Clinton's Veto Threats: A Deep Dive Into The 1% Budget Battle

Table of Contents

The 1990s witnessed intense budget battles in the United States, marked by President Bill Clinton's strategic use of veto threats. These threats, often wielded against proposals affecting the wealthiest Americans – the "1%" – significantly shaped the nation's economic and political landscape. This article explores Clinton's veto threats, analyzing their strategic deployment and impact on policy decisions concerning the distribution of wealth and the overall budgetary process. We will delve into the political climate, key players, and long-term consequences of these high-stakes confrontations.

1. The Political Landscape of Clinton-Era Budget Battles:

The economic and political climate of the Clinton years provided fertile ground for intense budget battles. Facing a large national debt and divided government, Clinton navigated a complex web of ideological clashes and competing economic priorities. Clinton's "1% budget battle" focused on tax policy, specifically, how to fairly redistribute the wealth and tackle the growing national debt.

H3: The Role of the "1%": The debate frequently centered on tax policies aimed at the wealthiest Americans. Proposals included increasing taxes on capital gains, raising the top marginal income tax rate, and closing loopholes that benefited high-income earners. These measures were presented as ways to reduce the deficit and fund social programs while simultaneously addressing economic inequality.

- Specific examples of tax increases or cuts proposed: The Omnibus Budget Reconciliation Act of 1993, for instance, increased taxes on higher earners. Conversely, some Republican proposals aimed at tax cuts for corporations and the wealthy were met with veto threats.

- Political factions involved: Democrats generally supported increased taxes on the wealthy, while Republicans largely opposed them, advocating for tax cuts to stimulate economic growth. Moderate Democrats sometimes played a crucial role in shaping the final legislation.

- Impact of public opinion: Public opinion on tax increases for the wealthy was divided, influencing the political strategies of both parties and shaping the negotiations.

H3: Key Players and Their Agendas: Newt Gingrich, as Speaker of the House, played a central role, often leading the Republican opposition to Clinton's budget proposals. Congressional leaders from both parties also wielded considerable influence, shaping the legislative process and navigating the compromises (or lack thereof).

- Profiles of key individuals: Understanding the individual agendas and political styles of figures like Clinton, Gingrich, and key Senate leaders is crucial to understanding the dynamics of these budget battles.

- Their stated goals: Republicans often prioritized tax cuts and reduced government spending, while Democrats emphasized social programs and a fairer tax system.

- Negotiation tactics: The use of veto threats, compromise, and legislative maneuvering were all part of the complex negotiation strategies employed by the various players.

2. Analyzing Clinton's Veto Threats as a Strategic Tool:

Clinton strategically used veto threats to influence the legislative process and shape budget outcomes. His willingness to use this power became a significant factor in the budget negotiations.

H3: Instances of Veto Threats and Their Outcomes: Several instances highlight Clinton's use of veto threats. Often, these threats were directed at bills that would significantly cut taxes for the wealthy or reduce funding for social programs.

- Specific bills or budget proposals: Identifying specific instances where a veto threat was issued allows for a detailed analysis of the context and consequences.

- Rationale behind Clinton's veto threats: Clinton’s rationale typically centered around protecting social programs, maintaining fiscal responsibility, and addressing income inequality.

- Legislative responses: The responses varied. Sometimes, Congress would compromise; other times, the bill was withdrawn or passed without the changes Clinton demanded.

- Ultimate impact: These threats often led to modified bills, reflecting a degree of compromise between the President and Congress.

H3: The Effectiveness of Clinton's Veto Strategy: Assessing the effectiveness requires analyzing both successful and unsuccessful veto threats. While some threats resulted in significant compromises, others may have contributed to legislative gridlock. The political costs and gains associated with each instance must also be considered.

- Quantitative analysis (if data is available): Statistics on the success rate of Clinton's veto threats could provide a quantitative assessment of his strategy's effectiveness.

- Qualitative assessment: Examining the long-term impact on the political landscape – strengthening his image or eroding public trust – is crucial for a comprehensive evaluation.

- Alternative strategies: Exploring whether alternative negotiation strategies could have yielded better outcomes is a key aspect of the analysis.

3. Long-Term Impacts of the Budget Battles and Veto Threats:

The budget battles of the Clinton era had lasting economic and political ramifications.

