Chinese Buyout Firm To Sell UTAC Chip Tester? Industry Speculation Mounts

Table of Contents

The Potential Buyer and Their Market Position

The identity of the potential buyer remains shrouded in mystery, fueling much of the current speculation. Several industry players are considered possible candidates. The motivations behind a Chinese buyout firm selling such a valuable asset are complex and multifaceted. Several factors are likely at play within the broader semiconductor market and M&A activity. The decision could stem from various factors, including a need for immediate capital injection, a strategic refocusing on core competencies, or perhaps even financial distress. Understanding the seller's motivations is critical to predicting the buyer's profile and the eventual deal structure.

- Possible buyer profiles: Leading competitors in the semiconductor testing equipment market, large private equity firms seeking high-growth investments, or even smaller, specialized companies looking to expand their technological capabilities are all potential candidates.

- Potential benefits for buyers: Acquiring UTAC's advanced testing technology would grant immediate access to a significant market share and potentially valuable intellectual property. Synergies with existing product lines could further enhance profitability.

- Potential drawbacks for buyers: Integrating UTAC's operations and technology into an existing infrastructure could prove challenging and costly. Regulatory hurdles and potential antitrust concerns in both China and the target market could also significantly delay or even derail the transaction. This level of scrutiny is typical for large-scale semiconductor acquisitions.

The Implications for the Semiconductor Industry

The sale of UTAC, a key player in the semiconductor testing sector, carries significant implications for the global semiconductor supply chain. This potential shift in ownership could reshape the competitive landscape, impacting pricing, technological advancements, and the overall availability of UTAC chip testers. Geopolitical implications are also significant, with concerns about technology transfer and potential threats to national security inevitably arising. The industry's response will be closely watched, particularly given the current focus on technological dominance in the global landscape.

- Potential shifts in market share: The sale could lead to significant shifts in market share, depending on the buyer's identity and strategic goals. A competitor acquiring UTAC might consolidate its dominance, while a new entrant might disrupt the existing order.

- Impact on pricing and availability: The transaction could affect the pricing and availability of UTAC chip testers. Increased consolidation might lead to higher prices or limited access for certain customers, potentially impacting the overall manufacturing capacity of the semiconductor industry.

- Influence on future technological developments: The future direction of UTAC's R&D efforts could be significantly altered depending on the buyer's priorities. This could lead to either accelerated innovation or a shift in focus, potentially affecting future technological advancements in semiconductor testing.

Regulatory Hurdles and Due Diligence

The sale of UTAC is likely to face considerable regulatory scrutiny from various government bodies in China and the target market. Cross-border transactions of this magnitude often trigger in-depth reviews focusing on regulatory compliance and antitrust regulations. Due diligence will be extensive, involving a thorough evaluation of UTAC's financial health, technological capabilities, and intellectual property portfolio. The process is complex and time-consuming and likely to add several months to the deal's closing.

- Key regulatory bodies involved: Expect close monitoring from competition authorities in both countries, as well as potentially from national security agencies concerned about technological transfer.

- Potential delays and complications during the process: Regulatory hurdles are common in such deals. The review process can be lengthy, leading to potential delays and even the ultimate failure of the transaction.

- Impact of regulatory hurdles on the timeline and success of the sale: The regulatory environment will significantly influence the timeline and potential success of the sale. Thorough preparation and expert legal counsel are crucial for navigating these complexities.

Conclusion: Chinese Buyout Firm and the Future of UTAC Chip Testers

The potential sale of the UTAC chip tester by the Chinese buyout firm remains shrouded in uncertainty. The implications for the broader semiconductor industry are considerable, encompassing potential shifts in market share, pricing dynamics, and technological development. The regulatory challenges are substantial, requiring meticulous due diligence and careful navigation of the complex geopolitical landscape. The future of UTAC chip testers and their role in shaping the semiconductor landscape will depend largely on the identity of the buyer and the resulting strategic direction.

Stay informed about this unfolding situation by subscribing to industry news sources, following updates from relevant organizations, and actively monitoring news regarding the UTAC chip tester sale. The potential outcomes of this Chinese firm divestment will significantly impact the global semiconductor market. Continue to explore developments surrounding this significant semiconductor acquisition.

Featured Posts

-

Ella Bleu Travolta Iznenadujuca Ljepota Kceri Johna Travolte

Apr 24, 2025

Ella Bleu Travolta Iznenadujuca Ljepota Kceri Johna Travolte

Apr 24, 2025 -

Niftys Ascent Analyzing The Positive Factors Driving Indias Market

Apr 24, 2025

Niftys Ascent Analyzing The Positive Factors Driving Indias Market

Apr 24, 2025 -

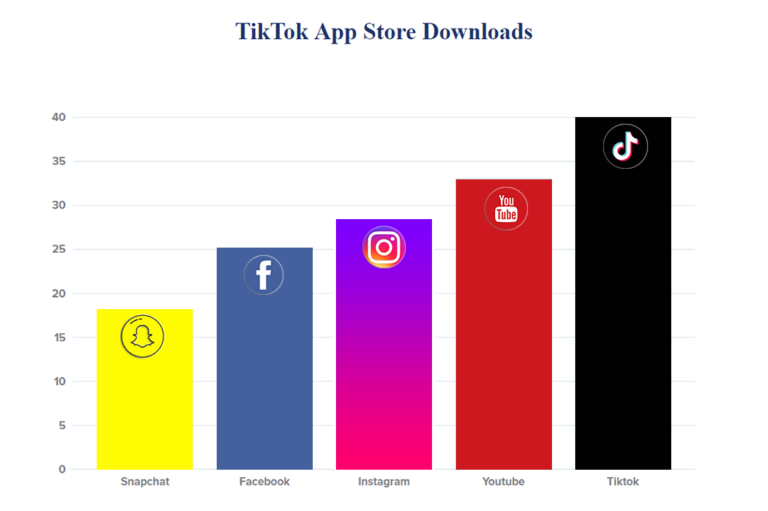

Video Editing Showdown Instagram Vs Tik Tok

Apr 24, 2025

Video Editing Showdown Instagram Vs Tik Tok

Apr 24, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 24, 2025

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 24, 2025 -

The Bold And The Beautiful April 9th Recap Steffys Anger And Liams Plea For Secrecy

Apr 24, 2025

The Bold And The Beautiful April 9th Recap Steffys Anger And Liams Plea For Secrecy

Apr 24, 2025

Latest Posts

-

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025