Delinquent Student Loans: The Government's Aggressive Enforcement Actions

Table of Contents

Wage Garnishment and Tax Refund Offset

The government employs several powerful methods to collect on delinquent student loan debt. Two of the most impactful are wage garnishment and tax refund offset.

Wage Garnishment

The government can garnish up to 15% of your disposable earnings to repay your delinquent student loans. This means a significant portion of your paycheck will be directly sent to the Department of Education, drastically impacting your monthly budget and overall financial stability.

- The Process: Wage garnishment begins with a notice from the Department of Education or a collection agency. This notice outlines the amount owed and the garnishment plan. Your employer is then legally obligated to deduct the specified amount from your paycheck.

- Exceptions and Limitations: While the maximum garnishment is 15%, the actual amount can vary based on your disposable income (income after essential expenses are considered). There are limited exceptions, usually granted only in cases of extreme financial hardship, which require substantial documentation.

- Government Resources: The Federal Student Aid website (studentaid.gov) provides detailed information on wage garnishment procedures and potential exemptions. You can find more information through the Department of Education's website as well.

Tax Refund Offset

Another aggressive tactic is the tax refund offset. The IRS can intercept your federal tax refund and apply the entire amount, or a portion of it, towards your delinquent student loan debt. This means you receive no refund, potentially exacerbating your financial challenges.

- How it Works: The Department of Education provides the IRS with a list of borrowers with delinquent student loans. The IRS then automatically offsets the refund before it's issued to you.

- Penalties and Interest: It's important to note that delinquent student loans accrue interest and potentially late payment penalties, which can significantly increase the total amount owed. This larger debt will be applied to your tax refund if applicable.

- Preventing Future Offsets: The best way to prevent tax refund offset is to actively manage your student loan debt and avoid delinquency. Contact your loan servicer to explore repayment options if you anticipate difficulties.

Credit Bureau Reporting and its Impact

Delinquent student loans have serious and long-lasting consequences beyond direct financial repercussions. They significantly impact your creditworthiness and financial future.

Negative Credit Impact

A delinquent student loan will severely damage your credit score. This negative mark remains on your credit report for seven years, making it extremely difficult to obtain credit in the future.

- Credit Score Impact: A delinquent loan will significantly lower your credit score, potentially making it impossible to qualify for mortgages, auto loans, credit cards, or even renting an apartment.

- Long-Term Consequences: Poor credit can negatively affect many aspects of your life, from higher interest rates on loans to difficulty securing employment in some industries.

- Improving Credit Scores: While the negative impact of a delinquent loan will remain on your credit report for seven years, actively managing your finances and making on-time payments on other accounts can help improve your credit score over time.

Collection Agencies

The Department of Education often works with private collection agencies to pursue delinquent student loans. These agencies can employ aggressive collection tactics, increasing the stress and complexity of an already challenging situation.

- Aggressive Collection Tactics: Collection agencies may use phone calls, letters, and even email to demand payment. They may also try to negotiate payment plans or threaten legal action.

- Your Rights: Remember that you have rights when dealing with collection agencies. They are bound by the Fair Debt Collection Practices Act, which protects you from abusive and harassing behavior.

- Handling Abusive Practices: If you experience abusive collection practices, document every interaction, and report them to the Consumer Financial Protection Bureau (CFPB).

Legal Action and Potential Lawsuits

In cases of significant delinquency, the government can take legal action to recover the debt.

Lawsuits and Wage Garnishment

The Department of Education can file lawsuits against borrowers with significant delinquent student loans. A lawsuit can result in a court order for wage garnishment, bank levies, and other legal actions.

- Legal Process: The Department of Education will notify you of the lawsuit. Failing to respond can lead to a default judgment, making it harder to challenge the debt later.

- Consequences of Ignoring Legal Action: Ignoring legal action can lead to more severe consequences, including the seizure of assets and additional legal fees.

- Legal Aid and Representation: If you are facing a lawsuit, it's crucial to seek legal counsel. Legal aid organizations or attorneys specializing in student loan debt can provide guidance and representation.

Bank Levies and Property Seizures

In extreme cases, the government can levy your bank accounts and even seize your property to recover delinquent student loan debt.

- How it Works: A court order allows the government to access your bank accounts and seize funds to cover the debt. In rare instances, property can also be seized and sold to recover the debt.

- Circumstances: These extreme actions are typically only taken after other collection methods have failed and significant debt remains outstanding.

- Protecting Your Assets: Understanding your rights and exploring all available repayment options before reaching this stage is crucial to protect your assets.

Available Options for Delinquent Borrowers

While the consequences of delinquent student loans are serious, there are options available to borrowers facing financial hardship.

