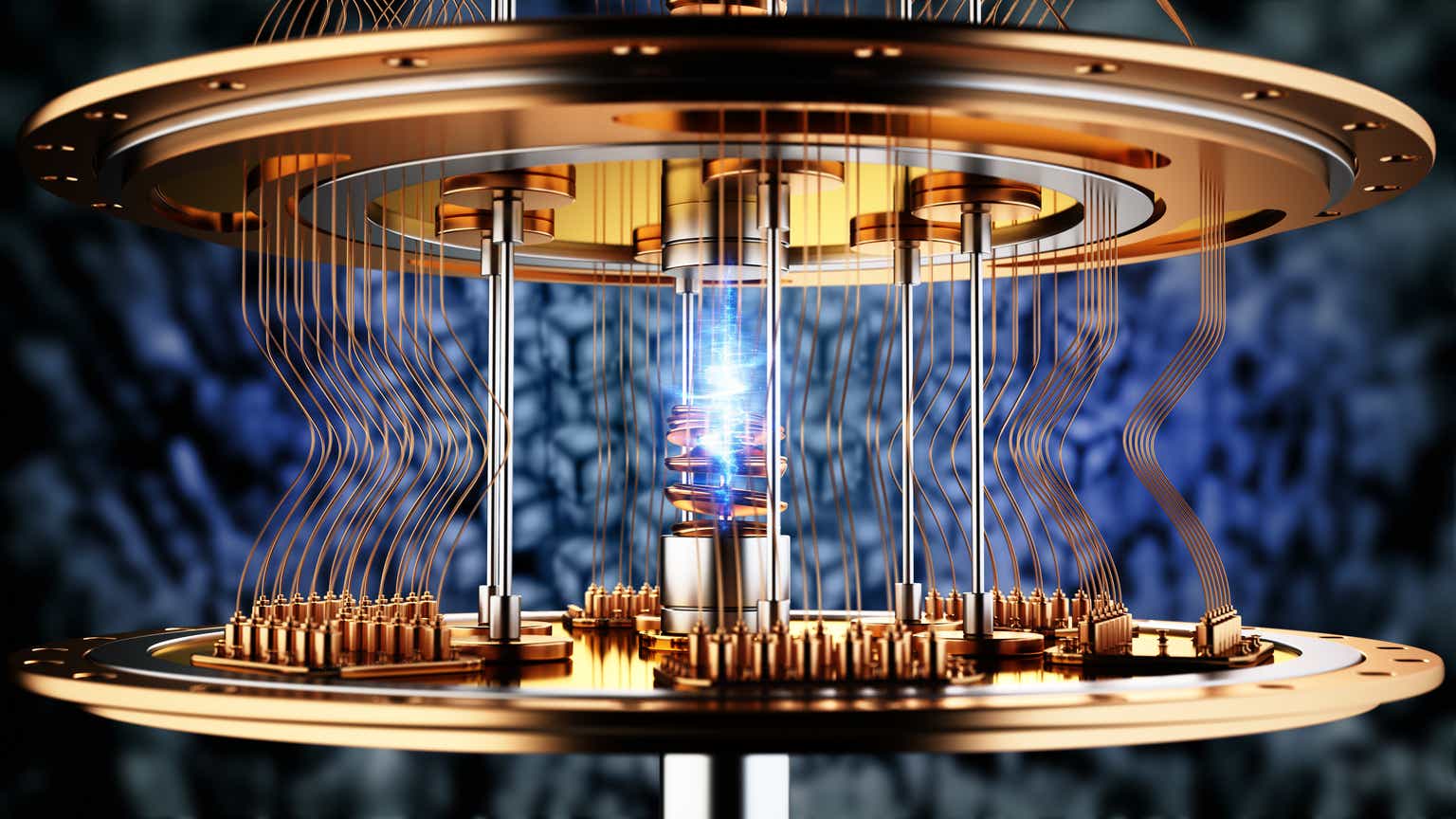

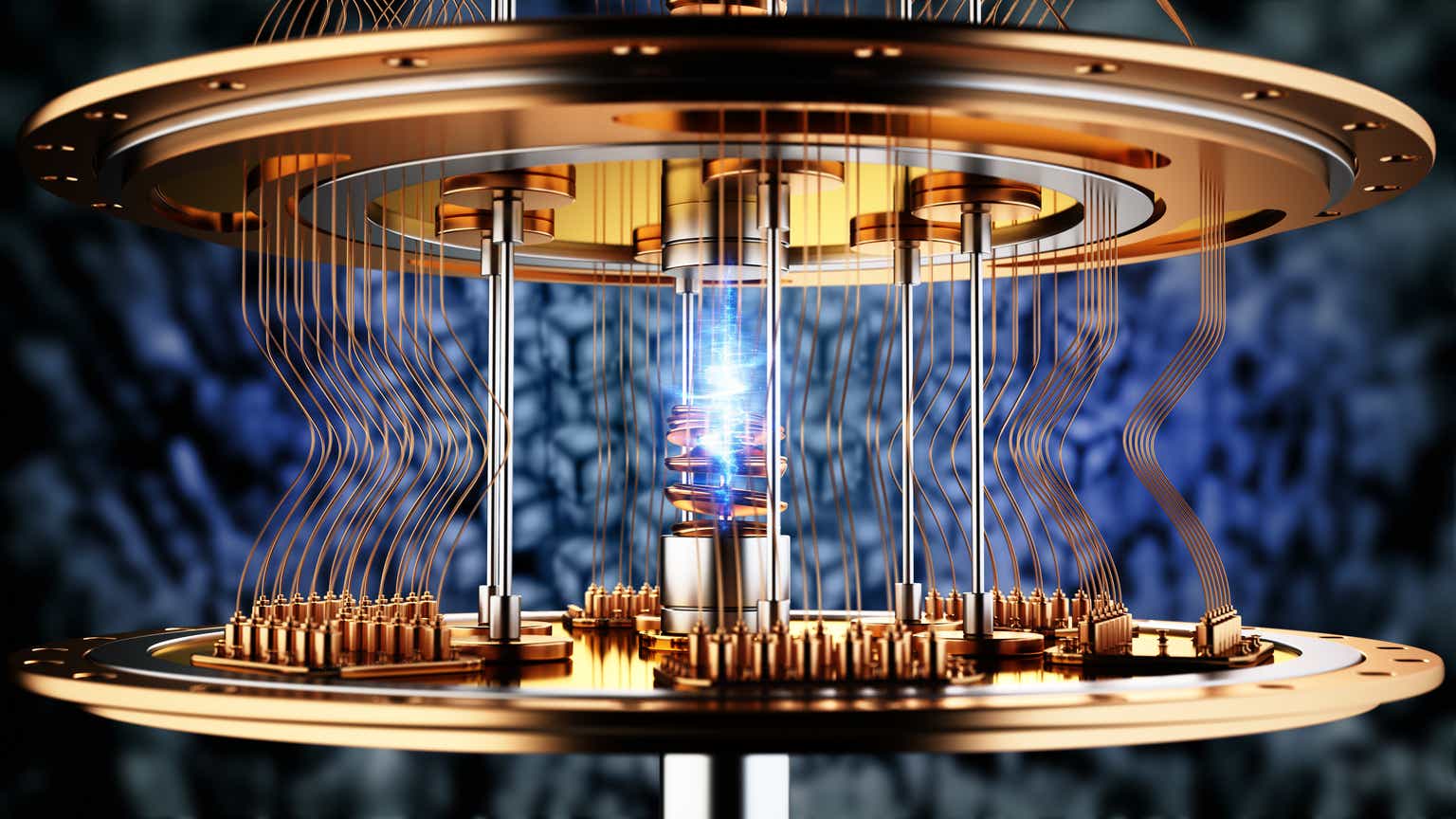

D-Wave Quantum (QBTS) Stock's Monday Fall: Causes And Implications

Table of Contents

Market Sentiment and the Broader Tech Sector

Monday's market conditions played a role in QBTS's fall. A general sell-off in the technology sector impacted many tech stocks, including those in the emerging quantum computing field. This broader market weakness created a negative environment, exacerbating the decline in D-Wave's stock price.

- Negative Trends in Tech: A prevailing sense of caution amongst investors, fueled by macroeconomic concerns, contributed to the overall tech downturn. Increased interest rates and persistent inflation anxieties often lead to risk aversion, impacting growth stocks like QBTS.

