Recent Bitcoin (BTC) Gains: A Look At Trade And Monetary Policy Factors

Table of Contents

The Impact of Global Trade Uncertainty on Bitcoin (BTC)

Global trade uncertainty significantly impacts Bitcoin's price. The cryptocurrency's performance is often intertwined with shifts in investor sentiment regarding global economic stability.

Safe-Haven Asset Narrative

Bitcoin is increasingly viewed as a safe-haven asset, offering a hedge against economic instability arising from global trade tensions. Its decentralized nature, independent of government control, makes it attractive during times of geopolitical uncertainty.

- Example: The US-China trade war of 2018-2020 saw increased Bitcoin investment as investors sought refuge from volatile equity markets.

- Decentralization: Bitcoin's decentralized nature protects it from the direct impact of trade sanctions or tariffs impacting traditional markets.

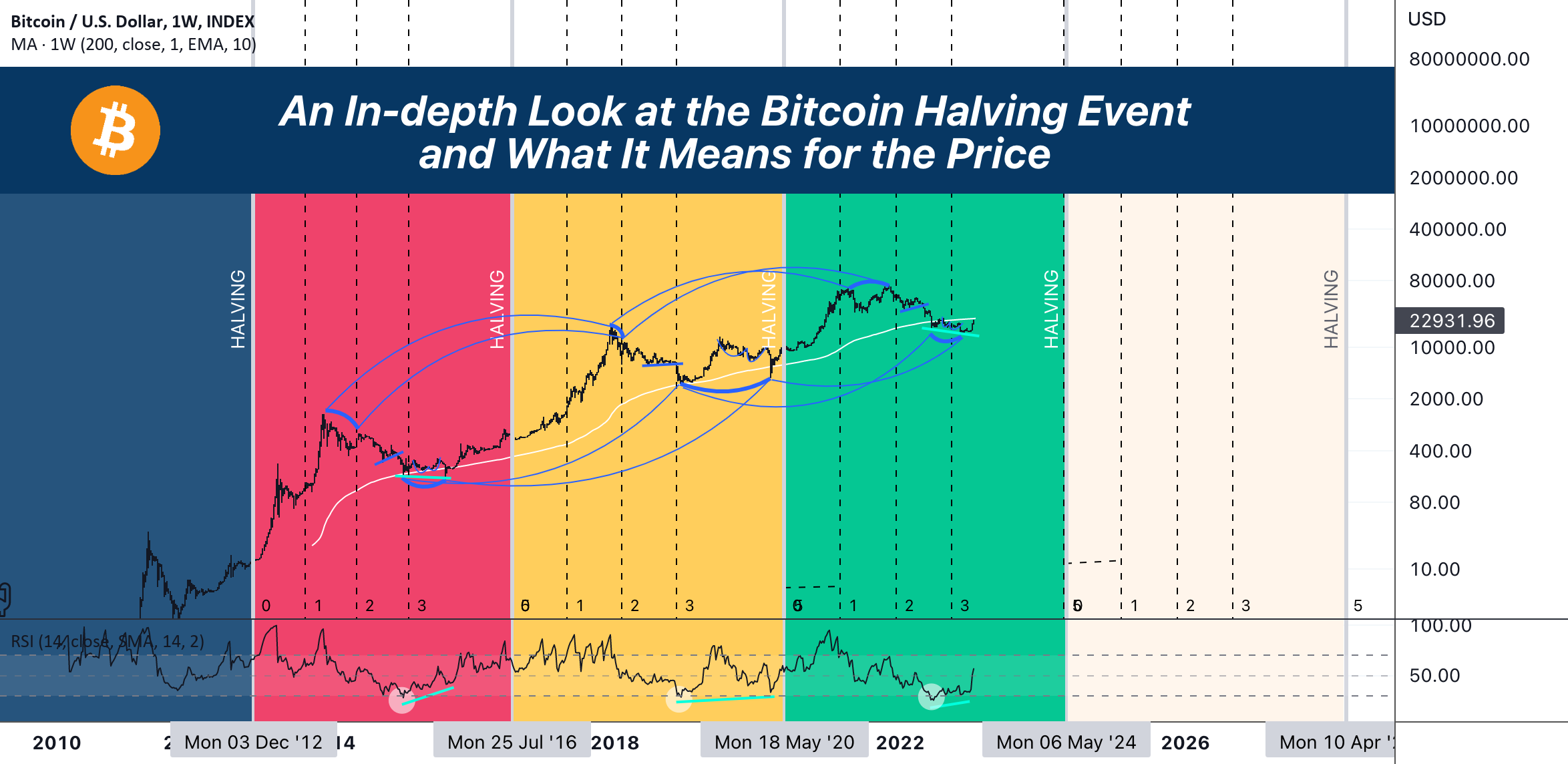

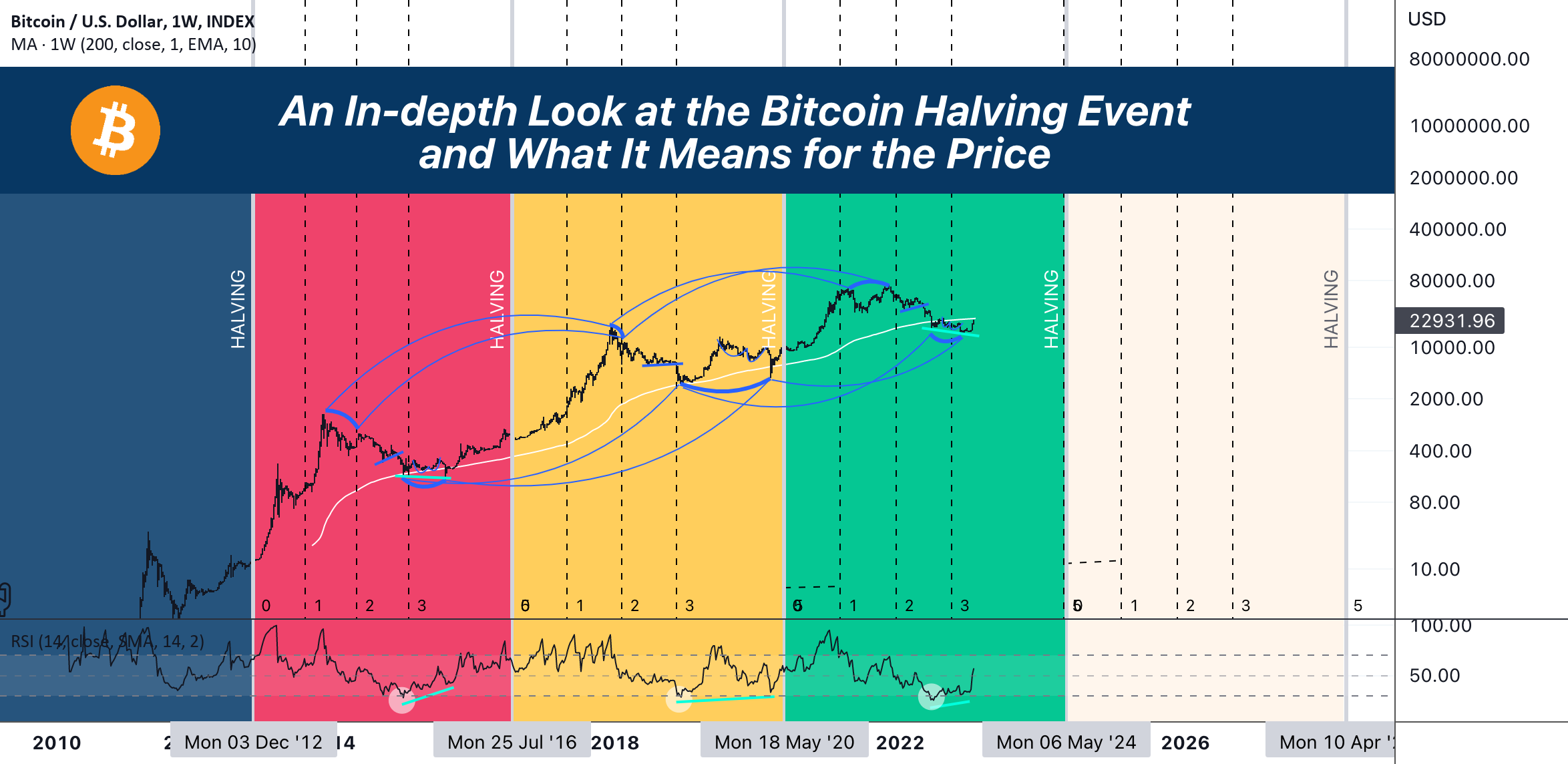

- Historical Data: Analysis of Bitcoin's price movements during previous periods of heightened trade uncertainty reveals a positive correlation, suggesting investors see Bitcoin as a safer bet during times of economic turbulence. This reinforces its safe-haven asset narrative.

Increased Volatility and Risk-On/Risk-Off Sentiment

