Emerging Markets Fund Closure: Point72 Traders Depart After Pod Shutdown

Table of Contents

The Point72 Emerging Markets Fund's Closure

Point72's decision to shutter its emerging markets fund marks a significant development, raising questions about the firm's overall investment strategy and the future of emerging markets investment.

Reasons Behind the Closure

Several factors likely contributed to this unexpected closure. While Point72 hasn't publicly disclosed all the reasons, industry analysts and experts point to several potential causes:

- Underperformance relative to benchmarks and competitors: The fund may have consistently underperformed compared to its benchmarks and rival emerging markets funds, leading to investor dissatisfaction and pressure on Point72 to take action.

- Changes in Point72's overall investment strategy: Point72 may have decided to reallocate its resources towards other areas deemed more promising or less risky, leading to the strategic closure of the emerging markets fund. This reflects a broader shift in the hedge fund industry as managers reassess risk and opportunity.

- Shifting macroeconomic factors impacting emerging markets: Global economic uncertainty, geopolitical instability in certain regions, and currency fluctuations can significantly impact emerging market performance. These external factors may have made the fund's investment strategy unsustainable.

- Increased regulatory scrutiny in specific emerging markets: Increased regulatory hurdles and compliance costs in certain emerging markets could have contributed to the decision to close the fund, making it less profitable or too complex to manage effectively.

Financial Implications of the Closure

The closure has significant financial ramifications for various stakeholders:

- Impact on Point72's overall portfolio performance: While likely not catastrophic, the closure will affect Point72's overall portfolio performance, especially if the fund held a substantial portion of its assets. This will likely be reflected in future financial reports.

- Losses for investors in the fund: Investors in the emerging markets fund are likely to face financial losses, depending on the fund's performance leading up to the closure. This highlights the risks inherent in emerging markets investment.

- Financial implications for the departing traders: The departing traders may face immediate financial uncertainty as they seek new employment opportunities. Their compensation and career trajectories are significantly impacted.

- Potential ripple effect on other emerging markets funds: The closure could trigger a reassessment of risk by other hedge funds specializing in emerging markets, potentially leading to more conservative investment strategies or even withdrawals from certain markets.

The Exodus of Traders

The closure of the emerging markets fund has resulted in a significant exodus of traders from Point72.

Number of Traders Affected

Reports suggest that dozens of traders, specializing in various emerging market regions and asset classes, have left the firm following the fund's closure. The precise number remains undisclosed.

Reasons for Trader Departures

The traders' departures are likely driven by a combination of factors:

- Lack of future opportunities within Point72: With the fund closed, there are limited opportunities for these specialists within Point72's remaining portfolio.

- Seeking better compensation packages elsewhere: Competition for top talent in the hedge fund industry is fierce. These experienced traders are likely receiving attractive offers from competing firms.

- Desire to work on different investment strategies: Some traders may seek opportunities to diversify their experience or pursue different investment strategies that are not currently offered at Point72.

- Impact on their careers and professional networks: The closure can have a significant impact on the traders' careers, affecting their reputation and potentially limiting future opportunities.

Potential Impact on the Industry

The departure of experienced emerging markets traders from Point72 has broader implications for the industry:

- Increased competition for talent in the hedge fund industry: The exodus creates increased competition among hedge funds seeking to acquire experienced and skilled professionals in emerging markets.

- Potential for these traders to establish their own firms: Some traders may choose to leverage their expertise and networks to launch their own hedge funds, potentially creating new competition and reshaping the market.

- Impact on the flow of capital into emerging markets: The closure and the subsequent departure of skilled traders could reduce the flow of capital into certain emerging markets, impacting their economic development.

Analysis of Point72's Investment Strategy and Future Plans

Point72's decision to close its emerging markets fund necessitates a review of its past performance and a look at its potential future strategies.

Review of Past Performance

While Point72's overall track record is strong, the underperformance of the specific emerging markets fund signals potential weaknesses in its investment strategy or risk management within that specific area.

Future Investment Focus

Following the closure, Point72 is likely to reassess its exposure to emerging markets. They may choose to focus on specific, less volatile emerging markets, or completely reallocate resources to other sectors and geographies deemed more attractive. This may include a greater focus on technology, private equity, or other alternative asset classes.

Lessons Learned

The closure serves as a reminder of the inherent risks and complexities involved in emerging markets investment. It underscores the importance of robust risk management, diversification, and a thorough understanding of macroeconomic and geopolitical factors before investing in emerging markets. It also highlights the need for flexibility and adaptability in hedge fund management, allowing firms to adjust their strategies in response to changing market conditions.

Conclusion

The closure of Point72's emerging markets fund and the resulting departure of experienced traders mark a significant event with far-reaching consequences. The situation underscores the challenges and risks associated with emerging markets investments and the dynamic nature of the hedge fund industry. Understanding the reasons behind the closure, the impact on various stakeholders, and the potential ripple effects is crucial for investors and industry professionals alike. Stay informed about further developments in the emerging markets fund space and continue following for in-depth analysis of hedge fund strategies and their implications for the financial world.