H3: Economic Consequences: The budget decisions significantly impacted different income groups. Economic data needs to be examined to determine the short-term and long-term consequences of the budgetary choices.

- Economic data: Analyzing economic growth rates, inflation, unemployment rates, and changes in income distribution will provide insights into the economic impact.

- Impact on government spending: The allocation of government funds to specific sectors directly affected by the budget battles needs analysis.

- Impact on income inequality: Did Clinton’s actions affect the distribution of wealth?

H3: Political Ramifications: The budget battles influenced party alignment and reshaped the political landscape, affecting future budget negotiations and legislative processes.

- Shifts in political alliances: The battles may have strengthened or weakened certain political alliances within and between parties.

- Changes in legislative processes: The strategies and tactics employed may have led to changes in how budgets are debated and negotiated.

- Impact on public trust: The public's perception of government effectiveness and responsiveness was likely impacted by these intense budget battles.

Conclusion:

Clinton's strategic use of veto threats during budget negotiations played a significant role in shaping economic policy and political dynamics throughout the 1990s. His approach, aimed at protecting social programs and addressing the needs of the middle class while potentially mitigating the impact on the “1%,” resulted in a complex interplay of compromises, gridlock, and enduring economic and political consequences. Further research into Clinton's budget vetoes, the 1990s budget crisis, and Clinton's broader economic policies is essential to fully grasp the lasting impact of this period. To delve deeper, consider searching terms like "Clinton Budget Vetoes," "1990s Budget Crisis," or "Clinton Economic Policies." Understanding Clinton's veto threats provides invaluable insight into the intricate workings of American politics and economics.

