Boosting Capital Market Cooperation: Pakistan, Sri Lanka, And Bangladesh Collaborate

Table of Contents

Shared Opportunities for Growth through Capital Market Integration

Capital market integration between Pakistan, Sri Lanka, and Bangladesh offers substantial benefits, leading to a more robust and interconnected regional economy. A collaborative approach promises increased liquidity, reduced costs, and enhanced economic stability.

Increased Liquidity and Investment

A unified approach to capital markets can attract significant foreign direct investment (FDI) and stimulate domestic investment. This increased liquidity will fuel economic growth across all three nations.

- Infrastructure Development: Investment opportunities abound in infrastructure projects, including transportation networks, energy grids, and telecommunications, crucial for economic modernization.

- Renewable Energy: The region's commitment to sustainable development creates substantial investment potential in renewable energy sources, like solar and wind power.

- Cross-Border Mutual Funds: The establishment of cross-border mutual funds allows investors in each country to diversify their portfolios, increasing investment flows and capital mobilization.

Reduced Transaction Costs

Streamlining regulatory processes and harmonizing standards will significantly reduce transaction costs for investors. This will make investing across borders more attractive and efficient.

- Brokerage Fees: Reduced brokerage fees through standardized commission structures will lower the cost of trading.

- Simplified Cross-Border Payments: Modernized and integrated payment systems will expedite cross-border transactions, minimizing delays and costs.

Enhanced Regional Economic Stability

Interconnected capital markets provide a crucial buffer against economic shocks. Diversification across national borders mitigates risks and strengthens overall regional stability.

- Risk Mitigation: Investments spread across different economies reduce vulnerability to country-specific economic downturns.

- Diversification Benefits: Investors gain access to a wider range of assets, lowering overall portfolio risk.

Overcoming Challenges to Capital Market Cooperation

Despite the considerable benefits, several obstacles hinder the development of enhanced capital market cooperation within the region. Addressing these challenges is crucial for success.

Regulatory Differences

Significant discrepancies in regulations and compliance standards across the three countries present a major hurdle.

- Listing Requirements: Variations in listing requirements for companies seeking to raise capital create complexities for cross-border investments.

- Investor Protection Laws: Differences in investor protection laws can deter investors concerned about the security of their investments.

Infrastructure Gaps

Inadequate technological and communication infrastructure hampers the efficient execution of cross-border transactions.

- Reliable Online Trading Platforms: The lack of secure and reliable online trading platforms hinders the seamless flow of capital across borders.

- Data Security and Privacy: Robust data security and privacy protocols are essential for building trust and ensuring investor confidence.

Political and Economic Volatility

Political and economic instability in any of the three countries can undermine investor confidence and hinder collaboration.

- Risk Management Frameworks: The implementation of strong risk management frameworks is crucial to mitigate these risks and attract foreign investors.

- Transparency and Accountability: Greater transparency and accountability in governance will enhance investor confidence and reduce uncertainty.

Strategies for Strengthening Capital Market Cooperation

Overcoming the challenges requires a multifaceted approach focusing on regulatory harmonization, infrastructure development, investor education, and strengthened regional financial institutions.

Harmonizing Regulatory Frameworks

Aligning regulatory standards and investor protection laws is paramount.

- Joint Regulatory Body: The establishment of a joint regulatory body or task force could facilitate the harmonization process and promote cooperation.

- Standardized Compliance Procedures: Standardizing compliance procedures will simplify the regulatory landscape and reduce compliance costs.

Developing Common Market Infrastructure

Creating shared platforms and technologies will streamline cross-border transactions.

- Regional Clearinghouse: Establishing a regional clearinghouse can significantly enhance the efficiency and security of cross-border settlements.

- Common Trading Platform: Developing a common trading platform will facilitate access to a wider range of investment opportunities.

Promoting Investor Education and Awareness

Educating investors about the opportunities and risks associated with cross-border investments is crucial.

- Collaborative Education Programs: Joint initiatives for investor education programs will promote understanding and increase participation.

- Financial Literacy Campaigns: Targeted financial literacy campaigns can enhance investor awareness and confidence.

Strengthening Regional Financial Institutions

Regional financial institutions play a pivotal role in facilitating capital market cooperation.

- Funding and Technical Assistance: These institutions can provide crucial funding and technical assistance to support infrastructure development and regulatory harmonization.

- Capacity Building: Supporting capacity building initiatives within each country's financial sector strengthens the overall regional financial system.

A Collaborative Future for Capital Market Cooperation in South Asia

Boosting capital market cooperation between Pakistan, Sri Lanka, and Bangladesh offers immense potential for regional economic growth. While challenges exist, the opportunities outweigh the risks. Addressing regulatory differences, improving infrastructure, fostering investor education, and strengthening regional financial institutions are crucial steps towards unlocking this potential. We encourage further research into the topic of capital market cooperation and support for policies aimed at achieving greater integration within the South Asian region. Engage in the conversation, advocate for collaborative initiatives, and help build a more prosperous future through strengthened capital market cooperation in South Asia.

