Broadcom's VMware Acquisition: A 1,050% Price Spike For AT&T And Others?

Table of Contents

The Deal's Impact on Enterprise Software and Infrastructure

VMware's Role in Enterprise IT

VMware is a dominant player in the virtualization and cloud computing market, providing crucial infrastructure for many organizations. Its products are integral to modern data centers and cloud strategies.

- VMware vSphere: This virtualization platform underpins many enterprise IT environments.

- vSAN: VMware's software-defined storage solution offers scalable and flexible storage management.

- NSX: VMware's network virtualization platform allows for agile and secure network management.

- Cloud Foundation: A comprehensive platform for building and managing private and hybrid clouds.

- Impact on Data Centers: VMware's technologies have fundamentally changed how data centers are designed, managed, and operated, enabling greater efficiency and scalability.

Broadcom's Strategic Goals

Broadcom's acquisition of VMware is a strategic move driven by several key objectives:

-

Expansion into Software: Broadcom, primarily known for its semiconductor business, is diversifying into the lucrative enterprise software market.

-

Increased Market Share: The acquisition significantly expands Broadcom's market reach and influence within the IT infrastructure space.

-

Synergy with Existing Products: Broadcom aims to integrate VMware's technologies with its existing portfolio, creating synergies and enhanced product offerings.

-

Broadcom's Semiconductor Business: This existing strength provides a solid financial foundation for the integration and expansion of VMware's operations.

-

Potential for Cross-selling: Broadcom can leverage its existing customer base to cross-sell VMware solutions, and vice-versa.

-

Expansion into New Markets: The acquisition opens doors to new market segments and opportunities for both companies.

Antitrust Concerns and Regulatory Scrutiny

The Broadcom VMware acquisition is subject to significant regulatory scrutiny and faces potential antitrust challenges.

- Government Investigations: Antitrust authorities in various jurisdictions are likely to investigate the deal's impact on competition.

- Potential Mergers and Acquisitions Blockades: There's a possibility the deal could be blocked or significantly altered by regulatory bodies.

- Impact on Competition: Critics argue the merger could stifle competition and lead to higher prices for enterprise software and services.

Analyzing the Price Spike: The Case of AT&T and Other Telecom Companies

AT&T's VMware Holdings

AT&T, like many telecom companies, relies heavily on VMware technologies. The Broadcom acquisition could significantly impact the value of AT&T's VMware holdings. The suggested 1050% increase is highly speculative and based on numerous hypothetical scenarios relating to the final acquisition price and AT&T's exact holdings.

- AT&T's Reliance on VMware: AT&T's network infrastructure and IT systems extensively utilize VMware's virtualization and cloud solutions.

- Hypothetical Scenarios for Price Increase: This dramatic increase depends on several factors, including the final sale price, AT&T's shareholding size, and Broadcom's post-acquisition strategies. It is crucial to understand this is a potential scenario, not a guaranteed outcome.

Impact on Other Telecoms

The Broadcom VMware acquisition has broad implications for other telecom companies.

- Verizon: Verizon, a major competitor to AT&T, also utilizes VMware technologies and will be affected by the deal's long-term consequences.

- T-Mobile: Similar to Verizon and AT&T, T-Mobile’s reliance on VMware’s infrastructure will impact its strategy and potential costs in the future.

- Other Major Players: Other large telecom companies globally will need to reassess their strategies in light of this significant market shift.

Valuation and Stock Market Reactions

The stock market reacted to the acquisition announcement, reflecting investor sentiment and predictions.

- Stock Price Changes: Both Broadcom and VMware saw significant stock price fluctuations following the announcement.

- Investor Sentiment: Investor confidence regarding the deal's success varied, influencing market reactions.

- Analyst Predictions: Analysts offered diverse predictions regarding the acquisition's long-term impact on both companies and the broader market.

Long-Term Implications of the Broadcom VMware Acquisition

Impact on Cloud Computing Strategies

The acquisition could reshape the cloud computing landscape.

- Competition with AWS, Azure, GCP: The combined entity will compete more directly with major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

- Potential Integration Challenges: Integrating VMware's technologies into Broadcom's existing operations may pose significant challenges.

Future Innovation and Technological Advancements

The merger could drive innovation.

- R&D Investment: Increased R&D investment is expected, potentially leading to new products and services.

