Canada Avoids Recession, But OECD Forecasts Slow Growth For 2025

Table of Contents

Canada's Recent Economic Resilience

Canada's ability to avoid a recession in the face of global uncertainty is noteworthy. Several factors contributed to this economic strength:

Factors Contributing to Recession Avoidance

-

Strong Labor Market: Canada has experienced consistently low unemployment rates, with robust job creation across various sectors. This strong labor market fueled consumer spending and overall economic activity. For example, the unemployment rate remained below 5% throughout much of 2023, significantly lower than many other developed nations.

-

Consumer Spending: Despite inflationary pressures, Canadian consumer confidence remained relatively high, supporting a sustained level of consumer spending. This resilience suggests a degree of underlying economic strength and adaptability.

-

Government Spending: Fiscal stimulus measures implemented by the Canadian government played a significant role in supporting economic activity and mitigating the impact of global economic shocks. These measures included investments in infrastructure and social programs.

-

Commodity Prices: High global demand for Canadian resources, particularly energy and minerals, boosted export revenues and contributed to overall economic growth. This positive impact on commodity-producing provinces helped offset some of the negative impacts from other sectors.

-

Key Economic Indicators:

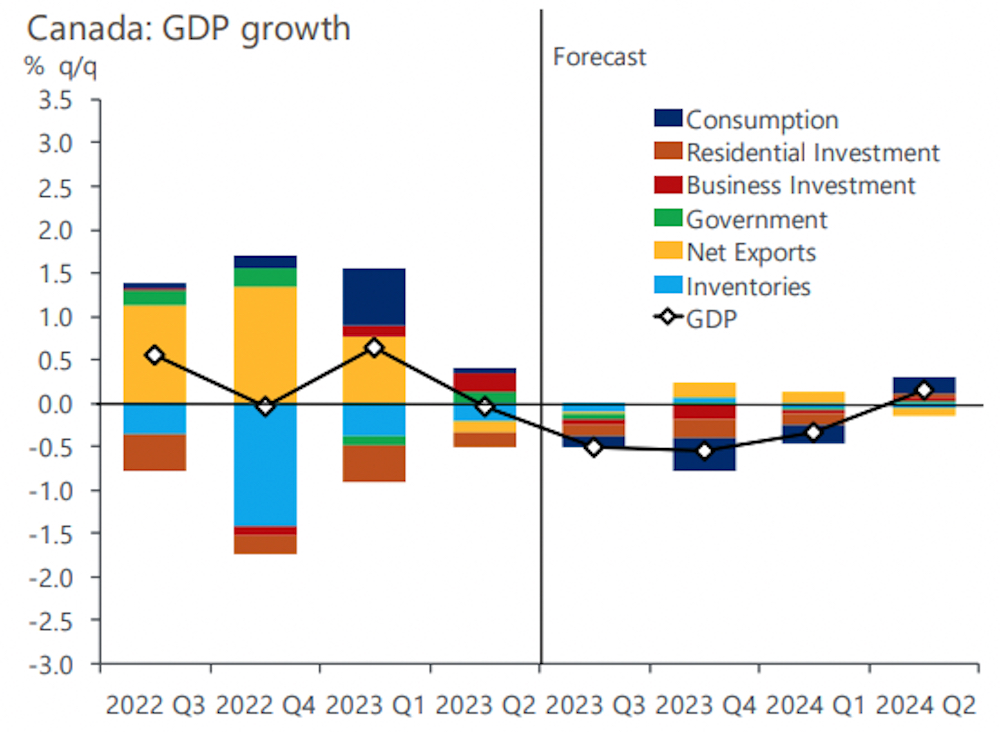

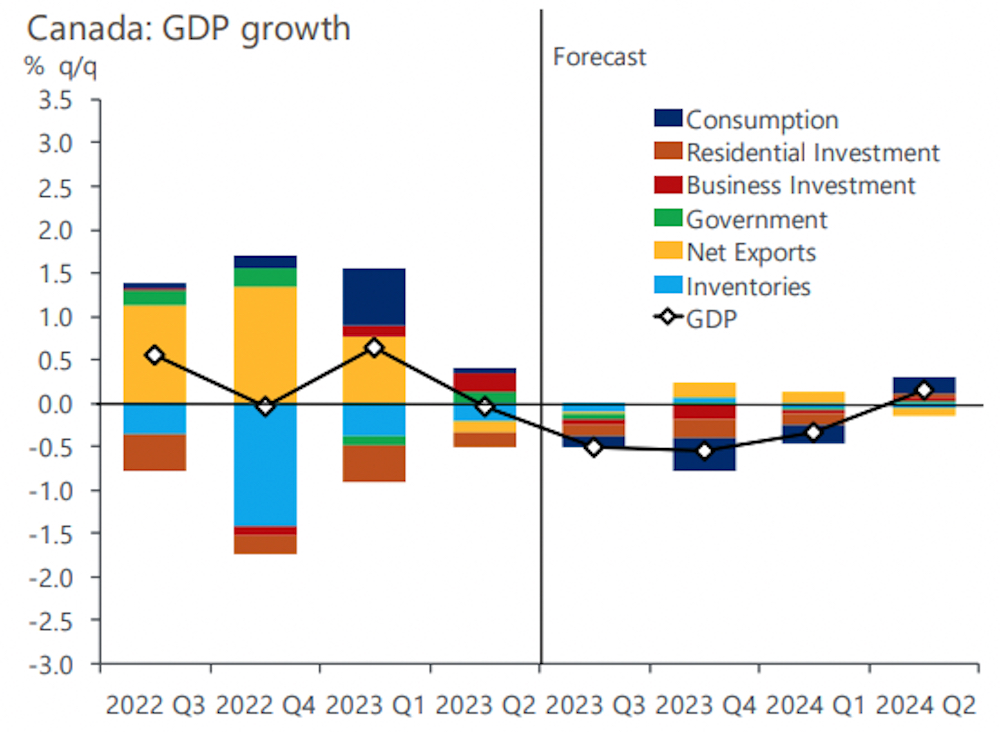

- GDP Growth: Canada experienced positive GDP growth in [Insert recent GDP growth figures and source].

- Inflation Rate: While inflation remained elevated, it showed signs of moderation in [Insert recent inflation data and source].

The OECD's Forecast for Slow Growth in 2025

Despite Canada's recent economic success, the OECD projects slower growth for 2025. This prediction is based on several factors:

Reasons Behind the Prediction

-

Global Economic Slowdown: The OECD cites global economic uncertainty and potential downturns in major economies as a significant factor impacting the Canadian economy. This interconnectedness means that global events inevitably influence the Canadian outlook.

-

Inflationary Pressures: Persistent inflationary pressures are expected to continue impacting consumer spending and business investment, potentially dampening economic growth. The sustained high inflation rates erode purchasing power and create uncertainty.

