Canadian Funds Flood US Stock Market: A New Investment High

Table of Contents

Driving Forces Behind the Canadian Investment Surge

Several factors contribute to the dramatic increase in Canadian investment flowing into the US stock market. Understanding these drivers is crucial to comprehending the current investment landscape and predicting future trends.

Favorable US Economic Conditions

The robust US economy presents a compelling investment environment for Canadian funds. Strong economic growth, low unemployment rates, and healthy consumer spending create a fertile ground for investment opportunities.

- Strong GDP Growth: Consistent GDP growth provides a stable backdrop for investment, attracting capital seeking higher returns.

- Low Unemployment: A low unemployment rate signifies a healthy economy, reducing the risk of economic downturn and fostering investor confidence.

- Robust Consumer Spending: High consumer spending fuels economic growth, boosting corporate profits and driving stock market performance.

- Stable Regulatory Environment: A stable and predictable regulatory framework minimizes uncertainty and encourages long-term investment.

The Loonie's Impact

The exchange rate between the Canadian dollar (Loonie) and the US dollar plays a crucial role in influencing investment decisions. A weaker Loonie makes US assets more affordable for Canadian investors, effectively increasing their purchasing power.

- Current Exchange Rate Trends: Fluctuations in the Loonie's value directly impact the return on investment (ROI) for Canadians investing in US assets. (Insert current exchange rate data here).

- Historical Comparisons: Analyzing historical exchange rate trends helps to understand the cyclical nature of currency fluctuations and their impact on investment strategies.

- Impact on ROI: A weaker Loonie can significantly boost the ROI for Canadian investors when their US investments are converted back into Canadian dollars.

Diversification Strategies

Many Canadian investors are utilizing the US market to diversify their portfolios and mitigate risk. Diversification reduces reliance on the Canadian economy and provides exposure to different asset classes and economic cycles.

- Reducing Reliance on the Canadian Economy: Diversification into the US market helps to insulate portfolios from potential downturns in the Canadian economy.

- Hedging Against Market Downturns: Investing in the US market offers a hedge against potential market volatility in Canada.

- Accessing Different Asset Classes: The US market provides access to a wider range of asset classes, including technology stocks, healthcare companies, and real estate, allowing for greater portfolio diversification.

- Specific Sectors: Canadian investors are particularly drawn to sectors like technology and healthcare, which offer high-growth potential.

Sectors Attracting Canadian Investment

Canadian funds are flowing into various sectors of the US economy, each offering unique investment opportunities and challenges.

Technology and Innovation

The US technology sector is a major draw for Canadian investment, fueled by innovation and high-growth potential.

- High-Profile Investments: (Include examples of significant Canadian investments in US tech companies and startups, citing news sources).

- Reasons for Popularity: The sector's dynamic nature, potential for disruptive innovation, and strong growth prospects attract significant investment.

Healthcare and Pharmaceuticals

The aging US population and advancements in medical technology are driving significant investment in the US healthcare sector.

- Aging Population: The increasing demand for healthcare services creates a robust market for pharmaceutical companies and healthcare providers.

- Innovative Treatments: Investment in research and development of innovative treatments and technologies fuels high-growth potential.

- Mergers and Acquisitions: Mergers and acquisitions play a significant role in shaping the healthcare landscape and generating investment opportunities.

Real Estate

Canadian investors are actively involved in the US real estate market, targeting both commercial and residential properties.

- Types of Properties: (Specify types of properties attracting investment, e.g., multi-family residences, commercial real estate in major cities).

- Geographical Location Preferences: (Mention specific regions or cities popular among Canadian investors).

- Impact of Interest Rates: Interest rate fluctuations significantly influence investment decisions in the real estate sector.

Implications and Future Outlook for the US and Canadian Markets

The influx of Canadian funds into the US stock market has significant implications for both economies.

Impact on US Market Volatility

Increased Canadian investment can influence US market volatility in several ways.

- Increased Liquidity: Increased capital flow adds liquidity to the US market, potentially easing price fluctuations.

- Potential Price Impacts: Large-scale investments can influence asset prices, particularly in specific sectors.

- Effect on Market Sentiment: The influx of foreign capital can signal investor confidence, influencing market sentiment positively.

Long-Term Investment Trends

Predicting long-term trends requires considering various factors.

- Potential Shifts in Investment Strategies: Changes in macroeconomic conditions or investor sentiment may lead to shifts in investment preferences.

- Macroeconomic Factors: Global economic growth, interest rate changes, and geopolitical events significantly impact investment decisions.

Opportunities and Risks for Canadian Investors

Investing in the US market offers both opportunities and challenges.

- Currency Risk: Fluctuations in the exchange rate between the Loonie and the US dollar represent a significant risk.

- Regulatory Differences: Navigating regulatory differences between Canada and the US requires careful consideration.

