Nifty's Ascent: Analyzing The Positive Factors Driving India's Market

Table of Contents

Robust Economic Fundamentals Driving Nifty's Growth

The robust growth of the Nifty 50 index is intrinsically linked to the strengthening Indian economy. Several fundamental factors underpin this upward trajectory.

A Booming Domestic Market

India boasts a large and rapidly expanding consumer base, a key driver of Nifty 50 index growth. The burgeoning middle class, with its increasing purchasing power and rising disposable incomes, fuels significant consumer spending. This translates into robust demand across various sectors, significantly impacting the performance of companies listed on the Nifty.

- Thriving Consumer Sectors: The FMCG (Fast-Moving Consumer Goods) sector, automobiles, and technology are prime examples of industries experiencing phenomenal growth, directly contributing to the Nifty's ascent.

- Increased Consumer Confidence: Positive economic indicators and government initiatives have boosted consumer confidence, leading to higher spending and investment.

- Rural Consumption: Growth in rural incomes and improved infrastructure are driving increased consumption in rural areas, further bolstering the Indian economy and the Nifty 50.

Government Initiatives and Policy Reforms

Pro-growth government policies have played a crucial role in fostering the positive environment driving Nifty's performance. Initiatives like "Make in India" and "Digital India" aim to boost domestic manufacturing and digital infrastructure, respectively. These policies, coupled with deregulation and improvements in the ease of doing business, have attracted both domestic and foreign investment.

- Make in India: This initiative encourages domestic manufacturing, creating jobs and stimulating economic growth, thereby positively impacting the Nifty 50 performance.

- Digital India: The push towards digitalization has improved efficiency and transparency across various sectors, creating a more conducive environment for business and investment.

- Infrastructure Development: Significant investments in infrastructure, including roads, railways, and power, have improved connectivity and reduced logistical bottlenecks, boosting economic activity.

Technological Advancement and Digitalization

Technological advancements and the rapid growth of the digital economy are significant contributors to India's economic progress and, consequently, Nifty's ascent. The increasing adoption of fintech solutions is transforming the financial market, making it more accessible and efficient.

- Fintech Revolution: The rise of fintech companies has increased financial inclusion and improved access to credit and investment opportunities.

- Digital Payments: The surge in digital payment adoption has streamlined transactions and boosted economic activity, leading to positive impacts on the Nifty 50.

- IT Sector Growth: The Indian IT sector's global dominance plays a crucial role, with many leading IT companies listed on the Nifty contributing significantly to its growth.

Foreign Investment and Global Market Dynamics Influencing Nifty

Foreign investment plays a vital role in shaping the Nifty 50's trajectory. Global market dynamics also significantly influence its performance.

Increased Foreign Institutional Investor (FII) Flows

A surge in Foreign Institutional Investor (FII) flows into the Indian market has significantly boosted the Nifty. The attractiveness of Indian equities compared to other global markets, driven by factors like strong growth prospects and a relatively young demographic, has lured substantial foreign investment.

- Attractive Valuation: Compared to other global markets, Indian equities often offer attractive valuations, making them a compelling investment destination.

- Long-Term Growth Potential: India's long-term growth prospects, driven by a young population and expanding economy, attract significant FII interest.

- Geopolitical Factors: Global uncertainties often drive investors towards stable, high-growth emerging markets like India, leading to increased FII inflows into the Nifty.

Global Economic Trends and Their Impact

Global economic trends and geopolitical events invariably influence the Nifty's performance. Factors like commodity prices, global interest rates, and overall global growth significantly impact the Indian market.

- Global Growth: Strong global growth generally benefits emerging markets like India, leading to increased investment and a positive impact on the Nifty.

- Commodity Prices: Fluctuations in commodity prices, particularly oil, can impact India's economy and consequently its stock market.

- Interest Rates: Changes in global interest rates can influence capital flows into and out of emerging markets, impacting the Nifty's performance.

Sector-Specific Growth Drivers Contributing to Nifty's Ascent

The Nifty 50's ascent is not solely driven by macroeconomic factors; sector-specific growth plays a crucial role.

Information Technology (IT) Sector's Contribution

The strong performance of the IT sector is a major contributor to Nifty's growth. The sector's large weight in the index and its robust growth, driven by global demand for IT services and digital transformation initiatives, significantly impact the overall Nifty performance.

- Outsourcing and Digital Transformation: The increasing demand for outsourcing and digital transformation services globally fuels the growth of the Indian IT sector.

- Technological Innovation: Continuous innovation and adaptation within the Indian IT sector maintain its competitiveness in the global market.

