Detailed Breakdown: The House GOP's Trump Tax Cut Plan

Table of Contents

Key Provisions of the House GOP Trump Tax Cut Plan

The core tenets of the proposed House GOP Trump Tax Cut Plan centered around substantial reductions in both individual and corporate income tax rates. The plan aimed to stimulate economic growth through these tax cuts, arguing that lower rates would incentivize investment and job creation.

-

Individual Income Tax Rate Reductions: The plan proposed significant reductions in individual income tax rates. While specific rates varied depending on the version of the plan, general reductions across all brackets were envisioned. For example, some proposals suggested lowering the top individual income tax rate from 37% to a significantly lower percentage.

-

Corporate Tax Rate Reductions: A key component was a dramatic reduction in the corporate tax rate. Proposals often suggested lowering the rate from the then-existing 21% to an even lower percentage, aiming to make the U.S. more competitive globally and attract investment.

-

Changes to Deductions and Credits: The plan also included adjustments to various deductions and credits. These changes often involved modifications to the standard deduction, itemized deductions, and the child tax credit. Some proposals aimed to simplify the tax code by limiting or eliminating certain itemized deductions. The child tax credit may have seen increases, though the specifics varied across different proposals.

-

Impact on Capital Gains Taxes: The plan likely included provisions affecting capital gains taxes, potentially lowering rates or making certain capital gains less subject to taxation. The aim here would be to further incentivize investment and economic activity.

-

Proposed Changes to Estate and Gift Taxes: Finally, the plan may have contained provisions related to estate and gift taxes, potentially increasing exemption levels or making other changes that would benefit wealthier individuals and families.

Economic Impact of the House GOP Trump Tax Cut Plan

The projected economic effects of the House GOP Trump Tax Cut Plan were a subject of significant debate. Proponents argued the tax cuts would boost economic growth through increased investment and consumer spending, leading to job creation. Opponents, however, expressed concern about the potential for increased national debt and rising income inequality.

-

Projected GDP Growth: Supporters cited projections of increased GDP growth, although the predicted magnitude varied widely depending on the economic model used. These predictions often failed to account for potential unforeseen consequences.

-

Potential Impact on Job Creation: The plan's proponents claimed it would lead to significant job creation. However, independent analyses often yielded more modest estimations, or even projected job losses in certain sectors.

-

Estimated Impact on the National Debt: A major point of contention was the plan's projected impact on the national debt. Critics argued the tax cuts would significantly increase the deficit, placing a strain on future budgets and potentially leading to higher interest rates.

-

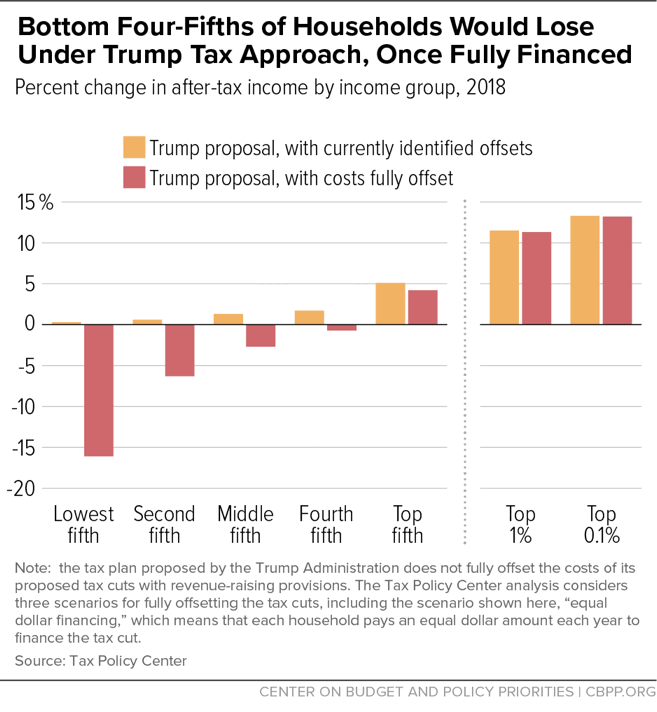

Potential Effect on Income Inequality: Concerns were raised that the tax cuts would disproportionately benefit high-income earners, exacerbating income inequality. Critics pointed to the potential for widening the gap between the wealthy and the working class.