- Interest Rate Hikes and Inflation: The Federal Reserve's monetary policy, aimed at curbing inflation, impacts investor confidence and can trigger a sell-off in high-growth, speculative sectors, including quantum computing. Higher interest rates make borrowing more expensive for companies, slowing growth and potentially impacting future investment in D-Wave and similar companies.

- Correlation with Other Tech Stocks: The correlation between QBTS and other quantum computing stocks, as well as broader technology indices like the Nasdaq Composite, needs to be analyzed. A general negative trend in these correlated assets suggests that the QBTS fall was partly due to a sector-wide pullback rather than solely company-specific issues.

Company-Specific News and Developments

While broader market forces played a role, company-specific news might have also contributed to the D-Wave Quantum (QBTS) stock price drop. Analyzing any press releases, announcements, or earnings reports from around that time is crucial.

- Press Releases and Announcements: Any negative news related to D-Wave's technology development, partnerships, or financial performance could have triggered selling pressure. Investors react swiftly to any perceived setbacks in the company's progress.

- Technological Setbacks or Partnership Issues: Potential delays in the development of new quantum computing technologies or challenges in securing crucial partnerships could have negatively impacted investor confidence in QBTS.

- Analyst Downgrades: Changes in investment ratings from financial analysts carry significant weight. A downgrade from a major analyst firm could contribute to the selling pressure observed on Monday.

Investor Sentiment and Trading Activity

Understanding investor sentiment and trading activity surrounding the stock price drop provides further insights. Analyzing trading volume and patterns helps to determine the forces at play.

- Short Selling and Institutional Selling: A significant increase in short selling activity, indicating bets against the stock's future performance, or large-scale selling by institutional investors could have amplified the downward pressure on QBTS.

- Social Media Sentiment and News Coverage: Negative sentiment expressed on social media platforms or in news articles can influence investor behavior and contribute to a sell-off. Analyzing the prevailing narrative around D-Wave Quantum (QBTS) in the days leading up to and following the decline is vital.

- Algorithmic Trading and Market Manipulation: While less likely to be a primary driver, algorithmic trading and potential market manipulation should also be considered as possible contributing factors to the volatility observed in QBTS's price.

Long-Term Implications for D-Wave Quantum (QBTS) Investors

The Monday fall raises questions about the long-term prospects for D-Wave Quantum (QBTS) investors. A comprehensive assessment is needed to determine the appropriate investment strategy.

- Financial Health and Growth Potential: Analyzing D-Wave's financial health, including its cash reserves, revenue streams, and projected growth, is paramount. This assessment will help investors determine the long-term viability of the company.

- Competitive Landscape: The quantum computing industry is competitive. Analyzing D-Wave's competitive position against other players in the field is crucial for evaluating its future prospects.

- Buy, Hold, or Sell: Based on the analysis of market conditions, company-specific news, and the competitive landscape, investors must determine whether to hold, buy, or sell their QBTS stock. This decision requires careful consideration of risk tolerance and investment goals.

Conclusion

The D-Wave Quantum (QBTS) stock's Monday decline resulted from a confluence of factors: a general negative market sentiment impacting the broader tech sector, potentially negative company-specific news, and investor behavior. The long-term implications for investors require careful analysis of D-Wave's financial health, competitive position, and future growth potential. Stay informed about future developments in the D-Wave Quantum (QBTS) stock and the quantum computing industry to make informed investment decisions regarding your D-Wave Quantum (QBTS) stock holdings. Continue to monitor QBTS stock performance and related news for a comprehensive understanding of this evolving market sector.

