China's Steel Curbs Trigger Iron Ore Price Decline: A Market Overview

Table of Contents

China's Steel Production Restrictions: The Underlying Cause

China, the world's largest steel producer, has implemented stringent policies to curtail its steel output. These restrictions, driven by a combination of environmental concerns and efforts to address overcapacity within the industry, have sent shockwaves through the global iron ore market. The Chinese government's aim is to create a more sustainable and efficient steel industry, reducing carbon emissions and promoting higher quality production.

- Specific policy examples: These include production quotas imposed on steel mills, stricter emission standards leading to plant closures or production slowdowns, and a crackdown on illegal steel production.

- Targeted regions and mills: The restrictions have impacted various regions across China, with some provinces experiencing more significant production cuts than others. Specific steel mills known for outdated technologies and high pollution levels have been particularly targeted.

- Timelines and durations: The implementation of these policies has been phased, with some restrictions being temporary and others more long-term. The ultimate duration and effectiveness of these measures remain to be seen, leading to considerable uncertainty in the market.

The Ripple Effect: Impact on Iron Ore Demand

The relationship between steel production and iron ore demand is inextricably linked. Steelmaking relies heavily on iron ore as a key raw material. Consequently, China's reduced steel output translates directly into significantly lower demand for iron ore. This decreased demand is the primary driver of the current iron ore price decline.

- Percentage change in steel production and iron ore demand: Estimates suggest a considerable percentage decrease in steel production in China has led to a comparable drop in iron ore demand. This has created a supply glut in the iron ore market, pushing prices down.

- Major iron ore importers' reactions: Major iron ore importers, particularly in Asia, have reacted to the price drop by adjusting their purchasing strategies, seeking more favorable contracts and potentially delaying orders.

- Impact on different types of steel production: The impact is not uniform across all steel sectors. Construction steel, highly sensitive to economic growth, has seen a sharper decline in demand compared to other steel types, like automotive steel.

Global Market Reactions: Price Volatility and Trader Sentiment

The reduced demand for iron ore has led to significant price volatility in major iron ore exchanges. Prices have fallen sharply, triggering uncertainty and impacting trader sentiment. This downturn is a testament to the interconnectedness of the global commodities market and China's outsized influence on it.

- Specific price changes: Major iron ore benchmarks have seen double-digit percentage drops since the implementation of China's steel curbs, indicating the severity of the price decline.

- Industry expert quotes: Market analysts and industry experts are expressing varying opinions on the future trajectory of iron ore prices, with some predicting further declines while others anticipate a potential stabilization or recovery in the coming months.

- Shifts in trading volumes: Trading volumes have fluctuated significantly, reflecting the uncertainty and risk aversion among traders navigating this turbulent market.

Impact on Related Industries and Economies

The iron ore price decline has far-reaching economic consequences, impacting iron ore producing countries, shipping and logistics companies, and related industries globally.

- Economic impact on major iron ore exporting nations: Australia and Brazil, major iron ore exporters, are experiencing a considerable economic impact due to the reduced demand and lower prices. This affects their national income, employment levels, and overall economic growth.

- Changes in shipping rates and vessel demand: The decreased demand for iron ore transportation has led to lower shipping rates and reduced demand for bulk carriers.

- Potential job losses: The downturn could lead to job losses in mining, transportation, and other related industries in iron ore-producing and exporting nations.

Conclusion: Navigating the Shifting Sands of the Iron Ore Market

China's steel curbs have undeniably triggered a significant iron ore price decline, impacting the global market in profound ways. The interconnectedness of global commodity markets is vividly demonstrated by this event, highlighting the influence of China's industrial policies on international trade and economic stability. The future of the iron ore market remains uncertain, with fluctuating prices and shifting demand patterns. Staying informed about China's steel curbs and their ongoing effects on the iron ore price decline is crucial for navigating this complex market. To stay updated, continue monitoring market analysis reports and subscribe to reputable financial news sources for the latest insights into this dynamic sector.

Featured Posts

-

Young Thugs Uy Scuti Release Date Hints Emerge

May 10, 2025

Young Thugs Uy Scuti Release Date Hints Emerge

May 10, 2025 -

Top 5 Stephen King Books A Fans Essential Reading List

May 10, 2025

Top 5 Stephen King Books A Fans Essential Reading List

May 10, 2025 -

Sensex Live Market Soars Adani Ports Up Eternal Down Todays Update

May 10, 2025

Sensex Live Market Soars Adani Ports Up Eternal Down Todays Update

May 10, 2025 -

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 10, 2025

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 10, 2025 -

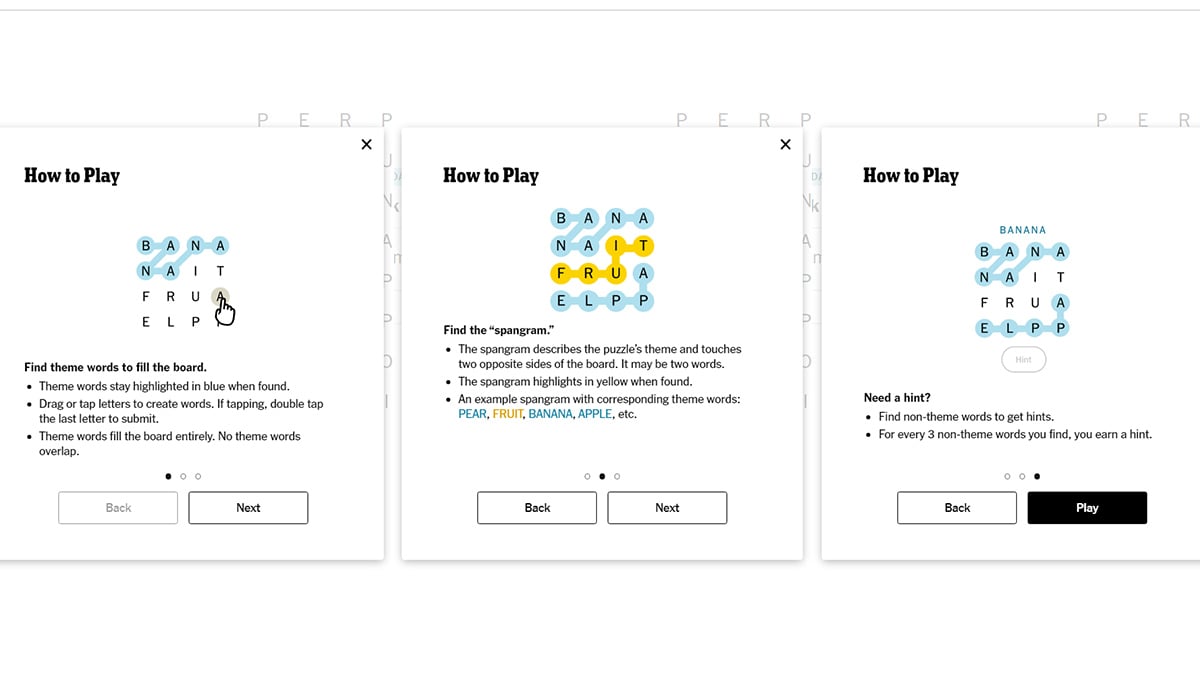

February 15th Nyt Strands Answers Game 349

May 10, 2025

February 15th Nyt Strands Answers Game 349

May 10, 2025