Trade wars introduce considerable volatility into traditional markets. This volatility drives investors towards alternative assets, like Bitcoin, as part of a "risk-off" strategy. Conversely, periods of reduced trade tensions can lead to a "risk-on" environment, potentially impacting Bitcoin price in either direction.

- Correlation: Studies show a clear correlation between significant trade news announcements and subsequent fluctuations in Bitcoin's price. Positive trade developments might lead to a slight dip as investors move back to traditional assets.

- Investor Behavior: During periods of high trade uncertainty, investors often shift their portfolios away from riskier assets like stocks and towards "safer" assets such as gold or Bitcoin.

- Risk Appetite: Bitcoin's price is heavily influenced by the overall risk appetite of investors. When risk appetite is low due to trade tensions, investors tend to flock to Bitcoin as a perceived store of value.

The Role of Monetary Policy in Bitcoin's (BTC) Price Appreciation

Monetary policy plays a significant role in shaping Bitcoin's price appreciation. Specifically, factors such as quantitative easing (QE) and interest rate hikes impact investor behavior and the attractiveness of Bitcoin as an investment.

Inflationary Pressures and the Search for Value

Quantitative easing, a monetary policy tool used to stimulate economic growth, often leads to increased money supply and inflationary pressures. This can drive investors towards Bitcoin as a store of value, offering a potential hedge against inflation.

- Quantitative Easing (QE): The expansion of the money supply through QE can lead to devaluation of fiat currencies, making Bitcoin, with its limited supply of 21 million coins, a more attractive investment.

- Limited Supply: Bitcoin's fixed supply acts as a deflationary mechanism, contrasting with the inflationary pressures often associated with fiat currencies.

- Comparison to Gold: Bitcoin shares similarities with gold as a traditional inflation hedge, offering a potential alternative to traditional safe havens.

Interest Rate Hikes and Their Effect on Bitcoin (BTC)

Interest rate hikes influence the opportunity cost of holding Bitcoin. Higher interest rates can make traditional investments like bonds more appealing, potentially diverting investment away from Bitcoin. Conversely, lower rates can make Bitcoin more attractive.

- Interest Rate & Bitcoin Price: The relationship between interest rate changes and Bitcoin price movements is complex and often depends on other market factors. However, higher rates can lead to decreased Bitcoin investment in the short term.

- Opportunity Cost: The opportunity cost of holding Bitcoin versus other interest-bearing assets needs to be considered. High-interest rates might discourage holding Bitcoin, which itself does not generate interest income.

- Impact of Policies: Different interest rate policies from various central banks worldwide significantly influence global market sentiment and Bitcoin's price.

