Palantir Stock: Investment Potential And Future Outlook

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's core business revolves around providing cutting-edge big data analytics software to government and commercial clients. Its success hinges on two primary platforms: Gotham and Foundry. Palantir Gotham caters to government agencies, offering powerful tools for national security, intelligence, and law enforcement. Meanwhile, Palantir Foundry targets commercial clients across various sectors, assisting them with operational efficiency, risk management, and strategic decision-making.

Palantir's revenue model is primarily subscription-based, generating recurring revenue streams through SaaS (Software as a Service) contracts. It also provides professional services, including implementation support and consulting, adding another layer to its revenue generation.

The growth potential of both platforms is significant. Gotham benefits from the persistent and growing demand for advanced data analytics within government organizations globally. Foundry, on the other hand, is experiencing rapid expansion as more commercial enterprises recognize the value of data-driven insights. This revenue diversification reduces reliance on a single sector, bolstering Palantir's overall financial stability.

- Successful Government Deployments: Palantir Gotham is utilized by numerous intelligence agencies and law enforcement organizations worldwide, aiding in counter-terrorism efforts and crime prevention.

- Commercial Success Stories: Palantir Foundry has secured partnerships with major corporations across healthcare, finance, and manufacturing, demonstrating its broad applicability and market acceptance. For example, a large pharmaceutical company leveraged Foundry to streamline clinical trials, significantly reducing development time and costs.

- Quantifiable Growth: Palantir's revenue has shown consistent year-over-year growth, demonstrating the market demand for its platforms. (Specific numbers should be inserted here based on the most recent financial reports).

Palantir's Financial Performance and Key Metrics

Analyzing Palantir's financial history reveals a company focused on growth. While profitability has been a focus area, the company's revenue growth rate has been impressive. Key financial metrics to consider include:

- Revenue Growth Rate: (Insert data from financial reports. Highlight trends – consistent growth or periods of acceleration/deceleration)

- Operating Margin: (Insert data from financial reports. Show the trend – improving or worsening?)

- Customer Churn Rate: (Insert data from financial reports. A low churn rate is crucial for a SaaS business model.)

- Cash Flow: (Insert data. Positive cash flow is indicative of a healthy business.)

Palantir's path to sustainable profitability involves a combination of factors, including increasing operating leverage and scaling its operations. Comparing these metrics to competitors in the big data analytics space will further illustrate Palantir's position and potential.

Competitive Landscape and Market Opportunities

Palantir faces competition from established players and emerging startups in the big data analytics market. Key competitors include companies like Tableau, Microsoft, and AWS. However, Palantir differentiates itself through several key competitive advantages:

- Proprietary Technology: Palantir's platforms are built on unique technologies and algorithms, allowing them to handle exceptionally complex data sets and deliver unique insights.

- Deep Expertise: Palantir possesses a team of highly skilled data scientists and engineers, providing a level of expertise unmatched by many competitors.

- Strong Customer Relationships: The company has established long-term partnerships with key clients, demonstrating its ability to meet their unique needs.

The global market for big data analytics is expanding rapidly, presenting enormous opportunities for Palantir. The company's diversified client base across government and commercial sectors positions it to capitalize on this growth.

- Market Size and Growth Projections: (Insert relevant market research data and projections.)

- Specific Market Segments: Palantir is targeting high-growth sectors like healthcare, finance, and cybersecurity, aligning itself with significant market opportunities.

Risks and Challenges Facing Palantir

While Palantir's outlook is positive, investors should be aware of potential risks:

- Intense Competition: The big data analytics market is becoming increasingly competitive, with established players and innovative startups vying for market share.

- Regulatory Changes: Data privacy regulations (like GDPR) can impact Palantir's operations and potentially increase compliance costs.

- Geopolitical Risks: Global instability and political changes can affect government contracts and commercial partnerships.

- Data Security and Privacy Concerns: Protecting sensitive data is paramount. Cybersecurity breaches could severely damage Palantir's reputation and business.

Addressing these risks requires a proactive approach, including strategic investments in cybersecurity, robust compliance programs, and diversification of revenue streams.

