How Netflix Is Outperforming Big Tech And Attracting Tariff-Seeking Investors

Table of Contents

Netflix's Superior Financial Performance Compared to Big Tech

Netflix's financial performance consistently outpaces many of its Big Tech counterparts, making it a compelling investment opportunity. This superior performance stems from robust revenue growth and impressive profitability.

Revenue Growth and Profitability

Comparing Netflix's revenue growth and profitability to giants like Amazon, Apple, and Google reveals a compelling narrative. Over the past few years, Netflix has demonstrated consistent year-over-year revenue growth, often exceeding the growth rates of its Big Tech competitors.

- Consistent Revenue Growth: Netflix has shown a steady upward trend in revenue, even amidst market fluctuations. This consistent growth showcases its ability to attract and retain subscribers globally.

- Increasing Subscriber Base: A continuously expanding subscriber base is a key driver of Netflix's revenue growth. The company's strategic expansion into international markets has significantly contributed to this increase.

- Higher Profit Margins: Despite significant investment in original content, Netflix has managed to maintain higher profit margins compared to some Big Tech companies, indicating efficient operational management and strong pricing power.

[Insert chart comparing Netflix's revenue growth and profitability to Amazon, Apple, and Google over the past 3-5 years. Source the data appropriately.]

Stock Performance and Investor Confidence

Netflix's strong financial performance translates directly into impressive stock performance. Compared to the broader tech market and its competitors, Netflix's stock has shown significant appreciation, reflecting investor confidence in the company's long-term growth prospects.

- Stock Price Appreciation: Netflix's stock price has consistently outperformed many tech indices and the stocks of its direct competitors, indicating strong investor sentiment.

- Market Capitalization: Its substantial market capitalization underscores its position as a leading player in the streaming entertainment industry.

- Positive Analyst Ratings: Many financial analysts have issued positive ratings and price targets for Netflix, further bolstering investor confidence.

Netflix's Strategic Adaptability in a Changing Global Market

Netflix's success isn't solely based on financial performance; it's also driven by its impressive strategic adaptability in a dynamic global market. Its international expansion, localization efforts, and content strategy are key factors in its continued growth.

International Expansion and Localization

Netflix's global reach is a significant advantage. The company's successful international expansion, coupled with effective localization strategies, has opened up vast new markets.

- Successful International Launches: Netflix's expansion into diverse regions, including Asia, Latin America, and Europe, has been remarkably successful.

- Catering to Local Preferences: Netflix invests heavily in creating and acquiring content tailored to specific regional tastes, enhancing its appeal to diverse audiences.

- Strong Growth in Key Regions: Several international markets have shown particularly strong subscriber growth, contributing significantly to Netflix's overall success.

