DAX Rally: Assessing The Risk Of A Wall Street-Driven Market Correction

Table of Contents

The Current State of the DAX Rally

The DAX has seen impressive gains in recent months. This rally is attributed to several factors, including a robust economic recovery in Germany, positive corporate earnings reports, and persistently low interest rates. However, this growth needs careful scrutiny.

- Recent DAX Performance Figures: The DAX has shown a [insert percentage]% increase over the past [insert timeframe, e.g., three months], and a [insert percentage]% increase over the past year. These figures, while impressive, don't tell the whole story.

- Key Sectors Driving the Rally: The technology and automotive sectors have been significant contributors to the DAX's recent gains, reflecting positive global trends and strong domestic demand.

- Influence of Global Economic Factors: Global economic growth, particularly in key trading partners like China and the US, plays a vital role in the DAX's performance. Positive global economic indicators typically support the rally, while negative news can lead to volatility.

- Analysis of Investor Sentiment and Trading Volume: Increased investor confidence and high trading volume often accompany a market rally. However, these indicators can also signal overbought conditions, potentially preceding a correction.

Wall Street's Influence on the DAX

The US and German economies are deeply intertwined, making the American stock market a significant influencer on the DAX. Events in the US, particularly those impacting major US indices, can quickly ripple across the Atlantic.

- Impact of US Interest Rate Hikes on the DAX: Interest rate hikes by the Federal Reserve often lead to a strengthening US dollar, impacting German exports and potentially cooling the DAX rally.

- Correlation between the Performance of the DAX and Major US Indices: A strong positive correlation exists between the DAX and indices like the S&P 500 and the Dow Jones. A downturn on Wall Street frequently foreshadows a similar trend in the DAX.

- Analysis of Cross-border Investment Flows between the US and Germany: Significant cross-border investment flows exist between the US and Germany. A shift in investor sentiment in the US can quickly impact capital flows to and from Germany, affecting the DAX.

- Effect of US Geopolitical Events on German Investor Confidence: Geopolitical events originating in the US, or impacting US interests globally (e.g., US-China relations), can negatively affect investor confidence and trigger a DAX correction.

Identifying Potential Risks of a Correction

While the DAX rally is impressive, several factors point to the potential for a market correction, particularly if triggered by events on Wall Street.

- Valuation Concerns within the DAX: High Price-to-Earnings (P/E) ratios for certain DAX companies could indicate overvaluation, making them vulnerable to a correction.

- Rising Inflation and its Impact on Corporate Profitability: Persistent inflation erodes corporate profitability and can lead to reduced investment and a subsequent market downturn.

- Geopolitical Uncertainties: Ongoing geopolitical uncertainties, such as the war in Ukraine and escalating tensions between the US and China, contribute to market volatility and increase the risk of a correction.

- Potential for a US Recession and its Ripple Effect on the German Economy: A US recession would likely negatively impact the German economy, potentially triggering a significant DAX correction.

Technical Analysis Indicators Suggesting a Correction

Technical analysis provides further insights into potential corrections. Several indicators might signal an upcoming downturn.

- Explanation of Relevant Technical Indicators (RSI, MACD, etc.): The Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and other technical indicators can signal overbought conditions or bearish divergences, suggesting a potential market correction.

- Interpretation of Charts and Graphs to Support the Analysis: Chart patterns, such as head and shoulders formations or descending triangles, can also provide valuable insights into potential market corrections.

- Comparison of Current Indicator Readings with Historical Data: Comparing current indicator readings with historical data helps assess the significance of the signals and the probability of a correction.

Strategies for Managing Risk During a DAX Rally

Managing risk is crucial during periods of market optimism. Investors should employ strategies to protect their portfolios from potential downturns.

- Diversification Strategies to Reduce Portfolio Risk: Diversification across different asset classes (stocks, bonds, real estate) and geographical regions reduces the impact of a DAX correction on the overall portfolio.

- Importance of Risk Assessment and Tolerance: Understanding your own risk tolerance is essential. Investors with lower risk tolerance should consider a more conservative investment approach.

