Copper Futures Jump On Renewed China-US Trade Dialogue

Table of Contents

The Role of China-US Trade Relations in Copper Prices

The relationship between China-US trade relations and copper prices is undeniable and historically significant. China, the world's largest consumer of copper, plays a pivotal role in determining global demand. Its robust manufacturing sector, construction projects, and technological advancements heavily rely on copper. Therefore, any disruption to trade between China and the US, a major copper supplier, directly impacts copper imports and overall market stability.

- Increased trade friction leads to reduced copper demand: Uncertainty stemming from trade disputes often discourages investment and reduces industrial activity in China, directly impacting copper consumption.

- Easing of tensions boosts investor confidence and demand: Conversely, positive developments in trade negotiations lead to increased confidence, stimulating investment and driving up demand for copper.

- China's economic growth is directly linked to copper consumption: Strong economic growth in China invariably translates to higher copper demand, pushing prices upward. A slowdown, however, can have the opposite effect.

Analyzing the Recent Trade Dialogue and its Impact

The renewed China-US trade dialogue, focusing on [mention specific topics discussed, e.g., tariff reductions, technology transfer], has injected a wave of optimism into the market. While details remain limited at this stage, [mention specific agreements reached, if any, or lack thereof], the mere resumption of talks has significantly altered market sentiment. Analysts suggest that [include expert quotes or paraphrased opinions from reputable sources, e.g., "The renewed dialogue signals a potential de-escalation of trade tensions, which is positive for copper demand," - Analyst Name, Institution].

- Specific statements made by officials impacting copper futures: Positive statements from both sides regarding potential compromises have directly influenced investor perception and spurred buying activity in copper futures.

- Market reaction to positive or negative news regarding trade agreements: The market demonstrates a high sensitivity to news regarding the progress (or lack thereof) of the trade dialogue. Any indication of a breakthrough leads to price increases; negative news can trigger a sell-off.

- Analysis of potential future trade policies and their likely effect on copper prices: The outcome of the ongoing dialogue will significantly influence copper prices in the coming months. A comprehensive trade agreement is likely to stabilize and potentially increase prices, while continued friction could lead to sustained volatility.

Other Factors Influencing Copper Futures Prices

While China-US trade relations are a dominant factor, other macroeconomic and market-specific factors influence copper futures prices.

- Global economic growth (or slowdown): Strong global economic growth generally boosts demand for copper, while a slowdown dampens it.

- Supply chain disruptions: Events like natural disasters or geopolitical instability in major copper-producing regions can create supply shortages and drive prices up.

- Changes in industrial production: Increased industrial activity in various sectors (construction, electronics, etc.) increases copper demand, affecting price.

- Speculative trading activity: Investor sentiment and speculative trading can also contribute to price volatility in the copper futures market, regardless of fundamental factors.

These factors interact dynamically with the China-US trade dynamic. For example, a positive trade agreement might be offset by a global economic slowdown, resulting in a less dramatic price increase than initially anticipated.

- Explanation of each factor's influence on copper prices: Each factor exerts its unique influence, sometimes reinforcing, sometimes counteracting the effects of others.

- Examples of recent events affecting supply and demand: [Cite recent examples, e.g., a mine closure impacting supply, or a large infrastructure project boosting demand].

- Assessment of the relative importance of each factor: While China-US trade is currently a major driver, the interplay of other factors needs to be carefully considered for accurate price prediction.

Technical Analysis of the Copper Futures Market

The recent price jump in copper futures can also be analyzed through technical indicators. [Mention specific indicators, e.g., breakout above a key resistance level, increased trading volume]. [Include charts and graphs illustrating the price movement, if possible, with clear labels and annotations]. These technical indicators provide further support for the bullish sentiment driven by the renewed trade dialogue.

Conclusion: Navigating the Future of Copper Futures Amidst Trade Dynamics

The surge in copper futures prices is intrinsically linked to the renewed China-US trade dialogue. The ongoing negotiations will continue to shape the copper market, and monitoring the progress of these talks is crucial for accurate price predictions. The volatility of copper futures is likely to persist in the near future, influenced not only by trade dynamics but also by global economic conditions and other market forces. To effectively navigate the volatile world of copper futures trading, stay updated on the latest developments in China-US trade relations and leverage comprehensive market analysis. Understanding the interplay of macroeconomic indicators and technical analysis is key to developing sound copper futures trading strategies.

Featured Posts

-

Stiven King Na X Reaktsiya Na Trampa Ta Maska Pislya Povernennya

May 06, 2025

Stiven King Na X Reaktsiya Na Trampa Ta Maska Pislya Povernennya

May 06, 2025 -

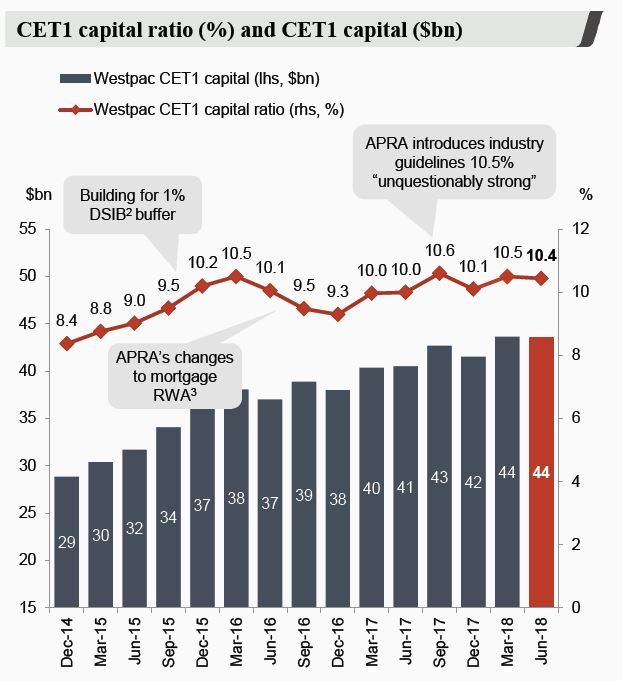

Falling Profits At Westpac Wbc The Role Of Shrinking Margins

May 06, 2025

Falling Profits At Westpac Wbc The Role Of Shrinking Margins

May 06, 2025 -

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025 -

Stephen King Vs Hollywood 5 Famous Feuds

May 06, 2025

Stephen King Vs Hollywood 5 Famous Feuds

May 06, 2025 -

Bollywood Outsider Priyanka Chopras Journey As Revealed By Her Mother

May 06, 2025

Bollywood Outsider Priyanka Chopras Journey As Revealed By Her Mother

May 06, 2025