Consumer Spending Slowdown: Impact On Credit Card Companies

Table of Contents

Reduced Transaction Volumes and Revenue Decline

A decrease in consumer spending directly translates to fewer credit card transactions, significantly impacting credit card companies' core revenue streams. This consumer spending slowdown leads to a double whammy: reduced transaction fees and decreased interest income.

- Lower merchant fees due to reduced sales: As consumers buy less, merchants process fewer transactions, resulting in lower merchant fees for credit card companies. This is a direct consequence of the reduced spending.

- Decreased interest income from lower outstanding balances: With less spending, consumers carry lower outstanding balances on their credit cards, leading to a reduction in the interest income earned by credit card companies. This is a key factor in the impact of a consumer spending slowdown.

- Potential impact on credit card company profitability and stock prices: The combined effect of lower transaction fees and interest income directly impacts the profitability of credit card companies, often reflected in their stock prices. Companies like Visa and Mastercard, heavily reliant on transaction volumes, are particularly vulnerable to a prolonged consumer spending slowdown.

- Examples of companies potentially affected and their recent performance reports: Recent quarterly reports from major credit card companies offer insights into the actual financial impact of the current economic situation. Analyzing these reports reveals the extent to which a consumer spending slowdown affects their bottom line.

Increased Credit Risk and Default Rates

Economic hardship often leads to higher credit card delinquency and default rates. A consumer spending slowdown exacerbates this trend, increasing the financial burden on credit card companies.

- Higher charge-off rates and write-downs: As consumers struggle financially, the likelihood of them defaulting on their credit card payments increases, leading to higher charge-off rates and substantial write-downs for credit card companies.

- Increased pressure on credit scoring and risk management strategies: Credit card companies are under increased pressure to refine their credit scoring and risk management strategies to minimize losses during a consumer spending slowdown. This involves more rigorous credit checks and potentially higher interest rates for higher-risk borrowers.

- Potential for tighter lending standards and stricter credit approvals: In response to rising default rates, credit card companies may implement tighter lending standards and stricter credit approvals, potentially excluding some borrowers from accessing credit.

- Impact on the credit card companies' balance sheets: The increased bad debt expenses and loss provisions directly impact the credit card companies' balance sheets, affecting their financial health and stability.

