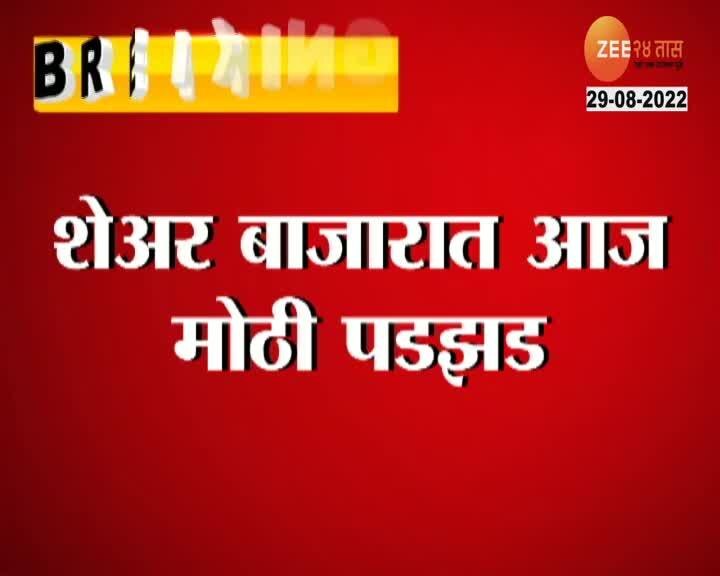

Chinese Stocks Listed In Hong Kong Experience Sharp Increase

Table of Contents

Factors Contributing to the Increase in Chinese Stocks in Hong Kong

Several interconnected factors have fueled the recent surge in Chinese stocks listed on the Hong Kong Stock Exchange (HKEX).

Improved Economic Outlook for China

Positive economic indicators paint a promising picture for the Chinese economy, bolstering investor confidence in Chinese stocks Hong Kong.

- GDP Growth: China's GDP growth [insert recent data and percentage] has exceeded expectations, indicating a robust economic recovery. This positive "China economic growth" trend signals a healthy foundation for listed companies.

- Industrial Production & Retail Sales: Strong industrial production and retail sales figures further confirm the strength of the Chinese economy. This upward trajectory in consumer spending and manufacturing activity translates directly into increased profits for many companies listed on the HKEX.

- Foreign Investment: Increased foreign direct investment (FDI) in China demonstrates growing international confidence in the country's economic prospects. This influx of capital further supports the rise of "Chinese stocks Hong Kong."

- Government Policies: The Chinese government's supportive policies, including infrastructure spending and targeted incentives for specific sectors, have played a crucial role in stimulating economic activity and boosting "GDP growth China." Easing of regulatory pressures, particularly in the tech sector, has also contributed to a more favorable investment environment.

Increased Investor Confidence

Growing investor confidence is a key driver of the recent market surge.

- Positive Earnings Reports: Many listed companies have reported strong earnings, exceeding market expectations. These positive results have fueled optimism and attracted further investment.

- Government Support Measures: Government support measures, designed to stimulate economic growth and stabilize the market, have helped to increase investor confidence in "Chinese stocks Hong Kong."

- Improved Geopolitical Stability (if applicable): [If relevant, discuss any improvements in geopolitical stability that have boosted investor sentiment. For example, eased tensions in US-China relations]

- International Investor Participation: A significant increase in participation from international investors has injected substantial liquidity into the market, driving up demand for Chinese stocks listed in Hong Kong. This influx of "foreign investment China" has been a major catalyst.

Attractiveness of the Hong Kong Stock Exchange

The HKEX's unique attributes have made it an attractive listing venue for Chinese companies.

- International Reach: The HKEX offers Chinese companies access to a broader pool of international investors, enhancing liquidity and valuation.

- Robust Regulatory Framework: The HKEX maintains a robust regulatory framework, providing a stable and transparent trading environment.

- Access to Capital: Listing on the HKEX provides access to a larger and more diverse pool of capital, facilitating expansion and growth opportunities.

- Competitive Advantages: Recent reforms and initiatives undertaken by the HKEX have further strengthened its competitive position among global stock exchanges, making it an increasingly attractive option for Chinese companies seeking to raise capital and expand their investor base. This competitiveness within the "Asia stock market" enhances the appeal of "HKEX listing".

Sector-Specific Performance Analysis

The recent surge has not been uniform across all sectors.

Top Performing Sectors

- Technology: The technology sector has seen explosive growth, driven by strong domestic demand and technological innovation. "Chinese tech stocks" have been among the best performers, reflecting the rapid expansion of the Chinese tech landscape.

- Energy: The energy sector has benefited from rising global energy prices and increased demand. Strong performance in "energy stocks Hong Kong" reflects this trend.

- Financials: The financial sector has also experienced significant growth, driven by increasing economic activity and financial market liberalization. "Financial stocks China" have seen substantial gains.