- Hedging Techniques to Protect Against Market Downturns: Hedging strategies, such as using put options or short selling, can help protect against losses during a market correction.

- The Benefits of a Long-Term Investment Approach: A long-term investment strategy allows investors to ride out short-term market fluctuations and benefit from long-term growth.

Conclusion

The DAX rally presents both opportunities and risks. While positive economic indicators and corporate earnings have fueled the recent gains, the strong correlation between the DAX and Wall Street, coupled with potential triggers like inflation, geopolitical risks, and valuation concerns, highlights the potential for a market correction. Understanding these risks, monitoring key economic indicators, and employing appropriate risk management strategies are vital. Stay informed about the DAX and the broader global economic landscape. Continuously monitor economic indicators, geopolitical events, and technical analysis to make informed investment decisions regarding your DAX investments. Properly assessing the risk associated with the DAX rally is crucial for successful long-term investment strategies.

Featured Posts

-

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berpadu

May 24, 2025

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berpadu

May 24, 2025 -

Serious Crash On M56 Motorway Closure And Live Traffic Information

May 24, 2025

Serious Crash On M56 Motorway Closure And Live Traffic Information

May 24, 2025 -

Yevrobachennya Scho Stalosya Z Peremozhtsyami Za Ostanni 10 Rokiv

May 24, 2025

Yevrobachennya Scho Stalosya Z Peremozhtsyami Za Ostanni 10 Rokiv

May 24, 2025 -

Lewis Hamiltons Comments Draw Sharp Criticism From Ferrari

May 24, 2025

Lewis Hamiltons Comments Draw Sharp Criticism From Ferrari

May 24, 2025 -

Realizing Your Dream An Escape To The Country

May 24, 2025

Realizing Your Dream An Escape To The Country

May 24, 2025

Latest Posts

-

Gucci Faces Supply Chain Leadership Change With Vians Departure

May 24, 2025

Gucci Faces Supply Chain Leadership Change With Vians Departure

May 24, 2025 -

Massimo Vian Leaves Gucci Impact On Industrial Operations

May 24, 2025

Massimo Vian Leaves Gucci Impact On Industrial Operations

May 24, 2025 -

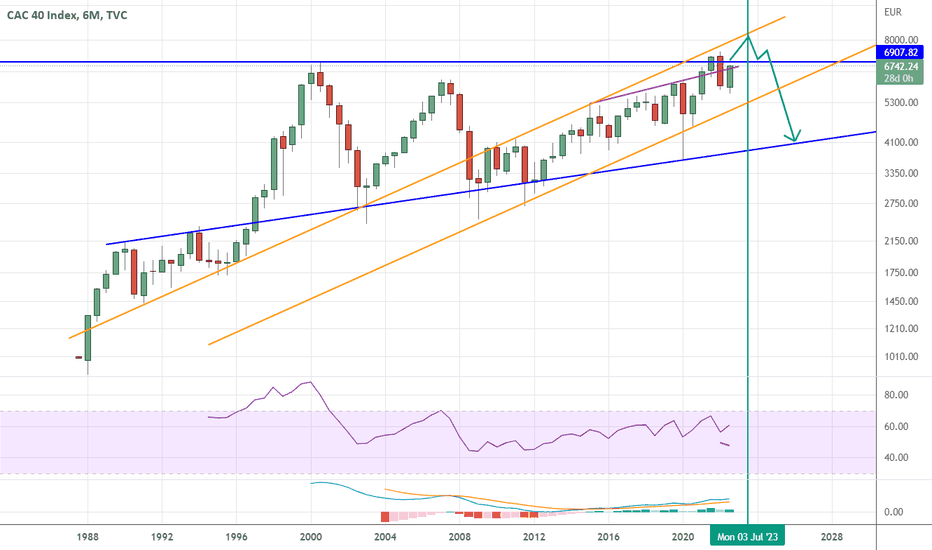

French Cac 40 Index Mixed Performance For The Week Ending March 7 2025

May 24, 2025

French Cac 40 Index Mixed Performance For The Week Ending March 7 2025

May 24, 2025 -

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025 -

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 24, 2025

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 24, 2025