Regulatory Developments and Their Influence on Bitcoin (BTC)

Regulatory developments, both positive and negative, have a profound impact on Bitcoin's price and overall market stability.

Positive Regulatory Developments

Positive regulatory announcements or actions often boost investor confidence and drive up Bitcoin's price. Clearer regulations and acceptance by institutional investors can lead to increased market participation and liquidity.

- Examples: Announcements of regulatory frameworks providing clarity for Bitcoin exchanges or the approval of Bitcoin-related ETFs can positively impact investor sentiment and market price.

- Institutional Investment: Positive regulatory changes can attract institutional investors, bringing significant capital into the Bitcoin market.

- Market Liquidity: Increased regulatory clarity and acceptance lead to higher trading volumes and improved market liquidity.

Negative Regulatory Developments

Conversely, negative regulatory actions or announcements can suppress Bitcoin's price. Stricter regulations, bans, or negative statements from regulatory bodies can negatively affect investor sentiment and lead to decreased market participation.

- Examples: Bans on cryptocurrency trading, increased scrutiny of exchanges, or negative pronouncements by government officials can create uncertainty and negatively impact Bitcoin's price.

- Investor Sentiment: Negative regulatory news can create fear and uncertainty among investors, leading to sell-offs and price drops.

- Impact on Market: Negative regulatory developments can hinder market growth in the short-term and long-term, potentially impacting adoption and investment.

Conclusion

Recent Bitcoin (BTC) gains are a result of a complex interplay between global trade uncertainty, shifting monetary policies, and evolving regulatory landscapes. Understanding these macroeconomic factors is crucial for accurately assessing Bitcoin's value and potential for future growth. Trade disputes drive investors to Bitcoin as a safe haven, while monetary policies influence the relative attractiveness of Bitcoin compared to other assets. Finally, regulatory clarity and acceptance significantly impact market stability and investor confidence.

Key Takeaways: Bitcoin's price is influenced by numerous external factors beyond the crypto market itself. Monitoring these global dynamics is vital for any Bitcoin investor.

Call to Action: Stay updated on the latest developments in global trade and monetary policy to make informed decisions about your Bitcoin (BTC) investments. Understanding these factors is crucial for navigating the dynamic world of cryptocurrency and making sound investment choices in Bitcoin (BTC) and other cryptocurrencies.

Featured Posts

-

Trump Reassures On Powells Position As Federal Reserve Chair

Apr 24, 2025

Trump Reassures On Powells Position As Federal Reserve Chair

Apr 24, 2025 -

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

Impact Of Chinas Rare Earth Restrictions On Teslas Optimus Robot Production

Apr 24, 2025

Impact Of Chinas Rare Earth Restrictions On Teslas Optimus Robot Production

Apr 24, 2025 -

John Travoltas Daughter Ella Bleu 24 Shines In Fashion Magazine

Apr 24, 2025

John Travoltas Daughter Ella Bleu 24 Shines In Fashion Magazine

Apr 24, 2025 -

Miami Heats Herro Claims Nba 3 Point Contest Victory

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Victory

Apr 24, 2025

Latest Posts

-

West Bengal Madhyamik Exam 2025 Merit List And Result Date

May 10, 2025

West Bengal Madhyamik Exam 2025 Merit List And Result Date

May 10, 2025 -

High Potential Season 1 And 2 Analyzing The Underrated Characters Arc

May 10, 2025

High Potential Season 1 And 2 Analyzing The Underrated Characters Arc

May 10, 2025 -

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025 -

The Lasting Power Of High Potential An 11 Year Retrospective

May 10, 2025

The Lasting Power Of High Potential An 11 Year Retrospective

May 10, 2025 -

High Potential Underrated Season 1 Characters Pivotal Season 2 Role

May 10, 2025

High Potential Underrated Season 1 Characters Pivotal Season 2 Role

May 10, 2025