China Diversifies LPG Supply: From US To Middle East

Table of Contents

Declining US LPG Exports to China

The decline in US LPG exports to China is a multifaceted issue, stemming from both US policy changes and increased domestic demand.

Impact of US Trade Policies

US trade policies have significantly impacted the US-China LPG trade relationship. Tariffs and trade disputes have created uncertainty and increased costs for Chinese importers.

- Reduced volumes: The imposition of tariffs led to a noticeable decrease in the volume of LPG imported from the US to China.

- Increased prices: Tariffs and trade tensions added to the overall cost, making US LPG less competitive in the Chinese market.

- Uncertainty for Chinese importers: The fluctuating nature of trade relations created uncertainty for Chinese importers, leading them to seek more stable and reliable supply sources.

Analysis of specific trade policy changes reveals a quantifiable impact. For instance, the imposition of X% tariff on LPG imports resulted in a Y% decrease in import volumes within Z months. This demonstrates the direct link between US trade policies and the shift in China's LPG import strategy.

Rising US Domestic Demand

Simultaneously, a surge in US domestic demand for LPG has reduced the volume available for export.

- Growth in the petrochemical industry: The expanding US petrochemical sector consumes significant quantities of LPG as a feedstock.

- Increased heating demand: Growing residential and commercial heating needs in certain US regions increase domestic consumption.

- Competition for resources: Increased competition for LPG within the US limits the availability for export to other countries, including China.

Statistical data illustrates this rise. US domestic LPG consumption has increased by X% over the past Y years, directly impacting the volume available for export to international markets like China.

The Rise of Middle Eastern LPG Suppliers

The Middle East has emerged as a key alternative supplier for China, driven by increased production capacity and improved geopolitical relations.

Increased Capacity and Investment

The Middle East has significantly expanded its LPG production and export infrastructure.

- New refinery projects: Several large-scale refinery projects in the Middle East are producing significant quantities of LPG as a byproduct.

- Pipeline expansions: Investments in new pipeline infrastructure have enhanced the efficiency and capacity of LPG exports from the region.

- Increased LNG production leading to LPG byproduct increase: The expansion of LNG production in countries like Qatar and Saudi Arabia has led to a substantial increase in LPG as a byproduct.

Saudi Arabia, Qatar, and other Middle Eastern nations are playing crucial roles in supplying China's growing LPG needs. The development of new export terminals and the upgrading of existing facilities demonstrate a commitment to meet this demand.

Favorable Geopolitical Relations

Strengthened diplomatic and economic ties between China and Middle Eastern nations have further facilitated this shift.

- Strengthened trade agreements: Long-term contracts and bilateral trade agreements have established stable and reliable LPG supply channels.

- Long-term supply contracts: These agreements provide price stability and reduce the uncertainties associated with shorter-term deals.

- Strategic partnerships: These partnerships extend beyond mere trade, encompassing broader economic and political cooperation.

Specific agreements, such as the X agreement between China and Saudi Arabia, have significantly contributed to increased LPG imports from the Middle East. These agreements illustrate a shift towards strategic partnerships that underpin the long-term reliability of LPG supply.

Strategic Implications of China's LPG Supply Diversification

The diversification of China's LPG supply chain holds significant strategic implications.

Enhanced Energy Security

Diversification significantly reduces China's reliance on a single source, mitigating various supply risks.

- Reduced vulnerability to geopolitical instability: A diversified supply chain reduces the impact of political tensions or conflicts in any single region.

- Price fluctuations: Multiple sources help mitigate the impact of price volatility in any particular market.

- Trade disruptions: Diversification minimizes the impact of trade disputes or sanctions on LPG supply.

This shift enhances China's overall energy security strategy, ensuring a more resilient and reliable supply of this crucial fuel.

Economic Impacts on Producers and Consumers

The shift has broad economic implications for both producing and consuming countries.

- Potential price competition: Increased competition among suppliers can lead to more competitive pricing for Chinese consumers.

- Increased market efficiency: A more diversified market generally leads to greater efficiency and improved resource allocation.

- Investment opportunities: The shift creates significant investment opportunities in LPG infrastructure and related industries in both the Middle East and China.

The long-term economic implications for both regions are far-reaching, impacting investment flows, trade balances, and the overall economic development of participating nations.

Conclusion

China's strategic shift in LPG sourcing from the US towards the Middle East marks a significant development in global energy markets. This diversification of China's LPG supply enhances China's energy security, reduces its reliance on a single supplier, and creates new economic opportunities for both importing and exporting nations. The interplay of trade policies, domestic demand fluctuations, and geopolitical factors will continue to shape the future landscape of China's LPG imports.

