Tesla's Q1 2024 Earnings Report: A 71% Drop In Net Income

Table of Contents

Analysis of the 71% Net Income Decline

The precipitous 71% fall in Tesla's Q1 2024 net income is a complex issue stemming from a confluence of factors. Understanding these factors is crucial to assessing the company's long-term health and its position within the increasingly competitive electric vehicle market.

-

Price reductions and their impact on profit margins: Tesla's aggressive price cuts across its vehicle lineup, implemented to boost sales volume and maintain market share, significantly impacted profit margins. While increasing sales, these reductions directly translated into lower revenue per vehicle.

-

Increased competition in the EV market: The EV market is rapidly expanding, with established automakers and new entrants aggressively competing for market share. This intensifying competition has put downward pressure on prices and profit margins across the board, affecting Tesla's profitability.

-

Rising production costs and supply chain challenges: Persisting supply chain disruptions and inflationary pressures have led to higher production costs for Tesla. The cost of raw materials, logistics, and manufacturing have all increased, eating into profitability.

-

Increased investment in research and development (R&D) and expansion: Tesla's continued heavy investment in R&D, including advancements in battery technology, autonomous driving capabilities, and new vehicle platforms, as well as significant expansion into new markets and production facilities, have consumed substantial resources, impacting short-term profitability.

-

Currency exchange rate fluctuations: Fluctuations in currency exchange rates, particularly the strength of the US dollar against other currencies, affected Tesla's international sales and profitability.

Impact on Tesla's Stock Price and Investor Sentiment

The Q1 2024 earnings report had an immediate and significant impact on Tesla's stock price, leading to considerable volatility.

-

Stock price fluctuations after the earnings release: Following the announcement, Tesla's stock experienced a sharp decline, reflecting investor concerns about the company's profitability and future growth.

-

Analyst predictions and ratings following the report: Many analysts downgraded their ratings and price targets for Tesla's stock, citing concerns about the sustained profitability of its current business model in the face of increased competition and price pressures.

-

Investor confidence and future outlook for Tesla: Investor confidence in Tesla's ability to maintain its market leadership and deliver consistent profitability took a hit. The long-term outlook remains uncertain, depending heavily on Tesla’s strategic responses to the challenges faced.

-

Comparison to previous quarters' performance and industry benchmarks: Compared to previous quarters and industry benchmarks, Tesla's Q1 2024 performance was significantly weaker, highlighting the severity of the challenges the company faces.

Tesla's Q1 2024 Sales and Production Figures

Despite the significant drop in net income, Tesla's Q1 2024 sales and production figures provide a nuanced perspective on the company's overall performance.

-

Total vehicle deliveries (Model 3, Model S, Model X, Model Y): While specific numbers are subject to official releases, the overall delivery figures likely show growth compared to previous years, but the growth rate might be slower than anticipated.

-

Geographic sales breakdown: Analysis of geographical sales data is crucial to understanding regional market performance and identifying areas for growth or adjustments in strategy.

-

Production capacity and output: Tesla's production capacity continues to expand, but optimizing output while maintaining quality and controlling costs is key to long-term success.

-

Sales growth rate compared to the previous year: The sales growth rate will likely be positive, but a slowdown in growth could indicate intensifying competition and the impact of price reductions.

Future Outlook and Tesla's Strategic Response

Tesla's future outlook depends heavily on its ability to address the challenges highlighted in the Q1 2024 earnings report and execute its strategic responses effectively.

-

Planned cost-cutting measures: Tesla is likely to implement further cost-cutting measures across its operations to improve margins.

-

New product launches or model updates: New product launches and model updates, such as the Cybertruck and potential advancements in battery technology, are crucial to driving future growth.

-

Expansion plans and market penetration strategies: Continued expansion into new markets and enhancement of existing sales strategies are key to achieving sustainable growth.

-

Predictions for future quarters' earnings: Analysts' predictions for future quarters' earnings will heavily depend on Tesla's success in implementing its strategic initiatives and navigating the evolving market dynamics.

Conclusion: Understanding Tesla's Q1 2024 Earnings Report – A Path Forward?

Tesla's Q1 2024 earnings report revealed a significant drop in net income, primarily due to price reductions, increased competition, rising costs, and substantial investments. This resulted in considerable volatility in Tesla's stock price and impacted investor sentiment. However, the company's strong sales and production figures offer some cause for optimism. Tesla's future success hinges on its ability to effectively implement its cost-cutting measures, launch new products, expand into new markets, and navigate the increasingly competitive electric vehicle market.

Call to Action: Stay informed on Tesla's performance and future developments by following our updates on Tesla Q1 2024 earnings and related news. Keep track of the evolving Tesla net income figures and Tesla stock price fluctuations for a comprehensive understanding of the company’s trajectory in the competitive electric vehicle market.

