Canada's Conservatives: Tax Cuts And Deficit Reduction Plan

Table of Contents

Proposed Tax Cuts

The Conservative Party's tax cut proposals generally focus on stimulating economic growth through lower taxes for individuals and businesses. Key elements often include:

-

Income Tax Cuts: Specific proposals vary depending on the election cycle, but often include reductions in income tax brackets. Past proposals have suggested lowering the highest marginal tax rate or implementing across-the-board percentage reductions, aiming to boost disposable income and consumer spending. The exact percentage reductions and targeted brackets are subject to change.

-

Corporate Tax Cuts: Lowering the corporate income tax rate is a central tenet of the Conservative economic platform. This measure aims to attract investment, encourage business expansion, and create jobs. The argument is that businesses will reinvest tax savings, leading to increased productivity and economic growth. The proposed rate reduction aims to improve Canada's competitiveness against other countries.

-

Small Business Tax Relief: Targeted tax relief for small businesses is another common element. This could involve reducing tax rates specifically for small businesses, increasing the small business deduction limit, or offering other tax credits. This aims to support job creation and entrepreneurship.

-

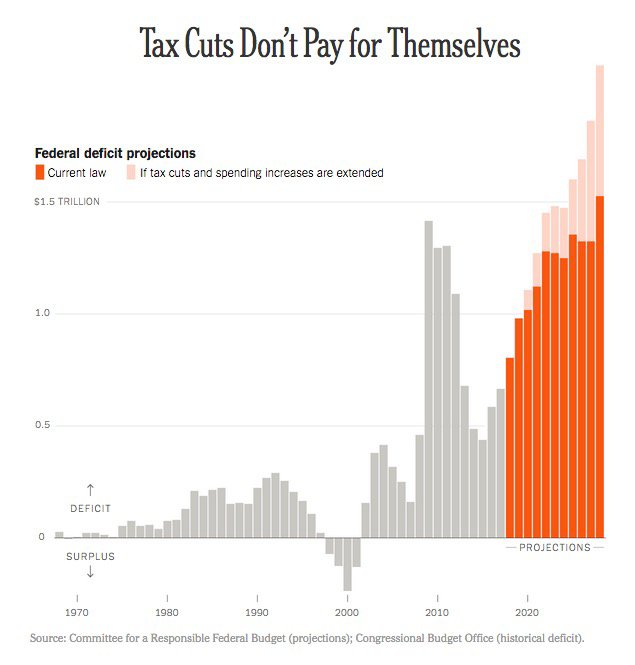

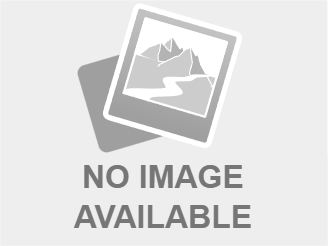

Analysis of Revenue Impact: Naturally, significant tax cuts will impact government revenue. The Conservatives usually project that the economic stimulus from the tax cuts will offset some of the revenue loss through increased tax revenue from a stronger economy. However, the magnitude of this effect and its timing are subject to debate and economic modelling.

Deficit Reduction Strategies

The Conservative Party emphasizes fiscal responsibility and achieving a balanced budget. Their proposed deficit reduction strategies generally involve a combination of:

-

Spending Cuts: Specific areas targeted for spending cuts often include government administrative costs, reducing duplication and streamlining programs. They may also propose targeted cuts to specific programs or departments, though the specifics are often debated. Prioritizing essential services is generally cited as a guiding principle.

-

Improved Government Efficiency: Increased efficiency and reduced waste within government operations are key elements. This could include measures such as modernizing IT systems, improving procurement processes, and reducing bureaucratic red tape. Specific initiatives aim to achieve savings without impacting essential services.

-

Path to Balanced Budget: The Conservatives typically outline a multi-year plan for deficit reduction, projecting a path toward a balanced budget over a specified period. This plan often includes detailed projections of government revenue and spending, though these projections and their underlying assumptions can be challenged by other parties and economists.