-

Possible Inflationary Pressures: Some economists warned of potential inflationary pressures as a result of increased consumer spending and business investment fueled by the tax cuts. This could lead to a decrease in the purchasing power of the dollar.

Winners and Losers Under the House GOP Trump Tax Cut Plan

The House GOP Trump Tax Cut Plan's impact varied significantly depending on income level and economic sector.

-

Impact on High-Income Earners: High-income earners stood to benefit the most from the proposed tax cuts, particularly due to reductions in individual income tax rates and potential changes to capital gains taxes.

-

Impact on Middle-Income Earners: The impact on middle-income earners was more complex and varied significantly depending on the specific details of the plan. Some proposals offered modest benefits, while others resulted in negligible changes or even slight tax increases in specific scenarios.

-

Impact on Low-Income Earners: Low-income earners were generally expected to experience minimal or no direct benefit from the tax cuts. In some instances, the elimination of certain tax credits could have even resulted in a negative impact.

-

Impact on Corporations and Businesses: Corporations and businesses would have seen substantial benefits from the proposed corporate tax rate reductions, potentially leading to increased investment and expansion. However, this benefit could be offset by reduced consumer spending if middle- and lower-income groups did not see equivalent benefits.

-

Impact on Specific Sectors of the Economy: The impact varied across different economic sectors. Some sectors, like manufacturing, could have benefited from increased investment, while others might have experienced minimal change or even negative effects due to indirect consequences of the overall plan.

Political Implications of the House GOP Trump Tax Cut Plan

The House GOP Trump Tax Cut Plan generated significant political debate and controversy.

-

Public Opinion Polls and Reactions: Public opinion polls showed a mixed response to the plan, with varying levels of support depending on the respondent's income bracket, political affiliation, and other demographic factors.

-

Congressional Support and Opposition: The plan faced significant opposition from Democrats and some Republicans, leading to lengthy debates and negotiations in Congress. The political divisions surrounding the plan were deep and reflected existing partisan divides.

-

Potential Impact on Upcoming Elections: The plan's impact on public perception and voter turnout played a significant role in subsequent elections, influencing campaigns and contributing to broader political discussions.

-

Comparison with Previous Tax Legislation: This plan drew comparisons to previous tax cuts enacted under Republican and Democratic administrations, sparking debates about the long-term effectiveness and consequences of such policies, both economically and socially.

Comparison with Previous Tax Legislation

The House GOP Trump Tax Cut Plan shared some similarities with previous tax cuts, such as the Reagan-era tax cuts and the 2001 Bush tax cuts, all emphasizing lower rates to stimulate economic growth. However, the specific provisions and the projected economic impact differed significantly depending on the economic climate and political context. Crucially, differences in implementation details and the scope of other government spending simultaneously enacted meant each plan’s results varied, highlighting the limitations of straightforward historical comparisons.

Conclusion

The House GOP Trump Tax Cut Plan was a complex piece of legislation with significant potential economic and political implications. While proponents argued it would boost economic growth and create jobs, critics expressed concern about its impact on the national debt, income inequality, and potential inflationary pressures. Understanding the nuances of the House GOP Trump Tax Cut Plan is critical for informed civic engagement. Continue researching the House GOP Trump Tax Cut Plan and its related legislation to fully comprehend its implications for your financial future and the nation's economic trajectory. Stay informed about upcoming legislative developments and participate in the political process. The long-term effects of this and similar proposed tax cut plans remain a subject of ongoing debate and require continued scrutiny.