Featured Posts

-

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025 -

Increased Rent In La After Fires Is Price Gouging To Blame

Apr 24, 2025

Increased Rent In La After Fires Is Price Gouging To Blame

Apr 24, 2025 -

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy Explained

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy Explained

Apr 24, 2025 -

Angry Voter Challenges Rep Nancy Mace In Public Video And Reaction

Apr 24, 2025

Angry Voter Challenges Rep Nancy Mace In Public Video And Reaction

Apr 24, 2025 -

The Bold And The Beautiful April 23 Finn Vows To Liam Spoiler Alert

Apr 24, 2025

The Bold And The Beautiful April 23 Finn Vows To Liam Spoiler Alert

Apr 24, 2025

Latest Posts

-

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

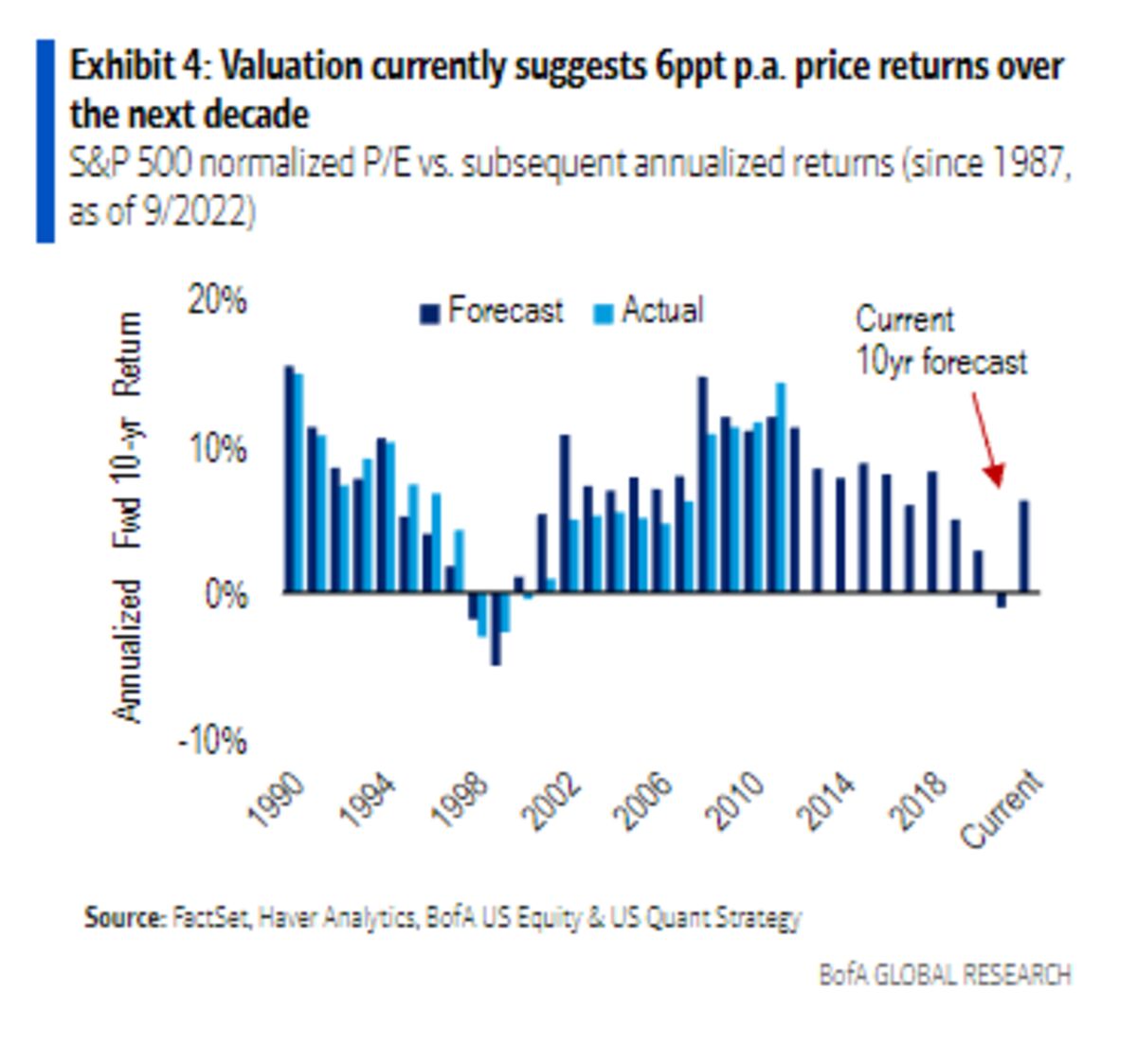

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025