DBS On Environmental Reform: A Period Of Grace For Major Polluters

Table of Contents

DBS's Stated Commitment to Environmental, Social, and Governance (ESG) Principles

DBS publicly champions its commitment to ESG principles, portraying itself as a leader in sustainable finance. However, a closer examination reveals a potential disconnect between stated goals and actual actions.

Public Relations and Marketing Efforts

DBS invests heavily in public relations and marketing campaigns showcasing its sustainability initiatives.

- Examples: Partnerships with environmental NGOs, sponsoring green initiatives, and publishing glossy sustainability reports.

- Potential Disconnect: While these efforts build a positive public image, critics argue they may overshadow a less environmentally conscious reality behind the scenes. The question remains: Are these campaigns genuine reflections of commitment, or simply effective PR strategies?

ESG Investment Strategies

DBS claims significant investments in renewable energy and green technologies.

- Examples: Investments in solar energy projects, wind farms, and electric vehicle infrastructure (specific examples and figures are needed here for a thorough analysis, and should be researched and added).

- Proportionality: A critical analysis is needed to determine the proportion of these green investments compared to investments in high-carbon sectors like fossil fuels. A significant imbalance would suggest a limited impact on overall emissions.

Transparency and Reporting

The transparency and accessibility of DBS's sustainability reporting are vital for assessing its true commitment.

- Strengths: (Research and add specific examples of strengths in DBS's reporting, e.g., use of specific metrics, independent audits).

- Weaknesses: (Research and add specific examples of weaknesses, e.g., lack of granular data, difficulty in verifying claims). The clarity and understandability of these reports for the average person need improvement.

DBS Lending Practices and High-Carbon Industries

This section delves into the core of the "period of grace" question: DBS's financing of high-carbon industries.

Financing of Fossil Fuel Projects

The extent of DBS's financing of fossil fuel projects (coal, oil, and gas) is a critical indicator of its commitment to environmental reform.

- Examples: (Research and add specific examples of loans and investments in fossil fuel projects. Include details like loan amounts and project descriptions).

- Rationale: DBS needs to clearly articulate its rationale for continuing to invest in these high-carbon projects. Justifications should be carefully scrutinized to determine if they align with long-term climate goals.

Engagement with Polluting Companies

DBS's engagement strategies with companies having poor environmental records are crucial for evaluating its influence on corporate behavior.

- Examples: (Research and add specific examples of companies with poor environmental records that DBS engages with. Describe the nature of the engagement).

- Effectiveness: A thorough assessment is needed to determine the effectiveness of these engagement efforts in driving tangible environmental improvements. Have these efforts led to meaningful emission reductions or improved environmental practices?

Conditions and Stipulations for Loans to Polluting Industries

The environmental conditions attached to loans provided to polluting industries are vital for mitigating environmental risks.

- Stringency: A detailed analysis of the stringency of these conditions is necessary. Are they merely symbolic, or do they genuinely drive environmental improvements?

- Risk Mitigation: Do these conditions adequately mitigate the environmental risks associated with these projects? Are they sufficient to align with the Paris Agreement targets?

Alternative Perspectives and Criticisms

A balanced perspective requires considering criticisms from various sources.

Activist Groups and NGO Positions

Environmental activist groups and NGOs have voiced concerns regarding DBS's environmental performance.

- Criticisms: (Research and include specific quotes and examples from reports, press releases, and statements from activist groups and NGOs. Summarize the key arguments and concerns).

- Key Arguments: These groups often highlight discrepancies between DBS's public image and its actual practices, particularly regarding financing of fossil fuel projects.

Comparative Analysis with Other Financial Institutions

Comparing DBS's performance with other major financial institutions provides valuable context.

- Best Practices: Identify best practices adopted by other institutions that DBS could emulate.

- Areas of Lag: Highlight areas where DBS lags behind its peers in terms of environmental sustainability and commitment to ESG principles. This comparative analysis provides a clearer picture of DBS's position within the industry.