Featured Posts

-

Atalanta Venezia 0 0 Reporte Del Encuentro Sin Goles

May 13, 2025

Atalanta Venezia 0 0 Reporte Del Encuentro Sin Goles

May 13, 2025 -

Potential Unicaja Sabadell Merger Investor Reactions And Implications

May 13, 2025

Potential Unicaja Sabadell Merger Investor Reactions And Implications

May 13, 2025 -

Muzh Nadezhdy Kadyshevoy Zaschitil Syna Posle Skandala S Dolgom

May 13, 2025

Muzh Nadezhdy Kadyshevoy Zaschitil Syna Posle Skandala S Dolgom

May 13, 2025 -

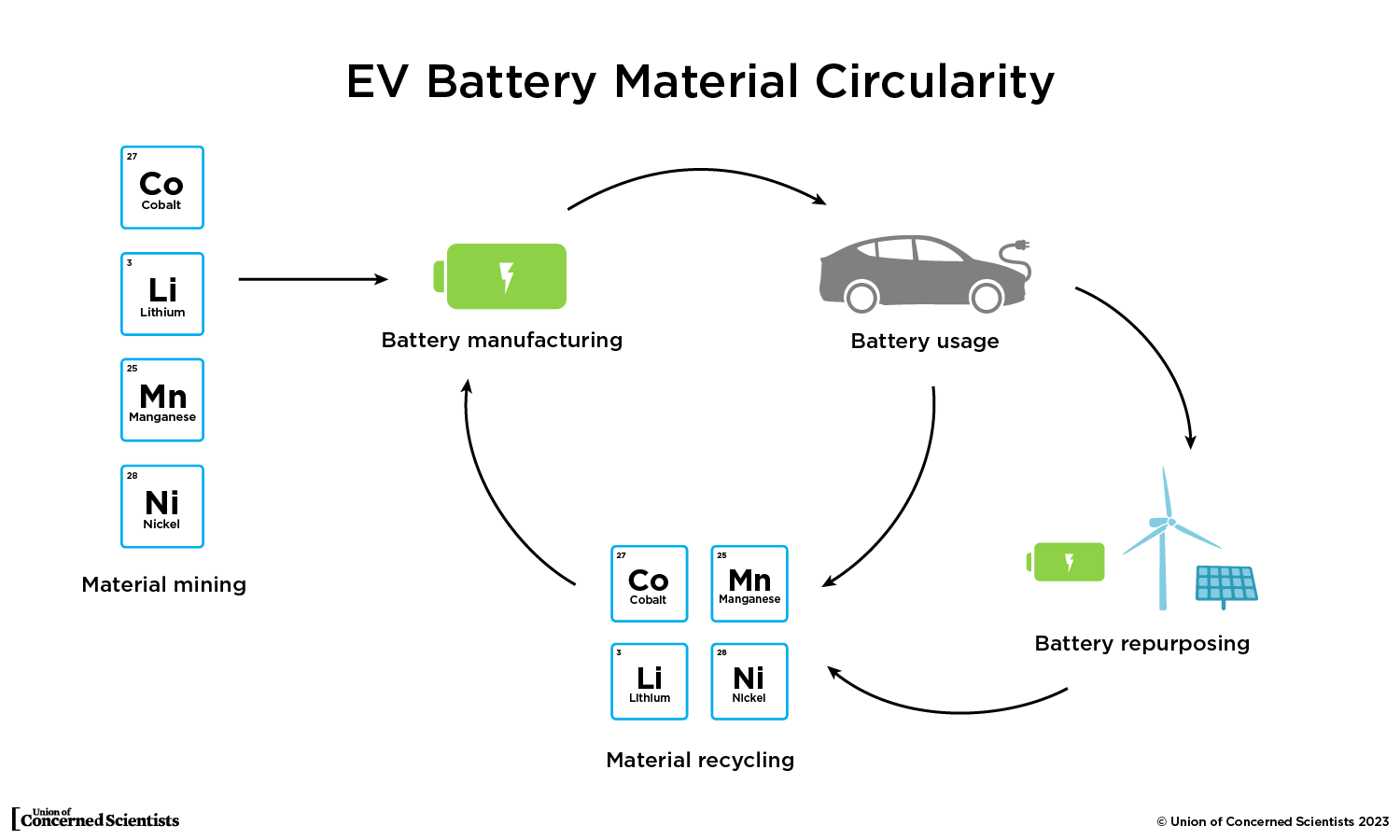

Byds Ev Battery Dominance A Case Study Addendum

May 13, 2025

Byds Ev Battery Dominance A Case Study Addendum

May 13, 2025 -

Tucows Announces New Board Nominees And Thanks Departing Directors

May 13, 2025

Tucows Announces New Board Nominees And Thanks Departing Directors

May 13, 2025