- Potential New Product Developments: The combined company’s resources could accelerate the development of innovative solutions in virtualization, cloud computing, and networking.

Potential for Job Displacement and Restructuring

The acquisition could lead to workforce changes.

- Redundancies: Overlapping roles and functions within both companies could result in job losses.

- Integration Challenges: The integration process may necessitate restructuring and re-allocation of resources.

- Workforce Changes: The combined company's workforce structure and culture will likely undergo significant changes.

Conclusion: Broadcom's VMware Acquisition: A New Era for Enterprise Technology?

The Broadcom VMware acquisition marks a pivotal moment in the enterprise technology sector. Its impact is multifaceted, affecting enterprise software, cloud computing strategies, and the valuations of companies like AT&T holding VMware stock. While the potential 1050% price increase for AT&T remains speculative, it illustrates the scale of potential impact. The long-term consequences require careful monitoring and further analysis. It's crucial to understand the evolving regulatory landscape and the potential for both positive and negative effects on competition and innovation. Continue following updates on the "Broadcom VMware acquisition" and its implications for your industry. Conduct further research into the specific impacts on your company's holdings in VMware to make informed decisions.

Featured Posts

-

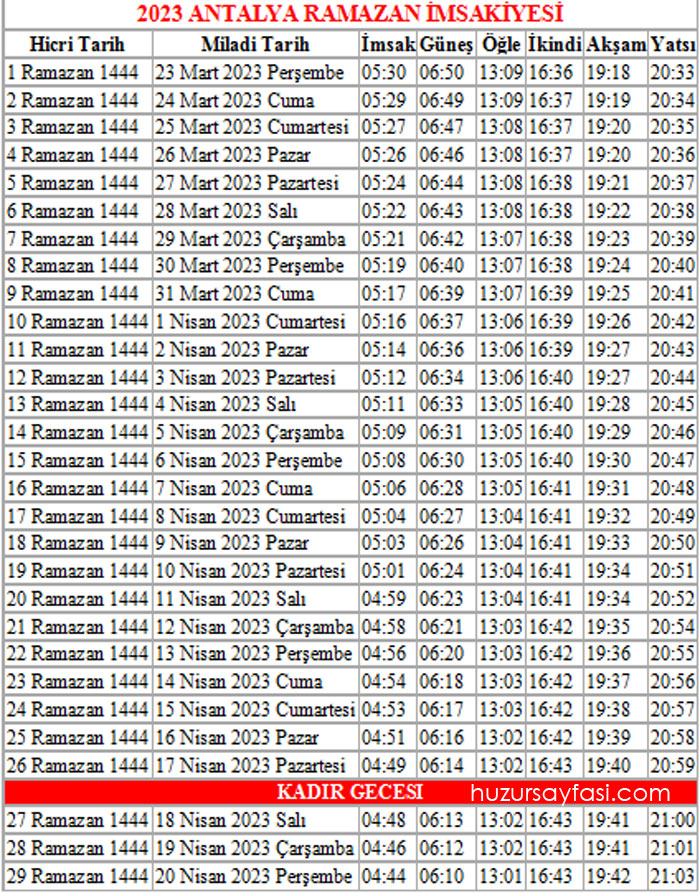

Istanbul Da 3 Mart Pazartesi Iftar Ve Sahur Vakitleri

Apr 23, 2025

Istanbul Da 3 Mart Pazartesi Iftar Ve Sahur Vakitleri

Apr 23, 2025 -

Bfm Bourse Du 24 Fevrier Le Resume Complet De La Journee

Apr 23, 2025

Bfm Bourse Du 24 Fevrier Le Resume Complet De La Journee

Apr 23, 2025 -

Go Delete Yourself From The Internet A Practical Guide

Apr 23, 2025

Go Delete Yourself From The Internet A Practical Guide

Apr 23, 2025 -

Section 230 And Banned Chemicals Legal Implications For Online Marketplaces Like E Bay

Apr 23, 2025

Section 230 And Banned Chemicals Legal Implications For Online Marketplaces Like E Bay

Apr 23, 2025 -

Brewers Win Walk Off Thriller Thanks To Turangs Bunt

Apr 23, 2025

Brewers Win Walk Off Thriller Thanks To Turangs Bunt

Apr 23, 2025