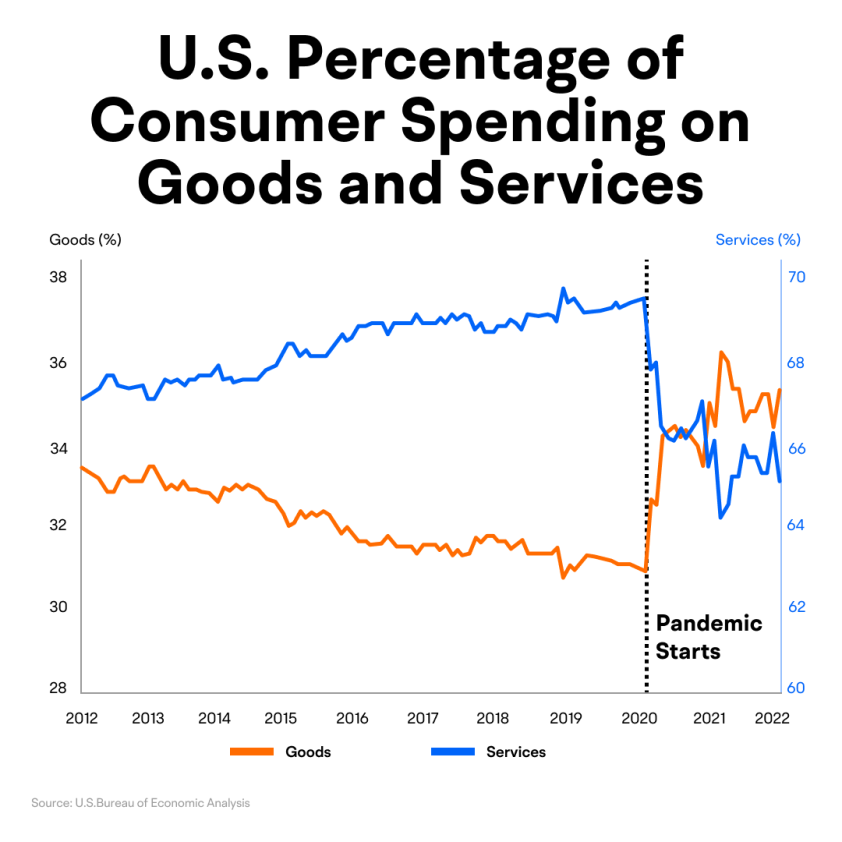

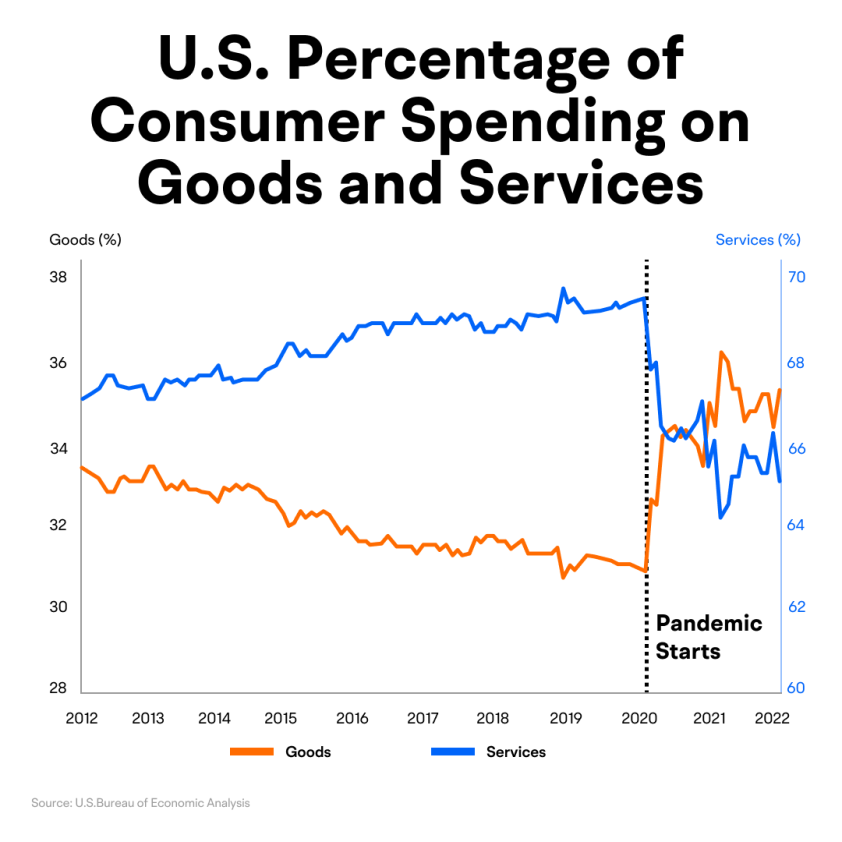

Shift in Consumer Behavior and Spending Patterns

A consumer spending slowdown forces consumers to adapt their spending habits. This shift in behavior has significant implications for credit card companies' marketing and product strategies.

- Increased use of debit cards and cash: Consumers may increasingly opt for debit cards or cash to avoid accumulating credit card debt during a period of economic uncertainty.

- Focus on value and affordability in consumer purchasing decisions: Consumers prioritize value and affordability, leading to a shift in purchasing decisions and potentially impacting the demand for premium credit card features.

- Changes in reward programs and loyalty initiatives: Credit card companies may need to adjust their reward programs and loyalty initiatives to attract and retain customers during a consumer spending slowdown.

- The potential rise of Buy Now, Pay Later (BNPL) services and its competition with credit cards: The rise of BNPL services presents increased competition for credit cards, further challenging the industry during a period of reduced spending.

Strategies for Credit Card Companies to Mitigate the Impact

Credit card companies need proactive strategies to navigate the challenges posed by a consumer spending slowdown. Strategic planning and effective risk management are paramount.

- Offering flexible repayment options and financial literacy programs: Offering flexible repayment options and providing financial literacy programs can help consumers manage their debt and reduce default rates.

- Diversifying revenue streams through other financial services: Diversifying revenue streams into other financial services can help reduce reliance on credit card transaction fees and interest income.

- Strengthening customer relationships and improving customer service: Strengthening customer relationships and improving customer service can help retain existing customers and attract new ones.

- Investing in technology to improve efficiency and reduce costs: Investing in technology to improve efficiency and reduce costs can help maintain profitability during a consumer spending slowdown.

- Exploring mergers and acquisitions to improve market share: Exploring mergers and acquisitions can help improve market share and enhance the company's overall position within the industry.

Conclusion: Navigating the Consumer Spending Slowdown – A Call to Action for Credit Card Companies

The consumer spending slowdown presents significant challenges for credit card companies, impacting their revenue streams, risk profiles, and overall profitability. Understanding the nuances of the consumer spending slowdown, including the implications for transaction volumes, credit risk, and shifting consumer behavior, is critical. Proactive strategies, including flexible repayment options, diversified revenue streams, and improved customer service, are essential for navigating this challenging period. Credit card companies must adapt and innovate to thrive in this evolving economic landscape. Staying informed on the latest economic trends and proactively addressing the challenges posed by a consumer spending slowdown is crucial for long-term success in the credit card industry.