-

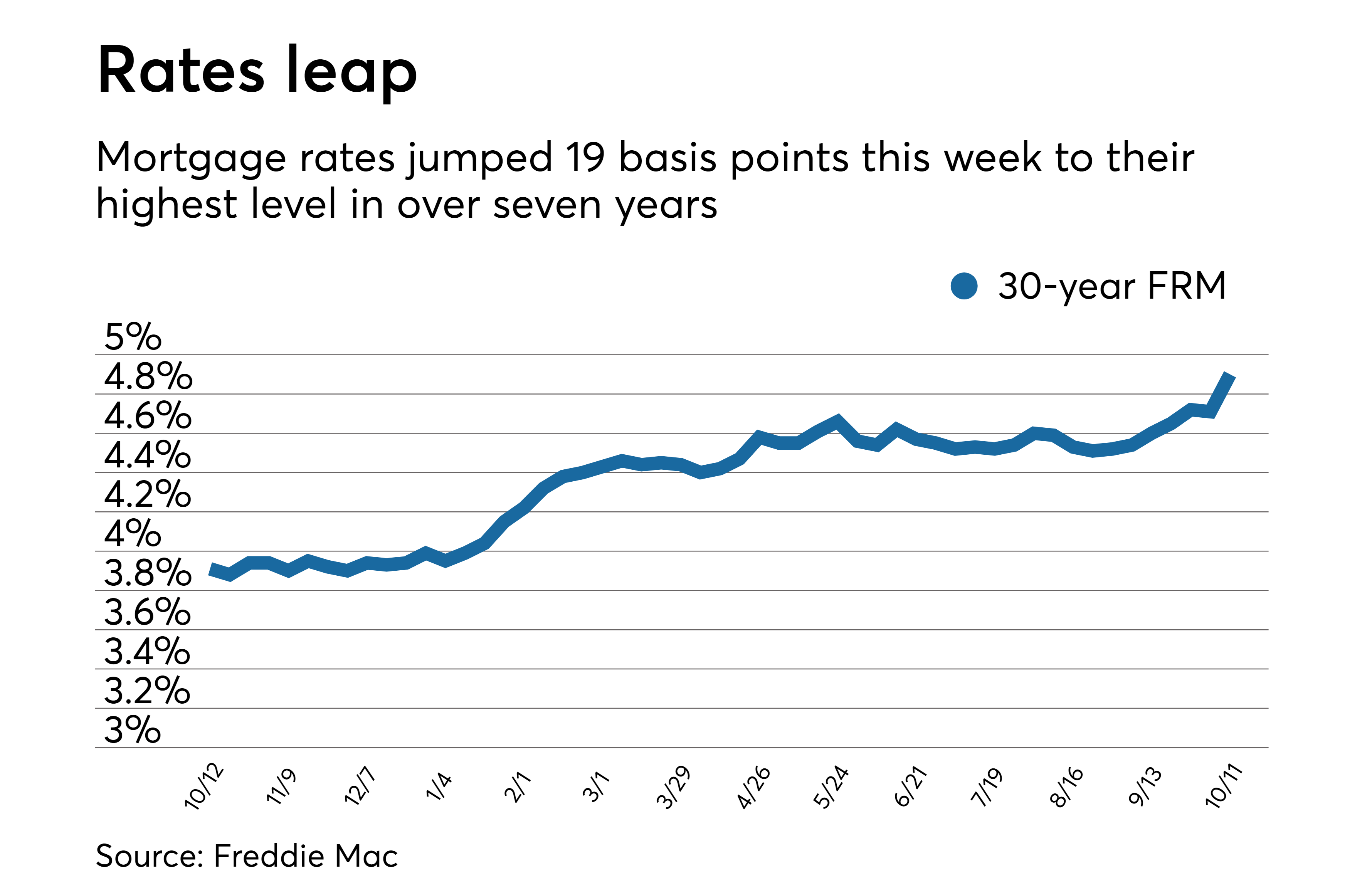

Interest Rate Hikes: The Bank of Canada's interest rate hikes, aimed at curbing inflation, increase borrowing costs for businesses and consumers, potentially slowing down investment and economic activity. Higher interest rates cool economic activity by reducing investment and consumer spending.

-

Housing Market Correction: A potential correction in the Canadian housing market, with potential for further price adjustments, could negatively impact related industries and overall economic growth. The housing market slowdown is a significant factor contributing to the moderated economic outlook.

-

OECD Projections: The OECD projects a [Insert specific percentage] growth rate for the Canadian economy in 2025 (Source: [Cite the OECD report]).

Key Sectors to Watch in the Canadian Economy

Monitoring key sectors is vital for understanding the Canada Economic Outlook. The performance of these sectors will significantly influence the overall economic trajectory:

Real Estate Market Outlook

The Canadian real estate market is expected to experience a period of adjustment, with potential for further price corrections in certain areas. This will impact related industries, including construction, finance, and retail. Potential risks include further price declines and reduced consumer confidence. Opportunities lie in potential long-term value creation for those able to navigate the market effectively.

