Canadian Homeownership Crisis: The Impact Of Large Down Payments

Table of Contents

The Rising Cost of Housing and its Impact on Down Payments

The Canadian housing market has experienced a dramatic surge in prices in recent years, making homeownership increasingly challenging. This significant increase directly impacts the amount needed for a down payment, creating a major hurdle for potential homeowners.

- Average House Prices (2023 Estimates – these figures will need updating regularly for SEO purposes):

- Toronto: $1,100,000+

- Vancouver: $1,300,000+

- Calgary: $550,000+

- Montreal: $600,000+

- (Note: These are estimates and vary greatly depending on location and property type. Update with current data for optimal SEO.)

This upward trend in Canadian house prices creates a vicious cycle. As prices rise, so does the required down payment, pricing many potential buyers out of the market. This contributes significantly to the ongoing Canadian homeownership crisis. The correlation between escalating housing costs and the need for larger down payments is undeniable, making affordability a critical concern across the country. Understanding the dynamics of the Canadian housing market is key to addressing this crisis.

The 20% Down Payment Barrier: A Major Hurdle for First-Time Buyers

Traditionally, a 20% down payment has been the standard for securing a mortgage in Canada. This requirement presents a massive obstacle, particularly for first-time homebuyers. Many simply cannot save this substantial sum, effectively locking them out of the market.

- Financial Implications:

- High Savings Required: Accumulating a 20% down payment on an average-priced home in major Canadian cities is a significant undertaking, often taking years of diligent saving.

- CMHC Insurance Costs: If a buyer puts down less than 20%, they’re required to obtain mortgage loan insurance through the Canada Mortgage and Housing Corporation (CMHC). This adds to the overall cost of the mortgage, increasing monthly payments.

- Higher Monthly Payments: Even with CMHC insurance, smaller down payments often result in higher monthly mortgage payments due to a larger loan amount.

Beyond the financial strain, the sheer size of the 20% down payment creates a significant psychological barrier. The daunting prospect of saving such a large sum can be discouraging, leading many potential buyers to postpone or abandon their homeownership dreams.

Alternatives to Large Down Payments: Exploring Options for First-Time Buyers

Fortunately, several options exist to help first-time homebuyers overcome the hurdle of large down payments.

-

Government Programs:

- First-Time Home Buyers' Incentive (FTHBI): This federal program provides a shared-equity mortgage loan, reducing the down payment required. Eligibility criteria and limitations apply.

- Other Provincial/Municipal Programs: Many provinces and municipalities offer their own programs to assist first-time homebuyers, often focusing on specific regions or income levels. Research your local options.

-

Mortgages with Smaller Down Payments: While CMHC insurance adds cost, it allows buyers to purchase homes with down payments as low as 5%. This significantly reduces the initial financial burden.

-

Pros and Cons: Each option has its pros and cons. Government programs may have income restrictions or limitations on the types of properties eligible for assistance. Mortgages with smaller down payments result in higher overall costs due to CMHC insurance and increased interest payments. Careful consideration and professional financial advice are crucial in making the right choice.

The Role of Rising Interest Rates on Affordability

Rising interest rates further complicate the Canadian homeownership crisis. Higher interest rates mean significantly higher monthly mortgage payments, even with a large down payment. This makes it even more difficult for potential buyers to afford a home, regardless of their savings capacity. The interplay between rising interest rates and the already high cost of housing exacerbates the need for larger down payments, thus squeezing many individuals out of the market entirely. Careful monitoring of Canadian mortgage rates is essential for anyone planning to purchase a home.

Conclusion

The high cost of housing in Canada necessitates large down payments, creating a significant barrier to homeownership, especially for first-time buyers. The 20% down payment requirement presents a major hurdle, though government programs and alternative mortgage options offer some relief. Rising interest rates further compound the difficulties.

Understanding the impact of large down payments on the Canadian homeownership crisis is crucial for navigating the market. Explore available government programs and mortgage options to find a path to achieving your dream of Canadian homeownership. Research thoroughly and seek professional financial advice to make informed decisions regarding your down payment and mortgage.