Call to Action: Stay informed about the evolving dynamics of China LPG supply diversification to understand the future of global LPG markets and their impact on your business. Further research into specific trade agreements and production capacity expansions will provide a more granular understanding of this crucial shift in the global energy landscape.

Featured Posts

-

Pope Francis Legacy A More Global Yet Divided Church

Apr 24, 2025

Pope Francis Legacy A More Global Yet Divided Church

Apr 24, 2025 -

Liam Collapses After Bill Showdown The Bold And The Beautiful April 3 Recap

Apr 24, 2025

Liam Collapses After Bill Showdown The Bold And The Beautiful April 3 Recap

Apr 24, 2025 -

Trump Reassures On Powells Position As Federal Reserve Chair

Apr 24, 2025

Trump Reassures On Powells Position As Federal Reserve Chair

Apr 24, 2025 -

The Los Angeles Wildfires And The Growing Market For Disaster Bets

Apr 24, 2025

The Los Angeles Wildfires And The Growing Market For Disaster Bets

Apr 24, 2025 -

Decrease In Apprehensions At U S Canada Border White House Statement

Apr 24, 2025

Decrease In Apprehensions At U S Canada Border White House Statement

Apr 24, 2025

Latest Posts

-

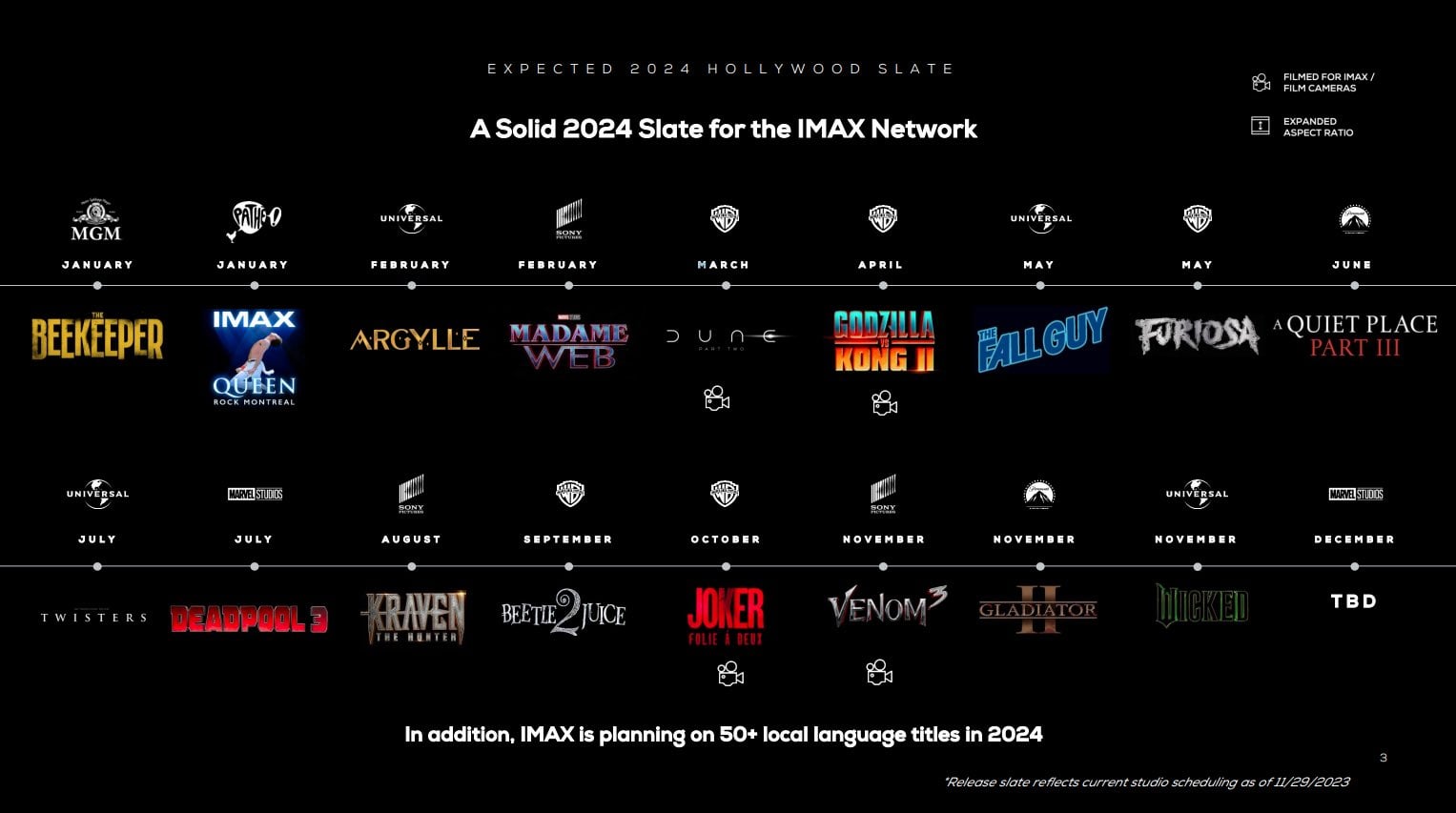

The Monkey And More A Look At Stephen Kings Exciting 2024 Movie Lineup

May 10, 2025

The Monkey And More A Look At Stephen Kings Exciting 2024 Movie Lineup

May 10, 2025 -

Charlz Iii Posvyatil Stivena Fraya V Rytsari

May 10, 2025

Charlz Iii Posvyatil Stivena Fraya V Rytsari

May 10, 2025 -

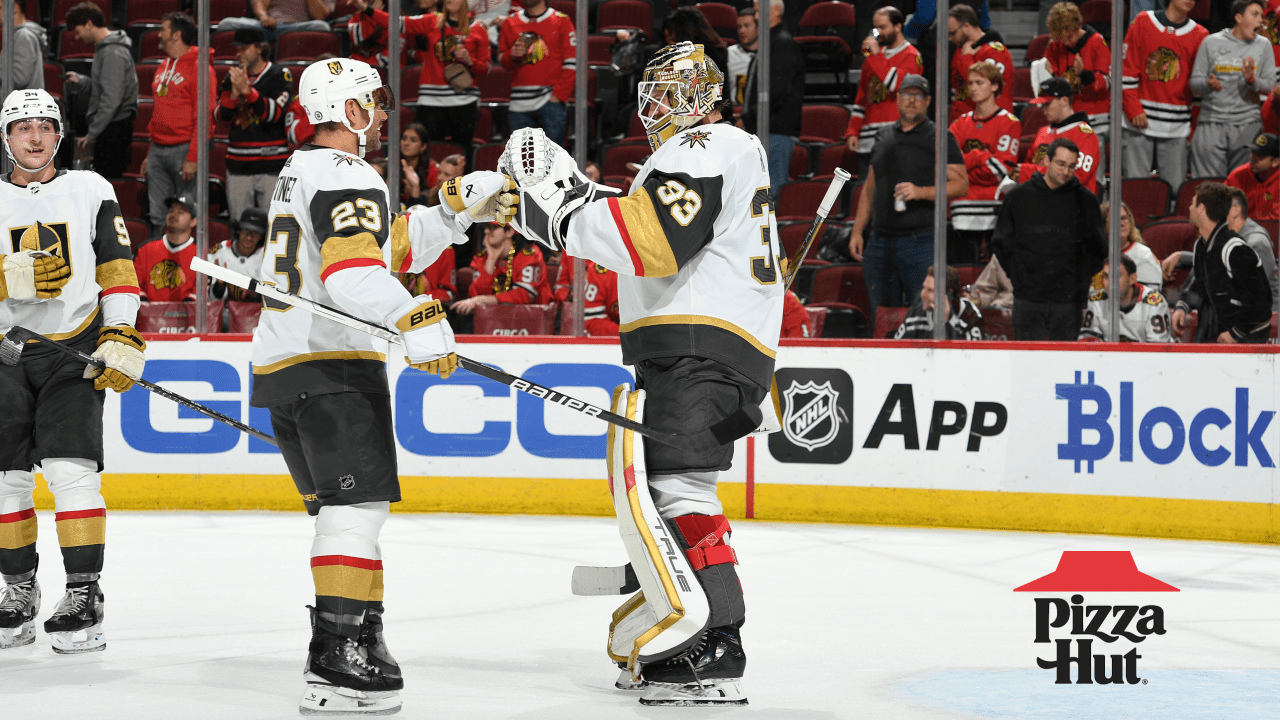

Barbashevs Ot Heroics Send Vegas Golden Knights And Minnesota Wild To Game 5

May 10, 2025

Barbashevs Ot Heroics Send Vegas Golden Knights And Minnesota Wild To Game 5

May 10, 2025 -

Stephen Kings 2024 Movie Slate The Monkey And Two More Thrilling Releases

May 10, 2025

Stephen Kings 2024 Movie Slate The Monkey And Two More Thrilling Releases

May 10, 2025 -

Vegas Golden Knights Win Game 4 Barbashevs Ot Goal Forces Series Tie

May 10, 2025

Vegas Golden Knights Win Game 4 Barbashevs Ot Goal Forces Series Tie

May 10, 2025