Featured Posts

-

Suksesi I Kosoves Ne Ligen E Kombeve Rrugetimi Nga Liga C Ne Ligen B

May 23, 2025

Suksesi I Kosoves Ne Ligen E Kombeve Rrugetimi Nga Liga C Ne Ligen B

May 23, 2025 -

Cat Deeleys This Morning Outfit How To Nail The Cowboy Denim Trend

May 23, 2025

Cat Deeleys This Morning Outfit How To Nail The Cowboy Denim Trend

May 23, 2025 -

Zimbabwe Cricket Away Test Victory Breaks Two Year Winless Streak In Sylhet

May 23, 2025

Zimbabwe Cricket Away Test Victory Breaks Two Year Winless Streak In Sylhet

May 23, 2025 -

Appeal Filed Ftc Challenges Microsoft Activision Blizzard Acquisition

May 23, 2025

Appeal Filed Ftc Challenges Microsoft Activision Blizzard Acquisition

May 23, 2025 -

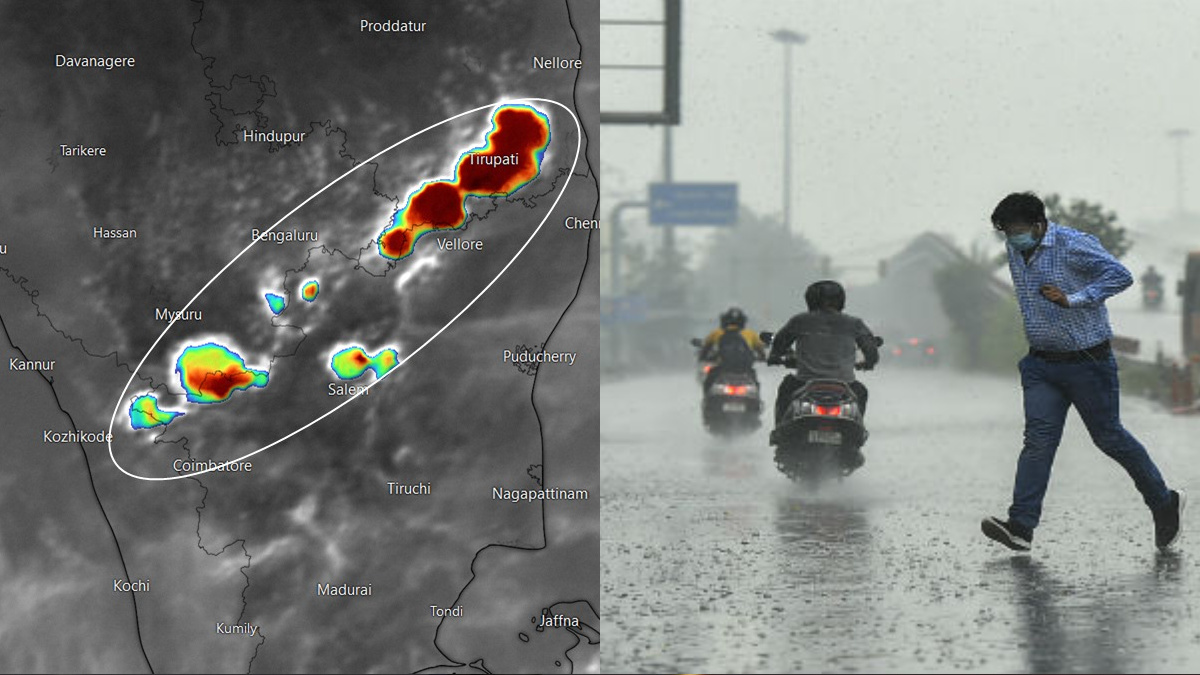

Prevision Meteorologica Lluvias Moderadas Esperadas

May 23, 2025

Prevision Meteorologica Lluvias Moderadas Esperadas

May 23, 2025

Latest Posts

-

