Trump Reassures On Powell's Position As Federal Reserve Chair

Table of Contents

Trump's Public Statements and Their Interpretation

President Trump's communication regarding Jerome Powell's tenure as Federal Reserve Chair has been characterized by periods of both praise and criticism. Analyzing the nuances of his statements is essential to understanding their true impact. His pronouncements, often delivered via Twitter or press conferences, directly influence market sentiment and investor behavior.

The tone and language used vary significantly. At times, Trump has expressed strong support for Powell's efforts, highlighting the need for economic stability. Other times, his language has been more critical, particularly during periods of economic slowdown or when interest rate hikes have been implemented. This ambiguity creates uncertainty in the market.

- Specific quote examples: While precise quotes require careful referencing to avoid misrepresentation, examples might include statements praising Powell’s handling of specific economic challenges alongside others expressing concern about interest rate policies.

- Media Outlets: Major news outlets like the New York Times, Wall Street Journal, Bloomberg, and Reuters extensively cover Trump's pronouncements on Powell and the Federal Reserve. These reports often include analysis from economists and market experts.

- Analyst Reactions: Market analysts and economists have offered diverse interpretations of Trump's statements, ranging from viewing them as reassurances to seeing them as subtle threats. This divergence in interpretation further underscores the volatility inherent in the situation.

The Significance of Powell's Role as Federal Reserve Chair

Jerome Powell's role as Federal Reserve Chair is of paramount importance to the US and the global economy. The Federal Reserve, often referred to as "the Fed," is the central bank of the United States, responsible for conducting the nation's monetary policy.

The Federal Reserve Chair wields considerable power, influencing key economic variables through monetary policy tools. These tools primarily involve setting interest rates, which impact borrowing costs for individuals, businesses, and governments. The Fed also engages in quantitative easing (QE) and other measures to influence the money supply.

- Impact of Interest Rate Decisions: Interest rate changes directly affect inflation, unemployment, and economic growth. Higher rates typically curb inflation but can slow economic growth, potentially leading to job losses. Lower rates stimulate economic activity but risk increased inflation.

- Influence on Global Markets: The US dollar is the world's reserve currency, meaning the Fed's actions significantly influence global financial markets. Decisions made by the Fed reverberate across international borders, impacting exchange rates and investment flows.

- Independence of the Federal Reserve: The Federal Reserve operates with a degree of independence from the executive branch, although the President nominates the Chair. This independence is crucial for maintaining the credibility and effectiveness of monetary policy. However, the President's public pronouncements can still significantly impact market confidence.

Market Reactions to Trump's Reassurances

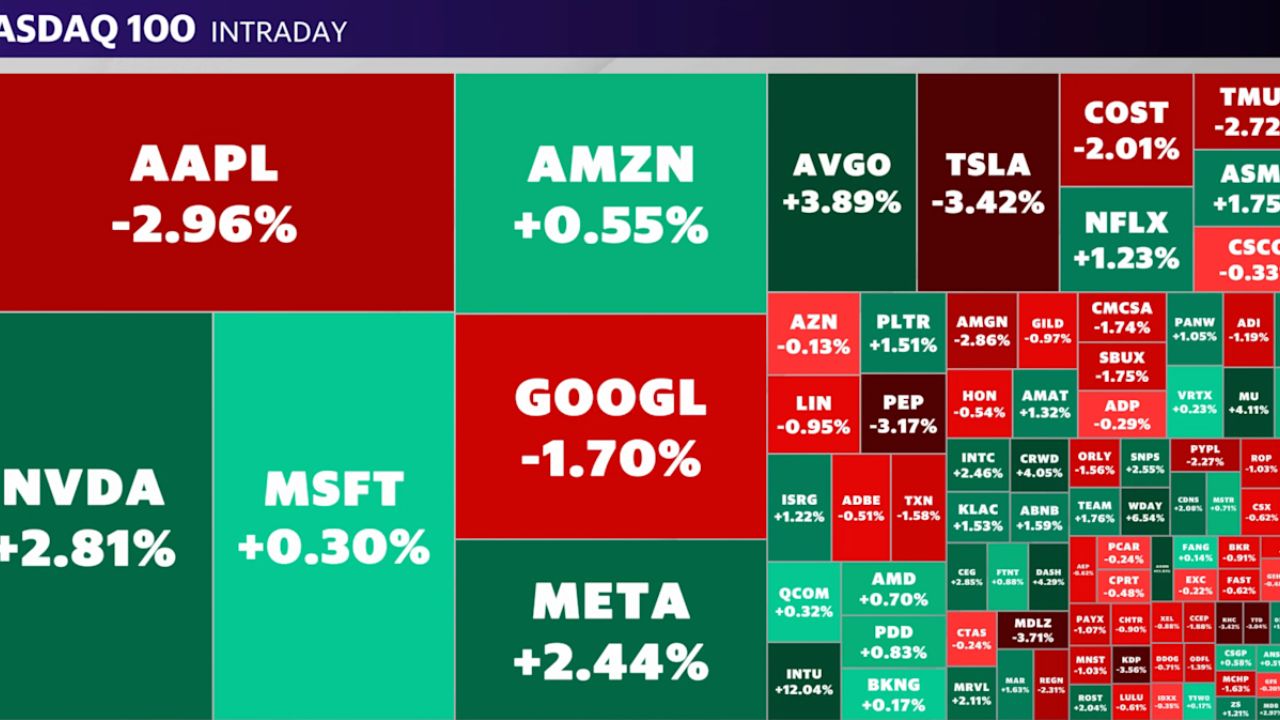

Market responses to Trump's statements concerning Powell's position have been complex and often volatile. Immediate reactions typically involve fluctuations in stock prices, bond yields, and the value of the US dollar.