- Potential for Higher Returns: The US market offers the potential for higher returns compared to the Canadian market.

- Potential for Losses: Investment in the US market carries inherent risks, including potential for losses.

Conclusion: Navigating the Surge – Canadian Funds and the US Stock Market

The surge of Canadian funds into the US stock market is driven by favorable US economic conditions, a weaker Loonie, and diversification strategies. This trend significantly impacts both the US and Canadian economies, affecting market volatility and long-term investment prospects. While the potential for higher returns exists, Canadian investors must carefully consider the risks involved, including currency fluctuations and regulatory differences. Learn more about leveraging the current market conditions to maximize your investment strategy using Canadian funds. Remember to seek professional financial advice before making any investment decisions.

Featured Posts

-

Seven Shutout Innings Skubals Masterful Performance Against Brewers

Apr 23, 2025

Seven Shutout Innings Skubals Masterful Performance Against Brewers

Apr 23, 2025 -

Aaron Judges 3 Hrs Highlight Yankees 9 Homer Game

Apr 23, 2025

Aaron Judges 3 Hrs Highlight Yankees 9 Homer Game

Apr 23, 2025 -

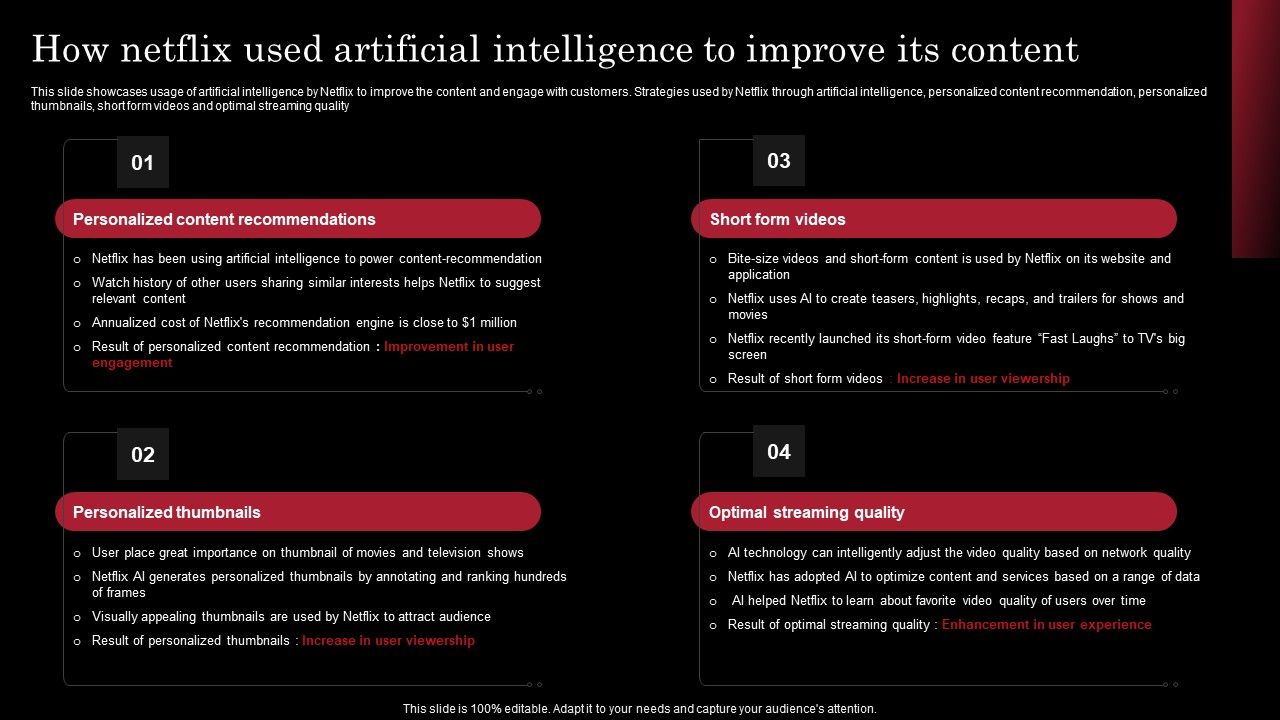

How Netflix Is Outperforming Big Tech And Attracting Tariff Seeking Investors

Apr 23, 2025

How Netflix Is Outperforming Big Tech And Attracting Tariff Seeking Investors

Apr 23, 2025 -

Pronadite Otvorene Trgovine Za Uskrs I Uskrsni Ponedjeljak

Apr 23, 2025

Pronadite Otvorene Trgovine Za Uskrs I Uskrsni Ponedjeljak

Apr 23, 2025 -

Recovery Complete Yelich Hits First Home Run After Back Surgery

Apr 23, 2025

Recovery Complete Yelich Hits First Home Run After Back Surgery

Apr 23, 2025