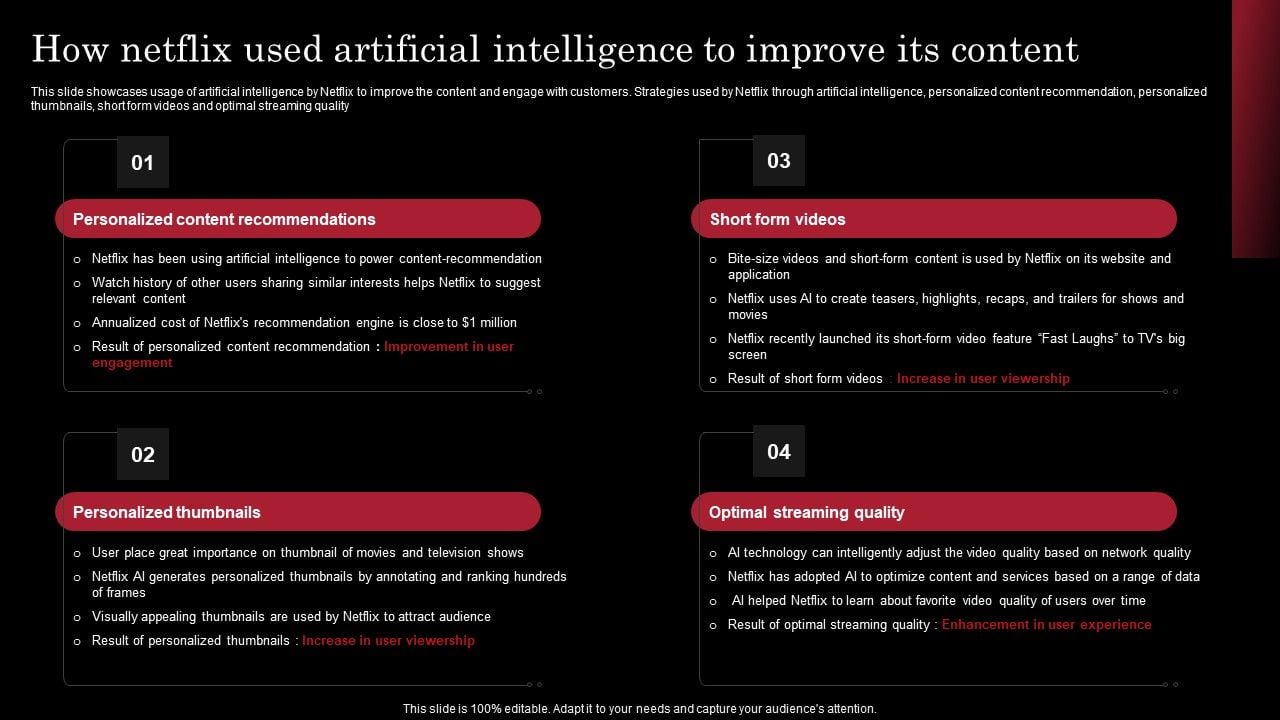

Content Strategy and Original Programming

Netflix's substantial investment in original programming has been instrumental in attracting and retaining subscribers. The platform's diverse range of high-quality content is a significant competitive advantage.

- Award-Winning Originals: Netflix's original shows and movies have garnered numerous prestigious awards, reinforcing their quality and attracting global audiences.

- Effective Content Strategy: Netflix's data-driven approach to content creation and acquisition ensures that it produces and acquires programming that resonates with its target audience.

- Subscriber Acquisition and Retention: The compelling and diverse nature of Netflix's content is a crucial factor in attracting new subscribers and retaining existing ones.

The Appeal of Netflix to Tariff-Seeking Investors

Netflix's global reach and diversified revenue streams make it particularly attractive to investors seeking to mitigate the risks associated with tariffs and global trade uncertainties.

Diversification and Geopolitical Stability

Netflix's global presence and diverse revenue streams offer a degree of protection against the negative impacts of tariffs. Its reliance on multiple international markets means that disruptions in one region have a less significant overall effect.

- Geographic Diversification: Netflix's broad geographic footprint minimizes reliance on any single market, reducing the potential impact of regional trade disputes or tariffs.

- Mitigating Tariff Risks: This diversification serves as a buffer against the negative consequences of tariffs imposed on specific countries or industries.

- Reduced Geopolitical Risk: Netflix's diverse revenue streams make it less vulnerable to geopolitical instability in any particular region.

Opportunities for Tax Optimization and Incentives

Netflix's international operations may present opportunities for tax optimization and leveraging international tax incentives. Disclaimer: This information is for educational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

- International Tax Treaties: Netflix's global presence may allow for leveraging benefits under various international tax treaties.

- Tax Incentives in Specific Regions: Certain regions may offer tax incentives that could benefit Netflix and its investors.

- Professional Financial Advice: It is crucial to seek professional financial advice to understand and comply with all applicable tax regulations.

Conclusion

In conclusion, Netflix's superior financial performance, its strategic adaptability in navigating the complexities of the global market, and the opportunities it presents for investors seeking to mitigate tariff risks make it a compelling investment choice. The combination of robust revenue growth, increasing subscriber bases, and a diverse content strategy sets Netflix apart from many Big Tech companies. Its global presence and diversified revenue streams further enhance its appeal to tariff-seeking investors looking for stability in a volatile world. Learn more about how Netflix's strategic position makes it an attractive investment for those seeking to navigate the complexities of global trade and tariffs. Start your research today!

Featured Posts

-

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 23, 2025

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 23, 2025 -

Chistiy Ponedelnik 3 Marta 2025 Traditsii I Pravila Velikogo Posta

Apr 23, 2025

Chistiy Ponedelnik 3 Marta 2025 Traditsii I Pravila Velikogo Posta

Apr 23, 2025 -

Dave Roberts World Series Would Have Been Different Without That One Hit

Apr 23, 2025

Dave Roberts World Series Would Have Been Different Without That One Hit

Apr 23, 2025 -

Ai Generated Podcasts Analyzing Mundane Scatological Data

Apr 23, 2025

Ai Generated Podcasts Analyzing Mundane Scatological Data

Apr 23, 2025 -

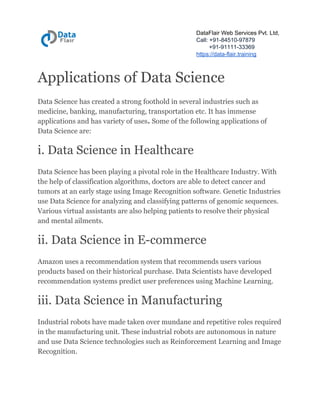

The Trump Presidency And The Us Economy A Statistical Perspective

Apr 23, 2025

The Trump Presidency And The Us Economy A Statistical Perspective

Apr 23, 2025