Featured Posts

-

Nadiem Amiri Profile Of A German Midfielder

May 20, 2025

Nadiem Amiri Profile Of A German Midfielder

May 20, 2025 -

El Helicoptero De Schumacher De Mallorca A Suiza Para Reunion Familiar

May 20, 2025

El Helicoptero De Schumacher De Mallorca A Suiza Para Reunion Familiar

May 20, 2025 -

Analyzing The Ftv Live Hell Of A Run A Critical Perspective

May 20, 2025

Analyzing The Ftv Live Hell Of A Run A Critical Perspective

May 20, 2025 -

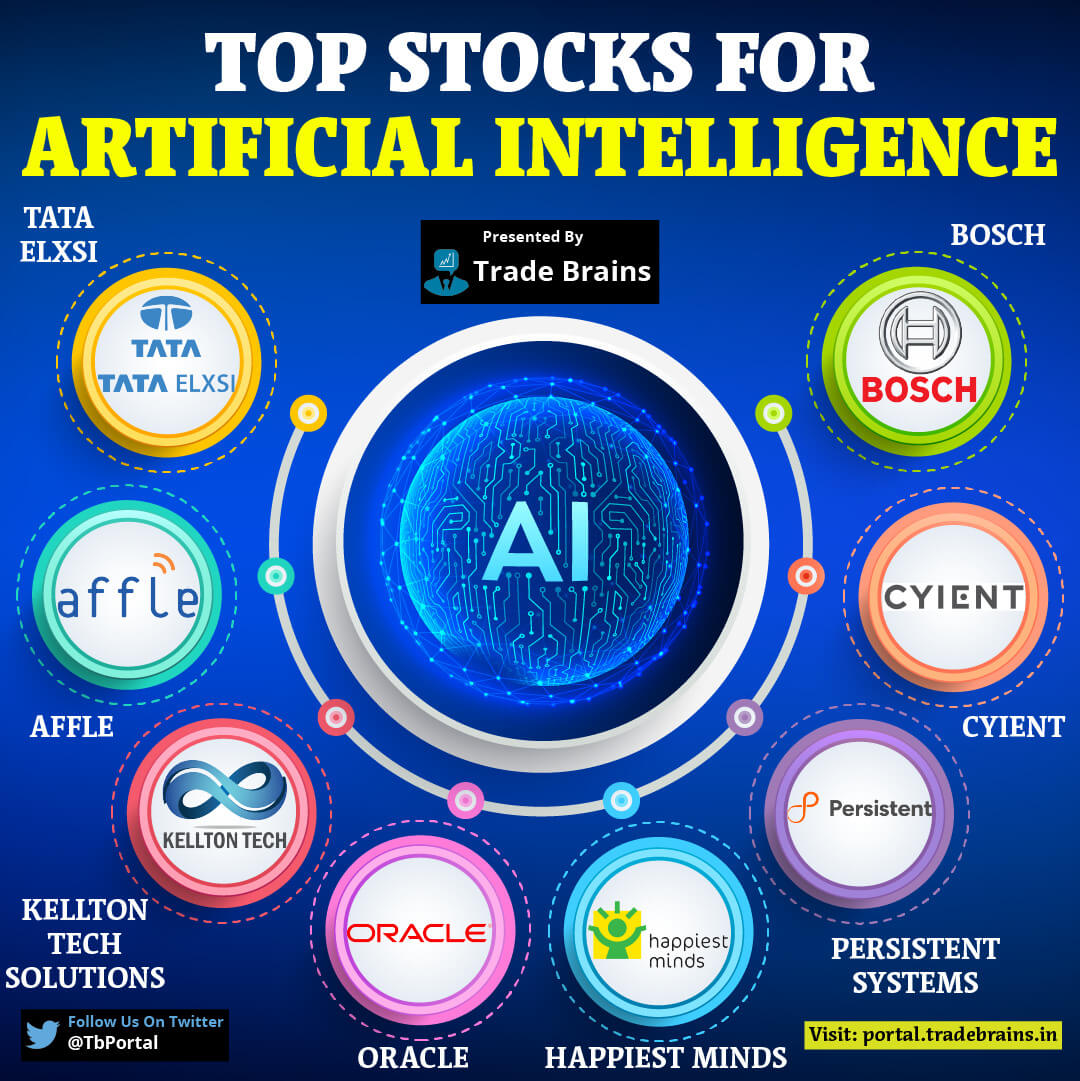

12 Promising Ai Stocks Insights From Reddit

May 20, 2025

12 Promising Ai Stocks Insights From Reddit

May 20, 2025 -

Prima Nepoata A Lui Michael Schumacher Gina Schumacher A Devenit Mama

May 20, 2025

Prima Nepoata A Lui Michael Schumacher Gina Schumacher A Devenit Mama

May 20, 2025