- Data Points: Tracking indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, as well as the yield on US Treasury bonds and the US Dollar Index, provides quantitative evidence of market reactions following Trump's comments.

- Expert Opinions: Financial analysts and economists offer crucial insights into market behavior by interpreting the data and assessing potential future impacts. Their commentary often appears in financial news outlets and reports.

- Long-Term vs. Short-Term Impacts: The short-term market impact of Trump’s comments is often dramatic, but the long-term effects are less predictable and depend on various economic factors.

Uncertainty and Future Outlook

Despite Trump's reassurances, uncertainty remains regarding Powell's long-term future as Federal Reserve Chair. Several scenarios are possible, each with significant implications for the economy and markets.

- Possible Future Actions by the Federal Reserve: The Fed may continue its current monetary policy course or adjust it based on evolving economic data and inflation levels. Further interest rate hikes or cuts, alongside other monetary policy tools, could be employed.

- Potential Impacts: Different sectors of the economy (e.g., manufacturing, technology, housing) are differentially affected by monetary policy changes. Understanding these impacts is crucial for investors and policymakers.

- Influencing Factors: Various factors – economic data, political developments, and public opinion – could influence Trump's future decisions regarding Powell’s position.

Conclusion

President Trump's reassurances on Jerome Powell's position as Federal Reserve Chair have had a measurable impact on financial markets, although the long-term implications remain unclear. Understanding the dynamic between the President and the Federal Reserve Chair is crucial for investors and economic observers alike. The interplay between presidential pronouncements and the independent operations of the Federal Reserve remains a significant factor shaping the US economy.

Call to Action: Staying informed about the relationship between President Trump and Federal Reserve Chair Powell is critical for making informed decisions about investments and understanding the direction of the US economy. Continue to follow reliable news sources for updates on this developing situation and other key developments impacting the Federal Reserve and Trump's stance on Powell's leadership.

Featured Posts

-

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025 -

Cybercriminals Millions Office365 Executive Inbox Hacks Exposed

Apr 24, 2025

Cybercriminals Millions Office365 Executive Inbox Hacks Exposed

Apr 24, 2025 -

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025 -

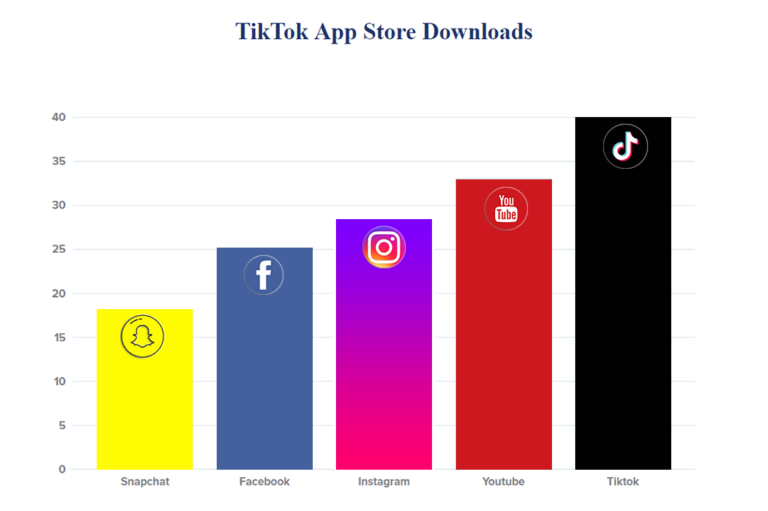

Video Editing Showdown Instagram Vs Tik Tok

Apr 24, 2025

Video Editing Showdown Instagram Vs Tik Tok

Apr 24, 2025 -

Stock Market Gains Nasdaq S And P 500 And Dows 1000 Point Surge

Apr 24, 2025

Stock Market Gains Nasdaq S And P 500 And Dows 1000 Point Surge

Apr 24, 2025

Latest Posts

-

Understanding Elon Musks Financial Journey Strategies And Investments

May 10, 2025

Understanding Elon Musks Financial Journey Strategies And Investments

May 10, 2025 -

The Impact Of Post Liberation Day Tariffs On Donald Trumps Billionaire Network

May 10, 2025

The Impact Of Post Liberation Day Tariffs On Donald Trumps Billionaire Network

May 10, 2025 -

The Elon Musk Business Empire How He Built His Billions

May 10, 2025

The Elon Musk Business Empire How He Built His Billions

May 10, 2025 -

Liberation Day Tariffs The Financial Fallout For Trumps Wealthy Allies

May 10, 2025

Liberation Day Tariffs The Financial Fallout For Trumps Wealthy Allies

May 10, 2025 -

Elon Musks Wealth From Pay Pal To Space X And Beyond

May 10, 2025

Elon Musks Wealth From Pay Pal To Space X And Beyond

May 10, 2025