Elon Musk's Billions: A Look At The Factors Affecting His Recent Net Worth Decline

Table of Contents

H2: Tesla Stock Performance and its Impact

The cornerstone of Elon Musk's wealth is undeniably Tesla. Therefore, the performance of Tesla stock directly and significantly impacts "Elon Musk's billions."

H3: Market Volatility and Investor Sentiment

Tesla's stock price, like that of many technology companies, is highly susceptible to market volatility. Recent economic downturns, marked by rising interest rates and persistent inflation, have created a climate of uncertainty, impacting investor sentiment across the board. This broader economic context significantly influences Tesla's valuation.

- Impact of negative news cycles on Tesla's stock: Negative press surrounding Tesla, whether related to production delays, safety concerns, or Elon Musk's public statements, often triggers immediate sell-offs, impacting the stock price and, consequently, Musk's net worth.

- Analysis of Tesla's financial reports and their influence on investor confidence: Quarterly earnings reports and financial performance heavily influence investor confidence. Any shortfall in projected growth or unexpected expenses can lead to a decrease in stock price.

- Competition from other electric vehicle manufacturers: The increasing competition in the electric vehicle (EV) market from established automakers and new entrants puts pressure on Tesla's market share and profitability, thus impacting its stock valuation.

- Correlation between Tesla's stock price and Elon Musk's net worth: A large portion of Elon Musk's net worth is directly tied to his ownership stake in Tesla. Therefore, fluctuations in Tesla's stock price directly translate to changes in his overall wealth.

H2: The Influence of SpaceX and Other Ventures

While Tesla is the primary driver of Elon Musk's wealth, his other ventures, notably SpaceX, and various investments also play a role.

H3: SpaceX's Financial Status and Future Projections

SpaceX, though not publicly traded, is a significant contributor to Musk's overall financial picture. While SpaceX has achieved remarkable milestones, its financial performance, including funding rounds and future projections for profitability, indirectly affects Musk's net worth. Significant investments or potential setbacks in SpaceX's ambitious projects could influence his overall financial standing.

H3: Investments and Diversification

Elon Musk's investments extend beyond Tesla and SpaceX. His portfolio includes various other companies and assets. The performance of these investments, both successes and losses, contributes to the overall fluctuation in "Elon Musk's billions."

- Relationship between SpaceX's funding rounds and Elon Musk's net worth: Successful funding rounds for SpaceX, which often involve significant valuations, can boost Musk's net worth. Conversely, challenges in securing funding or lower valuations could have a negative impact.

- Other significant investments held by Musk and their performance: The performance of these investments, whether they are in publicly traded companies or private ventures, directly impacts his overall wealth.

- Risks associated with diversification and its impact on net worth stability: While diversification can help mitigate risk, it doesn't eliminate it. Losses in one area of his investment portfolio could still negatively affect his overall net worth.

H2: The Role of Elon Musk's Public Persona and Actions

Elon Musk's outspoken nature and frequent public pronouncements have a demonstrable impact on market perception and investor confidence.

H3: Controversies and Their Market Impact

Controversial tweets, public statements, and actions by Elon Musk often trigger immediate and significant reactions in the stock market. Negative press surrounding his actions can lead to a decrease in investor confidence in Tesla and other related ventures.

H3: Leadership Style and its Influence on Company Valuation

Musk's leadership style and decision-making directly affect the perception of his companies and their market valuations. While his innovative approach has been a driver of success, it also carries inherent risks.

- Examples of controversial tweets and actions and their immediate market reaction: Numerous instances demonstrate how Musk's public actions can instantly influence Tesla's stock price and consequently, his net worth.

- Impact of leadership on employee morale and productivity, linking to company performance: Musk's management style and its impact on employee morale and productivity can indirectly affect the company’s overall performance and valuation.

- The role of public relations and damage control in mitigating the negative impact: Effective public relations and damage control strategies are crucial in mitigating the negative market reactions triggered by Musk's public actions.

H2: Macroeconomic Factors and Global Events

Global events and macroeconomic factors exert significant influence on the overall stock market and, subsequently, on Tesla's performance.

H3: Geopolitical Instability and its Influence

Geopolitical instability, supply chain disruptions, and international trade tensions can all impact Tesla's production, sales, and overall performance, thereby affecting "Elon Musk's billions."

H3: Inflation, Interest Rates, and Recessionary Fears

Macroeconomic factors such as inflation, interest rate hikes, and fears of a recession significantly influence investor behavior and stock valuations, impacting Tesla's stock price and Musk's net worth.

- Examples of global events affecting Tesla's supply chain or market access: Disruptions to global supply chains due to geopolitical events can directly impact Tesla’s production and sales, affecting its stock price.

- How inflation and interest rate hikes impact investor decisions regarding high-growth stocks like Tesla: Rising interest rates often lead investors to shift their portfolios towards more conservative investments, potentially impacting the valuation of high-growth stocks like Tesla.

