D-Wave Quantum (QBTS) Stock: Exploring The Reasons Behind The 2025 Plunge

Table of Contents

Macroeconomic Factors Contributing to the QBTS Stock Decline

Several macroeconomic factors likely contributed to the decline in QBTS stock in 2025. The interplay of these forces created a perfect storm, negatively impacting even the most promising tech companies.

Global Economic Recession

- Reduced Investor Risk Appetite: A global recession in 2025 would have significantly reduced investor risk tolerance. Investors, seeking safer havens for their capital, would have likely moved away from high-growth, high-risk investments like QBTS stock.

- Decreased Venture Capital Funding: Venture capital, a crucial funding source for many quantum computing startups, typically dries up during economic downturns. This reduced funding would have hampered D-Wave's growth and expansion plans.

- Market Correction Affecting Growth Stocks: Recessions often lead to market corrections, disproportionately affecting growth stocks like QBTS. These stocks, often valued based on future potential rather than current earnings, are particularly vulnerable during periods of economic uncertainty.

The inherent volatility associated with a company operating in a nascent industry like quantum computing makes it particularly susceptible to macroeconomic headwinds. A global recession would exacerbate the already present risks, leading to a significant devaluation.

Interest Rate Hikes and Inflation

- Increased Borrowing Costs for D-Wave: Rising interest rates increase borrowing costs for companies like D-Wave, making it more expensive to fund research and development, expansion, and operational expenses.

- Decreased Investor Confidence in Growth Stocks: High inflation erodes purchasing power and often leads to increased interest rates. This combination negatively impacts investor confidence in growth stocks, which are typically valued based on projected future earnings that become less certain in inflationary environments.

- Shift Towards Safer Investments: During periods of high inflation and rising interest rates, investors tend to shift their portfolios towards safer, more stable investments like government bonds or blue-chip stocks, further impacting the demand for riskier assets such as QBTS stock.

Higher interest rates directly impact the present value of future earnings, a key metric in valuing growth stocks like those in the quantum computing sector. The discounted cash flow models used by investors would show a lower valuation for D-Wave, contributing to the stock price decline.

Technological Challenges and Competitive Landscape

Beyond macroeconomic factors, D-Wave faced internal technological hurdles and external competitive pressures that likely impacted its stock performance.

Slower-Than-Expected Technological Advancements

- Difficulties in Scaling Quantum Computers: Scaling quantum computers to a commercially viable size remains a significant challenge. D-Wave might have encountered difficulties in overcoming these scaling limitations by 2025.

- Challenges in Developing Commercially Viable Quantum Algorithms: Developing practical quantum algorithms that can solve real-world problems efficiently is another major hurdle. A lack of progress in this area could have dampened investor enthusiasm.

- Competition from Other Quantum Computing Companies: The quantum computing field is becoming increasingly competitive, with numerous companies vying for market share. The emergence of superior technologies or more commercially successful approaches from competitors would naturally impact D-Wave's market position.

The failure to meet ambitious technological milestones could have resulted in a significant loss of investor confidence, negatively affecting the QBTS stock price.

Increased Competition in the Quantum Computing Market

- Emergence of New Technologies and Competitors: The quantum computing market is dynamic, with new technologies and competitors emerging constantly. Innovations from rivals could have rendered D-Wave's technology less attractive.

- Advancements in Rival Companies' Quantum Computing Systems: Competitors might have made significant breakthroughs in areas where D-Wave lagged, further eroding its competitive advantage.

- Price Wars in the Quantum Computing Market: Intense competition could have triggered price wars, squeezing D-Wave's profit margins and reducing its overall valuation.

The competitive landscape played a crucial role. The presence of stronger competitors with potentially more advanced technologies and better market positioning significantly impacted D-Wave's prospects and investor confidence.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation also played a crucial role in the QBTS stock price crash.

Overvalued Initial Public Offering (IPO)

- High Expectations Leading to Inflated Stock Price: The initial public offering (IPO) might have been oversubscribed, leading to an inflated stock price based on unrealistic expectations.

- Speculative Investment Driving Up the Initial Price: Speculative investment, driven by hype surrounding quantum computing, might have artificially inflated the initial stock price.

- Market Correction Due to Overvaluation: A subsequent market correction, adjusting the stock price to reflect its true value, could have caused a significant drop.

An overvalued IPO often sets the stage for a subsequent correction. The initial euphoria surrounding the IPO may have masked underlying vulnerabilities, leading to a sharp price decline once reality set in.

Negative News and Market Rumors

- Negative Press Coverage: Negative press coverage regarding D-Wave's technological progress or financial health could have triggered a sell-off.

