Dow Futures Rise: Positive Outlook For Today's Stock Market

Table of Contents

Analyzing the Dow Futures Increase

Dow futures are essentially contracts to buy or sell the Dow Jones Industrial Average at a specific price on a future date. They act as a powerful predictor of the overall market direction, offering a glimpse into the sentiment of institutional investors before the stock market opens. Understanding Dow futures movements is crucial for informed investment decisions.

- Numerical Data: At the time of writing, Dow futures are up 200 points, representing a 0.6% increase. This significant rise indicates strong buying pressure.

- Trading Volume: High trading volume accompanies this upward movement, suggesting considerable investor confidence and participation. This robust activity further reinforces the positive outlook.

- Economic Indicators: The recent positive employment figures and a rise in consumer confidence have fueled this optimistic market sentiment, contributing significantly to the Dow futures rise.

Factors Contributing to the Positive Outlook

Several factors are contributing to this positive market trend. The overall outlook appears bullish, although caution is always warranted.

- Positive Corporate Earnings: Strong Q2 earnings reports from major corporations across diverse sectors have boosted investor confidence. These positive results exceeded expectations in many cases.

- Strong Economic Data Releases: Recent economic indicators, including robust employment numbers and a rise in consumer spending, point towards a healthy economy. These positive data points bolster market optimism.

- Easing Geopolitical Tensions: A recent de-escalation in certain geopolitical hotspots has reduced investor uncertainty, allowing them to focus on positive economic indicators. This reduced uncertainty encourages investment.

- Positive Investor Sentiment: Overall, the prevailing investor sentiment is positive, driven by the factors mentioned above, leading to increased buying activity and pushing Dow futures higher.

Sectors Showing Strength

Certain industry sectors are displaying remarkable strength, leading the charge in today's positive market.

- Top-Performing Sectors: The technology, energy, and healthcare sectors are currently showing significant gains. This reflects investor confidence in these specific industries.

- Examples of Strong Performers: Companies like XYZ Corp (Technology), ABC Energy (Energy), and 123 Pharma (Healthcare) are experiencing significant price increases, reflecting sector strength.

- Reasons for Sector Strength: Strong earnings reports, coupled with expectations of continued growth, are driving the success of these specific sectors.

Potential Risks and Cautions

While the current market outlook appears positive, it's crucial to acknowledge potential risks and maintain a balanced perspective.

