Ethereum CrossX Indicators Flash Buy Signal: Institutions Accumulating, $4,000 Price Predicted

Table of Contents

Understanding Ethereum CrossX Indicators

Ethereum CrossX indicators are a suite of advanced technical analysis tools that combine on-chain data, trading volume, and market sentiment to generate actionable trading signals. Unlike traditional indicators relying solely on price action, CrossX incorporates a broader perspective, providing a more holistic view of the market. These indicators analyze various data points to identify potential buying or selling opportunities, offering insights into market dynamics often missed by simpler methods.

- Key Indicators: The specific indicators used within the Ethereum CrossX system often include moving averages (like the 50-day and 200-day MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various on-chain metrics measuring network activity and transaction volume. These are combined to provide a more robust signal.

- Signal Generation: These indicators don't act in isolation. The CrossX system analyzes the interplay between these metrics. For example, a bullish crossover of moving averages, coupled with an RSI breaking above oversold levels and a positive MACD divergence, could collectively trigger a buy signal.

- Limitations and Risk Mitigation: It's crucial to remember that even the most sophisticated indicators can produce false signals. Market conditions are constantly evolving, and unexpected events can significantly impact price movements. Therefore, utilizing risk management strategies, such as stop-loss orders and position sizing, is essential when trading based on any indicator, including Ethereum CrossX indicators.

The Recent Flash Buy Signal: A Detailed Analysis

On [Insert Date], the Ethereum CrossX indicators flashed a strong buy signal. This signal was triggered by a confluence of factors:

- Date and Time: [Insert precise date and time of the signal].

- Indicator Readings: At the time of the signal, the 50-day moving average crossed above the 200-day moving average, the RSI surged above 50, and the MACD showed a clear bullish crossover. [Insert specific numerical data for each indicator].

- Price Action and Volume: This signal coincided with a significant surge in trading volume, further corroborating the bullish sentiment. [Include a chart or graph depicting price action and volume around the signal time].

- Comparison to Previous Signals: While past performance is not indicative of future results, comparing this signal to previous CrossX signals and their subsequent market movements provides valuable context. [Discuss the outcomes of similar signals in the past and highlight any similarities or differences].

