The Future Of XRP: Analyzing The Impact Of ETFs, SEC Decisions, And Ripple's Progress

Table of Contents

The Ripple-SEC Lawsuit and its Potential Impact on XRP's Price

The Ripple-SEC lawsuit casts a long shadow over XRP's price and future. This legal battle centers on the SEC's claim that XRP is an unregistered security, a contention Ripple vehemently denies. The outcome will significantly impact XRP's price and the broader cryptocurrency market.

The Current State of the Lawsuit

The lawsuit has progressed through various stages, including motions to dismiss, expert witness testimonies, and ongoing legal arguments. The SEC alleges that Ripple's sales of XRP constituted an unregistered securities offering, violating federal securities laws. Ripple counters that XRP is a decentralized digital asset, not a security, and therefore not subject to SEC regulation.

- Potential positive outcomes for XRP if Ripple wins: A Ripple victory could lead to a significant surge in XRP's price, as the legal uncertainty surrounding the cryptocurrency would be resolved. This could unlock significant institutional investment and boost market confidence.

- Potential negative outcomes if Ripple loses: A loss for Ripple could result in a sharp decline in XRP's price, potentially leading to delistings from exchanges and harming investor confidence. The SEC's victory could set a precedent for regulating other cryptocurrencies.

- Impact on investor sentiment and market capitalization: The lawsuit's outcome will dramatically impact investor sentiment. A positive outcome could propel XRP to new highs, while a negative one could severely damage its market capitalization.

- Analysis of expert opinions and legal predictions: Legal experts offer varying opinions on the likely outcome, with some predicting a settlement while others anticipate a protracted legal battle. These conflicting predictions highlight the inherent uncertainty surrounding the XRP price prediction. This uncertainty also highlights the significant impact of SEC regulations on the cryptocurrency market. The legal uncertainty surrounding XRP is a key factor in its volatile price action.

The Rise of XRP ETFs and their Influence on Market Adoption

The potential approval of XRP Exchange Traded Funds (ETFs) is another significant factor shaping the future of XRP. ETFs offer a regulated and accessible way for investors to gain exposure to XRP, potentially driving widespread adoption.

Understanding the Potential Benefits of XRP ETFs

XRP ETF approval would unlock several key benefits:

- Increased trading volume and price stability: ETFs typically lead to increased trading volume, which can contribute to greater price stability.

- Attracting institutional investors: Institutional investors often prefer the regulated environment of ETFs, making them more likely to invest in XRP once ETFs become available.

- Greater mainstream adoption: ETFs make it easier for ordinary investors to access XRP, potentially driving significant mainstream adoption.

- Comparison with other crypto ETF approvals: The approval of Bitcoin and Ethereum ETFs has already demonstrated the potential for increased market capitalization and price appreciation. The approval of an XRP ETF could follow a similar trajectory.

Challenges and Hurdles to XRP ETF Approval

Despite the potential benefits, several challenges could hinder XRP ETF approval:

- SEC regulatory scrutiny: The SEC's ongoing scrutiny of the cryptocurrency market, particularly its concerns about the regulatory status of XRP, presents a significant hurdle.

- Market volatility: The inherent volatility of the cryptocurrency market could make regulators hesitant to approve XRP ETFs.

- Potential delays and uncertainty: The approval process for ETFs can be lengthy and uncertain, leading to potential delays. The overall regulatory approval process remains a critical factor in determining the timing and success of any XRP ETF launch. This also impacts market liquidity and the ability of investors to easily buy and sell the asset.

Ripple's Technological Advancements and its Role in Shaping XRP's Future

Ripple's ongoing technological advancements are crucial in shaping the future of XRP. The company's efforts to improve RippleNet and develop new technologies could significantly enhance XRP's utility and value.

RippleNet and its Expanding Global Reach

RippleNet, Ripple's global payment network, is steadily gaining traction, impacting XRP's utility:

- Growth of RippleNet partnerships and transactions: The increasing number of financial institutions using RippleNet demonstrates its growing relevance in the cross-border payment space.

- Impact on cross-border payments: RippleNet facilitates faster, cheaper, and more transparent cross-border payments, potentially increasing demand for XRP as a bridge currency.

- Increased demand for XRP as a bridge currency: Many RippleNet transactions utilize XRP to facilitate conversions between different currencies, creating demand for the cryptocurrency. The growth of RippleNet directly impacts the XRP utility and its potential for long-term growth.

Ongoing Development and Innovation within Ripple

Ripple continues to invest heavily in research and development:

- New features and functionalities: Ripple is constantly improving RippleNet and exploring new applications for its technology.

- Technological improvements: Ongoing improvements in blockchain technology are essential for the scalability and efficiency of XRP's network.

- Commitment to research and development: Ripple's commitment to innovation signifies its long-term vision for XRP and its potential as a leading cryptocurrency. This ongoing Ripple innovation is a crucial factor for the future success of XRP.

Conclusion: The Future of XRP Remains Uncertain, But Hopeful

The future of XRP hinges on the interplay between the Ripple-SEC lawsuit, the potential for XRP ETF approvals, and Ripple's continued technological progress. While uncertainty remains, particularly concerning the legal battle, the potential for significant growth is undeniable. The successful resolution of the lawsuit and the approval of XRP ETFs could unlock significant value for XRP, boosting its price and adoption. Conversely, a negative outcome in the lawsuit could severely impact XRP's price and long-term prospects. However, Ripple's continued investment in technology and the growing adoption of RippleNet present a strong foundation for future growth.

To stay informed about the future of XRP, it's crucial to follow developments in the lawsuit, monitor regulatory announcements regarding ETF approvals, and keep abreast of Ripple's technological advancements. Make informed investment decisions based on your risk tolerance and conduct thorough research before investing in any cryptocurrency. For further reading, consider exploring resources from reputable financial news outlets and cryptocurrency analysis websites. Understanding the future of XRP requires ongoing vigilance and research.

Featured Posts

-

Ultimate Nba Playoffs Triple Doubles Leader Quiz Expert Level

May 08, 2025

Ultimate Nba Playoffs Triple Doubles Leader Quiz Expert Level

May 08, 2025 -

Jayson Tatums Status Celtics Vs Nets Game Injury Update

May 08, 2025

Jayson Tatums Status Celtics Vs Nets Game Injury Update

May 08, 2025 -

Vesprem So Desetta Pobeda Vo Ligata Na Shampionite

May 08, 2025

Vesprem So Desetta Pobeda Vo Ligata Na Shampionite

May 08, 2025 -

Analyzing The Scholar Rock Stock Decline Mondays Market Reaction

May 08, 2025

Analyzing The Scholar Rock Stock Decline Mondays Market Reaction

May 08, 2025 -

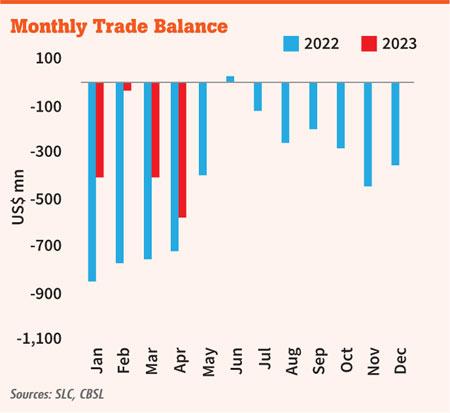

Recent Canadian Trade Data Deficit Narrows To 506 Million

May 08, 2025

Recent Canadian Trade Data Deficit Narrows To 506 Million

May 08, 2025