CoreWeave (CRWV) Stock's Thursday Dip: Causes And Future Implications

Table of Contents

Analyzing the Thursday Dip: Immediate Market Reactions

CRWV Stock Plunge: Immediate Market Sentiment and Trading Volume

The CoreWeave (CRWV) stock price plummeted by [Insert Percentage]% on Thursday, a considerable drop compared to its recent performance. To understand the gravity of this situation, we need to examine the trading volume. Was this a panicked sell-off reflected in unusually high trading volume, or a more subdued decline with low volume suggesting a less significant shift in market sentiment? The answer will offer crucial clues about the nature of the dip.

- Trading Volume Analysis: [Insert data on trading volume. Was it higher or lower than average? Analyze this data and its implications. For example: "The unusually high trading volume suggests a significant shift in investor sentiment, indicating a potentially market-driven rather than company-specific event."]

- News and Announcements: [Mention any relevant news or announcements released around the time of the decline. Was there any negative press coverage, regulatory updates, or competitor activity that could have influenced the market's reaction?]

- Market Context: [Briefly describe the overall market conditions on Thursday. Were other tech stocks also experiencing declines? Was there a broader market sell-off impacting the CRWV stock price?]

Potential Causes Behind the CoreWeave (CRWV) Stock Decline

Factors Contributing to the CRWV Stock Dip: A Deep Dive

The Thursday decline in CRWV stock price could be attributed to a combination of macro-economic factors and company-specific issues. Understanding these factors is crucial to assessing the long-term implications for investors.

- Macroeconomic Factors: Rising interest rates, concerns about inflation, and a general downturn in the broader tech market could have all played a role in the CRWV stock dip. Broader market sentiment often impacts even strong performers.

- Company-Specific Factors: [Analyze CoreWeave's recent financial performance, partnerships, or any potential internal issues. Mention any upcoming earnings reports that might be creating uncertainty in the market. For instance: "Concerns about CoreWeave's upcoming Q[Quarter] earnings report, particularly regarding [mention specific financial metric, e.g., revenue growth, profitability], might have contributed to investor anxiety."]

- Competitive Pressures: The cloud computing market is highly competitive. Analysis of competitors' activities and market share is essential. [Discuss any actions by competitors that might have negatively impacted CoreWeave's perceived market position.]

- Short Selling Activity: [Explore the possibility of increased short-selling activity putting downward pressure on the CRWV stock price. Data on short interest could provide valuable insights.]

Future Implications for CoreWeave (CRWV) Stock Investors

CRWV Stock Outlook: Long-Term Potential and Investment Strategies

Despite the Thursday dip, CoreWeave operates in a rapidly growing sector – cloud computing. This presents both risks and opportunities for investors.

-

Long-Term Prospects: CoreWeave's long-term prospects depend on its ability to maintain its competitive edge in the cloud computing market, innovate its technology, and secure strategic partnerships.

-

Recovery Scenarios: A price rebound could be triggered by positive earnings reports, new strategic partnerships, or a general improvement in the broader market sentiment.

-

Risk Assessment: Investing in CRWV involves inherent risks. These include the volatility of the tech sector, competition from established players, and the potential for unforeseen challenges.

-

Investment Strategies:

- Buy the Dip: Aggressive investors might see this as a buying opportunity.

- Wait and See: A more cautious approach would involve monitoring the situation and making a decision based on further information.

- Sell: Investors concerned about further declines might consider selling their shares.

The choice of strategy depends entirely on individual risk tolerance and investment goals.

Conclusion: Understanding CoreWeave (CRWV) Stock's Trajectory

The Thursday dip in CoreWeave (CRWV) stock price was likely a result of a combination of macroeconomic factors, potential company-specific concerns, and broader market sentiment. While the short-term outlook might seem uncertain, CoreWeave's position in the growing cloud computing market offers long-term potential. However, investors should carefully assess the risks involved before making any investment decisions. Understanding the CRWV stock fluctuations is crucial for informed investment decisions. Stay informed about CoreWeave's progress to make the most of this dynamic market.

Featured Posts

-

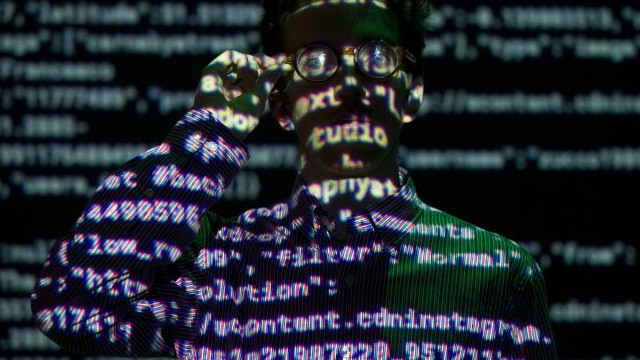

Home Depot Earnings Disappointing Results Tariff Guidance Maintained

May 22, 2025

Home Depot Earnings Disappointing Results Tariff Guidance Maintained

May 22, 2025 -

At Be X Ntt Multi Interconnect Ascii Jp

May 22, 2025

At Be X Ntt Multi Interconnect Ascii Jp

May 22, 2025 -

The World Of Gumball Gets Even Stranger A Sneak Peek

May 22, 2025

The World Of Gumball Gets Even Stranger A Sneak Peek

May 22, 2025 -

Across Australia On Foot A Britons Challenging Run

May 22, 2025

Across Australia On Foot A Britons Challenging Run

May 22, 2025 -

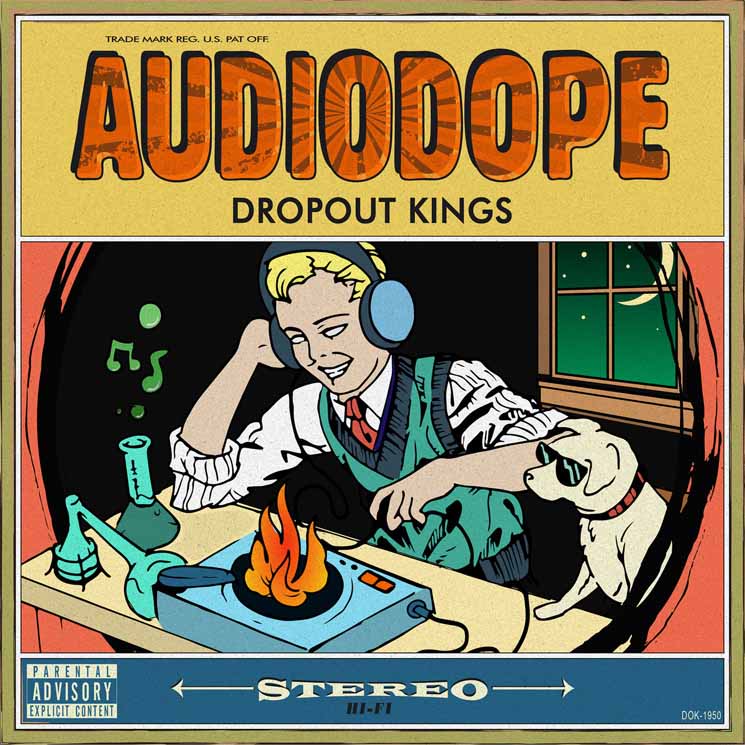

Dropout Kings Singer Adam Ramey Dead At Age

May 22, 2025

Dropout Kings Singer Adam Ramey Dead At Age

May 22, 2025