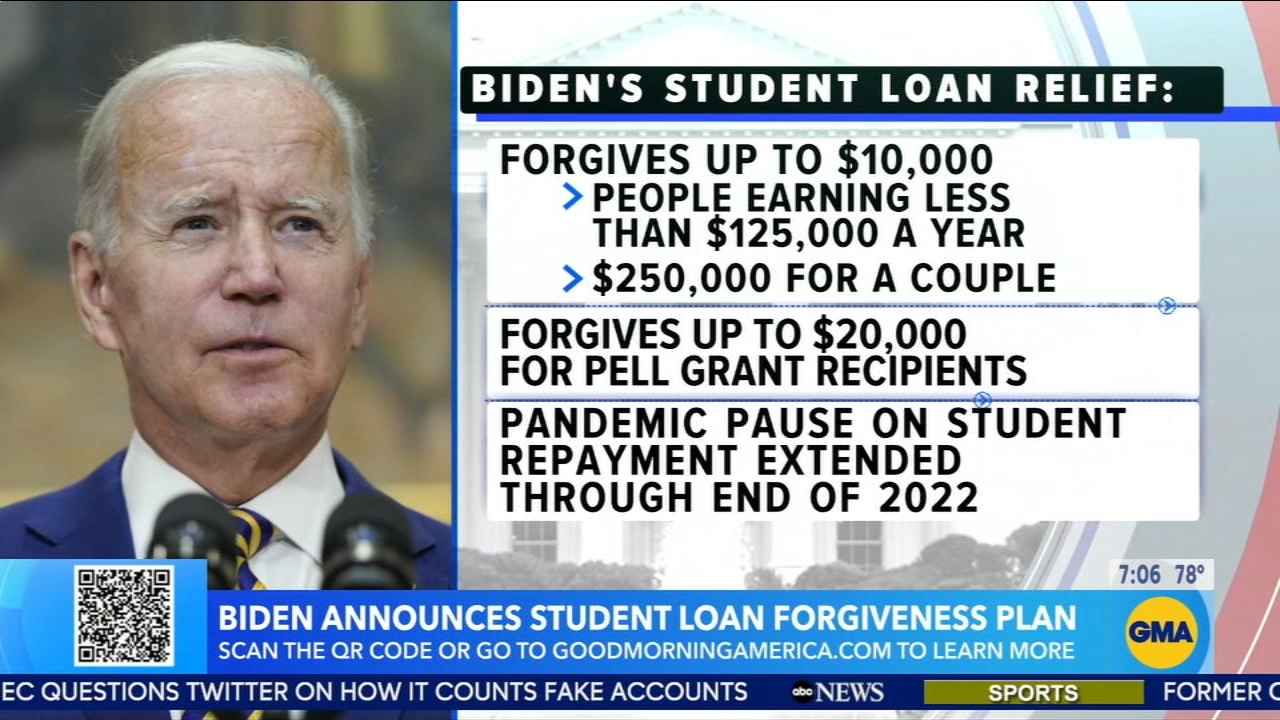

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans can significantly lower your monthly payments and prevent delinquency.

- IDR Plans: Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

- Eligibility Requirements: Eligibility requirements vary depending on the plan. You'll typically need to demonstrate financial need.

- Government Websites: The Federal Student Aid website (studentaid.gov) provides detailed information on each plan and the application process.

Deferment and Forbearance

Deferment and forbearance offer temporary relief from student loan payments. However, interest may still accrue during deferment, except for certain types of federal loans.

- Deferment vs. Forbearance: Deferment is a postponement of payments usually granted due to specific circumstances (e.g., unemployment or enrollment in school). Forbearance is a temporary suspension or reduction of payments.

- Eligibility Criteria: Eligibility criteria vary depending on your loan type and circumstances.

- Applying for Deferment/Forbearance: You typically apply for deferment or forbearance through your loan servicer.

Loan Consolidation

Consolidating your student loans into a single loan can simplify payments and potentially lower your monthly payment, though this depends on the interest rate of the new consolidated loan.

- Benefits and Drawbacks: Consolidation can simplify your repayment process but may not always result in a lower monthly payment, especially if a higher interest rate is applied to the consolidated loan.

- Consolidation Process: You apply for loan consolidation through the Department of Education's website.

- Choosing the Right Plan: Carefully compare different consolidation options to determine the best approach for your specific situation.

Conclusion

The government's aggressive pursuit of delinquent student loan debt is a serious matter. Understanding the potential consequences—from wage garnishment and tax refund offsets to legal action—is critical for borrowers. However, there are options available. By exploring income-driven repayment plans, deferment, forbearance, and loan consolidation, borrowers can take proactive steps to manage their debt and avoid the severe consequences of delinquency. Don't let delinquent student loans control your financial future; take action today to explore your options and regain control of your finances. Learn more about managing your delinquent student loans and explore your repayment options now.

Featured Posts

-

Protect Your Credit Score Manage Your Student Loan Debt Effectively

May 17, 2025

Protect Your Credit Score Manage Your Student Loan Debt Effectively

May 17, 2025 -

Knicks Season Outlook Jalen Brunsons Status Tyler Koleks Development And Key Upcoming Matches

May 17, 2025

Knicks Season Outlook Jalen Brunsons Status Tyler Koleks Development And Key Upcoming Matches

May 17, 2025 -

The Eminem Effect Reviving Detroits Wnba Hopes

May 17, 2025

The Eminem Effect Reviving Detroits Wnba Hopes

May 17, 2025 -

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025 -

Finding The Best Stake Casino Alternatives A 2025 Guide To Replacements

May 17, 2025

Finding The Best Stake Casino Alternatives A 2025 Guide To Replacements

May 17, 2025