China's Automotive Market: Challenges For Premium Brands Like BMW And Porsche

Table of Contents

H2: Intensifying Competition from Domestic Chinese Brands

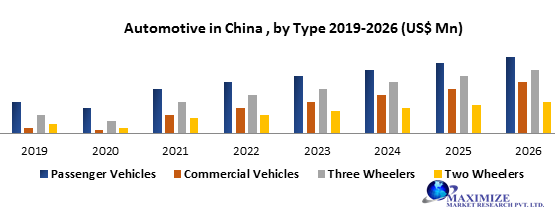

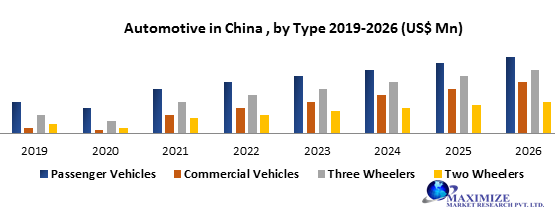

The rise of Chinese automakers represents a major challenge to established premium brands. Domestic brands like BYD, Geely, and NIO are rapidly gaining market share, fueled by significant technological advancements and aggressive pricing strategies. BYD, for instance, has become a leading player in the electric vehicle (EV) sector, surpassing Tesla in sales in China in 2022. This success stems not only from competitive pricing but also from the incorporation of cutting-edge features and technologies.

Increased market share of domestic brands: Data from the China Association of Automobile Manufacturers (CAAM) consistently shows the increasing dominance of domestic brands. Their combined market share has grown exponentially in the last decade, directly impacting the sales figures of premium imports. This growth isn't just about volume; it's about capturing segments previously dominated by international players.

Focus on features and technology: Chinese brands are effectively leveraging advanced features, such as sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and innovative electric powertrains, often at price points significantly lower than their premium counterparts. This directly targets the price-sensitive yet technologically savvy Chinese luxury consumer.

- Bullet points:

- Rapid innovation in electric vehicles (EVs) and autonomous driving capabilities.

- Aggressive pricing strategies targeting the price-sensitive luxury consumer segment.

- Strong government support and financial incentives favoring domestic brands.

- Increasingly sophisticated marketing campaigns targeting younger demographics.

H2: Shifting Consumer Preferences and Demands in China

Understanding the evolving preferences of Chinese consumers is crucial for premium brands. The market is experiencing a significant shift, driven by a growing emphasis on technological innovation, sustainability concerns, and a decreasing reliance on established brand loyalty. Younger generations are more willing to experiment with new brands offering compelling technology and value.

Evolving preferences: While brand prestige remains a factor, Chinese consumers increasingly prioritize technological features, environmental responsibility, and overall value for money. The demand for electric and hybrid vehicles is soaring, reflecting a broader global trend but particularly pronounced in China due to government policies and environmental awareness.

Brand loyalty vs. new technologies: Traditional brand loyalty, once a significant advantage for premium brands, is waning, particularly among younger consumers who are more receptive to new entrants with innovative technologies and competitive pricing. This necessitates a focus on delivering cutting-edge features and a seamless digital experience.

- Bullet points:

- Growing demand for electric and hybrid vehicles (PHEVs and BEVs).

- Increased preference for digital connectivity and advanced driver-assistance systems (ADAS).

- Greater emphasis on brand image and social status, balanced with a strong focus on value for money.

- A rising demand for personalized and customized options.

H2: Navigating Regulatory Hurdles and Supply Chain Disruptions

Navigating the regulatory environment and maintaining stable supply chains pose considerable challenges. High import tariffs, stringent emission standards, and complex regulations increase the cost of doing business for premium brands. Furthermore, geopolitical factors and global supply chain disruptions exacerbate these difficulties.

Import tariffs and regulations: High import duties significantly increase the cost of imported vehicles, reducing profit margins and making it harder to compete with domestically produced alternatives. Meeting increasingly stringent emission standards and safety regulations adds further complexity and cost.

Supply chain complexity: Maintaining efficient and reliable supply chains in China is becoming increasingly difficult due to geopolitical uncertainties, trade tensions, and the lingering impact of the COVID-19 pandemic. This necessitates diversification of sourcing and robust risk management strategies.

- Bullet points:

- High import duties significantly increasing the cost of imported vehicles.

- Stringent emission standards and safety regulations, demanding continuous technological adaptation.

- Potential supply chain disruptions caused by geopolitical factors and unforeseen events.

- Increased scrutiny and complexity in navigating Chinese regulatory processes.

H3: The Rise of Electric Vehicles (EVs) in China

The rapid growth of the EV market in China is transformative. Government incentives, technological advancements, and growing consumer demand are driving this explosive expansion, forcing premium brands to aggressively electrify their offerings.

Rapid EV adoption: China's commitment to electric mobility is evident in the dramatic growth of EV sales. This necessitates significant investment in research and development, manufacturing, and charging infrastructure to meet the increasing demand.

Charging infrastructure and range anxiety: While charging infrastructure is expanding rapidly, range anxiety remains a concern for some consumers. Addressing this requires not only enhancing charging networks but also developing vehicles with extended ranges and superior battery technology.

- Bullet points:

- Government subsidies and incentives are strongly pushing EV adoption.

- Rapid expansion of charging infrastructure, although uneven distribution persists in certain regions.

- Technological advancements in battery technology continuously improve range and charging times.

- Increased competition in the EV segment, both from domestic and international players.

3. Conclusion

The Chinese automotive market presents a complex and dynamic environment for premium brands like BMW and Porsche. Intense competition from domestic brands, evolving consumer preferences, and regulatory hurdles require sophisticated strategies for sustained success. To thrive in this competitive landscape, premium brands must prioritize innovation in electric vehicles, adapt to changing consumer demands, and proactively mitigate supply chain risks. Understanding the nuances of the China automotive market is paramount for long-term growth and profitability. Premium brands need to embrace localized strategies to genuinely connect with Chinese consumers and navigate this unique and challenging environment.

Featured Posts

-

High Stock Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 29, 2025

High Stock Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 29, 2025 -

Rose Pardon Trumps Decision And Potential Implications

Apr 29, 2025

Rose Pardon Trumps Decision And Potential Implications

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets A Maldon And Burnham Standard Guide

Apr 29, 2025

Capital Summertime Ball 2025 Tickets A Maldon And Burnham Standard Guide

Apr 29, 2025 -

Mlb Game Recap Twins Top Mets 6 3

Apr 29, 2025

Mlb Game Recap Twins Top Mets 6 3

Apr 29, 2025 -

Russias Military Posture A Source Of European Tension

Apr 29, 2025

Russias Military Posture A Source Of European Tension

Apr 29, 2025