Palantir Stock Valuation and Investment Strategies

Evaluating Palantir stock requires a thorough assessment of its valuation. Several metrics can provide insights:

- P/E Ratio: (Insert current P/E ratio and compare it to industry averages and historical values.)

- Price-to-Sales Ratio: (Insert current Price-to-Sales ratio and compare it to industry averages and historical values.)

Different investment strategies exist depending on risk tolerance and investment horizon:

- Long-Term Investment: A long-term approach may be suitable for investors who believe in Palantir's long-term growth potential.

- Short-Term Trading: Short-term trading involves higher risk but offers the potential for quicker returns. (Caution should be advised here)

Identifying potential entry and exit points requires careful analysis of the company's financial performance, market conditions, and overall investment strategy.

Conclusion: Final Thoughts on Palantir Stock

Palantir's innovative technology, diversified business model, and strong revenue growth provide a compelling investment narrative. However, investors must carefully consider the competitive landscape, regulatory risks, and potential geopolitical headwinds. The financial performance metrics, while positive, need to show consistent improvement to fully support a bullish outlook.

Our overall assessment of Palantir stock remains cautiously optimistic, suggesting a long-term investment strategy could be rewarding for investors with a moderate-to-high risk tolerance. However, this is not financial advice.

Consider investing in Palantir stock based on your individual risk tolerance and investment goals. Further research on Palantir stock is recommended before making any investment decisions.

Featured Posts

-

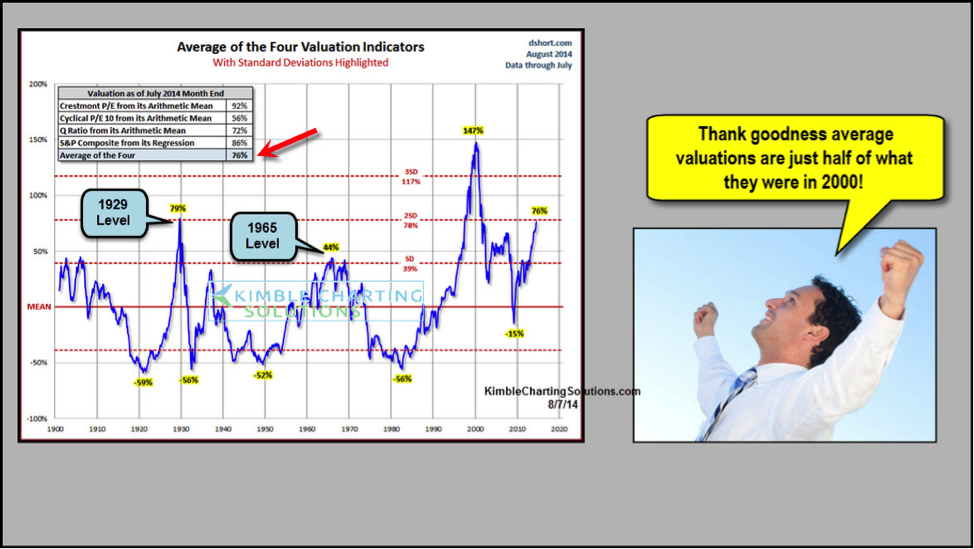

Bof A On Stock Market Valuations Reasons For Investor Confidence

May 10, 2025

Bof A On Stock Market Valuations Reasons For Investor Confidence

May 10, 2025 -

When To Watch The Next High Potential Episode On Abc

May 10, 2025

When To Watch The Next High Potential Episode On Abc

May 10, 2025 -

Los Angeles Wildfires And The Disturbing Trend Of Disaster Gambling

May 10, 2025

Los Angeles Wildfires And The Disturbing Trend Of Disaster Gambling

May 10, 2025 -

New Program Offers Technical Skills Training To Transgender People In Punjab

May 10, 2025

New Program Offers Technical Skills Training To Transgender People In Punjab

May 10, 2025 -

Palantir Stock A Pre May 5th Earnings Investment Analysis

May 10, 2025

Palantir Stock A Pre May 5th Earnings Investment Analysis

May 10, 2025