Featured Posts

-

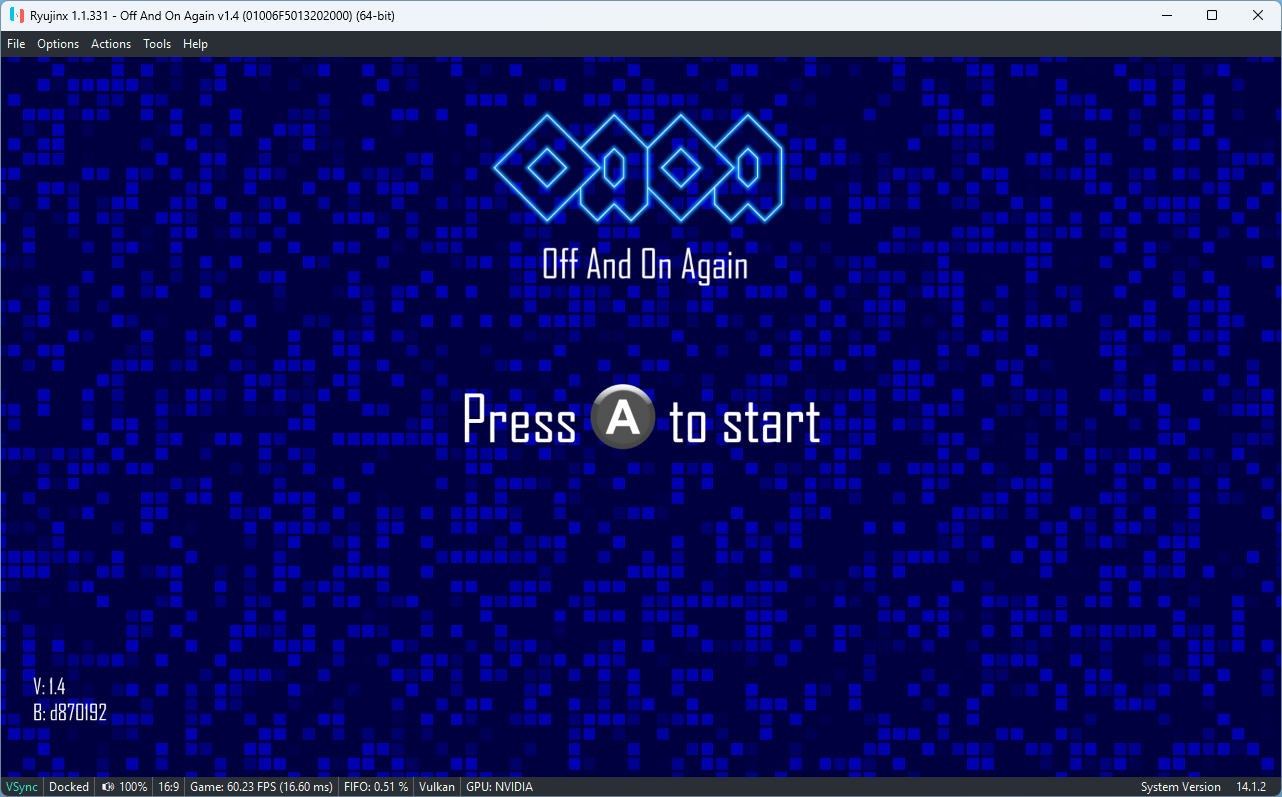

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025 -

Tajni Film S Johnom Travoltom Reakcija Quentina Tarantina

Apr 24, 2025

Tajni Film S Johnom Travoltom Reakcija Quentina Tarantina

Apr 24, 2025 -

Tzon Travolta I Sygklonistiki Anartisi Gia Ton Xamo Toy Tzin Xakman

Apr 24, 2025

Tzon Travolta I Sygklonistiki Anartisi Gia Ton Xamo Toy Tzin Xakman

Apr 24, 2025 -

V Mware Costs To Skyrocket At And T Details A 1 050 Price Hike From Broadcom

Apr 24, 2025

V Mware Costs To Skyrocket At And T Details A 1 050 Price Hike From Broadcom

Apr 24, 2025 -

The Bold And The Beautiful April 3rd Recap Liam Bill And Hopes Dramatic Thursday

Apr 24, 2025

The Bold And The Beautiful April 3rd Recap Liam Bill And Hopes Dramatic Thursday

Apr 24, 2025

Latest Posts

-

Palantir Stock Investment Potential And Future Outlook

May 10, 2025

Palantir Stock Investment Potential And Future Outlook

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025 -

Is Palantir Stock A Good Investment Analyzing The Risks And Rewards

May 10, 2025

Is Palantir Stock A Good Investment Analyzing The Risks And Rewards

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Streets Take

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Streets Take

May 10, 2025 -

Palantir Technologies Stock Buy Sell Or Hold A Current Market Evaluation

May 10, 2025

Palantir Technologies Stock Buy Sell Or Hold A Current Market Evaluation

May 10, 2025