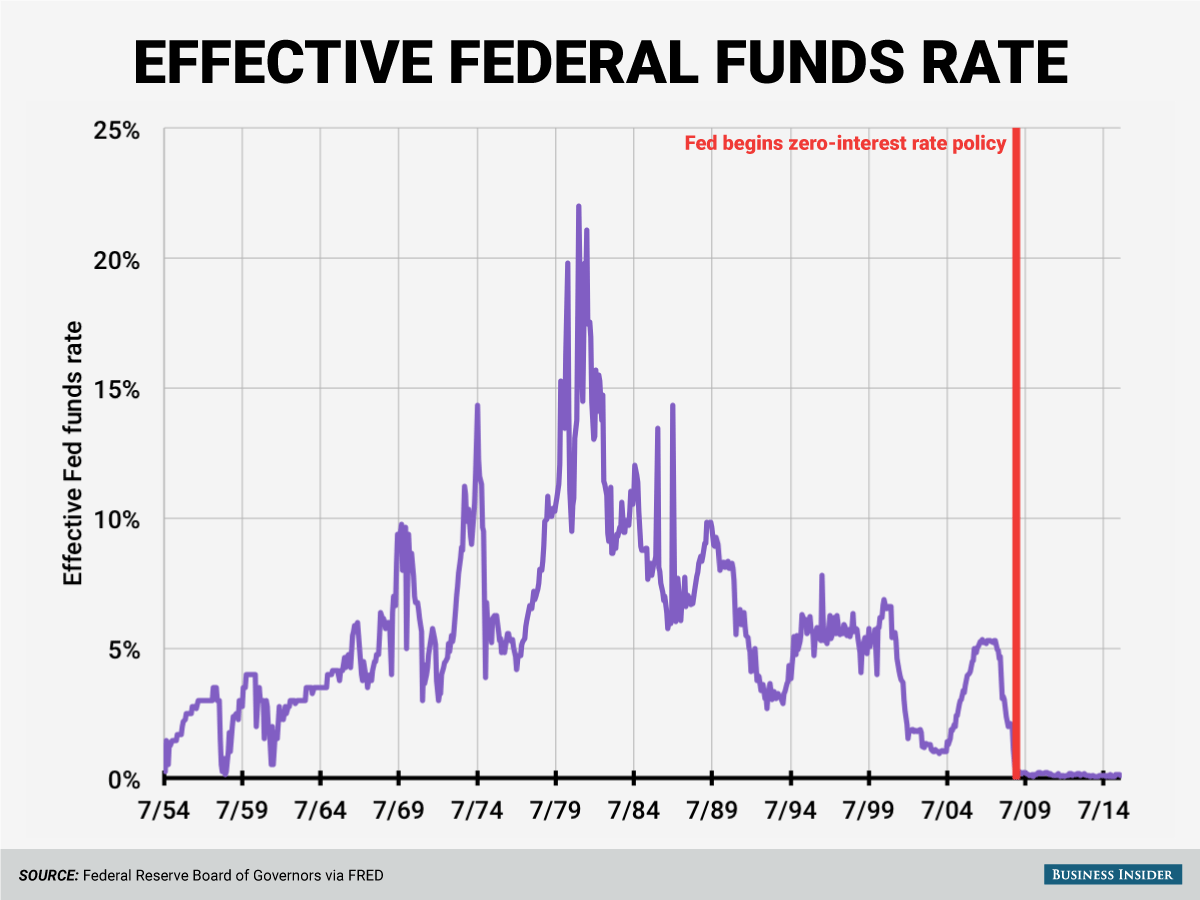

- Lingering Economic Uncertainties: Despite positive indicators, certain economic uncertainties remain, including inflation and potential interest rate hikes. These factors could impact future market performance.

- Potential Short-Term Corrections: Even in a bullish market, short-term corrections are possible. Investors should be prepared for potential volatility.

- Geopolitical Instability: While tensions have eased recently, unforeseen geopolitical events could negatively impact market sentiment.

Strategies for Today's Market

The current market conditions present both opportunities and challenges for investors.

- Capitalizing on the Positive Trend: Investors looking to capitalize on the current positive trend may consider carefully selected buying opportunities in strong sectors. Diversification is key.

- Cautious Approach for Risk-Averse Investors: Risk-averse investors might consider adopting a more cautious strategy, focusing on defensive assets or holding their current positions.

- Thorough Research is Crucial: Before making any investment decisions, thorough research and understanding of individual companies and market trends are paramount.

Conclusion

The rise in Dow futures signals a potentially positive day for the stock market, driven by strong corporate earnings, positive economic data, and easing geopolitical tensions. However, investors should remain aware of potential risks and uncertainties. While the current outlook is favorable, short-term corrections are possible. Monitor Dow Futures Rise and adjust your investment strategy based on the evolving market conditions. Stay informed about the latest developments in Dow Futures and other market indicators to make well-informed investment decisions. Follow us for regular updates on the market's performance and insightful analysis of Dow Futures movements.

Featured Posts

-

Ignoring High Stock Market Valuations A Bof A Perspective

Apr 26, 2025

Ignoring High Stock Market Valuations A Bof A Perspective

Apr 26, 2025 -

Saint Laurents Milan Design Week 2025 Tribute To Charlotte Perriand

Apr 26, 2025

Saint Laurents Milan Design Week 2025 Tribute To Charlotte Perriand

Apr 26, 2025 -

Hollywoods Biggest Strike In Decades Actors And Writers Demand Change

Apr 26, 2025

Hollywoods Biggest Strike In Decades Actors And Writers Demand Change

Apr 26, 2025 -

Ftcs Appeal Against Microsofts Activision Blizzard Acquisition Whats Next

Apr 26, 2025

Ftcs Appeal Against Microsofts Activision Blizzard Acquisition Whats Next

Apr 26, 2025 -

How Trumps Presidency Unexpectedly Shaped The Canadian Election Landscape

Apr 26, 2025

How Trumps Presidency Unexpectedly Shaped The Canadian Election Landscape

Apr 26, 2025

Latest Posts

-

U S Federal Reserve Rate Decision Economic Uncertainty And The Path Forward

May 10, 2025

U S Federal Reserve Rate Decision Economic Uncertainty And The Path Forward

May 10, 2025 -

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025 -

Suncor Production Reaches Record High While Sales Face Inventory Challenges

May 10, 2025

Suncor Production Reaches Record High While Sales Face Inventory Challenges

May 10, 2025 -

Weight Watchers Files For Bankruptcy Amidst Growing Weight Loss Medication Market

May 10, 2025

Weight Watchers Files For Bankruptcy Amidst Growing Weight Loss Medication Market

May 10, 2025 -

De Escalation Dominates Analysis Of U S China Trade Talks This Week

May 10, 2025

De Escalation Dominates Analysis Of U S China Trade Talks This Week

May 10, 2025