- Leading IT Companies: Several leading IT companies listed on the Nifty have consistently demonstrated strong financial performance, contributing to the index's overall growth.

Other Key Performing Sectors

Beyond the IT sector, other key sectors such as financials, pharmaceuticals, and consumer goods have also contributed significantly to Nifty's ascent. Their individual growth drivers and contributions to the overall market performance are essential aspects of the Nifty 50's success.

- Financials: The robust growth of the financial sector, encompassing banking, insurance, and other financial services, plays a crucial role in overall economic activity and Nifty's performance.

- Pharmaceuticals: The Indian pharmaceutical sector’s global presence and contribution to healthcare solutions drives significant growth and impacts the Nifty positively.

- Consumer Goods: The consistent growth of the consumer goods sector, mirroring the expansion of the middle class and increased consumer spending, significantly contributes to the Nifty 50's positive trend.

Conclusion

Nifty's ascent reflects a confluence of positive factors, including robust domestic economic fundamentals, supportive government policies, technological advancements, significant foreign investment, and strong sector-specific growth. Understanding these drivers is crucial for investors seeking to navigate the Indian market and benefit from its continued potential. Further research into individual sectors and companies within the Nifty 50 index can provide even more granular insights into the opportunities presented by this thriving market. Keep abreast of Nifty's progress and continue to analyze the contributing factors to maximize your understanding of this dynamic market. Learn more about Nifty's Ascent and its implications for the Indian economy.

Featured Posts

-

Recent Bitcoin Btc Gains A Look At Trade And Monetary Policy Factors

Apr 24, 2025

Recent Bitcoin Btc Gains A Look At Trade And Monetary Policy Factors

Apr 24, 2025 -

Increased Rent In La After Fires Is Price Gouging To Blame

Apr 24, 2025

Increased Rent In La After Fires Is Price Gouging To Blame

Apr 24, 2025 -

Subsystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 24, 2025

Subsystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 24, 2025 -

Extreme V Mware Price Hike At And T Highlights 1 050 Increase Proposed By Broadcom

Apr 24, 2025

Extreme V Mware Price Hike At And T Highlights 1 050 Increase Proposed By Broadcom

Apr 24, 2025 -

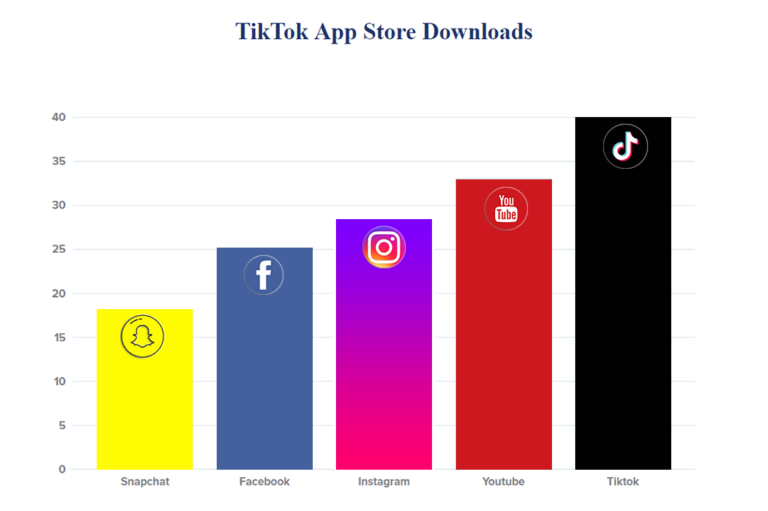

Video Editing Showdown Instagram Vs Tik Tok

Apr 24, 2025

Video Editing Showdown Instagram Vs Tik Tok

Apr 24, 2025

Latest Posts

-

Understanding Elon Musks Financial Journey Strategies And Investments

May 10, 2025

Understanding Elon Musks Financial Journey Strategies And Investments

May 10, 2025 -

The Impact Of Post Liberation Day Tariffs On Donald Trumps Billionaire Network

May 10, 2025

The Impact Of Post Liberation Day Tariffs On Donald Trumps Billionaire Network

May 10, 2025 -

The Elon Musk Business Empire How He Built His Billions

May 10, 2025

The Elon Musk Business Empire How He Built His Billions

May 10, 2025 -

Liberation Day Tariffs The Financial Fallout For Trumps Wealthy Allies

May 10, 2025

Liberation Day Tariffs The Financial Fallout For Trumps Wealthy Allies

May 10, 2025 -

Elon Musks Wealth From Pay Pal To Space X And Beyond

May 10, 2025

Elon Musks Wealth From Pay Pal To Space X And Beyond

May 10, 2025