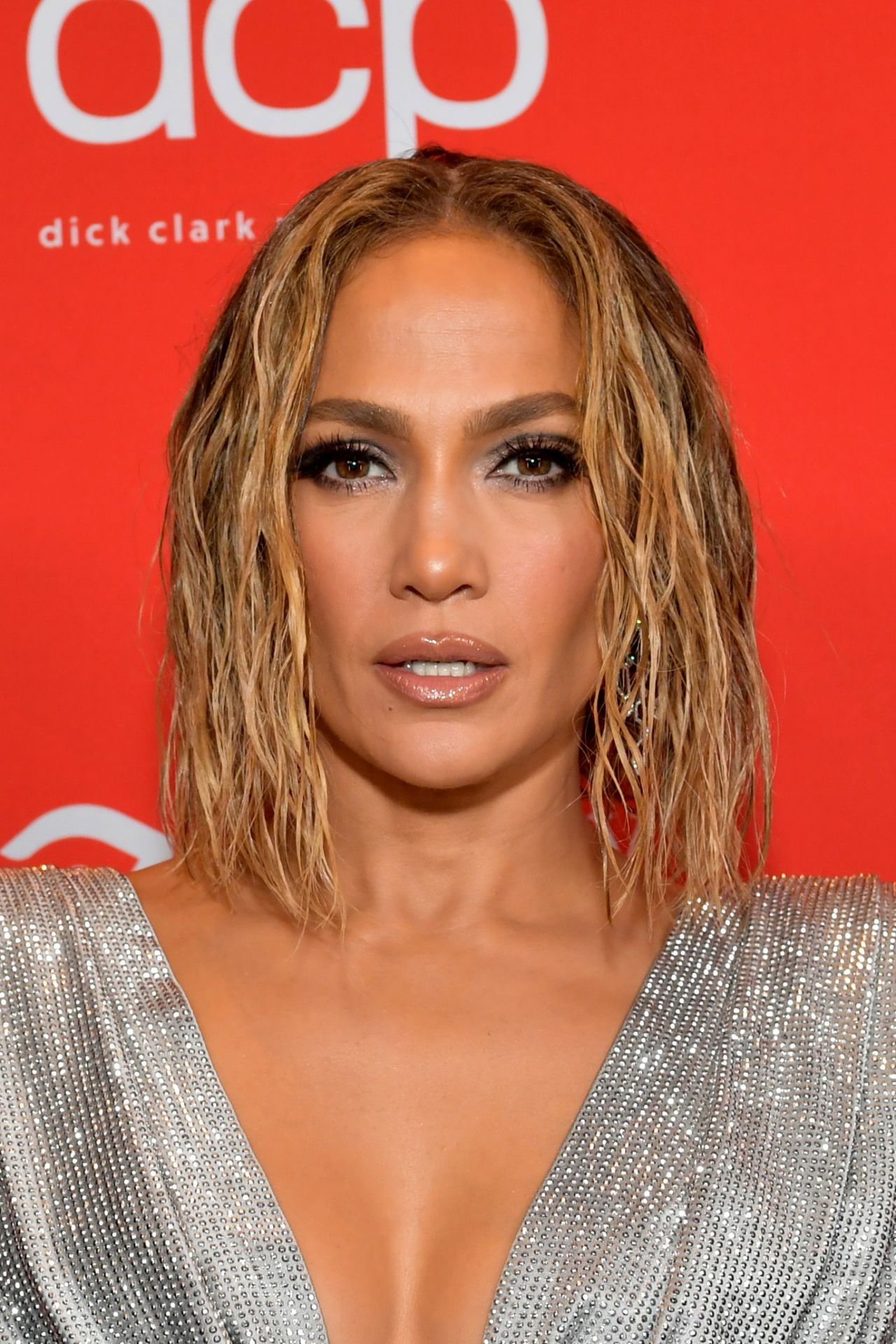

American Music Awards 2024 Jennifer Lopez Confirmed As Host

May 28, 2025

American Music Awards 2024 Jennifer Lopez Confirmed As Host

May 28, 2025 -

Tennis Star Jannik Sinners Unexpected Meeting With Pope Leo Xiv

May 28, 2025

Tennis Star Jannik Sinners Unexpected Meeting With Pope Leo Xiv

May 28, 2025 -

Legal Battle Looms As Mali Targets Barricks Gold Mine

May 28, 2025

Legal Battle Looms As Mali Targets Barricks Gold Mine

May 28, 2025 -

Waspada Hujan Lanjutan Di Jawa Timur 24 Maret 2024

May 28, 2025

Waspada Hujan Lanjutan Di Jawa Timur 24 Maret 2024

May 28, 2025 -

Pernyataan Surya Paloh Jalan Raya Bali Dalam Krisis Infrastruktur

May 28, 2025

Pernyataan Surya Paloh Jalan Raya Bali Dalam Krisis Infrastruktur

May 28, 2025