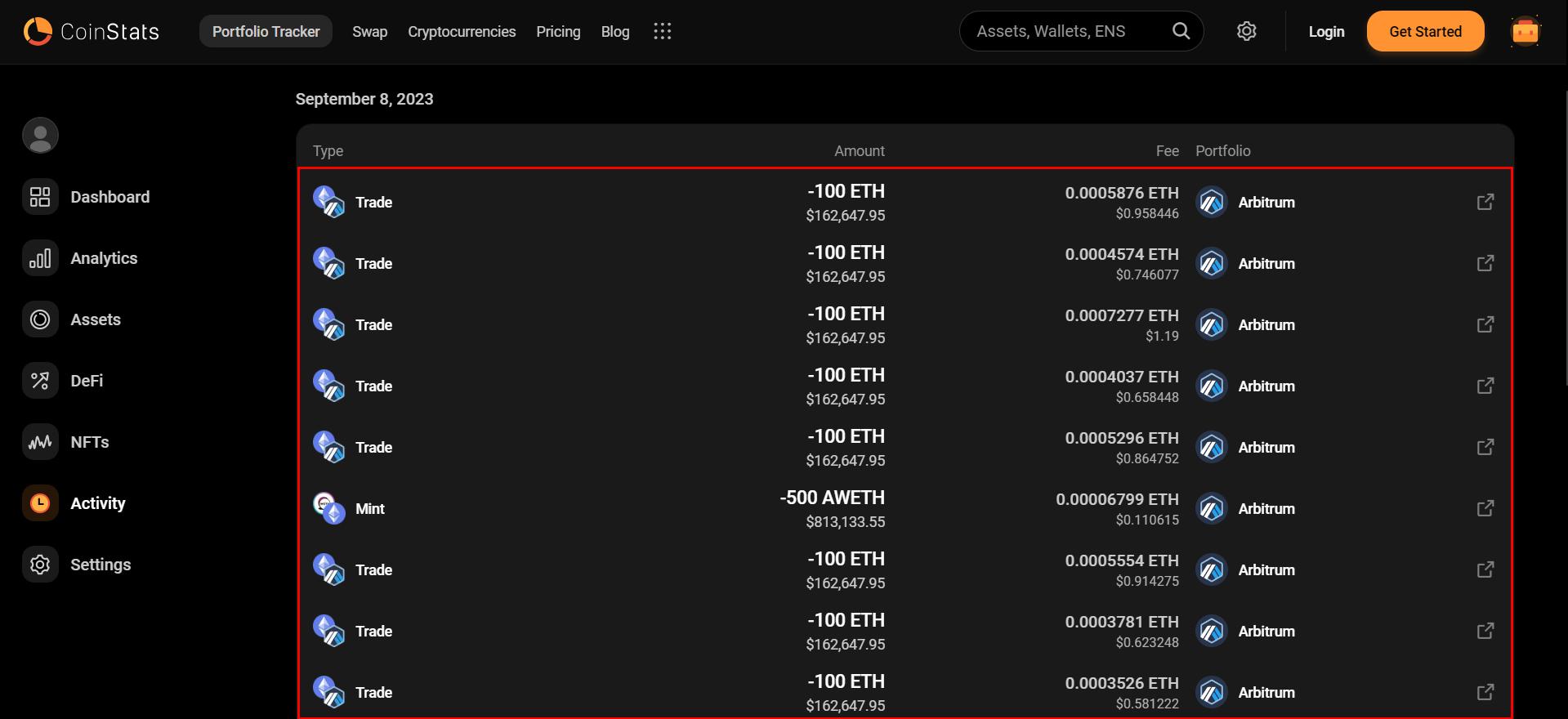

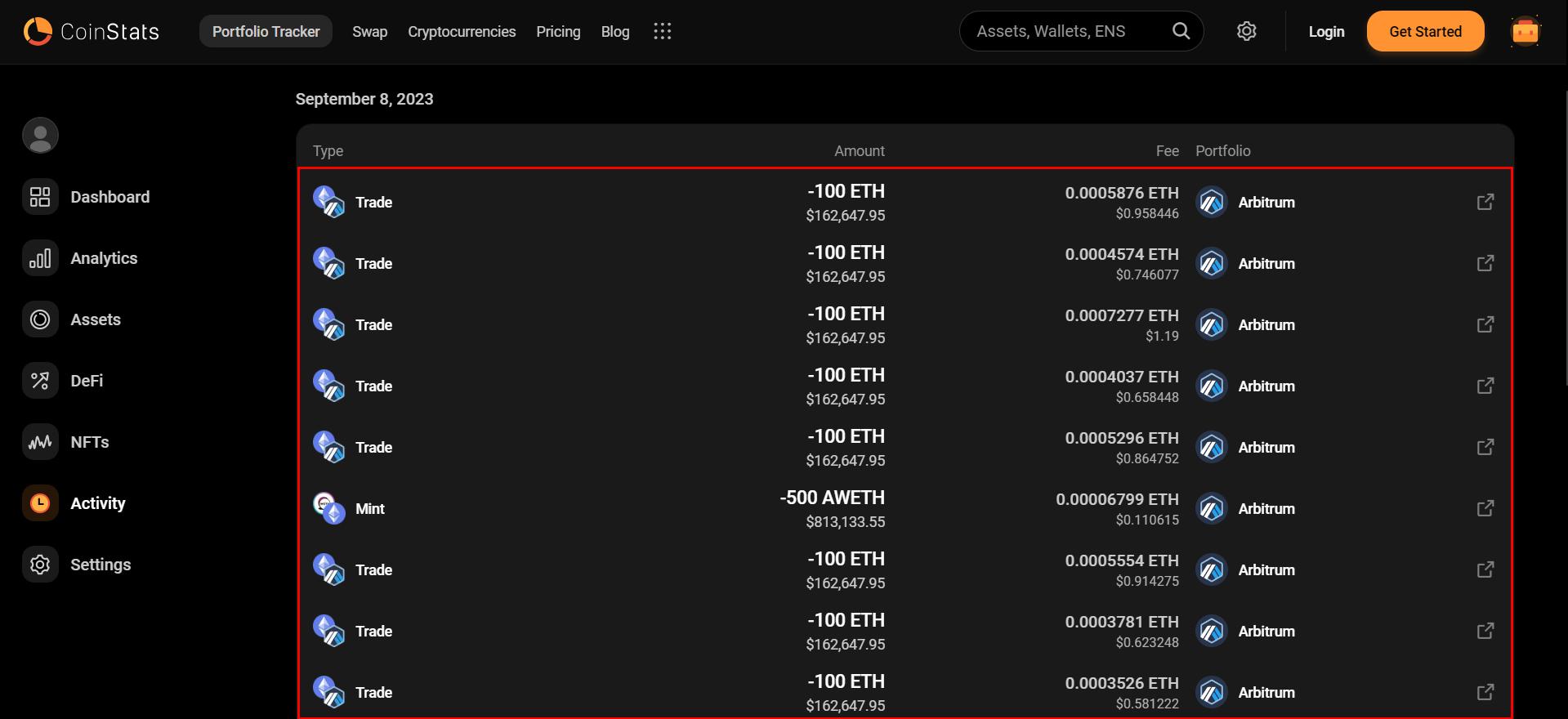

Evidence of Institutional Accumulation in Ethereum

Beyond the technical indicators, growing evidence points to significant institutional accumulation of ETH. This institutional buying pressure could be a key driver behind the recent price movement and the potential for further gains.

- Large Transactions: Analysis of on-chain data reveals several large ETH transactions exceeding [Insert Amount] ETH, suggestive of institutional investors entering the market. [Provide examples of these transactions with sources if possible].

- Exchange Outflows: A noticeable net outflow of ETH from major cryptocurrency exchanges indicates that institutions are likely moving their holdings off exchanges into cold storage, reducing the supply available for immediate trading. [Include data or links to sources supporting this claim].

- Reports and News: Recent reports from financial institutions and news outlets suggest increasing interest in Ethereum from institutional investors, driven by factors such as the growth of the DeFi ecosystem and the anticipated completion of Ethereum 2.0. [Cite relevant news articles and reports].

- Reasons for Institutional Investment: The increasing adoption of Ethereum in decentralized finance (DeFi), the ongoing development of Ethereum 2.0, and the overall growth of the blockchain technology sector are all significant factors attracting institutional investment.

Debunking Potential Concerns: Is This a Pump and Dump?

The concern of a pump-and-dump scheme is valid in the volatile crypto market. However, several factors mitigate this risk in this instance. The sustained institutional buying pressure, coupled with the fundamental growth of the Ethereum ecosystem, suggests a more organic and long-term bullish trend rather than a short-lived artificial pump. Thorough due diligence, including understanding the underlying technology and market trends, is crucial before making any investment decision. Responsible investing practices are paramount.

The $4,000 Ethereum Price Prediction: Realistic or Overly Optimistic?

The $4,000 Ethereum price prediction is not without basis. Several factors support this target:

- Supporting Factors: The combination of the strong buy signal, substantial institutional accumulation, ongoing development of the Ethereum network, and the continued growth of DeFi applications all contribute to the bullish outlook.

- Potential Headwinds: Market corrections, regulatory uncertainty, and competition from other cryptocurrencies are potential headwinds that could impact the price negatively.

- Risk Assessment: Investing in cryptocurrencies carries inherent risk. Price volatility can be extreme, and significant losses are possible. Thorough research and risk management are essential.

Conclusion:

The recent flash buy signal generated by Ethereum CrossX indicators, combined with evidence of significant institutional accumulation, paints a potentially bullish picture for Ethereum. While a $4,000 price target is ambitious, it’s not unrealistic considering the factors outlined above. However, it's crucial to remember that the cryptocurrency market is highly volatile. Before making any investment decisions, conduct your own thorough research and consider consulting with a financial advisor. Learn more about using Ethereum CrossX indicators to identify potential buying opportunities and navigate the volatile cryptocurrency market. Further exploration of on-chain data analysis and technical indicators will significantly improve your understanding of the market.