Manufacturing and Exports

The manufacturing and export sectors are crucial drivers of economic growth. The outlook for these sectors depends heavily on global demand, trade policies, and supply chain resilience. Risks include global trade tensions and potential supply chain disruptions. Opportunities are presented by innovation and increased focus on value-added manufacturing.

Energy Sector Performance

The Canadian energy sector’s performance will continue to heavily influence the national economic outlook. Oil and gas production will be affected by global demand, energy transition policies, and investment in renewable energy sources. Risks include price volatility and shifts in global energy markets. Opportunities exist in diversification towards cleaner energy sources and technological advancements within the sector.

Government Policy and its Role

Government policies will play a vital role in shaping the Canada Economic Outlook.

Fiscal Policy Initiatives

The government's ongoing fiscal policy initiatives, including investments in infrastructure and social programs, aim to stimulate economic activity and address social challenges. These fiscal measures can provide support or add to economic instability.

Monetary Policy Adjustments

The Bank of Canada's monetary policy adjustments, particularly interest rate decisions, will significantly impact borrowing costs, investment, and consumer spending. Further interest rate adjustments are possible depending on inflation developments. Any potential changes to monetary policy will have a direct impact on the overall health of the economy.

Conclusion:

While Canada has demonstrated impressive economic resilience recently, the OECD's forecast of slow growth in 2025 highlights the need for continued vigilance. Understanding the various factors influencing the Canada Economic Outlook, including global economic conditions, inflation, and government policies, is crucial for businesses and investors. By closely monitoring key economic indicators and adapting strategies accordingly, businesses and investors can effectively navigate the evolving economic landscape. Continue to monitor updates on the Canada Economic Outlook for informed decision-making and improved strategic planning. Understanding the nuances of the Canadian economic forecast is vital for success in this dynamic environment.

Featured Posts

-

Avrupa Yi Salsalastircak Transfer Ingiliz Devi Anlasmayi Neredeyse Tamamladi

May 28, 2025

Avrupa Yi Salsalastircak Transfer Ingiliz Devi Anlasmayi Neredeyse Tamamladi

May 28, 2025 -

Finding The Right Personal Loan Bad Credit And Direct Lender Options

May 28, 2025

Finding The Right Personal Loan Bad Credit And Direct Lender Options

May 28, 2025 -

Hujan Di Semarang Siang Hari Prakiraan Cuaca Lengkap 22 April 2024

May 28, 2025

Hujan Di Semarang Siang Hari Prakiraan Cuaca Lengkap 22 April 2024

May 28, 2025 -

Post Fire La Investigation Into Landlord Price Gouging Practices

May 28, 2025

Post Fire La Investigation Into Landlord Price Gouging Practices

May 28, 2025 -

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025

Latest Posts

-

4 Recetas De Emergencia Comida Rica Sin Luz Ni Gas

May 31, 2025

4 Recetas De Emergencia Comida Rica Sin Luz Ni Gas

May 31, 2025 -

Receta Aragonesa De 3 Ingredientes Sabores Del Siglo Xix

May 31, 2025

Receta Aragonesa De 3 Ingredientes Sabores Del Siglo Xix

May 31, 2025 -

Preparate Para Un Apagon 4 Recetas Faciles Y Nutritivas

May 31, 2025

Preparate Para Un Apagon 4 Recetas Faciles Y Nutritivas

May 31, 2025 -

Descubre Una Receta Aragonesa Del Siglo Xix Solo 3 Ingredientes

May 31, 2025

Descubre Una Receta Aragonesa Del Siglo Xix Solo 3 Ingredientes

May 31, 2025 -

La Autentica Receta Aragonesa 3 Ingredientes Siglo Xix

May 31, 2025

La Autentica Receta Aragonesa 3 Ingredientes Siglo Xix

May 31, 2025