-

Addressing Criticisms: A frequent criticism of Conservative spending cuts focuses on the potential impact on vital social programs. The party typically counters by emphasizing targeted efficiency improvements and protecting essential services while eliminating wasteful spending.

Economic Impacts and Analysis

The economic consequences of the Conservative Party's plan are a subject of ongoing debate among economists.

-

Impact on Economic Growth and Job Creation: The Conservatives argue that tax cuts, especially for businesses, stimulate investment and job creation. However, the magnitude of this effect is uncertain and depends on several factors, including the size of the tax cuts and the responsiveness of businesses to these incentives. Independent economic analyses may offer different projections.

-

Inflationary Effects: Stimulus from tax cuts could potentially lead to increased inflation. This depends on the overall state of the economy and other economic factors. Balancing the need for economic stimulus with the risks of inflation is a crucial aspect of the debate.

-

Distributional Impacts: Tax cuts often benefit higher-income earners more than lower-income earners due to the structure of the tax system. The Conservatives may argue that overall economic growth benefits all Canadians, however, critics may emphasize that the benefits may not be equally distributed.

-

Feasibility and Sustainability: The feasibility and long-term sustainability of the Conservative fiscal plan are crucial considerations. Critics may point to potential risks if economic growth projections are not met or if the proposed spending cuts are insufficient to address the deficit.

Comparison to other parties

Comparing the Conservative plan to those of the Liberal Party, NDP, and Bloc Québécois reveals significant differences in approach to tax cuts and deficit reduction. The Liberals often favour targeted social programs and investments in infrastructure, while the NDP typically emphasizes social programs and wealth redistribution. The Bloc Québécois' focus tends to be on Quebec-specific priorities. A detailed comparison requires examining each party's specific proposals in each election.

Conclusion

Canada's Conservatives' approach to tax cuts and deficit reduction centers on stimulating economic growth through lower taxes and targeted spending cuts. Their proposals aim to create jobs, increase investment, and ultimately achieve a balanced budget. However, the plan's economic impact, including its distributional effects and potential inflationary pressures, remains a subject of ongoing debate and scrutiny. Understanding the intricacies of this plan, including potential drawbacks and areas of contention, is key to forming an informed opinion. Learn more about their complete economic plan and how it might affect you by visiting [link to relevant source]. Continue researching Canada's Conservatives, tax cuts, and deficit reduction to make an informed decision during the next election.

Featured Posts

-

Missed Mammogram Leads To Breast Cancer Diagnosis Tina Knowles Story

Apr 24, 2025

Missed Mammogram Leads To Breast Cancer Diagnosis Tina Knowles Story

Apr 24, 2025 -

Analysis Of Teslas Q1 Earnings 71 Net Income Decrease Explained

Apr 24, 2025

Analysis Of Teslas Q1 Earnings 71 Net Income Decrease Explained

Apr 24, 2025 -

Instagrams Tik Tok Competitor A New Video Editing App

Apr 24, 2025

Instagrams Tik Tok Competitor A New Video Editing App

Apr 24, 2025 -

Has Sk Hynix Surpassed Samsung As The Leading Dram Provider The Role Of Ai

Apr 24, 2025

Has Sk Hynix Surpassed Samsung As The Leading Dram Provider The Role Of Ai

Apr 24, 2025 -

Ai Generated Poop Podcast A Novel Approach To Processing Repetitive Documents

Apr 24, 2025

Ai Generated Poop Podcast A Novel Approach To Processing Repetitive Documents

Apr 24, 2025

Latest Posts

-

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 10, 2025

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 10, 2025 -

Nhl Post Trade Deadline Playoff Projections 2025 Season

May 10, 2025

Nhl Post Trade Deadline Playoff Projections 2025 Season

May 10, 2025 -

2025 Nhl Playoffs How The Trade Deadline Shaped The Contenders

May 10, 2025

2025 Nhl Playoffs How The Trade Deadline Shaped The Contenders

May 10, 2025 -

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Contenders

May 10, 2025

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Contenders

May 10, 2025 -

Oilers Overtime Victory Levels Series With Kings

May 10, 2025

Oilers Overtime Victory Levels Series With Kings

May 10, 2025