Featured Posts

-

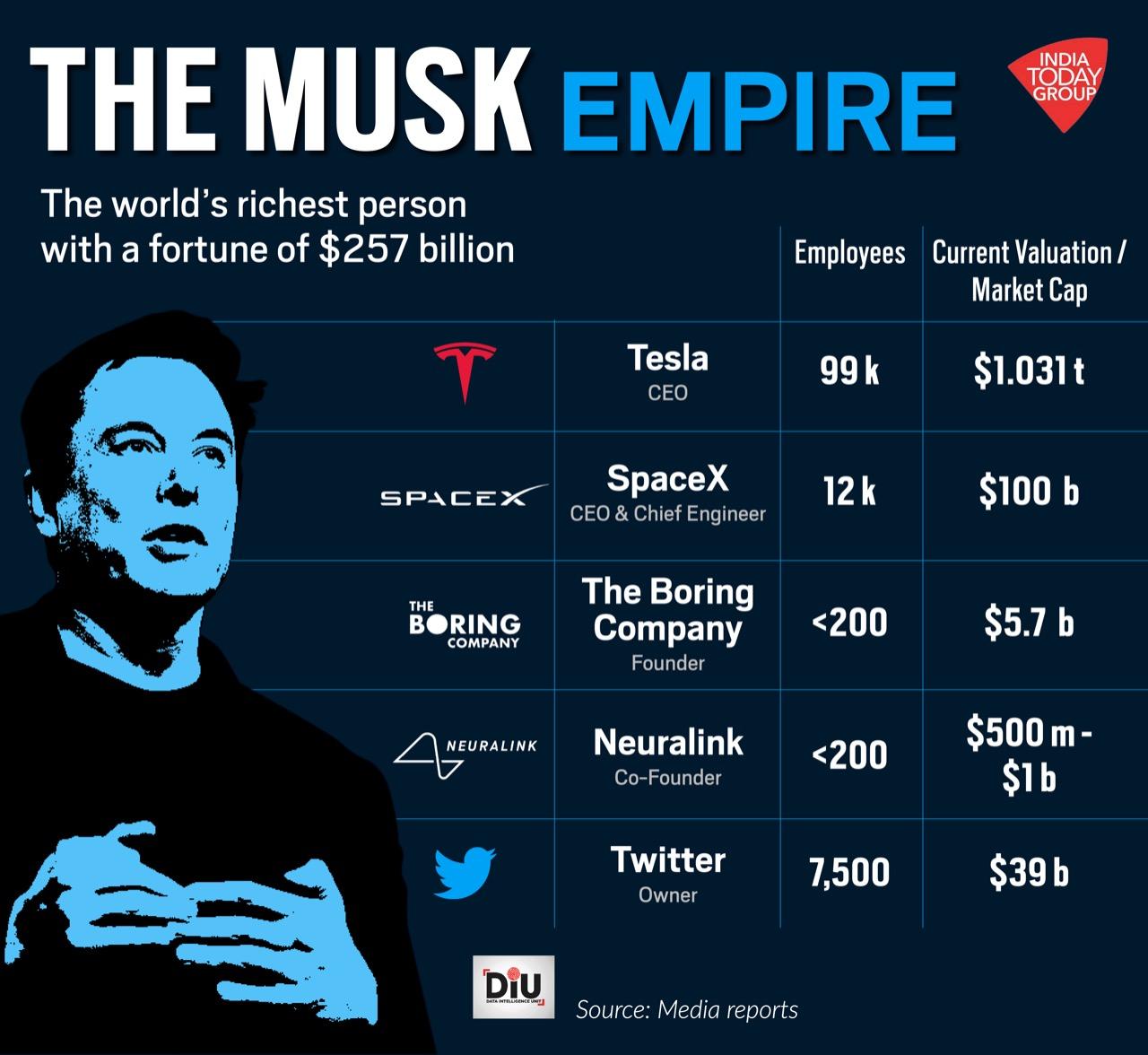

Elon Musk Net Worth The Influence Of Us Politics On Tesla And Space X

May 09, 2025

Elon Musk Net Worth The Influence Of Us Politics On Tesla And Space X

May 09, 2025 -

Nottingham Attack Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025

Nottingham Attack Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025 -

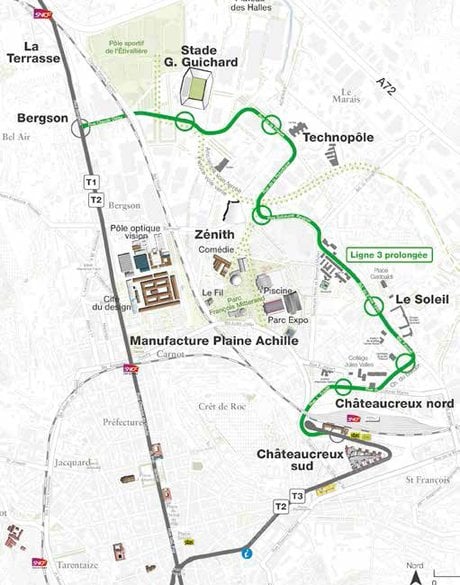

Dijon Adoption Du Projet De Concertation Pour La 3e Ligne De Tram

May 09, 2025

Dijon Adoption Du Projet De Concertation Pour La 3e Ligne De Tram

May 09, 2025 -

Nottingham Attacks Inquiry Retired Judge Appointed To Chair

May 09, 2025

Nottingham Attacks Inquiry Retired Judge Appointed To Chair

May 09, 2025 -

Leon Draisaitl Injury Update Out Against Winnipeg

May 09, 2025

Leon Draisaitl Injury Update Out Against Winnipeg

May 09, 2025