- Impact of potential recessionary scenarios on Elon Musk's net worth: Recessions typically lead to decreased consumer spending and investment, negatively impacting the performance of companies like Tesla and consequently, Elon Musk's net worth.

3. Conclusion

The recent decline in "Elon Musk's billions" is not attributable to a single cause but rather a complex interplay of factors. Tesla's stock performance, influenced by market volatility and investor sentiment, remains a central driver. SpaceX's performance, Musk's public persona and controversies, and broader macroeconomic conditions all contribute significantly. Understanding this intricate web of influences provides crucial insights into the dynamics of wealth creation and the volatility of the modern economy. To stay updated on the continuing fluctuations of Elon Musk's net worth and the broader economic landscape impacting it, subscribe to our newsletter and follow us on social media for the latest analysis on "Elon Musk's Billions" and related topics.

Featured Posts

-

Market Rally Sensex 200 Nifty Crosses 18 600 Despite Ultra Tech Fall

May 09, 2025

Market Rally Sensex 200 Nifty Crosses 18 600 Despite Ultra Tech Fall

May 09, 2025 -

The Latest On Doohan At Williams Addressing Colapinto Transfer Talk

May 09, 2025

The Latest On Doohan At Williams Addressing Colapinto Transfer Talk

May 09, 2025 -

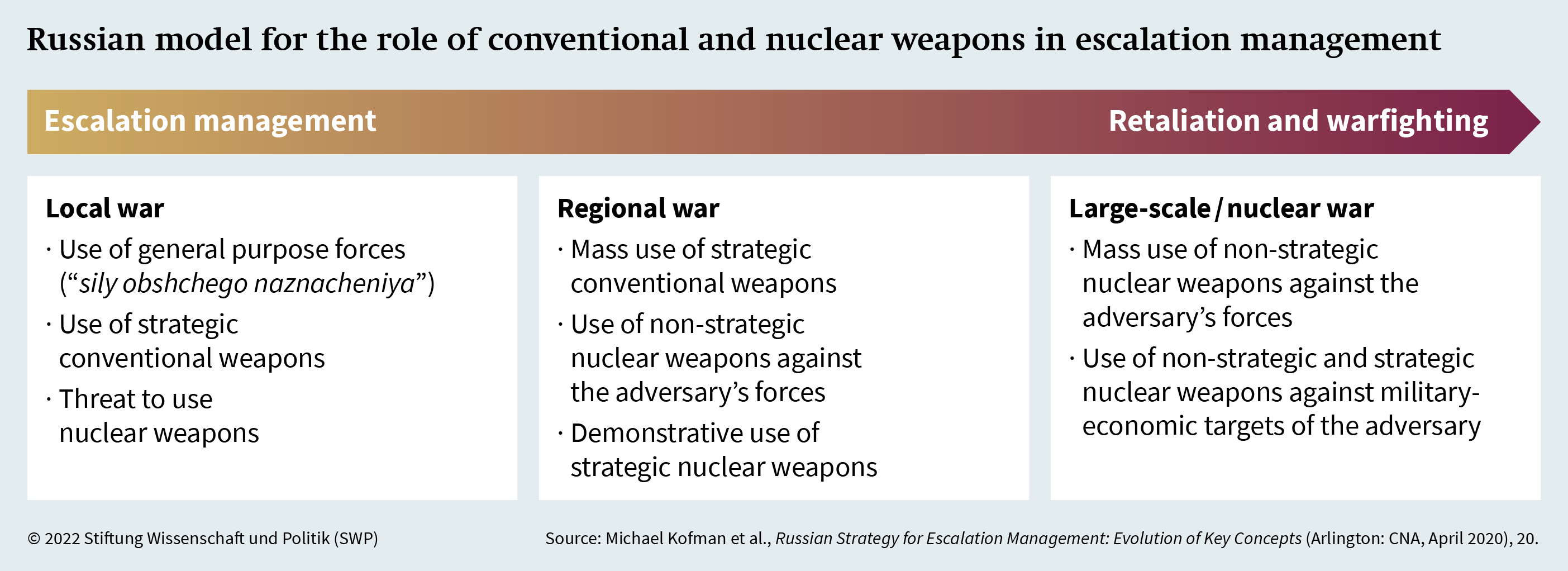

Shared Nuclear Deterrence A French Ministers Vision For Europe

May 09, 2025

Shared Nuclear Deterrence A French Ministers Vision For Europe

May 09, 2025 -

Harry Styles Response To A Critically Bad Snl Impression

May 09, 2025

Harry Styles Response To A Critically Bad Snl Impression

May 09, 2025 -

Ai Powered Figma A New Era In Design And Collaboration

May 09, 2025

Ai Powered Figma A New Era In Design And Collaboration

May 09, 2025