Underperforming Sectors

While many sectors have flourished, some have experienced slower growth or even declines. This could be due to factors such as increased competition, regulatory changes, or specific economic headwinds impacting particular industries. A balanced assessment of both positive and negative trends is essential for a comprehensive understanding of the "Hong Kong stock market."

Potential Risks and Challenges

Despite the recent surge, several risks and challenges remain.

Geopolitical Risks

Geopolitical risks, such as US-China relations and tensions in the Taiwan Strait, could significantly impact the market. These external factors can create volatility and uncertainty for investors in "China stock market risk".

Regulatory Uncertainty

Future regulatory changes in China could affect listed companies and investor sentiment. This "regulatory uncertainty" adds a layer of risk to consider.

Market Volatility

The inherent volatility of the stock market remains a significant risk. Investors should be prepared for fluctuations in the "Hong Kong market volatility" and develop robust investment strategies accordingly. Understanding and mitigating "investment risk China" is crucial.

Conclusion

The sharp increase in Chinese stocks listed in Hong Kong is a complex phenomenon driven by a confluence of factors, including improved economic prospects, increased investor confidence, and the attractiveness of the HKEX. While various sectors have experienced significant growth, potential risks remain, including geopolitical uncertainties, regulatory changes, and inherent market volatility. Before investing in "Chinese stocks Hong Kong," conduct thorough due diligence and consider seeking professional financial advice. Understanding the "Chinese stock market" and its intricacies is critical for making informed investment decisions. Explore reputable financial news sources and analytical tools to further enhance your understanding of "investing in Chinese stocks Hong Kong" and its associated opportunities and risks.

Featured Posts

-

Are People Betting On The La Wildfires A Troubling Trend

Apr 24, 2025

Are People Betting On The La Wildfires A Troubling Trend

Apr 24, 2025 -

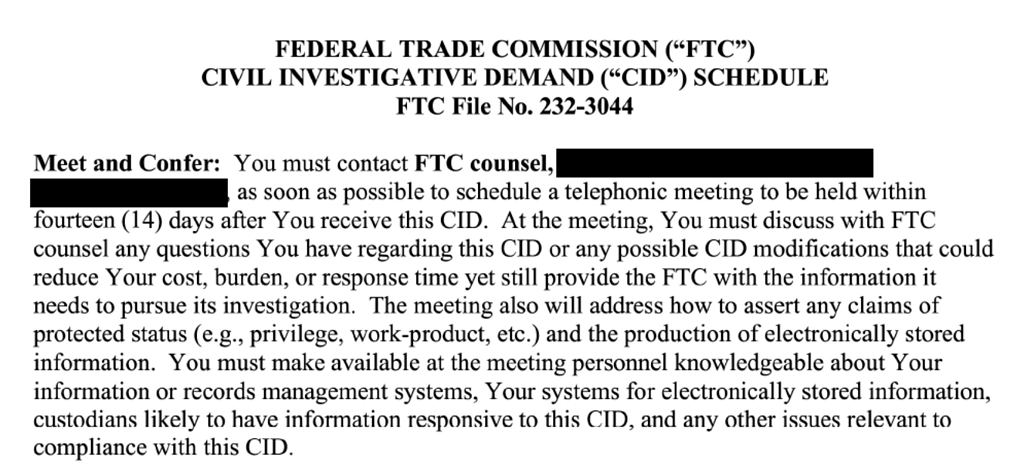

Chat Gpts Developer Open Ai Faces Ftc Investigation A Deep Dive

Apr 24, 2025

Chat Gpts Developer Open Ai Faces Ftc Investigation A Deep Dive

Apr 24, 2025 -

The Aftermath Of La Fires Allegations Of Landlord Price Gouging

Apr 24, 2025

The Aftermath Of La Fires Allegations Of Landlord Price Gouging

Apr 24, 2025 -

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025 -

Trumps Immigration Enforcement New Legal Setbacks

Apr 24, 2025

Trumps Immigration Enforcement New Legal Setbacks

Apr 24, 2025

Latest Posts

-

Market Rally Sensex Rises 200 Nifty Crosses 18 600 Key Highlights

May 10, 2025

Market Rally Sensex Rises 200 Nifty Crosses 18 600 Key Highlights

May 10, 2025 -

Indian Stock Market Update Sensex Nifty Close Higher Despite Ultra Tech Fall

May 10, 2025

Indian Stock Market Update Sensex Nifty Close Higher Despite Ultra Tech Fall

May 10, 2025 -

1 420

May 10, 2025

1 420

May 10, 2025 -

Palantir Stock Assessing The Risks And Rewards Of A Potential 40 Gain By 2025

May 10, 2025

Palantir Stock Assessing The Risks And Rewards Of A Potential 40 Gain By 2025

May 10, 2025 -

1078 2025 R5

May 10, 2025

1078 2025 R5

May 10, 2025