Featured Posts

-

Nba Buzz Kuzmas Comments On Tatums Popular Instagram Post

May 08, 2025

Nba Buzz Kuzmas Comments On Tatums Popular Instagram Post

May 08, 2025 -

Players On The Okc Thunder Take Aim At National Media

May 08, 2025

Players On The Okc Thunder Take Aim At National Media

May 08, 2025 -

Okc Thunder Vs Indiana Pacers Injury Report For March 29th Game

May 08, 2025

Okc Thunder Vs Indiana Pacers Injury Report For March 29th Game

May 08, 2025 -

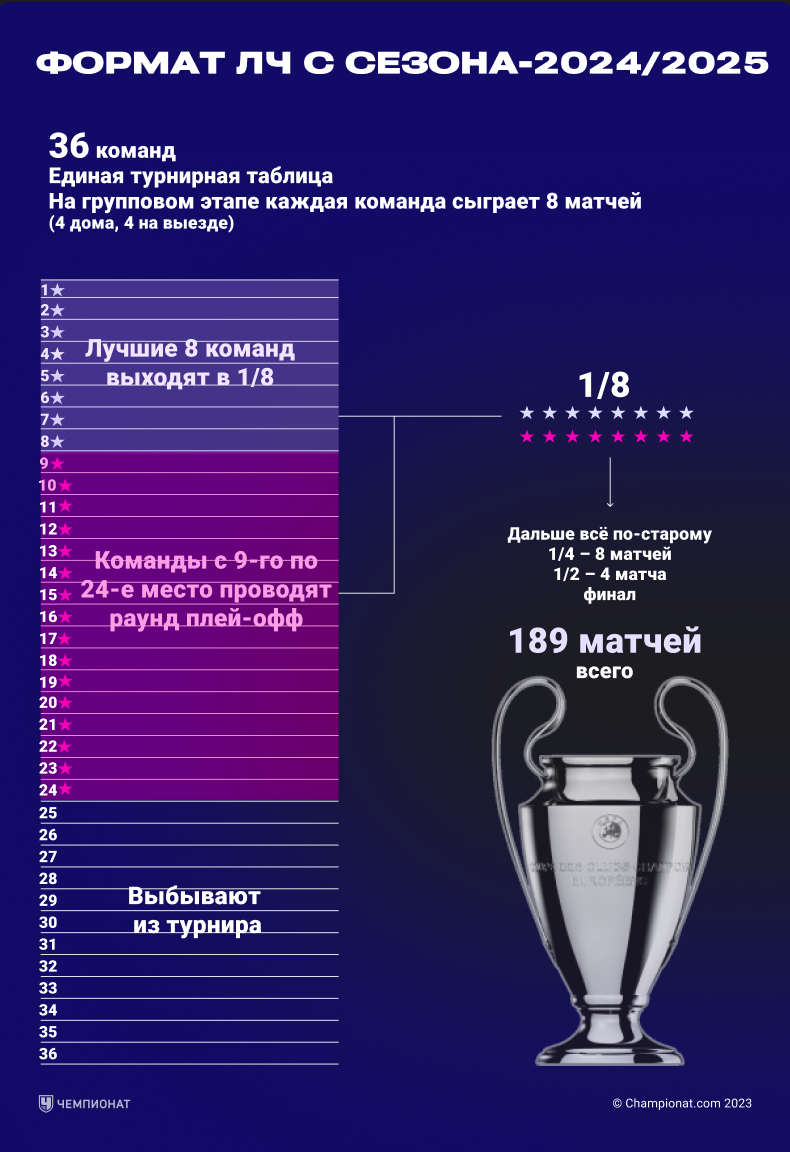

Arsenal Ps Zh Barselona Inter Anons Matchey 1 2 Finala Ligi Chempionov 2024 2025

May 08, 2025

Arsenal Ps Zh Barselona Inter Anons Matchey 1 2 Finala Ligi Chempionov 2024 2025

May 08, 2025 -

Dbs On Environmental Reform A Period Of Grace For Major Polluters

May 08, 2025

Dbs On Environmental Reform A Period Of Grace For Major Polluters

May 08, 2025