Unlocking Potential The Critical Role Of Middle Managers In Modern Organizations

May 23, 2025

Unlocking Potential The Critical Role Of Middle Managers In Modern Organizations

May 23, 2025 -

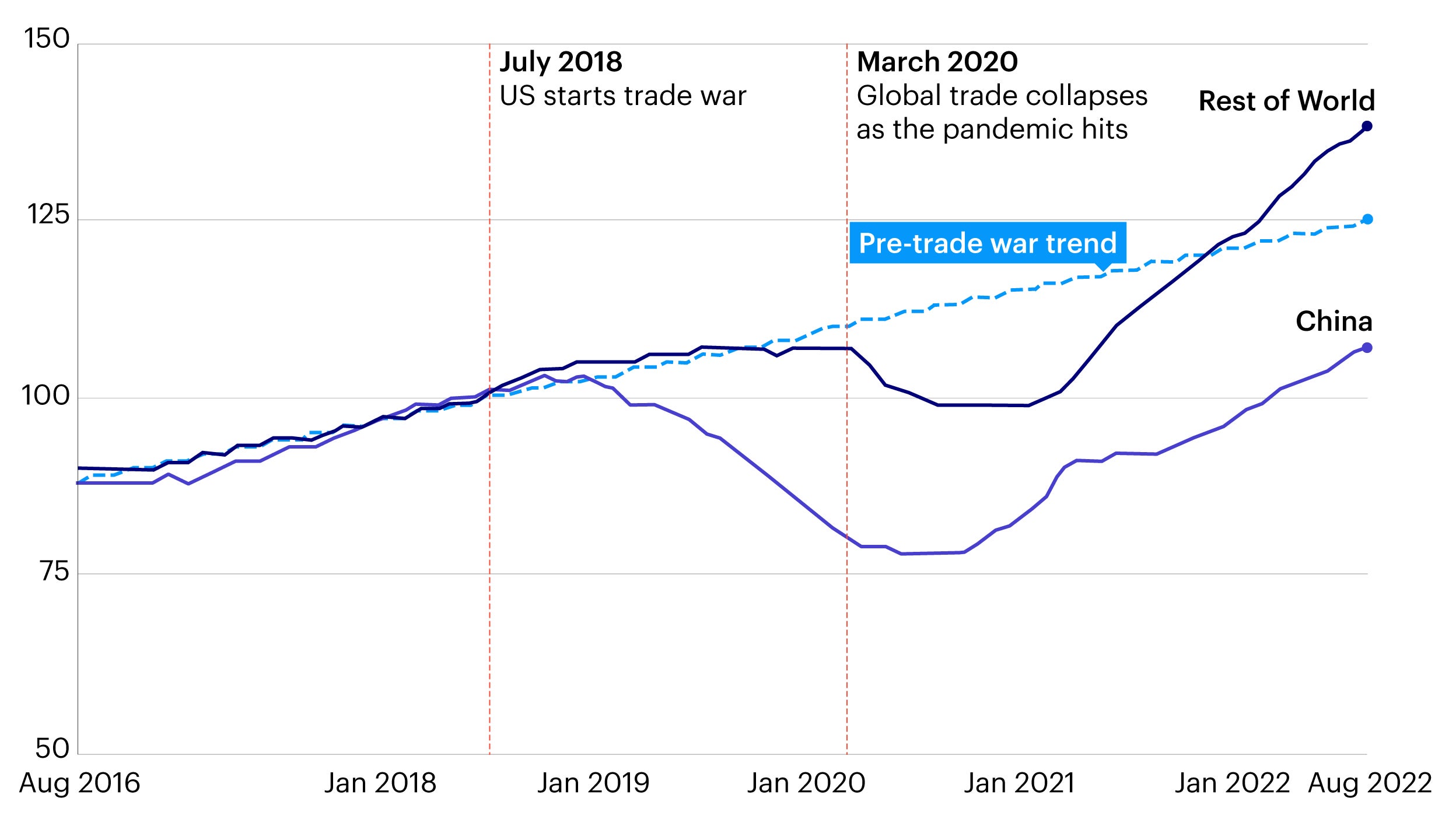

China And Us Trade A Race Against Time To Meet Trade Agreement Goals

May 23, 2025

China And Us Trade A Race Against Time To Meet Trade Agreement Goals

May 23, 2025 -

Us China Trade Soars Ahead Of Trade Truce Deadline

May 23, 2025

Us China Trade Soars Ahead Of Trade Truce Deadline

May 23, 2025 -

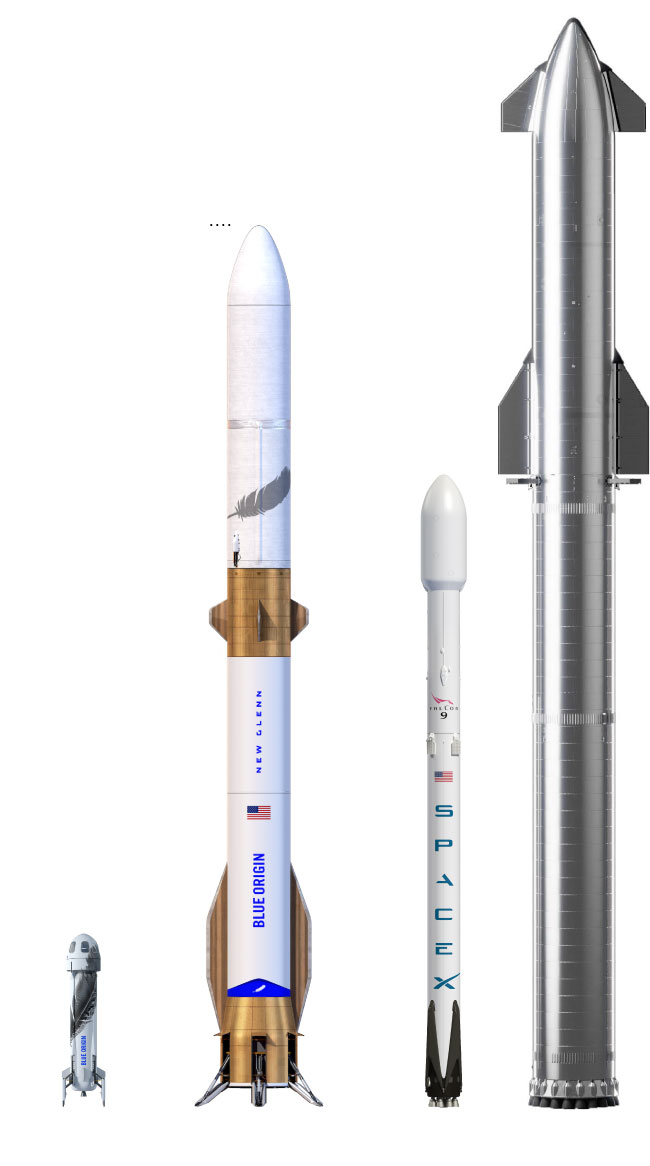

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

May 23, 2025

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

May 23, 2025 -

The Undervalued Asset How Middle Managers Drive Employee Engagement And Business Growth

May 23, 2025

The Undervalued Asset How Middle Managers Drive Employee Engagement And Business Growth

May 23, 2025