Featured Posts

-

Cinema Con 2024 New Mission Impossible Dead Reckoning Part Two Standee Revealed

Apr 26, 2025

Cinema Con 2024 New Mission Impossible Dead Reckoning Part Two Standee Revealed

Apr 26, 2025 -

Norriss Injury What Happened At The Djs Party

Apr 26, 2025

Norriss Injury What Happened At The Djs Party

Apr 26, 2025 -

Ten Years Later Construction To Continue On Worlds Tallest Abandoned Skyscraper Project

Apr 26, 2025

Ten Years Later Construction To Continue On Worlds Tallest Abandoned Skyscraper Project

Apr 26, 2025 -

Chat Gpt Creator Open Ai Investigated By The Ftc

Apr 26, 2025

Chat Gpt Creator Open Ai Investigated By The Ftc

Apr 26, 2025 -

Thaksins Return Implications For Thai Us Trade And Tariff Negotiations

Apr 26, 2025

Thaksins Return Implications For Thai Us Trade And Tariff Negotiations

Apr 26, 2025

Latest Posts

-

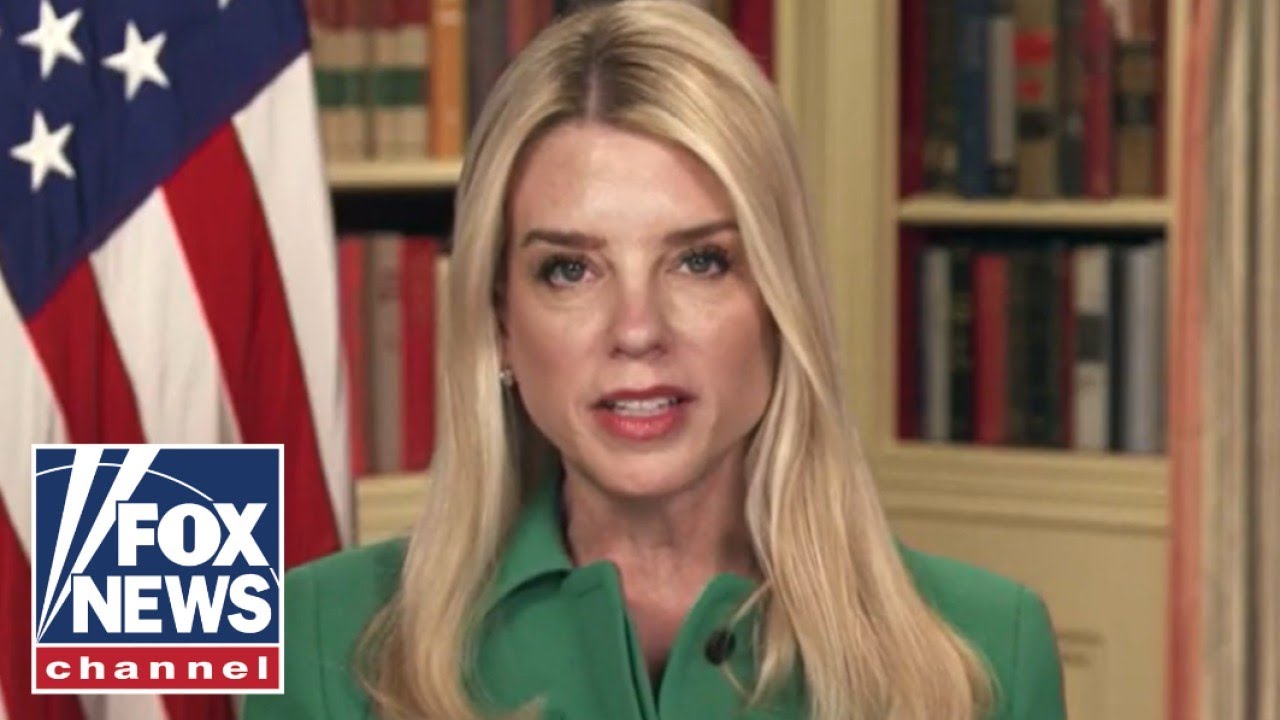

Pam Bondi And James Comer Clash Over Epstein Files

May 10, 2025

Pam Bondi And James Comer Clash Over Epstein Files

May 10, 2025 -

The Daily Fox News Briefings Analyzing The Us Attorney Generals Role

May 10, 2025

The Daily Fox News Briefings Analyzing The Us Attorney Generals Role

May 10, 2025 -

Fox News And The Us Attorney General Unpacking The Daily Dialogue

May 10, 2025

Fox News And The Us Attorney General Unpacking The Daily Dialogue

May 10, 2025 -

James Comers Epstein Files Tirade Pam Bondis Response

May 10, 2025

James Comers Epstein Files Tirade Pam Bondis Response

May 10, 2025 -

Pam Bondi Laughs Reaction To James Comers Epstein Files Accusations

May 10, 2025

Pam Bondi Laughs Reaction To James Comers Epstein Files Accusations

May 10, 2025