Featured Posts

-

Bitcoin Madenciliginin Gelecegi Karlilik Ve Zorluklar

May 09, 2025

Bitcoin Madenciliginin Gelecegi Karlilik Ve Zorluklar

May 09, 2025 -

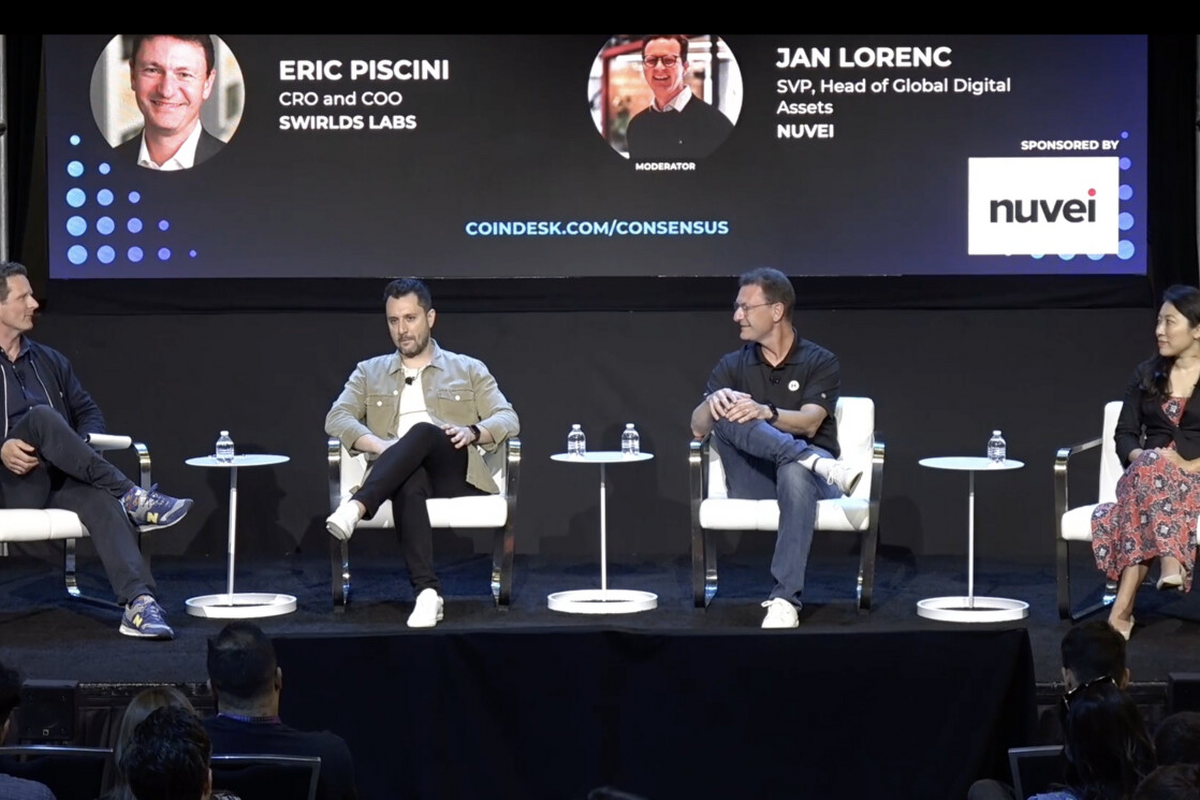

The Impact Of Reduced Chinese Steel Production On Iron Ore Prices

May 09, 2025

The Impact Of Reduced Chinese Steel Production On Iron Ore Prices

May 09, 2025 -

Indian Stock Market Update Sensex Nifty Close Higher

May 09, 2025

Indian Stock Market Update Sensex Nifty Close Higher

May 09, 2025 -

Nova Prisao Em Caso Madeleine Mc Cann Suspeita De Perseguicao Aos Pais

May 09, 2025

Nova Prisao Em Caso Madeleine Mc Cann Suspeita De Perseguicao Aos Pais

May 09, 2025 -

Addressing The Nursing Shortage Community Colleges Receive 56 Million

May 09, 2025

Addressing The Nursing Shortage Community Colleges Receive 56 Million

May 09, 2025