Conclusion: Re-evaluating DBS's Role in Environmental Reform

This article has explored the question of whether DBS is providing a "period of grace" for major polluters. The evidence presented suggests a complex picture. While DBS makes strong public commitments to ESG principles and invests in some green initiatives, its continued financing of high-carbon industries and the perceived lack of stringency in environmental conditions attached to loans raise serious concerns. Transparency and accountability are paramount. We urge readers to actively engage with DBS's sustainability reports, contact DBS directly with their concerns, and advocate for stricter environmental policies from financial institutions. Further research and open discussion are crucial to understanding the role of DBS and other banks in either accelerating environmental reform or inadvertently granting a "period of grace" to major polluters. Let's demand more than just words; let's demand concrete action to combat climate change.

Featured Posts

-

Predicting Ethereums Future A Deep Dive Into Market Trends And Price Dynamics

May 08, 2025

Predicting Ethereums Future A Deep Dive Into Market Trends And Price Dynamics

May 08, 2025 -

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Fall Since 2008

May 08, 2025

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Fall Since 2008

May 08, 2025 -

The Future Of Xrp Analyzing The Impact Of Etfs Sec Decisions And Ripples Progress

May 08, 2025

The Future Of Xrp Analyzing The Impact Of Etfs Sec Decisions And Ripples Progress

May 08, 2025 -

Analyzing Bitcoins Potential For A 1 500 Rise

May 08, 2025

Analyzing Bitcoins Potential For A 1 500 Rise

May 08, 2025 -

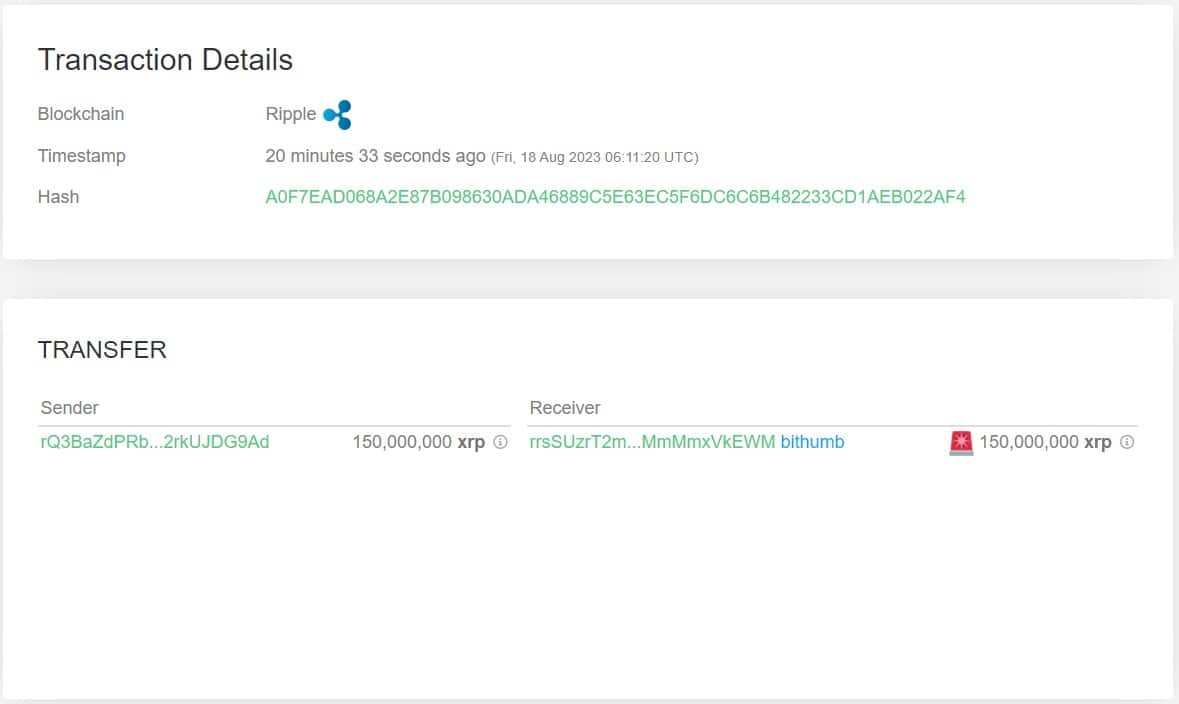

Significant Xrp Purchase Whale Transaction Sparks Market Speculation

May 08, 2025

Significant Xrp Purchase Whale Transaction Sparks Market Speculation

May 08, 2025