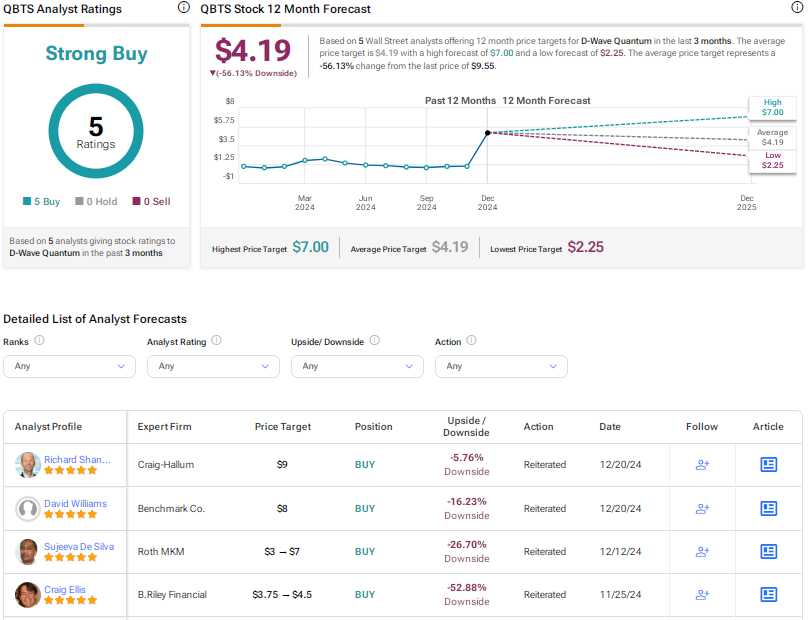

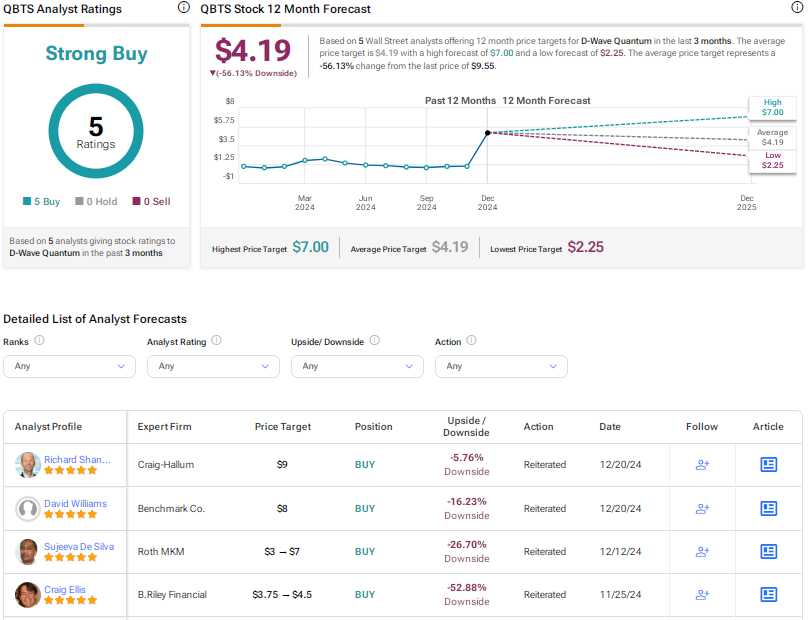

- Analyst Downgrades: Negative analyst reports or downgrades could have further fueled investor anxieties and contributed to the price decline.

- Rumors Regarding D-Wave's Financial Health: Rumors, whether true or false, can significantly impact investor sentiment and trigger sell-offs.

Negative news, even if unfounded, can severely damage investor confidence and lead to significant stock price drops.

Conclusion

The 2025 plunge in D-Wave Quantum (QBTS) stock was likely a result of a confluence of factors: macroeconomic headwinds, technological challenges, intense competition, and possibly overinflated initial expectations. Understanding these interconnected elements is vital for navigating the risks and opportunities within the quantum computing investment landscape. While the QBTS stock price crash serves as a cautionary tale, the long-term potential of quantum computing remains significant. Further research into the factors affecting D-Wave and other quantum computing stocks is crucial before making any investment decisions in this volatile yet promising sector. Stay informed about the future of D-Wave Quantum (QBTS) stock and other quantum computing investments to navigate this evolving market effectively.

Featured Posts

-

Zoey Stark Out After Wwe Raw Injury

May 20, 2025

Zoey Stark Out After Wwe Raw Injury

May 20, 2025 -

M Night Shyamalans The Village A Study In Christie Esque Suspense

May 20, 2025

M Night Shyamalans The Village A Study In Christie Esque Suspense

May 20, 2025 -

Thqyq Fy Mkhalfat Dywan Almhasbt Mwqf Alnwab 2022 2023

May 20, 2025

Thqyq Fy Mkhalfat Dywan Almhasbt Mwqf Alnwab 2022 2023

May 20, 2025 -

Hmrc Tax Codes Understanding Your New Savings Allowance

May 20, 2025

Hmrc Tax Codes Understanding Your New Savings Allowance

May 20, 2025 -

Asheville Rising Good Morning Americas Ginger Zees Wlos Visit

May 20, 2025

Asheville Rising Good Morning Americas Ginger Zees Wlos Visit

May 20, 2025